22 July 2021

Analytics and data flows in the banking sector can equip banks and their corporate clients with the tools needed to respond to crises more effectively. Experts at Deutsche Bank’s ‘Data planning through disruption’ webinar took a closer look what this means in practice. flow reports

MINUTES min read

Today, individuals, companies and financial institutions produce an unprecedented amount of data, and, following a quantum leap in the technology and software used to analyse it, we have already seen how this data is being put to work.1 It comes at a critical time for the banking industry, with the Covid-19 pandemic and the accompanying uncertainties having brought the importance of data, and the informed decisions it can enable, into sharper focus. Banks are embedding data into their processes – not just in the middle and back offices, but also towards the front – to better respond to the ongoing crisis, as well as any future ones.

The great reset

Collecting and analysing real-time data gives banks the opportunity to provide value-added, tailored services to clients – providing them with a competitive advantage while cementing loyalty with services generated from what the client data is telling them. Used in conjunction with emerging technologies, such as machine learning, artificial intelligence and robotics, data can also help banks to optimise and streamline internal processes that improve performance and reduce operational costs. In addition, it can help reduce compliance risks.2

Yet at a Deutsche Bank webinar on “Data Planning through Disruption” held on 18 May 2021, Francois Zimmermann, EMEA Field CTO at Tableau Software noted that “in most organisations, less than 20% of people are effectively engaged with data – meaning that a lot of decisions are made based on either what has worked in the past, or on a kind of bias or gut instinct? Clearly, during a crisis, what has worked in the past is no longer adequate.”

Covid-19 has brought the need for data to the fore. In the fast-changing landscape created by the pandemic, the ability to rapidly analyse a new situation and adapt processes accordingly has been the key to maintaining business continuity. And, according to KPMG, this dexterity has to continue going forward. “A crucial element is also to introduce advanced data analytics capabilities that will allow banks to model likely outcomes. To be robust, this also means combining internal data with external information and inputs too – something for which cloud-based tools including AI are likely to be indispensable,” noted the consultancy in July 2020, before the second Covid-19 waves had hit.3

Klaus Schwab, Founder of the World Economic Forum, called this the “time for a great reset”,4 emphasising the importance of getting to grips with the acceleration of change. Businesses not only need to implement new metrics, launch new products and facilitate new customer interactions, but they need to do so with speed and precision. How quickly businesses can integrate this new, data-driven view of the world, according to Zimmerman, will determine who wins and who loses. Ultimately, the end goal is to move from just 20% of people using data to democratising the whole organisation. To achieve this, “it is imperative that we embed data into our culture, such that we are able to serve our clients with the quality, real-time solutions they increasingly expect,” he concluded.

From the middle to the front

The Basel Committee on Banking Supervision’s standard number 239 (BCBS239), which contains "Principles for effective risk data aggregation and risk reporting", has resulted in tangible progress in several key areas of data regulation, including overarching governance, risk data aggregation capabilities and reporting practices.5 Elsewhere, since 2017 international standard IFRS 17 has brought about a significant shift in the way data is collected, stored and analysed in the insurance industry.6

“These regulatory changes, which are explicitly about data management, have put banks in much better shape when it comes to the middle office,” explained Zimmerman. This trend, he said, “has not necessarily been operationalised across the front-office function, where many are still not effectively using their data”. The key challenge is that banks run a number of different applications across their business, and much of the data contained within these applications often exists in silos. Indeed, reports suggest 89% of technology leaders struggle with data silos – with the average enterprise maintaining 900 applications where only one-third are connected7.

“Banks need to empower the front office to use data to lead decision making”

This is proving to be an issue for banks. The front office is a bank’s shop window – it is how they retain old customers and attract new ones. A report by McKinsey Global Institute found that data-driven organisations are 23 times more likely to acquire customers, six times as likely to retain customers and 19 times as likely to be profitable.8 These findings are not lost on Arif Panjwani, Global Head of Client Analytics & Insights, Corporate Treasury Services, Deutsche Bank Corporate Bank, who explained that “Banks are focussed on creating a data-first culture and empower the front office to take data led decisions. There is a lot to be done but we have made significant progress and heading in the right direction.”

Dennis de Weerdt, Global Head of Client Service, Cash Management, Deutsche Bank Corporate Bank agrees that this trend is well under way, adding that the way banks discuss data has changed. “We are no longer the only ones pushing the agenda. In fact, our corporate clients are now asking more and more questions around data – and the pandemic has helped to make this change both meaningful and necessary.”

Democratising data

Banks have a diverse store of data across hundreds of applications. Collecting the data itself is not the challenge; rather it lies in ensuring everybody has access to data – and that they can use to proactively make informed decisions anytime, anywhere. To democratise data, it needs to be sorted and presented in a way that offers actionable insights. “What we do with the information is more important than the information itself,” explained Panjwani.

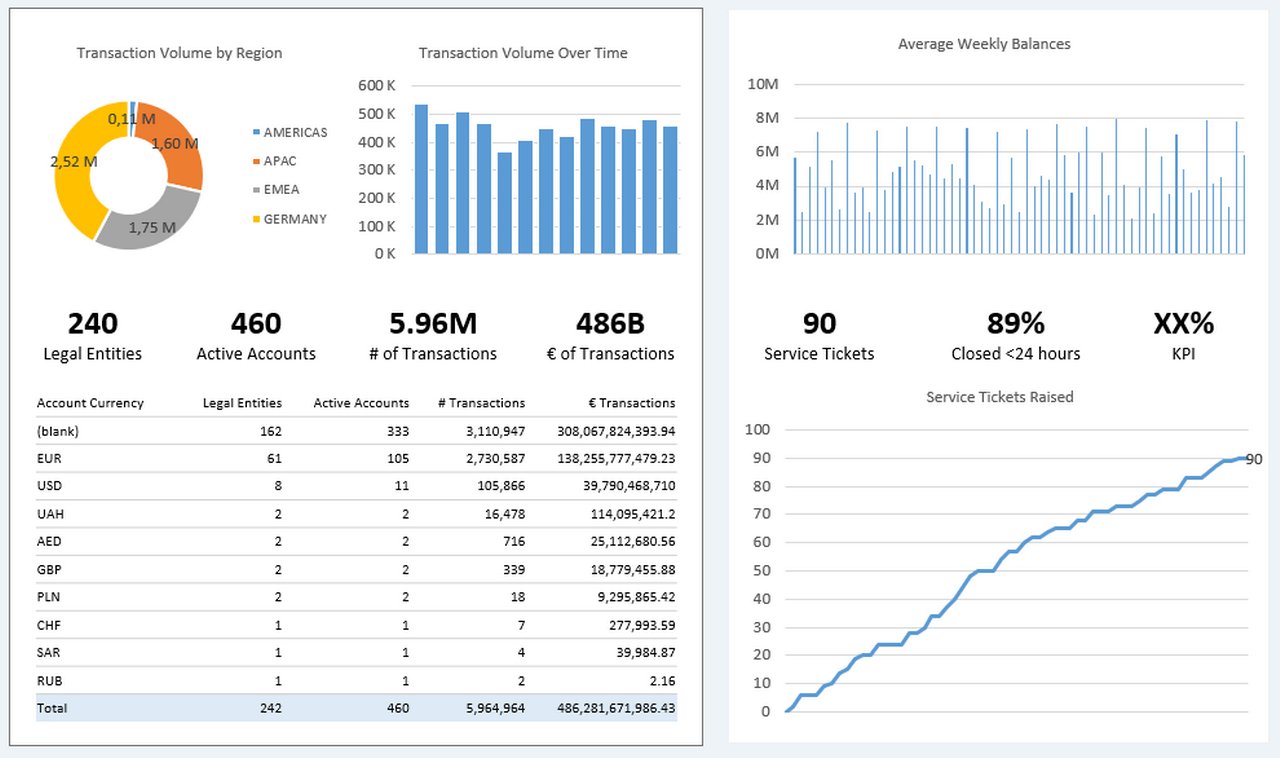

Deutsche Bank’s Beacon Next Gen platform – a partnership with the Tableau platform – puts this concept at the forefront. Beacon enables the cash management team to better understand data, not just at an aggregate level but also in a way that is customised for different portfolios and clients. Figure 1 demonstrates how this platform can also provide client facing teams with aggregated data in a single dashboard – offering them a holistic understanding of the client's requirements that is not just based on their previous interactions, but on meaningful data insights.

Figure 1: A Beacon next Gen dashboard showing how data insights are displayed

Source: Deutsche Bank. Note this is sample data only

Treasuries that were more digitally oriented managed to respond to the Covid-19 shock faster than others. Those that implemented data-driven techniques were better able to provide accurate advisory services to clients, as well as forecasting. As a result, the data-driven teams were better able to plan their capacities, operations and infrastructure based on the needs of clients. A Tableau Software/YouGov survey found that 82% of data-driven companies had reported critical business advantages since the pandemic began – creating a cyclical pattern of holistic customer support through data planning.9

“Data can also be used to help with looking to the future and creating contingency plans for disruption”

For example, in early 2020, when Malaysia went into its first full lockdown, the FX markets were completely shut down. In response, Deutsche Bank leveraged its data analytics capabilities to help clients understand their average operational balances. This allowed the Bank to discover and execute alternative funding methods for its clients’ subsidiaries until the currency markets reopened.

The next step, explained de Weerdt, will be to use this approach to help with future business and unusual environments. “Going one step further, data can also be used to help with looking to the future and creating contingency plans for disruption. Banks can accurately use predictive data to put together a plan for when a currency rises or falls to a certain amount or if there was fraudulent activity. This puts the bank in a better position in terms of control and creating solid, well-thought-out response plans.”

Integrating AI

Looking to the future, artificial intelligence (AI) will play a significant role in how financial institutions interact with data. Whether used in the front, middle or back offices, AI technologies can unlock a host of cost savings and opportunities for banks. In fact, McKinsey estimates that they could potentially deliver up to US$1trn of additional value for global banking annually.10 The potential opportunity has not been lost on those within the sector either, with a recent survey by the World Economic Forum and the Cambridge Centre for Alternative Finance (CCAF) finding that 64% of financial services leaders expect to be mass adopters of AI in just two years.11

There are number of business-critical AI use cases being used today, primarily around autonomous decision making. This, according to Zimmermann, already spans from automating processes such as real-time fraud detection to creating augmented solutions, whereby a human operator works alongside a bot or an AI algorithm to make decisions. “This is an extremely interesting part of AI at the moment,” added Zimmermann. “We are seeing bots bring data into everyday workflows and enabling teams to ‘level up’ by working alongside AI.”

Integrating data analytics as part of workflows is the ultimate goal. The algorithms can work across many different business practices, with data scientists using AI for fraud and risk modelling, business experts using AI in sales and marketing and data analysts using AI to optimise their processes. As Panjwani concluded, “Optimistic yet cautionary AI adoption is essential and data analytics is a journey which has plenty of milestones, cross roads and an ever changing destination.”

For more detail on themes covered in this article, you can replay Deutsche Bank’s “Data planning through disruption” webinar here

Sources

1 See Driving data quality at flow.db.com

2 See https://bit.ly/2V2FHYO at projectivegroup.com

3 See https://bit.ly/3izt4MZ at home.kpmg

4 See https://bit.ly/2V0rj3B at weforum.org

5 See https://bit.ly/36RM8kk at bis.org

6 See https://bit.ly/3hRFHnG at deloitte.com

7 See https://bit.ly/36QXhSq at mulesoft.com

8 See https://tabsoft.co/36SSNdS at tableau.com

9 See https://bit.ly/36Otk5o at businesstimes.com.sg

10 See https://mck.co/3ir6czm at mckinsey.com

11 See https://bit.ly/3xWVWWa at weforum.org

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

TECHNOLOGY

Driving data quality Driving data quality

Corporate clients are demanding insights & predictive analytics built on high quality data from their bank and there is good reason for this, as many have a global footprint, complex flows and a large product suite. flow’s Clarissa Dann and Deutsche Bank’s Cian Murchu share the Deutsche Bank journey

TECHNOLOGY {icon-book}

Data-driven planning Data-driven planning

The use of data to contain the spread of the coronavirus has been well-documented. But it can also highlight disparate Covid-19 impacts and influence better planning decisions for recovery, as ANHD’s Barika Williams tells flow

CASH MANAGEMENT

Tomorrow's treasury today Tomorrow's treasury today

At Eurofinance 2018, the 27th conference on International Treasury Management, the cooperation between banks, corporate treasurers and fintechs to achieve common goals of speed and transparency was very much in evidence. Clarissa Dann reports on how buzz words made way for road maps and milestones