07 October 2022

Businesses globally want to approach their data in a holistic way, but often struggle to gain the traction needed to be successful. flow explores how Deutsche Bank has transformed its data function – and the key learning points from the bank’s journey

MINUTES min read

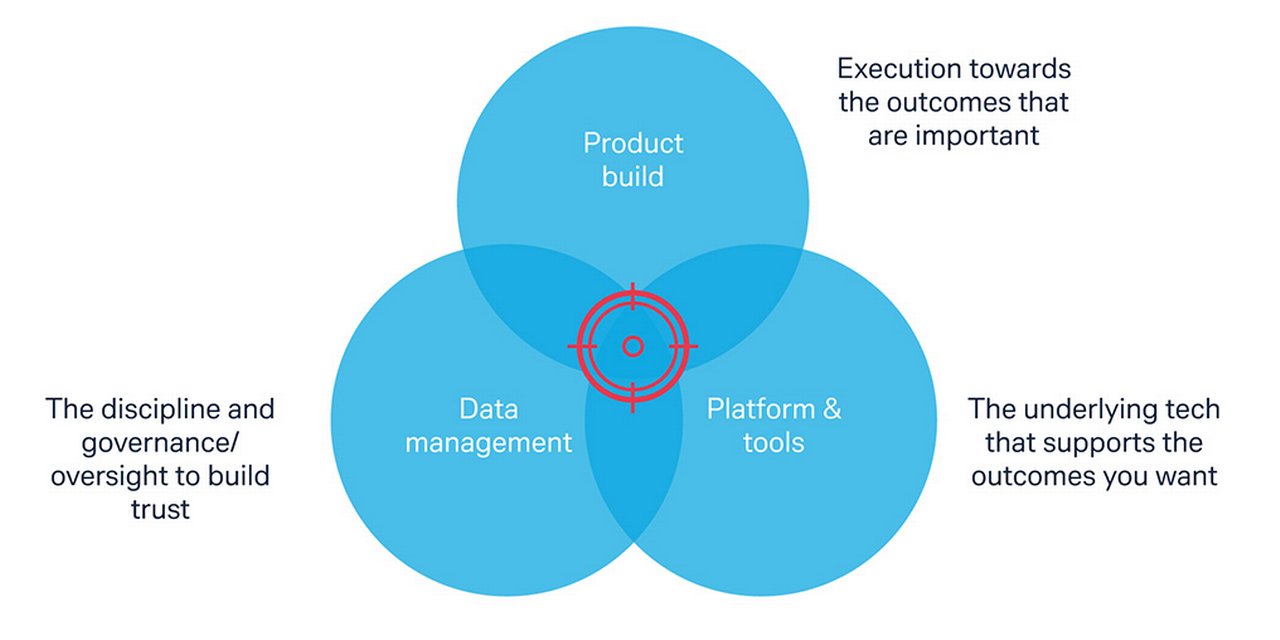

Discussion of data often centres on one of three core components depending on the audience. It might refer to:

- The underlying platform and tools that are used to drive outcomes when in a technology area;

- The discipline and oversight needed to build trust in data when in a data governance function; or

- The products that are built to solve a specific challenge when in a business line.

An effective data strategy, however, is one that does not exist in siloes, but rather brings these components together.

According to Chris Daniels, Chief Data Officer, Deutsche Bank Corporate Bank, it’s about finding the sweet spot in the middle . “When I talk about holistic data, I'm talking about balancing these components – not focusing on any one to the extreme – and finding an approach that unlocks the best of all three,” he explains.

In this sense, a holistic data approach can help businesses maximise the benefits of their data teams to create solutions that don’t just exist in isolation, but rather thrive on the dynamic collaboration, as well as the constant, multidirectional exchange of information this provides. See Figure 1.

Figure 1: A holistic approach to data

Source: Deutsche Bank

But how are businesses integrating this holistic approach to data into their offering? And how can organisations become more mature in terms of their use of data?

The data journey

For Daniels, it is clear that a lack of awareness or appreciation of data is not the challenge, but rather making that data accessible to those that need it.

“Data shouldn’t be an objective in its own right, it should directly serve business objectives and help create tangible solutions,” he argues.

“Data shouldn’t be an objective in its own right, it should serve business objectives”

In late 2017, Daniels was Head of Data Products and Governance – Securities Services at Deutsche Bank. As part of this role, he was tasked with creating a data-driven intraday liquidity platform. Rather than focus on a brand new, single-use liquidity platform, Daniels and team decided to leverage data analytics to deliver the insights needed. This not only allowed them to execute the task much quicker, but also meant they could improve the output and scale the solution to other business areas.

But for Daniels, the takeaway was much greater than the resulting product. He reflects, “It is not just about the fact that we used one technical approach in place of another; it’s about the mindset that got us to this outcome as well. It showed us the importance of working closely with the direct users of the products we were making. By understanding the problem, we were able to create a solution that met the needs of the team on an ongoing basis.”

When offered a new, broader role, Daniels took these learnings with him, and could apply what had worked well in one product line to multiple product lines – ensuring the connections between data and the business needs were strong.

In his new role, Daniels sought to further optimise the way Deutsche Bank was integrating and leveraging data. “We had lots of talented data scientists, but they weren’t being connected to tangible business opportunities,” he recalls. “We had a great governance team, but the set-up meant that they were typically seen as the guys that would slow down execution rather than make the process more robust. We had data modelling teams working to solve complex issues, but there was an information disconnect between the producers of the model and the consumers.”

So Deutsche Bank inverted the set-up – moving from a model that aimed to provide data solutions without a focussed purpose, to one that was driven by needs originating from the business. Daniels brought various teams together to create a complete package – from risk management and governance, to technology platform and data science.

By connecting specialists directly with business teams looking for specific solutions, the data team went from being distinct and separate, to one that was woven into the core of Deutsche Bank’s operating model.

The Importance of Agile

Incorporating a holistic approach to data into a small firm is challenging enough– and in a large financial institution it is formidable. Banks have traditionally used large bureaucratic and hierarchical structures – such as Working Groups or Steering Committees – to move projects stage by stage from conception to execution. The issue with this approach is that projects can often be held up, not because the executing team lacks the capacity to work on it, but because the decision-makers don’t have the time to provide sign-off.

One way that firms of all sizes – including Deutsche Bank – are tackling this is through an “agile” organisational structure. The agile approach (termed simply ‘Agile’) splits an organisation into a series of self-managing structures, which are repeated at various different scales. Deutsche Bank chose to use a model, based on the one Spotify had mobilised, to improve their engineering. The flow article, ‘New ways of working’ (June 2022) sets out the bank’s Agile journey and roadmap. “To thrive in a competitive environment, the Corporate Bank must quickly adapt at scale to changing market trends and customer needs – this lies at the heart of our Global Hausbank identity,” explains Julia Rutsch, the Corporate Bank’s Global Lead Agile Accelerator.

The basic unit of this agile organisational structure is the squad. Designed to resemble a small start-up, they have a cross-functional skill set and complete autonomy as they design, develop, and test to achieve their specific goals. Importantly, each squad contains the decision makers as well as those executing – as fast feedback and incremental improvements are central to the agile mindset.

As Daniels explains, “A squad at Deutsche Bank might include engineers, analysts and a product owner. It is, in essence, a set up like I had for the development of the intra-day liquidity platform all the way back in 2018. Every Deutsche Bank team member relevant to the project is involved from day one.”

Above this is the tribe, which is a collection of squads that work in related areas. Each tribe has a tribe leader who coordinates what each squad should focus on. There are also centres of expertise that focus on one area – such as data science or data management – and can be deployed as needed across tribes.

As the leader for Deutsche Bank’s data tribe, Daniels says that each quarter he will meet with the product owners to identify priorities and allocate squads and centres of expertise accordingly. Should the plan need to change during the quarter or at its end, the Agile set-up allows the bank to do so with ease.

“I think the misconception of Agile is that we don't plan deeply – and that is how we can become agile. That's not what it's about,” explains Daniels “There is actually a lot of structure, discipline and planning – as you would have under the traditional set up – except it is all centred on quick feedback cycles with minimal bureaucracy to slow progress,”.

Outside of this, one of the other vital elements is culture: “Squad members need to have the psychological safety to make mistakes, otherwise people will feel too cautious to move fast. Culture, though, takes time to build – and you need to make sure you are investing time into fostering these collaborative relationships.”

Principles for success

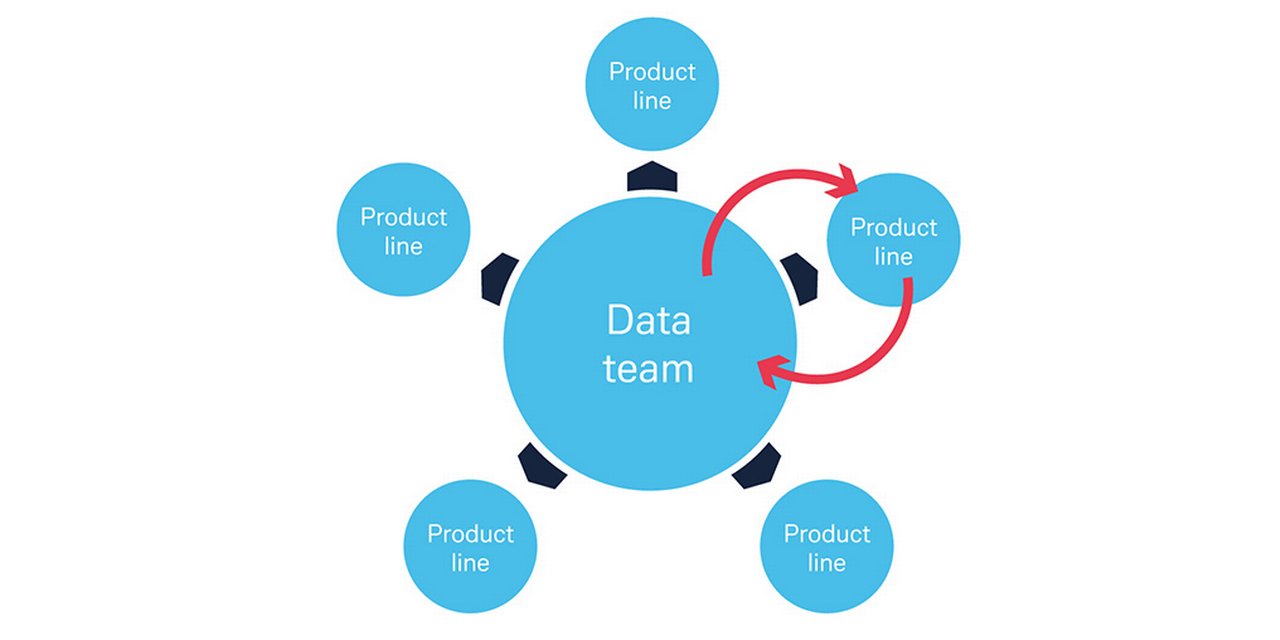

When choosing a set up for your data team, there are a couple of options. The first is the distributed model, where the data resources sit alongside other business roles and are not managed centrally. This is often done by smaller companies or start-ups where data is being used, but not yet large enough to be functional in its own right. The result can often be a set up that responds to the needs of the business, but as the business grows it can become inconsistent and inefficient as multiple teams work to solve common and sometimes, complex, problems by themselves.

Larger companies, by contrast, often have a centralised set up, where those with understanding of data are brought together and managed under a single structure to drive consistency and efficiencies. But, by moving the data team further away from the needs of the business, it can become more difficult to get the traction and directional input needed for data-related projects to succeed and you risk losing the ownership and accountability that is key to getting quality outcomes.

So which is better? Daniels believes it is not a binary choice. In fact, his work with the bank suggests a third model – one that incorporates the best of both – is possible (see Figure 2).

Figure 2: Deutsche Bank’s hybrid approach

Source: Deutsche Bank

“What we have built is essentially a model that can function in both a centralised and distributed way,” says Daniels. “We have found that while you don't want everything massively uncoordinated, you do want people to own the data they use. We’ve been successful in maturing products, processes or ideas at a central level and then rolling out the day-to-day ownership of these to the relevant business lines. Engagement and accountability has improved massively as a result.”

Deutsche Bank’s hybrid approach is just one path to effective data use by a financial institution, but it has proven to be impactful. In the first year of execution, the data tribe rolled out 24 platform releases, while launching an automated data catalogue, nine data science projects and multiple feature deliveries – demonstrating the productivity potential of agile working models, as well as the team’s commitment to holistic data practices.

While all data journeys will be different, Daniels identifies four principles for success that should apply in the majority of cases:

- Listen. Understand the real problems encountered and the elements that can create value for colleagues and clients in their day-to-day work.

- Identify a shared vision. A goal-oriented, purpose-driven internal culture helps harmonise the priorities and understanding of business and technological specialists across the company. On a technical level, it is also important to have purpose when pulling data in. This keeps the gathering and usage of data in the “sweet spot” of holistic data management.

- Start small but focused. High expectations and theoretical planning can pose barriers to successful execution using data. While simple, starting – and starting small but focused – helps build trust, and traction, which can grow into something much bigger.

- Promote an iterative feedback culture. A big part of Agile is the ability to change direction when something is not working, refocusing on more impactful opportunities or even changing course altogether if priorities are no longer aligned.

Cash management solutions Explore more

Find out more about our Cash management solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

TECHNOLOGY

Driving data quality Driving data quality

Corporate clients are demanding insights & predictive analytics built on high quality data from their bank and there is good reason for this, as many have a global footprint, complex flows and a large product suite. flow’s Clarissa Dann and Deutsche Bank’s Cian Murchu share the Deutsche Bank journey

Community, flow case studies

New ways of working New ways of working

Agile working promises to make companies more dynamic. How? flow’s Desiree Buchholz and Clarissa Dann report on how this is happening on the ground, providing insights from Deutsche Bank Corporate Bank’s own agility journey together with that of the SAP treasury team

CASH MANAGEMENT {icon-book}

Creative sounds Creative sounds

Until Spotify disrupted the music ownership model, the music industry was under siege from piracy. Clarissa Dann reports on how the Swedish audio media phenomenon has applied its corporate treasury infrastructure to support this incredible growth story