27 March 2020

While some optimism about light at the end of the Covid-19 tunnel sooner rather than later has emerged, the reality is that each region’s journey has a different starting point. flow’s Clarissa Dann takes a closer look at the pandemic’s economic impact and responses so far as households and firms plan for the eventual recovery

As former UK Prime Minister Harold Wilson famously observed, “a week is a long time in politics” and it appears to be an even lengthier period when it comes to the impact of Covid-19 and the various measures in place to manage the pandemic.

Further to our summary article, ‘Coping with Covid-19’ this piece provides further insights and analysis from the Deutsche Bank Research teams around the world, ranging from wider macro-economic analysis to specific country and business sector insights.

"Our human and physical capital, our technology, and our institutions are going to come through this fairly unscathed"

Governments to the rescue?

Bold action from central banks – such as the ECB’s €750m bond buying programme covering both sovereign and corporate debt – has been the monetary policy response. But with interest rates already at historically low levels, that particular tool in the armoury is of limited effectiveness. The problem, noted Deutsche Bank’s market strategists Oliver Harvey and Robin Winckler on 20 March, is not one of demand shock but rather supply shock that is now spilling over into demand.

“Consumers did not initially stay away from shops and restaurants because they were worried about their future economic prospects, but because governments told them to stay at home,” they reflect. “Holidays are not being cancelled to shore up household finances but because countries have closed their borders. Workers have not been furloughed from factories because of insufficient orders, but because employers are worried about the risk of spreading disease.”

The point is that the mass unemployment caused by such measures will result in a dramatic drop in aggregate demand. At the same time the fiscal responses of the various stimulus packages coming from governments could, they note, drive up inflation, while not being particularly effective. Vast economic stimulus is unlikely to boost demand in these sectors as long as the pandemic ravages, Harvey and Winkler reflect.

They continue, “If the government tries to keep spending at levels before lockdowns began, while at the same time keeping lockdowns in place, there will be simply more money chasing after significantly fewer goods and services. The result of this will be inflation, and a lot of it.”

But overall, they don’t believe the risk of “runaway inflation that would warrant a flight to pure inflation hedges like gold” to be very high. And despite comparisons with wartime conditions, they conclude “this pandemic is going to have far less of a dent on the productive potential of the economy: our human and physical capital, our technology, and our institutions are going to come through this fairly unscathed”.

"Fiscal policy is trying to deal with a solvency issue"

However, many firms and households will not be able to navigate the crisis – the end of which seems to be a light further down the tunnel each time an economy releases an ever-expanding case and death rate list – in the absence of government support. As Torsten Slok, Chief Economist of Deutsche Bank Securities puts it in his socially distanced Podzept telephone podcast with colleague Matt Barnard of 25 March, “Fiscal policy is trying to deal with a solvency issue, making sure that households are solvent and can stay afloat and build a bridge to the other side of the virus”.

In its briefing, “The economic emergency: experimental treatment”, published 21 March, The Economist shares its own analysis that “40% of consumer spending in advanced economies is vulnerable to people shunning social situations. Firms in leisure and hospitality are especially rattled”.

The article goes on to detail regional measures to avert widespread unemployment and SME sector collapse. It also points out that rich countries, both in human and economic terms, are in a relatively fortunate position with strong healthcare systems, “and investors who, for now, remain willing to lend to them on cheap terms”. Poorer nations have far less certain prospects, with less room to borrow and job markets containing a large number of informal workers ineligible for protection.

Deutsche Bank’s Barnard notes that there is huge uncertainty about how long companies can weather low revenues and high costs – resulting in stock market falls. While merchandise-based businesses can build up inventory going into a recession, the service industry cannot do likewise, and an economy based on service revenues will take longer to recover. This can be seen in the Covid-19 ‘heat map’ below.

Turning to the EU, writing on 24 March UK-based economists Mark Wall and Peter Sidorov explain that the issue is whether each member state can respond to the virus shock with “equal intensity” or whether the EU needs to step in and address the differentials. “Some member states are able to bear the costs of this more than others. This is putting the spotlight on the European Stability Mechanism (ESM), Europe’s crisis fighting tool, to step up and play a role in financing the response to the virus crisis,” they note.

What rebound?

While most experts agree the virus will eventually fade and the world rally from the temporary external shock, certainty has lessened that there will be an economic rebound in the second half of 2020. Not only that, but because of where different regions are in their various points of the pandemic “cycle”, the recovery is very difficult to predict. “Any optimistic vision needs to believe in some kind of ‘V’, and that is next to impossible when the real economy is only starting the downside of the V at an historic pace of descent,” reflects Alan Ruskin, Deutsche Bank’s Co-head of FX Strategy. “We are too soon into social distancing to start seeing its end, which is the core metric for risk recovery.”

In the beginning is the end

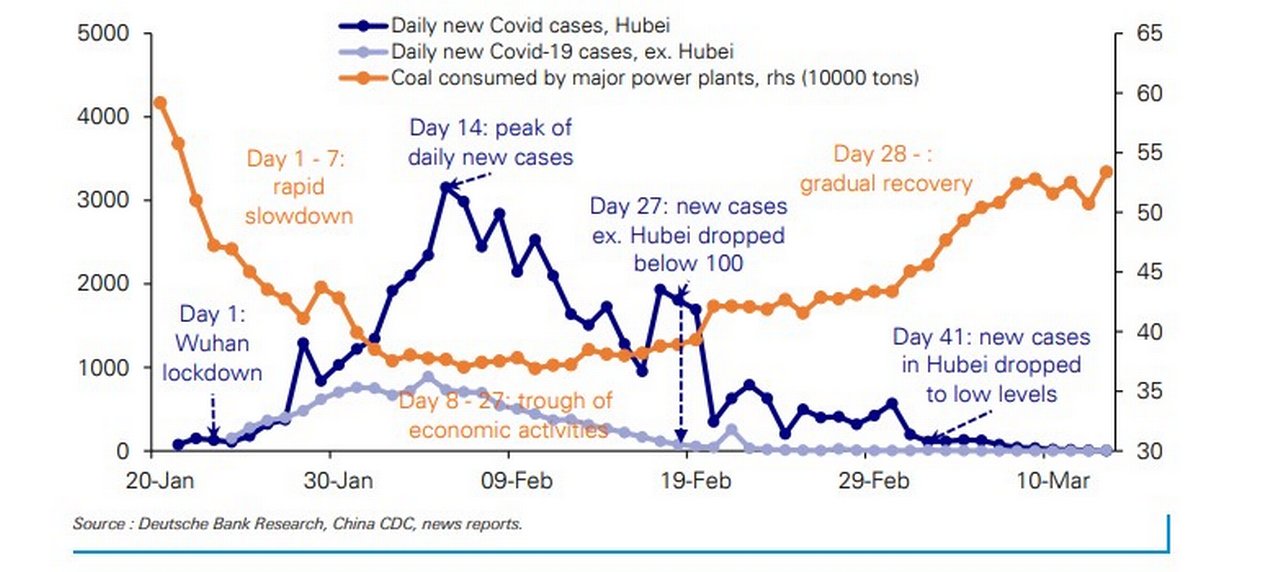

As the virus first started in China, notes Deutsche Bank’s Hong-Kong-based economist Yi Xiong, the country also holds possible clues as to how the rest of the world might recover from a shock in Q2 that looks likely, he says to be “unprecedented in the 70 years of the post-World War II economic history”.

Chinese households cut more than half of their discretionary spending on items such as automobile, apparel and home appliances in response to the pandemic. While spending on mobile phones, entertainment and pharmaceuticals was less impacted, growth rates were nevertheless negative. More was spent on food and while one would expect household savings to increase, data for February 2020 indicate this did not happen.

As for the corporate sector, “industries that saw plummeting retail sales also had a bigger decline in output”, this being less severe in upstream capital industries such as steel and oil refineries. However, explains Xiong, “the disconnect between upstream and downstream production also means that inventories are likely building up. This, combined with record low oil prices, creates heavy deflationary pressures on producer prices”.

Interestingly, the domestic financial markets were, he noted, “remarkably resilient during the Covid-19 outbreak”, which was more a reflection of market confidence that the outbreak was coming under control and the slowdown of the actual epidemic curve. While the government provided some liquidity support, it did not intervene directly in the markets. In addition the People’s Bank of China, China’s central bank, injected sufficient liquidity through open market operations; and the China Banking Regulatory Commission briefly extended the time required for stock trading accounts to cover margin calls. “These measures are nothing comparable to what the government's direct intervention during the 2015 stock market crash,” reflects Xiong.

Although the Covid-19 outbreak in China appears to have now been contained, economic activities are still far from fully recovered. “The pace of recovery has been slower than we had hoped, and it appears the momentum might be slowing lately,” he concludes.

As China returns to work, some 50 days after the start of the crisis in Wuhan, questions remain about whether leaders have prioritised restarting the economy over, as the Guardian put it on 23 March “decisively containing the virus”. It is a difficult balance.

Ongoing outlook

Postponement rather than cancellation seems to be the theme of the day, with firms and households hunkering down in their regional lockdowns while preparing for recovery. With the announcement that the 2020 Tokyo Olympics will not be cancelled but rather moved to 2021 – a move unprecedented in peacetime – the collective spirit to survive and thrive seems alive and well.

For further information, please visit Deutsche Bank Research here

Deutsche Bank clients can access the full research reports via the research portal here

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

Macro and markets, Cash management, Trade finance and lending

Coping with Covid-19 Coping with Covid-19

With the coronavirus now pronounced a pandemic by the World Health Organisation and lockdown imposed on more regions and cities, what will be the impact on the global economy? flow reviews extracts from Deutsche Bank research

NEWS, CASH MANAGEMENT

Supporting corporate treasurers working from home Supporting corporate treasurers working from home

Deutsche Bank’s FX platform capabilities are helping corporates facing exceptional challenges triggered by the global pandemic – from maintaining liquidity to enabling employees to work from home

Macro and markets, Cash management, Trade finance and lending {icon-book}

US-German trade ramps up US-German trade ramps up

As the US overtakes China to become Germany’s top non-European FDI destination, financial journalist Ivan Castano Freeman provides a deep dive into these burgeoning corridors, drawing on insights from Deutsche Bank experts and the German American Chamber of Commerce, Inc. (GACC New York)