April 2020

Changing dynamics of renewable energy in Europe have upended the market in the past decade as new buyers, investors and technology enter the fray. Janet du Chenne reports on investor enthusiasm, and forecasts what to expect from the next 10 years

When technology giant Google signed a 12-year contract with Norway’s Tellenes Vind Park in 2016, following its 2015 pledge to purchase 781 megawatts (MW) worth of renewable energy output, it set a trend that is gathering momentum. In May 2018, social media platform Facebook signed for the whole output and environmental attributes of the Bjerkreim Cluster, which consists of three contiguous wind projects and has a capacity of 294MW. The energy forming part of the purchase power agreement (PPA) is enough to offset the power used by the company’s massive data centres in the Nordic region.1

The deal closed as European governments and regulators began to step up the pressure on corporates to behave in a more sustainable manner, in line with a global decarbonisation agenda that looks set to ramp up the level of renewable replacements with ambitious capacity targets.

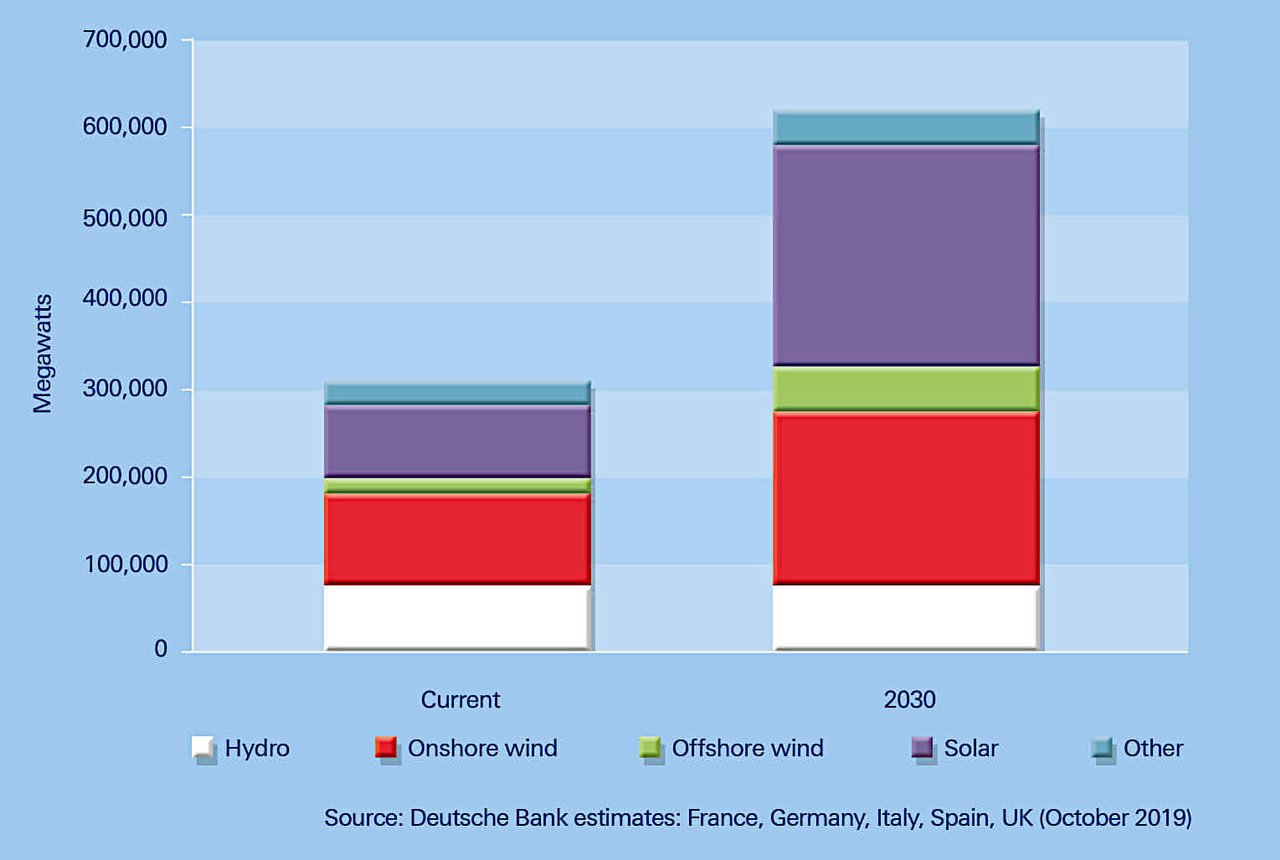

According to Deutsche Bank Research, the largest European countries are targeting a doubling of renewable capacity by 2030, and analysts note that there is “scope for continued attractive investment-driven growth in this area”. In particular, analysts say that this rapid pace of development means the share of renewables in electricity production is anticipated to increase to almost three-quarters of power output in Spain and to more than 50% in the UK, Italy and Germany by 2030.2

Egersund wind farm’s offtaker under a 15year PPA is the Axpo group in Switzerland

"Alternative energy sources have reached grid parity"

An increasing number of global firms have secured power directly from a renewable source for data centres or production facilities under PPAs, instead of from a supplier or traditional utility. These developments signal a change in the European energy landscape, with new buyers, new investors and new technologies facilitating energy transition from fossil fuels.

Dr Alexandra von Bernstorff, Founder and Senior Managing Partner of Luxcara, a Germany-based asset manager that owns, structures, finances and operates renewable energy projects (and also manages the sale of energy from the Bjerkreim Cluster of wind farms to Facebook), notes that the renewable energy market has gathered pace over the past few years. “Ten years ago, if I told people about renewable energy, they’d look blank,” she says. “Today, everyone has an opinion about it. We are currently in the middle of one of the most significant, and fastest-moving, periods of the energy transition. Alternative energy sources have reached grid parity, and there have been profound changes in market dynamics and the public perception of energy topics.”

Attracting more institutional investment

Given these dynamics, Luxcara adjusted its investment strategy in 2015 and, since then, has been investing exclusively in renewable PPA-backed projects on behalf of institutional investors. It is joined in the market by a swathe of asset managers who have forged long-term offtake agreements with corporates.3 The asset manager sells the energy from the renewable energy source to a corporate off-taker for long-term periods, often of 10 years or more (based on recent European corporate PPA deals). This meets the objectives of investors seeking projects whose duration and steady revenue stream match their long-term liabilities.

In the case of the 294MW Bjerkreim Cluster, Luxcara and MEAG, the asset manager of Munich Re and ERGO, initiated and structured two project bonds to finance the wind farms. The project bonds were privately placed with investors of the Munich Re group, the Austrian insurance company UNIQA and one further European insurance group. Deutsche Bank’s Corporate Trust team within Trust & Agency Services acts as financing agent and security agent to facilitate the needs of borrowers and bond investors.

Financing projects in a post-subsidy world

US $ 15trn

Renewable energy assets have, until recently, been protected from variable power prices by generous subsidies. However, the withdrawal of government incentives for renewables in countries such as Spain and Portugal, and a huge backlog of wind and solar plants to be developed over the next decade, should herald a profound change in the way clean technologies are funded.

PPAs are being touted as the solution to financing projects in a post-subsidy world. And, for Silicon Valley behemoths such as Facebook and Google, which increasingly want to identify as users of clean energy, PPAs provide a mechanism for buying energy directly from a wind farm, while enabling project developers to have the security to build renewable schemes knowing there is a commitment from an end customer. Other PPAs include technologies such as carbon capture and storage, geothermal energy, hydropower and solar power.

These PPAs underpin the transition of energy from fossil fuels to renewable energy, and the private sector is making an increasingly important contribution to the process. As an asset manager, Luxcara offers investors the chance of returns through long-term investment in this growing market as energy transition gathers greater pace. Energy demand is increasing worldwide. The question is, asks von Bernstorff, where is energy going to come from when European countries are shutting down nuclear and coal? “It’s going to be the most prominent topic on the infrastructure agenda for the next five to 10 years worldwide,” she reflects.

"It’s going to be the most prominent topic on the infrastructure agenda for the next five to 10 years worldwide"

As corporate offtake agreements grow in number and businesses increasingly adopt a sustainable agenda, investors will play a significant part in meeting the estimated US$15trn needed4 in investments for European infrastructure to meet current sustainability targets. Christian Andersson, Managing Partner at placement agent Worthwhile Capital Partners, noted in an Inspiratia-hosted panel discussion that these investors will find greater comfort in their forays into renewable energy if the projects they are involved in are backed by a PPA. “Many of the infrastructure mandates in these portfolios, across state pension funds, occupational pension funds and life insurers, are constructed to have stable returns,” he said. “So PPAs are absolutely crucial for them to be in a position to invest in these types of direct assets.”

Fears that these agreements may render utilities obsolete are unwarranted, says von Bernstorff. “Only investment grade companies providing very good warranties can buy energy directly from the source,” she explains. “So the majority of companies have to continue to buy the power from a utility, which then buys from a wind farm or solar park.

Embracing sustainability

Investors have many different strategic reasons for investing in renewables. For Luxcara, which was founded a year after the 2008 financial crisis, its strategy was based on long-term sustainable investing. With dwindling leverage post-crisis, the asset manager, which was bought out from its previous owners, decided to approach investments that earn their return by operation, and not market valuation. “Some invest in renewables mainly for marketing purposes, others want to make profits by buying cheap and selling the asset at a high price,” says von Bernstorff. “We follow a buy-and-hold approach and are really into our assets for the long term. Our investors can rely on us optimising the asset in every possible way, because we will hold it for its lifetime.”

Von Bernstorff and co-founder Kathrin Oechtering launched Luxcara in the belief that energy procurement could not continue in the same way as before and sustainability would become a driving force. “We still believe it,” says von Bernstorff. “Renewables are constantly evolving. It’s not just wind and solar; increasingly it’s grid technology, or batteries or electric car-charging stations. It’s going to be much bigger than it is today.”

Figure 1: Rise of renewable capacity in five focus markets

Evolving merchant risk

"Merchant is the way the market should be"

With headwinds from political, regulatory, social and lifecycle risks spelling the end to support schemes for renewable projects in Europe, a renewables merchant risk ecosystem is beginning to take shape, notes a McKinsey report.5

Several subsidy-free projects, such as solar photovoltaic (PV) and onshore projects in Spain and multiple offshore projects in Germany, have been announced and are under development (see box out). While these projects have benefited from favourable site conditions and economies of scale, this change in the renewables marketplace indicates that the industry is transitioning into the next phase of market integration. Governments will phase out schemes – such as the UK’s Feed-in Tariff subsidy that followed the Energy Act 2008 – which were brought in to promote green technologies. Auction systems are taking their place, driving tariffs down, while asset owners will be fully exposed to wholesale prices.

With the progressive reduction of subsidies and introduction of auction systems driving guaranteed tariffs down, private PPAs, which offer a fixed long-term price for some or all of the energy produced by a project, are becoming more important for managing merchant risk exposure and financing renewable energy in Europe.

According to von Bernstorff, embracing merchant risk will be important for the long-term success and independence of the renewables sector. “Subsidies should have been abolished a few years ago,” she asserts. “By reaching grid parity some time ago, renewable energy has proven to be competitive to traditional energy sources in all aspects, including costs. Merchant is the way the market should be. Fully merchant projects will not depend on auction schemes, and markets where prices are not tied to subsidies are also healthier.”

Sources

1 See https://bit.ly/2RV0RnU at cleantechnica.com

2 Deutsche Bank Research: European Utilities, Decarbonising heading: An electric century? (8 October 2019)

3 See Nordic Wind energy blows hot with investors at flow.db.com

4 Global Infrastructure Hub (2019)

5 See https://mck.co/2tTTRyB at mckinsey.com

6 See https://bit.ly/39v2YGH at bundesnetzagentur.de/EN

7 See https://bit.ly/2uSuIVo at energifaktanorge.no

8 See https://bit.ly/38PrWyh at pv-magazine.com

9 The reform capped returns on renewable energy at roughly 7.5% and became effective from June 2014. And, with plummeting interest rates, the result of the policy was that the following year – 2015 – Spain did not install a single MW of wind energy

You might be interested in

TRUST AND AGENCY SERVICES

A time of change in corporate trust and agency services A time of change in corporate trust and agency services

Deutsche Bank’s corporate trust and agency services experts share their thoughts on supporting infrastructure investment over the past decade and the decade to come

TRUST AND AGENCY SERVICES

Arrivals: New private financing model for Newark Airport ConRAC Arrivals: New private financing model for Newark Airport ConRAC

flow looks at how an innovative model of private financing for consolidated rent-a-car facilities is set to provide numerous benefits to Newark airport, passengers and the rent-a-car industry

TRUST AND AGENCY SERVICES

Are you ready to leave Libor? Are you ready to leave Libor?

With the phasing out of the most widely-used benchmark interest rate, flow looks at how one bond transaction successfully switched to a new reference rate