May 2020

The most recent Global Custodian webinar checked-in on the transformation of securities services, how the Covid-19 pandemic has accelerated this journey, and the road ahead. flow reports on the key takeaways

Over the past decade, the emergence of new technologies combined with regulatory and infrastructure change in securities services precipitated more efficient and harmonised operating models in an industry where legacy infrastructure and non-standardised processes were the norm. In the last week of April, a Global Custodian webinar, titled Embracing the New Post-trade Decade, road checked that transformation journey and how it is being impacted by Covid-19.

With pandemic-related challenges spilling over into the securities sector, Joe Parsons, Global Custodian’s moderator and online editor called on panellists Daron Pearce, CEO of EMEA Asset Servicing at BNY Mellon, Michaela Ludbrook, global head of Securities Services at Deutsche Bank and Alan Copping, head of Market Support at SimCorp, to share with more than 100 listeners their experiences of operating during the crisis.

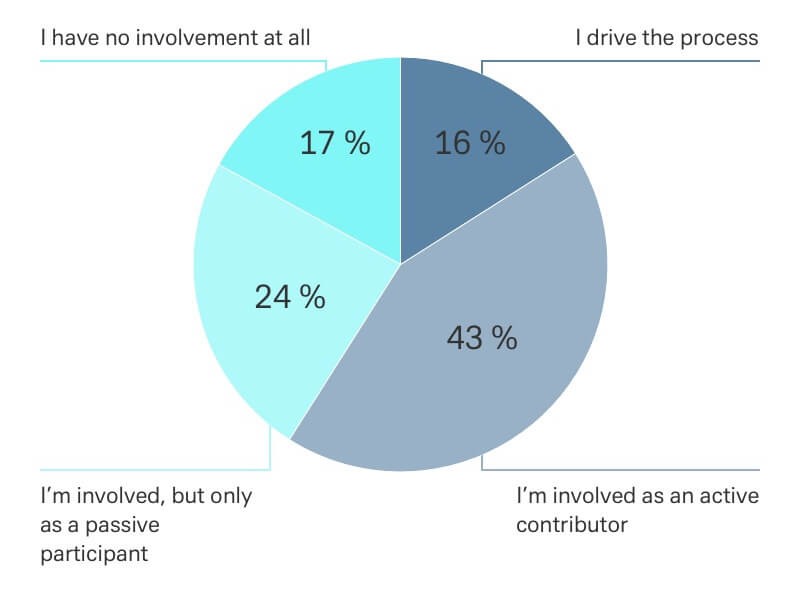

As a prelude to the discussion, the moderator invited the online audience to vote in the first of four polls, which posed the following question and invited responses to the four options:

Where have you felt the effects of the Coronavirus pandemic the most on your securities services operations?

Number of respondents: 92

Commenting on these results and the state of the industry pre-crisis and where it is now, Ludbrook’s view was that it has illuminated plans the business wanted to accelerate, rather than inhibit them.

Protect, pioneer and invigorate

Ludbrook explained that the current environment has given Securities Services an opportunity to reflect on where the industry was, where it is now and where it is going – and that the crisis highlights the need for data and technology to protect, scale and streamline, people to invigorate processes, and partnerships to pioneer the next set of solutions.

Half of those polled on the webinar suggested that the area of operations and technology is where the effect of the Covid-19 pandemic has been felt most strongly as firms manage through the day-to-day impact. Here, the industry has pivoted towards getting the nuts and bolts right to ensure resilience and stability, accelerating the digitalisation agenda to streamline paper-based processes. “With the crisis precipitating home working across various locations around the world, we have invoked digital tools such as electronic signatures, transparency around flows, data reporting and lifecycle transparency,” said Ludbrook.

With Covid-19 accelerating the digitalisation agenda, operating and business models will change as the way people execute tasks or the technology they use evolves, she added. “AI, data and DLT will be crucial for future transparency around data and people being able to self-service”.

Data was, of course, already a key area of focus yet it is rising further up the agenda. SimCorp’s Alan Copping outlined how they are seeing increased demand for access to data and questions about how this can better service firms: “Given market volatility, firms will want to see their portfolio and positions and the key question is: how to get data out to them quickly and efficiently from a centralised and validated place?” At the heart of the answer is increased automation of data management.

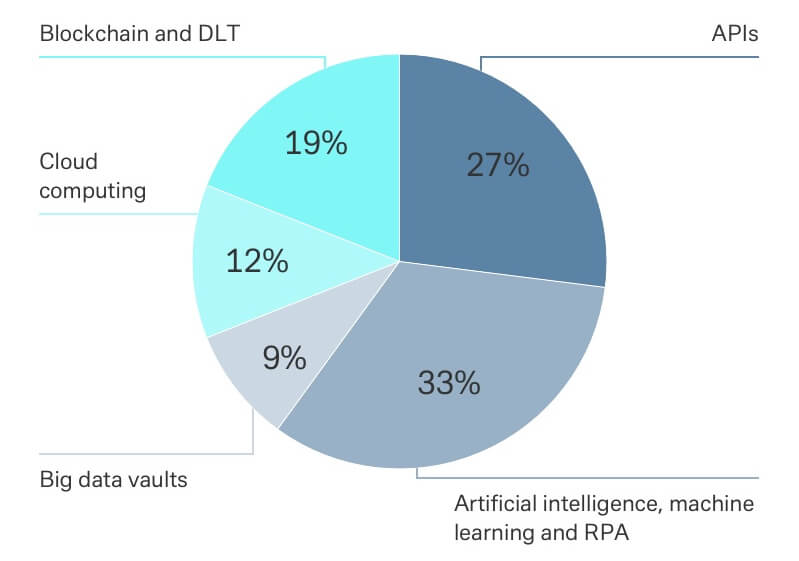

Integrating disruptive technologies

With new technologies and data enabling the industry to alleviate manual processes, a second poll illustrated industry sentiment towards the potential of application programming interfaces (APIs), AI, machine learning and robotic process automation (RPA), big data, cloud computing and blockchain to help post-trade processes and operations going forward.

What disruptive technologies will take off to help improve post-trade processes and operations?

Number of respondents: 100

Ludbrook opined that while all of these technologies will feature going forward, the industry needs to be flexible about which ones to test and drive to figure out how best to integrate them. “It could be eliminating tasks like email queries with self-service models, for instance APIs enable us to link, and plug and play very quickly and DLT enables some parallel processes to eliminate handoffs,” she suggested.

“In this time of uncertainty, you need to be looking at technology that can help you to react quickly, such as machine learning that is intelligent enough to adjust hard-based rules to account for market volatility,” added Copping. He noted that machine learning was of particular value in the area of trade processing and handling exceptions, particularly in predicting where those exceptions will come from.

"In this time of uncertainty, you need to be looking at technology that can help you to react quickly, such as machine learning"

Rethinking engagement models

Such advancements and focussed attention on the technology and operational enhancements mean that the traditional near and far shore locations have almost been replaced overnight with multiple new ways to service clients remotely. According to Ludbrook, this has given the industry cause to reflect on traditional engagement models. “We need to think about how to serve them in future whether through home working, or more sites but smaller groups of people to satisfy some of the technical “new normal” requirements,” she said. “We’ll see an acceleration of the use of instant messaging (IM), video, audio and governed communication mediums as precipitated by the current environment.”

BNY Mellon’s Daron Pearce said that, from his perspective, the pandemic has driven an uptick in the quality of communications with their clients in some areas. Anecdotally, a recent virtual event the bank staged drew 250 attendees – in normal times they would have expected around 80. He and his team are seeing the same opportunities for engagement. “We have also seen a shift in the front office, with increasing uptake of online tools by a wider range of individuals,” he added. “Some firms have, of course, found technology vulnerabilities due to their previous under-investment – and this has proved a catalyst for improved architecture.”

Digital footprint to replace bricks and mortar?

With these new ways of engaging with clients – given that many firms’ data sits in the private cloud, panellists agreed that as more capabilities become digitised it is worth considering whether local custody can be delivered without having a physical presence.

“You’ll always need some bricks and mortar, but cloud computing and other technologies will make that physical footprint less and less important over time,” explained Pearce.

"You’ll always need some bricks and mortar, but cloud computing and other technologies will make that physical footprint less and less important over time"

Digital solutions have replaced otherwise manual tasks and the number of wet signatures have reduced, so the percentage of those working from home should increase given cloud computing capabilities have been proven to work in this lockdown environment. “Client-facing teams have also engaged virtually and extensively with their clients, to discuss products, markets, business and technical solutions and impacts – the breadth of topics has been endless, which is generating great ideas and thoughts,” commented Ludbrook. “Home working will be a long-term trend and in the next three to six months the industry will be figuring out what can and can’t be done remotely.”

While remote working capabilities have risen to the challenges of the crisis, at the same time there will always be a need for some physical presence. “We will always need some bricks and mortar for wet signatures and physical deliveries,” said Ludbrook. “So real estate should not be ruled out, but cloud computing and some of the other technologies are going to make that physical footprint less relevant over time.”

Regulation to drive standardisation

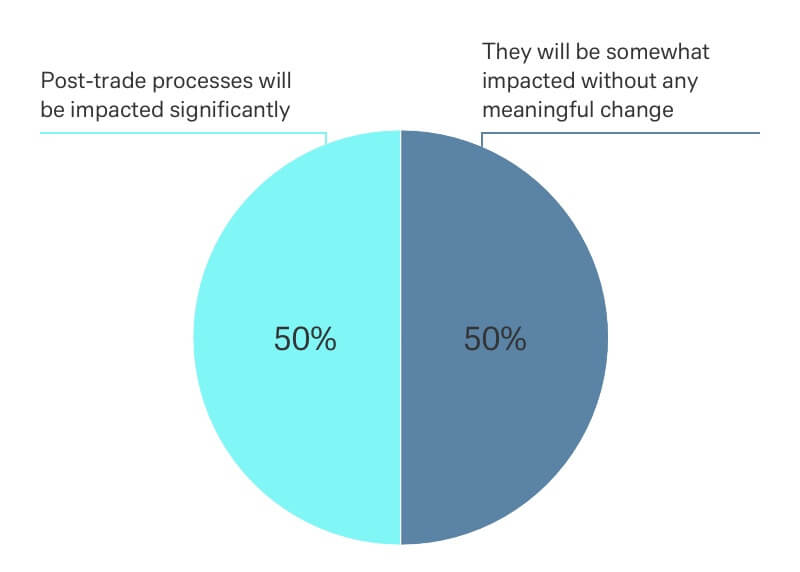

With the postponement of significant financial regulations such as the central securities depository regulation (CSDR), uncleared margin requirements (UMR) and the securities financial transaction regulation (SFTR) offering securities industry some temporary reprieve, a third audience poll revealed divided opinion on the disruptive impact they will have in shaping post-trade workflows.

Will regulation such as CSDR, UMR, and SFTR play a disruptive role in shaping post-trade workflows?

Number of respondents: 78

Panellists agreed that the regulations have triggered the move towards a service-oriented regulatory process where clients need services to help them comply. Ludbrook advocated that they have a crucial role in highlighting what the industry should be doing anyway, which is standardising and harmonising processes and data. “We’re moving more towards a data transparency driven industry to eliminate some manual processes and to streamline others,” she noted.

“Regulation is complementary to and integrated within that. Given the regional nuances this has helped create a foundation to encourage that standardisation around processes.” She added that much has been done to achieve standardisation and harmonisation in post-trade workflows to date, with CSDR setting the standards around securities settlement and voting.

Regulation can also support the increased focus on governance and cybersecurity in these times of stress, given that securities services firms are running very distributed organisations from a geographic perspective. “Regulation has helped to eliminate some of those hurdles and has led to an acceleration of process in different countries given they’re in different stages of evolution,” said Ludbrook.

Planning for all events

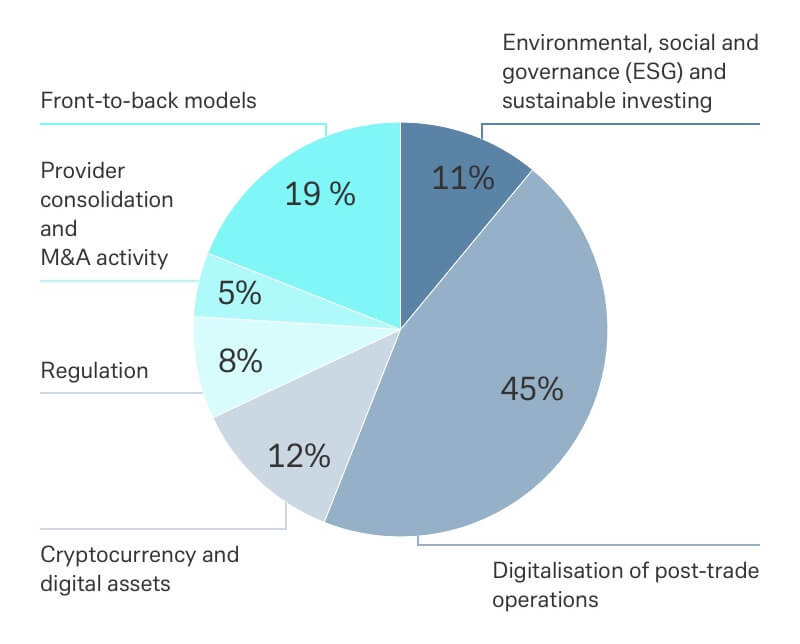

The fourth and final poll solicited opinion on what topics will dominate the post-trade agenda over the decade ahead, with digitalisation, front-to-back models, and cryptocurrency and digital assets identified as the key points on the agenda.

What topics will dominate the post-trade agenda for the next 10 years?

Number of respondents: 83

What the latest crisis has shown is that every eventuality needs to be planned, given how unpredictable Covid-19 has demonstrated things can be. As Ludbrook succinctly put it: “If you asked me in 2010 what the biggest event would be in 2020, it wouldn’t be the one we are experiencing now! The lesson is that when trying to future proof the business, there is no single event you can plan for.”

"You’ll always need some bricks and mortar, but cloud computing and other technologies will make that physical footprint less and less important over time"

Pearce also suggested that while his bank might have tested the impact of the loss of several operating sites and planned for how they would transfer processes from these, their stress test would not have extended to losing all of them.

Such planning requires continuous evolution, said Ludbrook, because it’s a very complex ecosystem and there will be elements of technology, infrastructure, people and “scenario busting” that the industry needs to plan for. “But we should also be dynamic and react.”

The webinar panellists concluded that a landscape capable of adapting to all scenarios will be the most sustainable one going forward. “We need to react to scenarios such as changes in the economy, interest rates, and geopolitical events, ensure the security and stability of the infrastructure and at the same time work through the foundational elements in terms of data, transparency, regulation, digitalisation and ESG,” asserted Ludbrook.

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

SECURITIES SERVICES {icon-book}

Fast-forwarding capital markets Fast-forwarding capital markets

In today’s business environment, investment firms need to be able to make quicker decisions, remove latency and eliminate manual tasks. flow’s Janet Du Chenne reports on how BNY Mellon’s technological transformation has enabled it to help clients achieve

SECURITIES SERVICES {icon-book}

Regulating securities settlement Regulating securities settlement

The settlement discipline regime, a key element of the Central Securities Depositories Regulation, has been delayed until 1 February 2021. Emma Johnson explains the changes required of market participants to meet their new post-trade obligations

TECHNOLOGY, CASH MANAGEMENT

From the engine room From the engine room

Almost overnight, Deutsche Bank relocated more than 65.000 of its employees to working from home locations ahead of Covid-19 lockdown. flow reports on operational resilience and business continuity management