November 2019

With more than 300 delegates from more than 145 nations gathered in Greece at the EBRD’s Trade Facilitation Programme Trade Finance (TFP) Forum 2019, it was clear that 20 years after the TFP’s foundation, countries lacking in correspondent banking lines need this trade leg-up more than ever. Clarissa Dann reports from Athens

One could be forgiven for thinking that the Greeks invented trade, with their establishment of Piraeus in the early 5th century BC as the new port of classical Athens through which import and export transit trade made its way. Its reputation for maritime trade has endured, with Piraeus ranking as the second-largest passenger port in the world, and among the top 10 for container traffic.

So it was rather fitting that some 2.5 millennia later, at the end of October 2019 the European Reconstruction and Development Bank brought together its participants in a trade facilitation programme that has also kept trade flowing after seismic political shifts. The chosen venue was some seven kilometres away at Syntagma Square, opposite the Parliament building

Delegates fill ballroom of the Grande Bretagne Hotel on the first day of the EBRD TFP Annual Conference in Athens

EBRD Director of Financial Institutions Alexander Saveliev welcomed delegates, thanked sponsors, including the Taipei Representative Office, paid tribute to what the TFP had achieved in two decades and observed that trade finance was going through a difficult period. “A combinations of trade tensions, the global economic slowdown and geopolitical risks are impacting trade finance,” he noted. “And according to the WTO Goods Trade Barometer, the velocity of trade in goods has been declining since 2017 when it was almost 6%, to the 1% in Q1 2019.”

Despite this cloud of macroeconomic gloom, issuing and confirming banks were busy in breaks and networking sessions working on their deals and underpinning relationships – everywhere you went there were huddles in corners, with laptops and intense discussions in languages that included English, Russian, Greek and German.

The EBRD’s TFP was born out of the Russian crisis that followed the collapse of the Soviet Union in 1999 to nurture its emerging new countries towards trade finance self-sufficiency with guarantees and loans. There is always a need for development finance; just as one country gets back on its feet, more reach out, so the EBRD TFP looks set to be continuing its mission for several decades to come.

Over the 20 years to 2019, more than 200 issuing banks and 800 confirming banks have joined the EBRD TFP network, supporting €17.6bn of trade activity. Its outreach programme of training has, since 2010, extended to 9,186 banking employees.

EBRD TFP Head Rudolf Putz told flow, “We delighted that so many representatives of foreign correspondent banks, co-financing partners, donors and sponsors from all over the world have attended our event to learn more about the development of trade finance in Greece and other EBRD countries of operations. I trust that our meetings and discussions in Athens will help participants to find new business opportunities and grow their international trade finance.”

The TFP in Greece

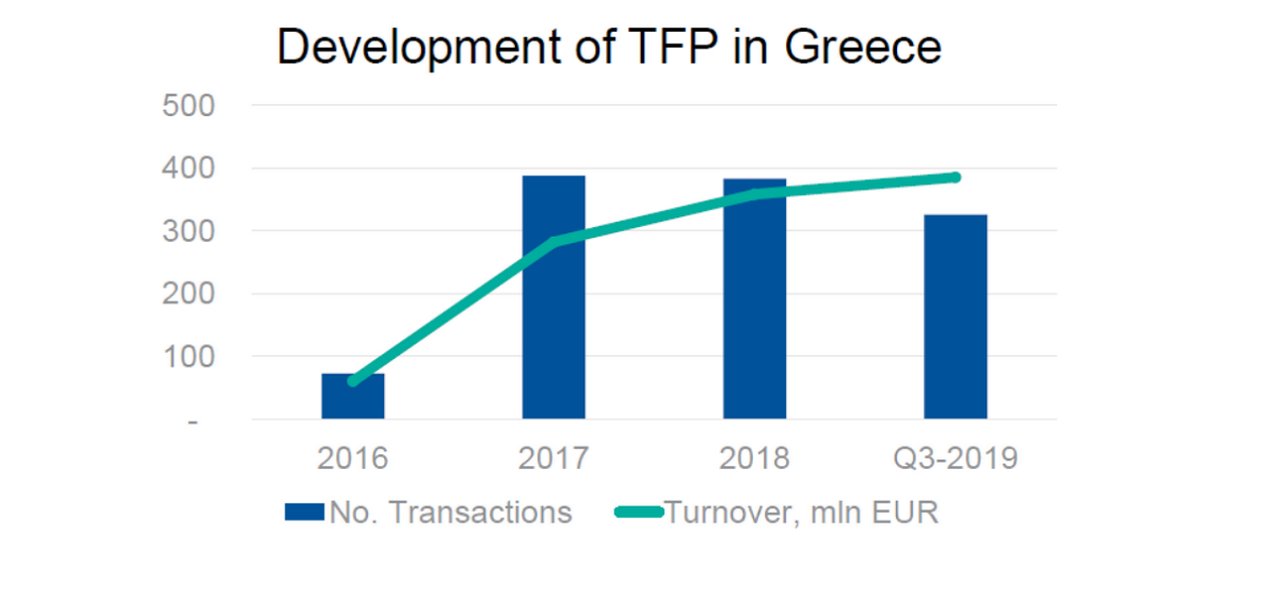

Why Greece? Since the TFP included Greece and Cyprus in its 30 countries of operation stretching from Mongolia in the East to Morocco in the West, the country has been the heaviest user of the programme as Greece gets back on its trade feet, with its 1,200 transactions totalling a volume of around US$1.1bn.

According to TFP Head Rudolf Putz, Greece is by far the most prolific user of the facility, with Cyprus in fourth place. Its national banks are also well-established Deutsche Bank clients both for institutional cash management and trade finance, with relationships having been in place long before the Greek government debt crisis that emerged in 2009 in the aftermath of the global financial crisis.

Figure 1: Development of the EBRD TFP in Greece

Source: EBRD

The TFP supports trade through all stages of the transactional chain from export/production, transport, storage/distribution and receivables by providing:

- Guarantees that cover risks arising from trade finance and factoring transactions;

- Cash advances/financing to issuing banks for trade finance and factoring purposes; and

- Donor-funded trade finance and advisory services to issuing banks and factoring companies.

For example, a Greek corporate importing trucks from the Netherlands would turn to an issuing bank in Greece, which, under the EBRD TFP would in turn issue a counter guarantee to a confirming bank with the EBRD covering 100% of the political and commercial payment risk. Similarly, a Greek exporter selling packing materials to Egypt would have a performance bond issued by a Greek issuing bank under the TFP to a confirming bank in Egypt.

Comeback heroes

A maritime nation with shipping as its most important industry (estimated at around US$21bn in 2018), Greece has compensated for its rocky, crop-resistant soil – food security being an ongoing concern – by taking to the sea and trading exports such as wine, olives, and ceramics for imports of staples such as grain. Silver mines in Southern Attica contributed to the development of the Greek economy and its financial system in the 5th century, but this industry was never sustainable and it was the trading relationships with other ancient civilisations that helped bring in the revenues to pay for imports.

Fast forward to 2009 when Greece’s sovereign debt crisis heralded the longest recession of a developed capitalist economy and loss of confidence in its ability to service debt. Although in recovery and three months into a new austerity-focussed administration, the level of non-performing loans remains at around 40% of GDP, something the EU is addressing with its approval in early October 2019 of a Greek government scheme designed to help its banks sell bad debts on to specialist investors.

Protesters outside Greece’s parliament building on 24 October 2019

However three consecutive international bailouts since 2010 have taken their toll, and the new government’s business reforms to improve the country’s attractiveness to investors and reduce debt servicing costs sparked protests and strikes, evidence of which there for all to see outside the parliament building as 2000 municipal workers rallied outside it (24 October).

Adonis Georgiadis, the government Minister of Development and Investments told delegates in his opening keynote, “You being here is one of the signals Greece is coming back, and I want to express a warm thanks to the EBRD which, since 2015, has started investing in Greece. We are delighted with the strong cooperation, with what we have achieved and what we are about to achieve.”

Adonis Georgiadis, Greece’s Minister of Development and Investment welcomes delegates to Athens

He pointed out that Greece seems to have an inverse economic relationship with the rest of Europe. “When the EU had political stability we were going through a crisis, and now these other countries have problems, our country risk is zero.” He concluded his welcome by declaring, “The Greek public sector is entering a new phase of active engagement in international markets with increased volumes and stability.”

Navigating a new trade order

Among the recent trade finance challenges facing EBRD TFP partner banks are, said Putz:

Less demand for imported machinery and equipment;

- Shorter tenors;

- More guarantees, fewer letters of credit;

- Compressed pricing;

- Reduced number of correspondent banking relationships;

- Concentration of trade finance business with large and state-owned banks; and

- Slow development of receivables financing.

However, he added, new opportunities to finance trade are opening up, which the EBRD TFP team is busy addressing. These are:

- Replacement of working capital facilities by trade finance facilities;

- Financing imports and exports of fast-moving goods;

- Development of trade finance business with SME clients;

- Development of trade finance solutions for exporters;

- Education of trade finance clients and client relationship management;

- Development of trade finance business also with smaller and medium-sized banks, private banks and banks in smaller and early transition countries; and

- Development of domestic and cross-border receivables financing.

Left to right: Zuzanna Franz (ODDO BHF); Marc Auboin (WTO); Olivier Paul (ICC Banking Commission); Rudolf Putz (EBRD TFP); Peter Mulroy (FCI); Sean Edwards (ITFA)

In the first panel of the conference, ODDO BHF Germany’s Zuzanna Franz noted that in its correspondent relationships the Franco-German financial services group has had to pass on the effect of the ECB’s recent hike to 50 basis points for overnight deposits to its customers. This was a situation that “nobody had predicted”. Her bank is looking closely at how to find more efficiencies, including what can be digitalised, and she reported that business is growing – revenues and portfolio up by 20% with ODDO in hiring mode.

Marc Auboin, Economic Counsellor at the WTO reminded delegates that 20 years ago, trade finance did not really feature in the organisation’s policy, and it took the Russian and Asia crises to propel it up the agenda.

"Research shows that a movement of 10% of trade finance availability impacts world trade by 4% in each direction"

Auboin returned to the podium on the second day, alongside Bill Howarth, Chair of the International Compliance Association (ICA) in a session that looked at ways of building anti-money laundering and other financial crime prevention techniques in countries that lost correspondent banking lines as global banks de-risked. “This is an expanding partnership that focuses on using training and education to raise professional standards and in doing so make it easier for EBRD network members are their associates to do more business,” said Howarth.

The EBRD has joined forces with the ICA develop training courses and qualifications on compliance, and the WTO has co-published with the International Finance Corporation a helpful report (Trade finance and the compliance challenge) summarising the cooperation in place between these two organisations, along with the EBRD, Asian Development Bank and International Islamic Trade Finance Corporation to directly address the reluctance of the global financial sector to invest in developing countries.

These countries, said Auboin, have under-developed financial sectors compared with their trade flows. As world trade continues to transition into a new order where labour-intensive processes move away from China and current countries of production to new frontiers such as Vietnam and Ukraine, trade finance capacity needs to be built in those locations, where savings can be invested in trade loans.

International Trade & Forfaiting Association (ITFA) Chair Sean Edwards added that the ITFA was also celebrating its 20th anniversary. Its position in the open account receivables space is coming of age; with renewed interest across the membership in the discounting of certain types of trade finance instruments such as bills of exchange and letters of credit. “They are easy to digitalise and very safe,” he said and outlined how ITFA has embraced the whole fintech spectrum to create an ecosystem where “everyone contributes their own specialities such as data analytics, platform provision and software”.

Trade finance in Greece

Left to right: Kyriakos Aspergis (Aegean Baltic Bank); Katerina Theodorou (Piraeus Bank); Marco Nindl (EBRD TFP); Piero Rizzi (Citibank); Eleftherios Vlachogiannis (Eurobank); Nassos Pavlidis (Alpha Bank)

During the Greek economic crisis not only was there very limited access to funding, but foreign counterparties did not believe they would get paid. This lack of trust meant everything had to be paid for in advance.

Recollections of these tough times and how things were now improving underpinned observations from a panel comprising the main Greek banks in the form of the National Bank of Greece, Piraeus Bank, Aegean Baltic Bank, Eurobank, and Alpha Bank, joined by Citibank UK to represent the correspondent banking perspective.

Delegates heard more on how Greek entrepreneurs facing low domestic demand were being helped with the information and financial instruments they needed to export. “Thanks to the EBRD TFP, we have seen the demand for payments in advance replaced by letters of credit and other trade instruments – which ware better alternatives,” said one panellist.

In particular there was an increase in guarantees. Clean lines extended by global banking institutions (such as Citibank and Deutsche Bank to name just two) have, said another panellist, demonstrated interest in what local Greek banks have to offer. EBRD’s Marco Nindl, who moderated the panel, noted that Greece is an importing country, with export transactional support mainly taking the form of bid bonds and performance bonds – construction services being a growing area. Another panellist explained how they had developed a platform to support exporters with information about the target markets they export to where those banks lack a presence.

Green trade finance

Left to right: Kateryna Shulga (Raiffeisen Bank Aval Ukraine); Nelli Kocharyan (Converse Bank Armenia); Maria Mogilinaya (EBRD TFP; Mger Oganesyan RICHEL Group Armenia); Maya Hennerkes (EBRD UK)

With the ESG market in most asset classes – particularly in Green Bonds – on an upward growth trajectory and enjoying high demand, it was no surprise that Green Trade Finance, moderated by Maria Mogilinaya of the EBRD was a popular first-day panel. The EBRD’s Green TFP finances and supports the introduction of and use of green technologies, which often need to be imported into the EBRD countries of operation. Today, the initiative has supported more than €425m in some 600 green trade finance transactions resulting in, according to the EBRD, annual energy savings of 733,130 MWh, water savings of 1,618,025m3 and emission reductions of 310,728 tonnes of CO2 equivalent.

"ESG is moving from a side show to the centre of operational excellence, and when you get it right, there is a very positive impact on performance and a strong mitigant against reputational risk."

The Green TFP is particularly active in Ukraine, where and 50% of the current programme is deployed, with much of the support covering environmentally efficient agricultural machinery and vehicles, said Mogilinaya. Raiffeisen Bank Aval’s Kateryna Shulga works closely with the TFP on these transactions and commented that Ukraine is aligning its energy policy with the EU vision for clean and renewable energy production and the fight against climate change. Co-winner of the EBRD Deal of the Year for Green Trade Converse Bank (Armenia) was also on the panel in the form of Nelli Kocharyan, who treated delegates to a video about a transaction involving an Armenian greenhouse grower of strawberries. The environmental impact was, according to the EBRD, equivalent to annual energy savings of 17,281 MWh.

Innovation and career development

Delegates then heard from an innovation panel chaired by ICC Austria’s Eleanore Treu about the perils of digital islands in the collective journey towards trade finance digitalisation, and the challenge of getting new technology and “solutions” actually adopted. As one panellist put it, there has to be some incentive for the corporates to adopt digital platforms: “How can we bring our corporates onto the digital platforms just to save us money?” noted one astute banking panellist.

After a successful discussion about trade finance career development at the EBRD’s May Annual Meeting in Sarajevo, EBRD’s Anna Brod led a follow-up iteration. This looked at panellists’ journeys into the industry, and their perspective on encouraging the next generation with training and mentoring. At Deutsche Bank, a free seat at the one-week DB International Bankers’ Seminar in Frankfurt is awarded to the top EBRD Trade Finance e-Learning graduate, with Yanina Ropitska of Raiffeisen Bank Aval in Ukraine sharing her experiences in the EBRD’s own Trade Exchange.

Left to right: Irina Chuvahina (Priorbank Belarus); Vincent O’Brien (ICC Banking Commission); Anna Bros (EBRD TFP); Ana Kavtaradze (Bank of Georgia); Frank Aldenhoff (Deutsche Bank); Antonija Koceva (Komercijalna Bank Macedonia)

Frank Aldenhoff, Deutsche Bank’s TFFI Regional Head of Western Europe and East & Southern Africa told delegates that it was the importance of trade to the international economy, along with the cultural education of interacting with so many countries that attracted him into trade finance. However, he noted that organisations have to work at making the industry attractive to new recruits and this includes leveraging the experience of older colleagues. “They are very passionate and have sometimes been in their roles for more than 30 years. We should have them mentoring the younger colleagues,” he said.

Bank of Georgia’s Ana Kavtaradze, who had studied and worked in Germany as part of her training, agreed that trade finance is somewhat addictive, because everything in an organisation comes back to trade – treasury, loans – they are all linked. “It is a universe where you can see the business from a different angle and get ideas on how it should be structured,” she said. Passion for interaction is vital, she continued, and this is not just between customers and bankers, but internally around the organisation, so that everything is aligned.

At Bank of Georgia, the trade finance team learn a lot from their new recruits, and she was pleased to report that of those who moved on, nobody actually left the field of trade finance to choose a different career path.

Everything is in flow

It was the Greek philosopher Heraclitus who declared “everything flows” and “no man steps in the same river twice”. Much can be said about trade itself, with the landscape much changed by trade wars and economic sunrises and sunsets, leading to the emergence of new trade corridors. It would seem that Rudolf Putz and his EBRD TFP team won’t be able to retire anytime soon…

The 2019 EBRD TFP Trade Finance Forum took place at the Hotel Grande Bretagne, Syntagma Square, Athens, Greece, 23−24 October 2019

Delegates at the end of Day II visit Cape Sounion to hear more about the silver mines, the development of ancient Piraeus as a port and the Temple of Poseidon

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

TRADE FINANCE, MACRO AND MARKETS

Covid-19 and commodities Covid-19 and commodities

Covid-19 has shaken up the world’s commodities sector although price volatility is no stranger to its participants. Reduced demand has seen falling prices, lack of investment, and logistics log jams. Clarissa Dann reviews the fundamentals

Trade finance and lending {icon-book}

Market makeover Market makeover

Thanks to some transformational lending, Ghana’s Kumasi Market is undergoing a makeover that is set to transform the Ashanti economy and all it touches. flow tells the story of a project involving three governments, a Brazilian contractor and Deutsche Bank’s Structured Trade & Export Finance team

Trade finance and lending

Back from the brink Back from the brink

As the International Trade & Forfaiting Association met in Budapest for its 46th Annual Conference, flow reports on how heads of trade agree that in times of economic stress, flight to trade finance instruments of trust seems to be on the rise