10 March 2023

Investor understanding of trade finance funds and how they fit into a balanced portfolio has some way to go, agreed panelists at the 2022 ITFA Annual Conference, and the asset class must hold its own against other structured finance asset offerings to gain momentum. Track record, insurance mitigants and good structuring are vital, reports flow’s Clarissa Dann

MINUTES min read

In the flow article ‘Trade finance funds – where next’ (January 2022), the attraction of this asset class to investors is explained, along with the need for wider understanding of how it balances yield and liquidity – and how it compares with other investible assets.

The article also drew on insights from speakers at the 47th International Trade & Forfaiting Association (ITFA) Annual Conference in 2021. When delegates reconvened a year later for the 48th ITFA Annual Conference in Porto, Portugal last September, trade finance funds were still a major focus with increased attention paid to the underlying structure and comparative pricing.

This article draws on insights from the panel titled, ‘Has Asset Management embraced trade finance and what more is left to be done?’ The short answer to that question is “not entirely” and “it’s an ongoing journey”. As 2023 gets underway, geopolitical and macroeconomic issues have multiplied, and interest in the private credit market has rocketed in the face of rising inflation.

Facts and figures

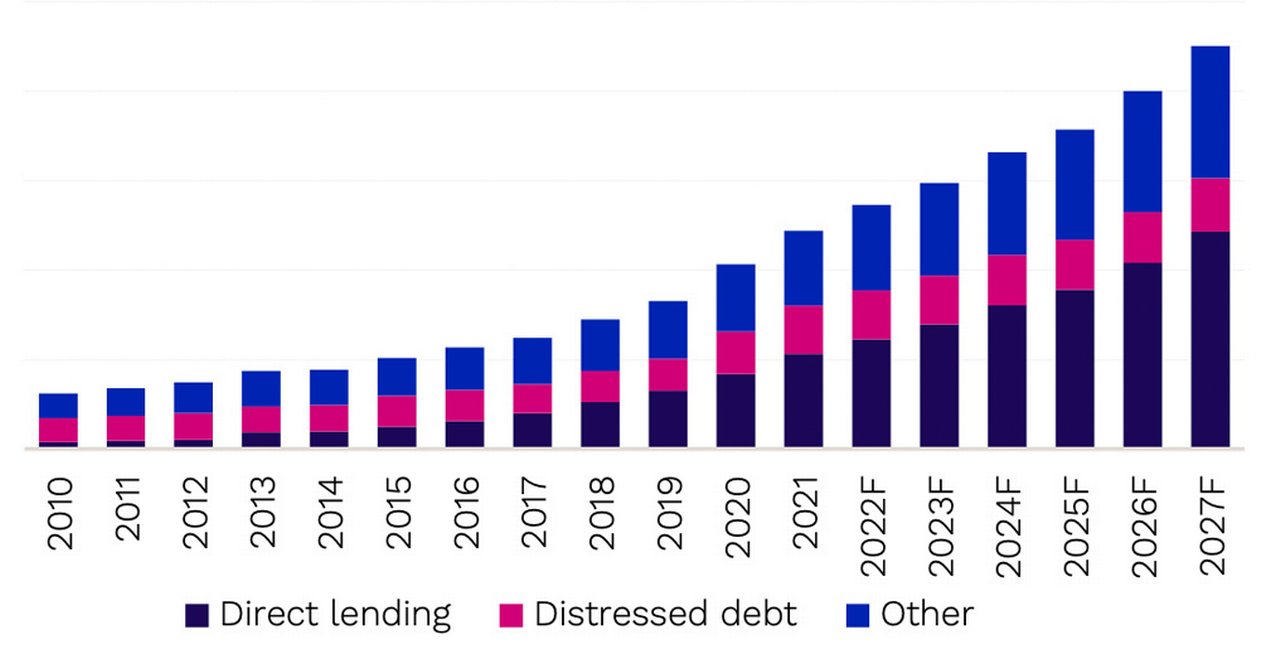

In the 2023 Preqin Global Private Debt Report (published 14 December 2022), financial data provider Preqin notes that US$172.1bn “was raised by private debt funds globally” in the past year.1 Their data also suggests, adds the report, that while investors remain positive on the overall asset class (fewer funds closed in 2022 than in 2021), they are “becoming more discerning in their allocations, with larger commitments going to fewer managers”. As at Q3 2022, Preqin noted 837 private debt funds collectively targeting US$297bn. The report’s forecasts out to 2027 “suggest that private debt assets under management (AUM) will grow to US$2.3tn in 2027, although with fundraising and performance at a slightly slower pace than in recent years”.

Figure 1: Global private debt assets under management (US$bn) by sub-strategy, 2010 – 2027

Source: Preqin

While trade finance funds (a type of private debt) have indeed gained traction over recent years – driven by investor demand for alternative asset classes with low volatility and consistent return as well as low correlation against the broader financial market – education and benchmarking remain sticking points.

After a period of consolidation in this part of the market, there are four or five large funds focusing on the short-term working capital finance (WCF) space – i.e. greater than US$500m of AUM targeting spread returns of around. 200–300 basis points over the secured overnight financing rate (SOFR) plus a group of niche commodity finance funds that target higher returns but have a smaller AUM.

What does this mean for trade finance debt as an investible asset?

Perspectives on the trade finance funds landscape

Source: ITFA

The ITFA 2022 panel moderated by flow’s Clarissa Dann (far left) comprised:

- Ian Duffy – Founder and CEO, Accelerated Payments (2nd left)

- Guy Brooks – Managing Director – Working Capital Finance, Pemberton Distribution (centre)

- Ian Henderson – Board Member and Chief Investment Officer, Artis Finance Limited (2nd right)

- Jason Barrass – Chief Commercial Officer, ARC Ratings (right)

Both Brooks and Henderson agreed that there had been consolidation of the trade finance funds space over the past year. As Brooks put it, “the main players today are the same ones we saw three years ago, with the weaker ones falling away or closing down”. Henderson pointed out that since the US$10bn of trade finance assets reported by Eurekahedge in their 2019 report,2 five of the larger owner manager funds have gone, amid difficulties around fraud prevention and general mismanagement. “New entrants among the current players are all institutional asset managers running trade finance funds or allocations towards trade finance funds, and I think that is positive for the industry,” he said and the trade finance funds market was becoming “more institutionalised, more professional – and that is where we need to go”.

Accelerated Payments’ co-founder Ian Duffy said that as a fintech it is working with high street banks that would not normally fund SMEs by making an online portal available to cash-strapped businesses, advancing payment for invoices due to be paid to them. These invoices are made investible using a special purpose vehicle, where the book includes a credit insurance wrapper. In other words, this is an example of how, at the SME end of the business scale, short-term trade finance is accessing capital markets.

Education and language

Brooks said that there was scope for more funds to move into the trade finance space but “without doubt this requires further education and a more thorough discussion with investors about what trade and working capital finance actually is and the benefits it brings”. While there has been consolidation over the last few years, he added, “we are now starting to see some new entrants which will only help making the asset class known and investable”. He reflected that many institutional investors are only now just starting to understand the advantages of the asset class but the level of knowledge is still low. “Greensill [Capital] was an issue, especially in 2021 but I think the market has now moved on and it’s being mentioned increasingly less. Despite this, appetite for the asset class is growing strongly,” added Brooks.

Jason Barrass confirmed that Greensill featured in discussions at the Association for Financial Markets in Europe and Information Management Network’s (AFME/IMN) annual Global ABS conference held in June 2022. With around 4,500 delegates attending the event, this is a good barometer of appetite. “On the first day of the conference there has been a ‘trade receivables as an asset class’ session and so many more people going to this now,” he reported. “As an asset class it is slowly moving into the mainstream but still seen as an alternative investment,” said Barrass.

“Our industry has to move into the broader structured finance market to get distribution – and returns up”

He explained how many of the questions from the floor at the structured finance conference were around terminology, safety, implications of Greensill, and operations. In addition to rating assets, ARC Ratings is in a position, he said, to “take some of the nuances we have in our industry and terminology and put it into language a German pension fund investment manager will understand.” In other words, is the asset investment grade? Clients are, said Barrass, worried about fraud and need help navigating that risk. “Our industry has to move into the broader structured finance market to get distribution – and returns up – to make the asset understandable in the broader market.”

Pricing

Returning to the ITFA event, a topical question from the floor raised the issue of comparative pricing and the issue that trade finance assets “price very tight – even in emerging markets”. The questioner asked, “Although funds, fund managers and investors recognise it as an attractive alternative asset class they just don’t like the price and they can’t understand the risk associated with it. How do you solve this – [is it] with an insurance wrapper so they can take a credit view over an asset class with a different product credit profile?”

You get different buckets of risk, explained Henderson. The Artis Finance programmes work with investment grade ratings to achieve more affordable pricing. “But even with investment grade rating your yield investors are looking at 300 points at the swap rates for BBB- minus paper,” he said. “That is way above what banks are charging for trade finance.

“Our market is complementary to the banks and does not suit every borrower but there is a huge segment of borrowers that cannot access bank liquidity so they will pay around 10% or 12% for their money and factor it into their trading cost because they are still looking for liquidity – that is the trade finance gap they are trying to address.”

Henderson added that non-bank and alternative finance providers are “never going to replace the banks as we do not have deposit holders’ money, but we have to take money from pension funds, life insurance companies and other asset allocators. In the current environment we are competing with sovereign rates” In other words if, for example, you can get five-year US treasuries at 3.5%, why do trade finance in Ghana at 3%?

And therein lies the difficulty said the floor speaker. While a Ghanaian confirmation would be rated CCC from a country and credit rating perspective, the actual intrinsic credit risk is 0.01% and better than AAA. But the funds don’t penetrate that deeply to see what the real risk is.

Duffy responded that there was probably no set answer to this but more of a “mismatch”, he suggested. “It does not work trying to get specific over precise ratings etc. at a transactional level, and in any case, returns do not reflect individual transactions. It’s a dynamic portfolio and track record is everything. We also credit insure 95% of our portfolio for additional risk mitigation.” He added that for his firm preferably there is a fund manager between themselves as the originator of the asset and the investor as a fund manager can efficiently triage exceptions that constantly arise for the benefit of both parties including a higher overall return.

Brooks reminded delegates that the other underlying issue is the role played by the banks in these operations. “I often hear banks saying that the funds – non-bank investors and asset managers – are too expensive,” he said. “Having come from a large bank, active in trade finance distribution, we had a similar observation. However, now working on the other side, I don’t entirely agree with this observation.”

Brooks set out three segments to the market:

- Where the banks operate. Pricing for bankable names, large cap and investment grade, is typically very fine and often trades inside public markets. “The banks can justify this as they often have broad pool of lucrative products with that client that can often subsidise the trade-related lending,” he explained

- The fringes and the sub-IG and crossover names space, bank liquidity starts to thin out and, explained Brooks, “Pricing starts to become more market driven and not a relationship one”.

- Sub IG and lower where they don’t or struggle to operate. “This is we start to see the value. Given the bank regulatory changes since the Global Financial Crisis, banks have navigated towards IG names leaving a gap in the sub-IG space, providing an opportunity non-bank investors and asset managers to move into it.”

This part of the discussion closed with the ratings perspective from Barrass, who reminded delegates how the broader structured finance market “looks at risk in a different way to trade finance market looks at it” and when an asset is securitised it is not just a matter of looking at the credit risk.

“As well as educating the new investors it requires us to understand what the art of the possible is for this class of investors”

“Lending money to one person more is riskier than lending to a thousand people,” Barrass added. “If you have it structured in a certain way, you are able to achieve a cumulate better rating than you would individually because the credit rating agencies look at it from a probability risk weighted default average. When you attach other mitigants then you get potentially a good investment grade asset that brings down the cost and makes it more broadstream.”

Outlook for the asset class

It would appear that the education and appetite sharpening process will take the time it needs, and once understanding is reached – mainstream could be just around the corner.

“And that is a challenge ITFA has taken up,” says IFTA’s Chair Sean Edwards. “Our ITFIE (ITFA Trade Finance Investment Ecosystem) group has been delving into what needs to change to make this asset class investable to non-banks and funds. As well as educating the new investors it requires us to understand what the art of the possible is for this class of investors and what needs to change in terms not just of understanding and mindset but technology, documentation and so on. A lot needs to be done but greater involvement will spur greater efforts from the industry and this what we are facilitating.”

Trade finance solutions Explore more

Find out more about our Trade finance solutions

solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print