17 November 2025

As Asia continues to attract investor attention for its high growth and promising returns, how is post-trade keeping pace in a shifting global economic landscape shaped by tariff shocks? flow shares key takeaways from a seminar hosted by The Asset in association with Deutsche Bank

MINUTES min read

One year ago, flow noted how “Asia’s vast and interconnected markets are teeming with opportunities”, as we reported on The Asset’s 7th Future of Asset Servicing Leadership Series hosted at Deutsche Bank’s 21 Moorfields offices in London. At the time, panellists were cautious due to the uncertainty around ongoing tensions between the US and China, “which could be further shaped by the outcome of the November 2024 presidential election”.

With the re-introduction of widespread tariffs following Donald Trump’s subsequent re-election as US President, resiliency in the face of a year defined by economic shocks – and what these mean for investors and providers of post-trade services – was the main backdrop to the 2025 focus on emerging markets in Asia.

Deutsche Bank’s Head of Trust and Agency Services Europe, Jason Connery (pictured, above) welcomed guests to The Asset’s 8ᵗʰ Future of Asset Servicing Leadership Series – Emerging Markets: Rethinking Investment and Post-Trade, opening with the reflection on the prior year takeaway that “geopolitics do matter” and what has evolved globally since then. In addition, since the 2024 event, he said, there had been an acceleration in digital themes – the US GENIUS Act providing a regulatory framework for stablecoins in July 2025. Another major development over the past 12 months has been the developing partnerships evolving between banks and non-bank digital asset platforms.

A year of shocks – and surprising resilience

“For all that’s happened over the last year, the key takeaway is just how resilient the global economy has been,” commented Henry Allen, Macro Strategist, Deutsche Bank Research, who had returned to provide the 2025 macroeconomic overview. He proceeded to explain that this year “has seen a succession of shocks, particularly on the trade side” and that Deutsche Bank Research expects the tariff rate to settle at its highest level in decades. “Global growth has remained steady, at around 3%,” he added and “financial markets are doing really well right now,” with the S&P 500 hitting record highs in October and emerging-market equities at their strongest in four years.1

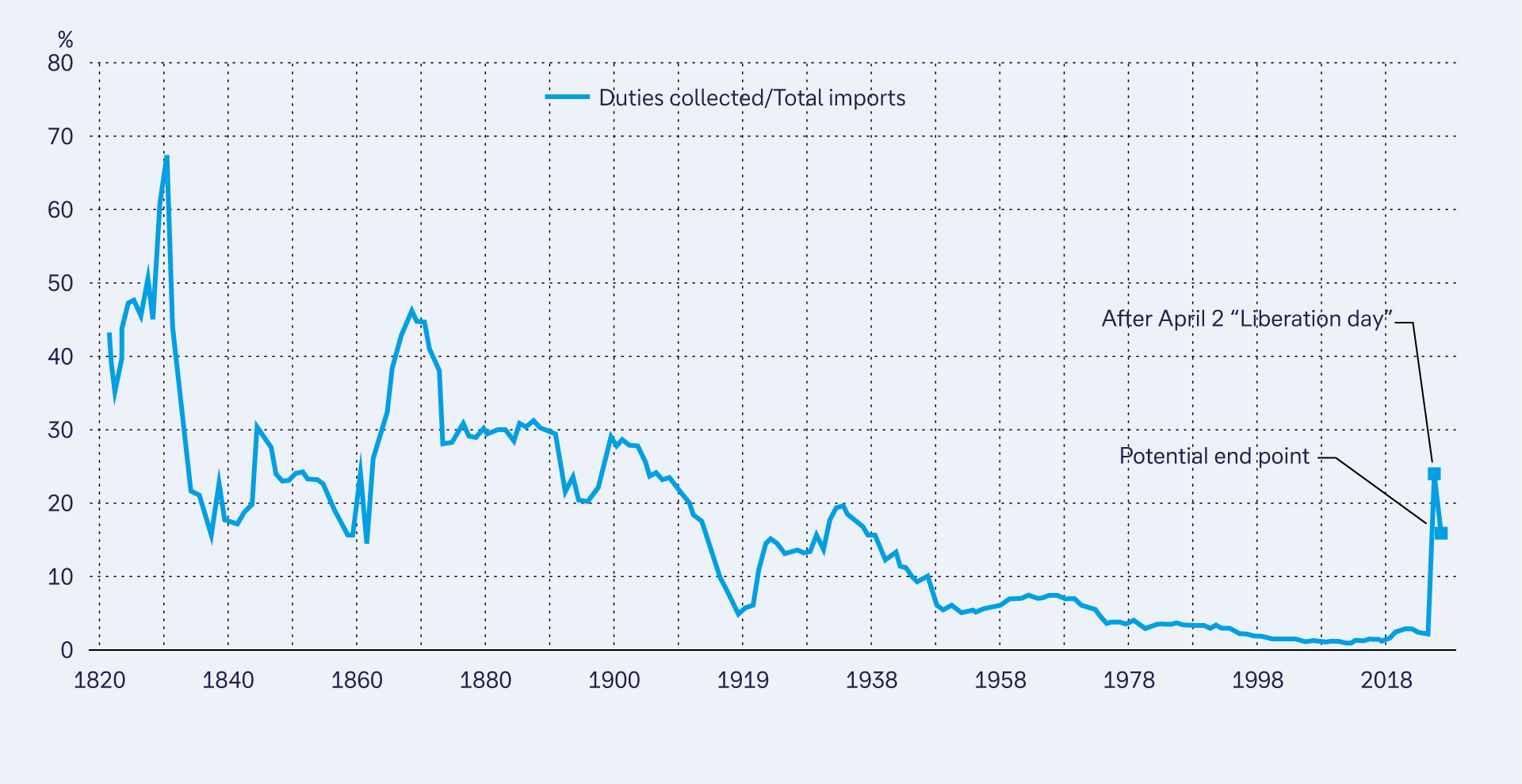

Figure 1: Tariff duties as a share of imported goods (%)

Source: Historical statistics of the United States, US census, Deutsche Bank

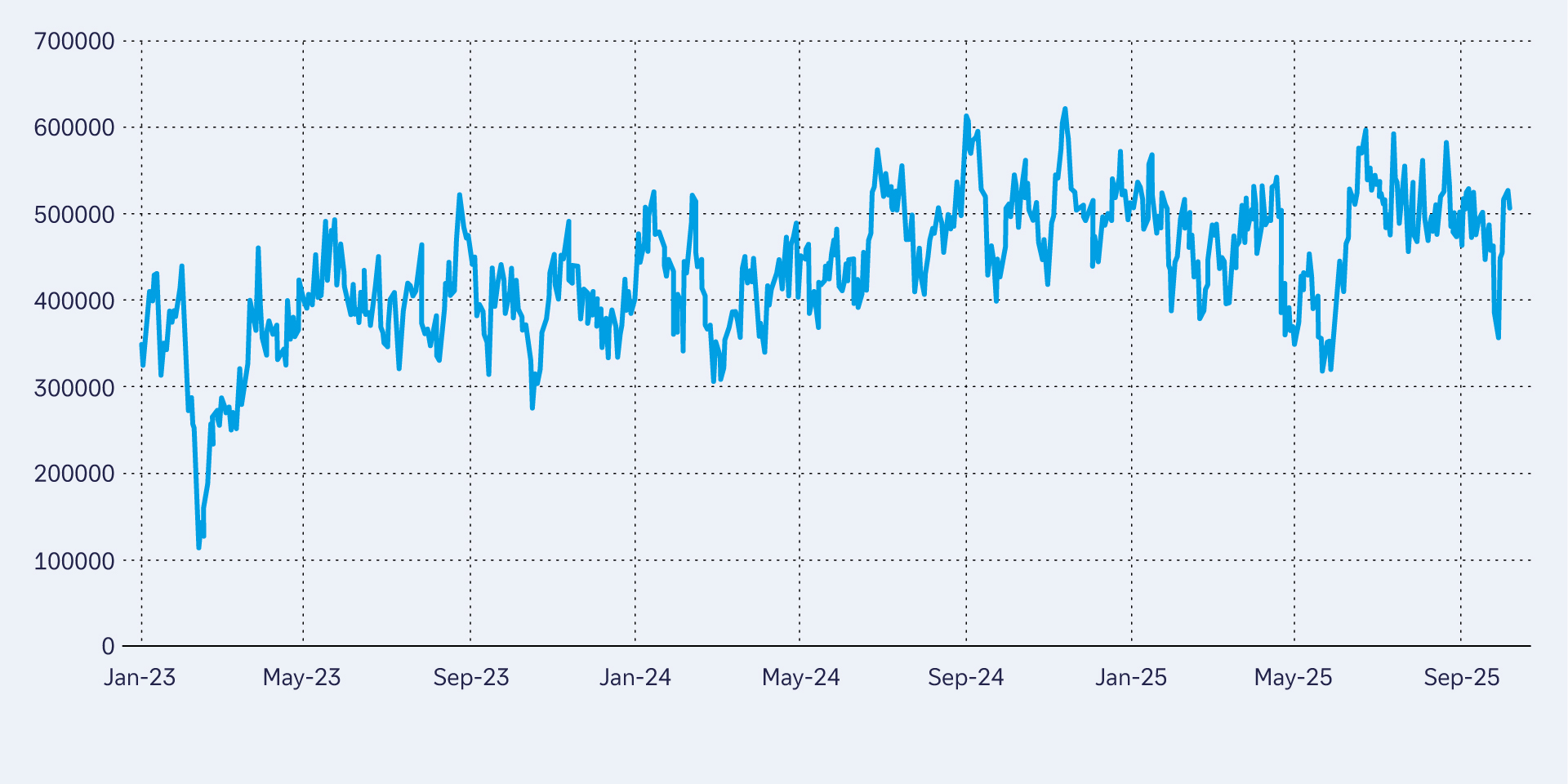

Figure 2: Container Ship Tonnage (TEU) – Departures from China to the US

Source: Bloomberg Finance, Deutsche Bank

Despite the second Trump administration delivering what Allen described as “one of the biggest trade shocks since the 19th century,” the feared collapse in global trade, he continued, has not materialised. Shipping volumes between China and the US, for example, have “remained roughly in line with 2023–24 levels,” and the recession that many people anticipated never transpired. See Figures 1 and 2 above.

Tailwinds provided by monetary policy have helped. “The Federal Reserve has just begun a new cycle of rate cuts, inflation has proved tamer than expected, and the dollar has weakened,” Allen continued. “That’s been good for emerging markets, because their central banks have more space to cut rates.”

He nonetheless cautioned that the global economy faces a “paradoxical” moment: strong growth and markets on the one hand, but rising inflation and investor anxiety on the other. With the tariff impact still filtering through to US consumer prices, inflation could climb again, potentially forcing the Fed to rethink its easing path. He also pointed to surging gold prices – now above their 1980 inflation-adjusted peak – as a sign that “investors are looking for assets that maintain real value in times of stress”.

Despite the potential challenges on the horizon, Allen’s final message was one of cautious optimism: “For all the tariff threats, growth has been a lot more resilient than people have given it credit for – and I expect that resilience to continue.”

Where next for China?

Panellists on the ‘Rethinking Investment’ session examined how investors are rethinking exposure across China, India and Southeast Asia after a year of sharp swings and policy surprises, as global supply chains realign and artificial intelligence (AI) spending reshapes industrial demand.

The discussion opened with the China conundrum. After rising from around 3.5% of global GDP in 2000 to a peak of roughly 18.5% in 2021, China’s share has since slipped to about 16.5%. While there are initial signs of a rebound, Aberdeen’s Michael Langham argued that the current trajectory suggests the country has likely passed its peak growth – and must now pivot from a manufacturing- and investment-led model to a more sustainable, consumption-driven one.

“China remains too important to ignore”

Amundi’s Claire Huang described China’s recent economic rebound as “largely liquidity-driven” rather than a genuine recovery of fundamentals. As she noted, the real test will be whether policymakers can address deflationary pressures through stronger demand-side measures, rather than relying solely on supply-side or anti-involution policies.

Despite those headwinds, China remains too important to ignore, according to Kirsty McLaren at Schroders. “There are some world-leading companies and a lot of innovation,” she observed, pointing to industrial sectors where China holds clear technological advantages and continues to capture global market share. Yet she cautioned that it remains “a ruthlessly competitive market,” where even firms that apparently benefit from moats can be quickly disrupted.

‘Rethinking Investment’ panel from left to right: Michael Langham, Emerging Markets Economist at Aberdeen; Claire Huang, Senior Emerging Markets Macro Strategist, Amundi; Kirsty McLaren, Investment Director, Emerging Market Equities at Schroders; and Daniel Yu, Editor-in-Chief, The Asset (moderator).

India’s potential

In last year’s panel discussion – Accessing Asia – how to invest in a dynamic market – India was similarly framed as a “market that can’t be ignored”, thanks to its young demographics, robust domestic consumption and structural reforms. These drivers continue to be backed by the numbers: according to Crisil, an S&P Global company, the country’s GDP is forecast to grow 6.5% in fiscal 2026, equalling fiscal 2025.2 Downside risks are, however, on the horizon, including the direct and indirect impacts of tariffs alongside declining growth in trade destinations.

Commenting on India’s trajectory, Langham described the country’s “demographic dividend” as its greatest asset, supported by a rapidly upskilling workforce and a wave of domestic entrepreneurship. However, he warned that continued success is contingent on translating education into employment and using trade deals to draw in manufacturing investment.

While panellists agreed that India remains one of the strongest long-term growth stories in emerging markets, they also urged valuation discipline. Schroders’ McLaren noted that Indian equities, long valued at a premium, remain “expensive even versus their own history” after several years of outperformance. Still, she sees cause for renewed optimism: “Earnings have cooled, valuations have come off, and we’re starting to get more interested.”

For Huang, cyclical and structural forces are now aligning in India. The combination of Goods and Services Tax reform, supportive fiscal policy and a gradual shift in monetary stance should help maintain strong growth – particularly in domestic-facing sectors such as consumer goods and financial services.

Tariffs, meanwhile, have become a far more complex variable. What began as a US–China trade dispute has evolved into an environment in which “everyone is a potential target”. McLaren highlighted that, in this context, investors are now focusing on where it makes most strategic sense to build capacity closer to end markets – such as EV-component production in Europe or manufacturing in Mexico for the US.

At the same time, diversification trends across Southeast Asia are reshaping opportunity. Vietnam has emerged as a clear standout from the “China-plus-one” shift, while Malaysia and Mexico continue to attract investment, and India shows early signs of momentum despite regulatory and logistical hurdles.

Balancing speed and resilience

The second panel, moderated by Nicholas Bone from Deutsche Bank, explored how shifting investment corridors, sanctions risk, and rapid advances in technology are reshaping the post-trade landscape.

State Street’s Dan Hickey noted that investors are becoming more selective in how they structure their sub-custody networks – particularly in regions affected by tariffs or policy volatility.

“Clients are thinking carefully about the counterparties they use and how to protect themselves from sanctions exposure while maintaining access,” he said. “The lessons of Russia’s market isolation have left a long tail of operational implications” that continue to influence decisions about liquidity, network diversification, and asset servicing.

According to Deutsche Bank’s Anand Rengarajan, the industry’s central challenge is balancing competing demands.

“From an asset-servicing perspective, we constantly deal with contradictions,” he said. “Clients want near-instant settlement, yet we also need to maintain strong controls and have time to manoeuvre if issues arise. Balancing speed with control is an art, and that’s what this business has always been about – and large, established firms have the scale and governance to handle that.”

‘Rethinking post-trade’. From left to right: Anand Rengarajan, Managing Director and Head of Sales, Trust & Securities Services, Asia Pacific, Middle East and Africa, Deutsche Bank; Dan Hickey, Global Head of Custody Product and Network Management at State Street; and Nicholas Bone, Head of Sales, UK, Middle East and Africa, Trust & Securities Services, Deutsche Bank

Lessons in ambition and standardisation

Rengarajan also highlighted how evolving investment flows are giving rise to new cross-border corridors – notably between Saudi Arabia and China – and how emerging markets are leapfrogging older infrastructures in their drive for efficiency.

“Markets such as India are moving to T+1 and even T+0 not because it’s fashionable, but because there’s a genuine business need,” he said.

That momentum is evident in India’s regulatory push. In early 2025 the Securities and Exchange Board of India began phasing in optional same-day (T+0) settlement for its top 500 stocks – a world first – as a step towards greater efficiency, investor protection, and trust.3

This shift is underscored by surging retail participation, with more than 100 million individual investors now active in India’s markets. This is fuelled by two main factors: technological advancements – such as e-KYC, mobile apps, and digital platforms – that simplify account opening and investing; and favourable economic conditions and greater financial inclusion, which have made investing more accessible to a broader population.”4

“The big thing Europe can take from Asia is its vision for growth”

“If you want to serve a segment like that, you need an entirely different setup,” added Rengarajan. “That’s one of the main reasons we’ve had to upgrade. Our infrastructure now has to handle 500 times the volume it did a decade ago. And this new class of investors? They expect T+0 settlement.”

Turning to regional comparisons, Hickey suggested that European markets could learn from Asia’s ambition and pace of reform.

“The big thing Europe can take from Asia is its vision for growth,” he said. “In places like India and Saudi Arabia, the ambition and the rate of change are remarkable. In Europe, we can sometimes get lost in regulation and process – we could use more of that forward drive.”

Future foundations

Resilience, the panellists agreed, now begins with data. Standardising information across fund-accounting and transfer-agency functions is not just operational housekeeping but the foundation for large-scale AI adoption – enabling predictive analytics, faster innovation, and more efficient client servicing.

This focus on automation is inseparable from the need to strengthen operational resilience. Cybersecurity, argued Hickey, remains the industry’s single greatest threat –particularly as concentration risk rises within global sub-custody networks. Smaller providers are struggling to keep up with heightened security expectations, while larger players are investing heavily to meet them. “We spend hundreds of millions annually,” Hickey said, “and we expect the same of our key sub-custodians.”

Technology, however, is not only reinforcing resilience but reshaping the market model. Tokenised funds and bond issuances are beginning to move into live operation, with digital assets offering a path to more efficient distribution rather than outright disruption of the core. “This isn’t about replacing existing infrastructure,” Rengarajan said, “but about enhancing the distribution leg.”

Ultimately, the discussion underscored how AI, cybersecurity and geopolitics are converging to redefine the custody model – one technological, the other structural. Hickey concluded that custodians will need to “move responsibly” as these new developments continue to take shape.

Post-event video highlights featuring a selection of the panellists can be viewed here on The Asset website

The 8th Future of Asset Servicing Leadership Series – Emerging Markets: Rethinking Investment and Post-trade took place on 15 October 2025 at Deutsche Bank, 21 Moorfields, London