August 2019

With the phasing out of the most widely-used benchmark interest rate, flow looks at how one bond transaction successfully switched to a new reference rate

On 11 June 2019, a group of investors voted in favour of a proposal by Associated British Ports (ABP) to amend a £65 million floating rate note so that subsequent interest coupons are linked to the compounded Sterling Overnight Index Average (Sonia), instead of Libor, or the London Inter-Bank Offered Rate. The switch was hailed as a blueprint1 for issuers moving away from the most widely used benchmark for short term interest rates and looking to amend their documentation for future and existing issuances.

ABP achieved a modification to the terms which included an adjustment to compensate for any pricing difference between forward looking Libor and backward looking Sonia for the remaining term of the note.

The success of this consent solicitation process was hailed as a “first of its kind”, serving as a proof of concept in the industry, and should be encouraging for other bond issuers in the run up to January 2022, when contracts using Libor could become obsolete.

Deutsche Bank, as tabulation agent, facilitated the flow of information between ABP and key stakeholders. The bank’s experienced team of specialists provided dynamic reporting during the consent solicitation process and was one of the key parties in delivering the transparency needed to obtain the noteholders’ approval and getting the transaction over the line.

Deutsche Bank’s independent consent solicitation and tabulation agency services:

- Launching and managing of events through the clearing systems and on to noteholders

- Tailored reporting of participation and voting broken down by security

- Publishing consent results to the market

The discontinuation of Libor

Libor, which forms the basis for around US$300trn of financial instruments including loans, bonds, and derivatives2 will gradually come to an end in 2021. This benchmark rate, which is calculated from daily submissions of estimated borrowing rates by leading London banks is based on an element of judgement of bank’s credit risks, rather than actual transactions. However, after the financial crisis, when banks retreated from the interbank lending market, the market on which Libor rates are measured became less active and the rate itself therefore was less representative of actual lending rates.

Moreover, financial and commercial counterparties increasingly questioned why the interbank rate was a meaningful benchmark for entirely different transactions. Confidence in the benchmark was further eroded following allegations of Libor manipulation by several banks in 2012, prompting a review3 by the UK government shortly after which it recommended reform and called for stricter processes to verify banks’ submissions with transaction data.

The Financial Conduct Authority’s (FCA) view was that by the end of 2021, it would no longer be necessary for the FCA to persuade, or compel, banks to submit to Libor.

Alternatives to Libor

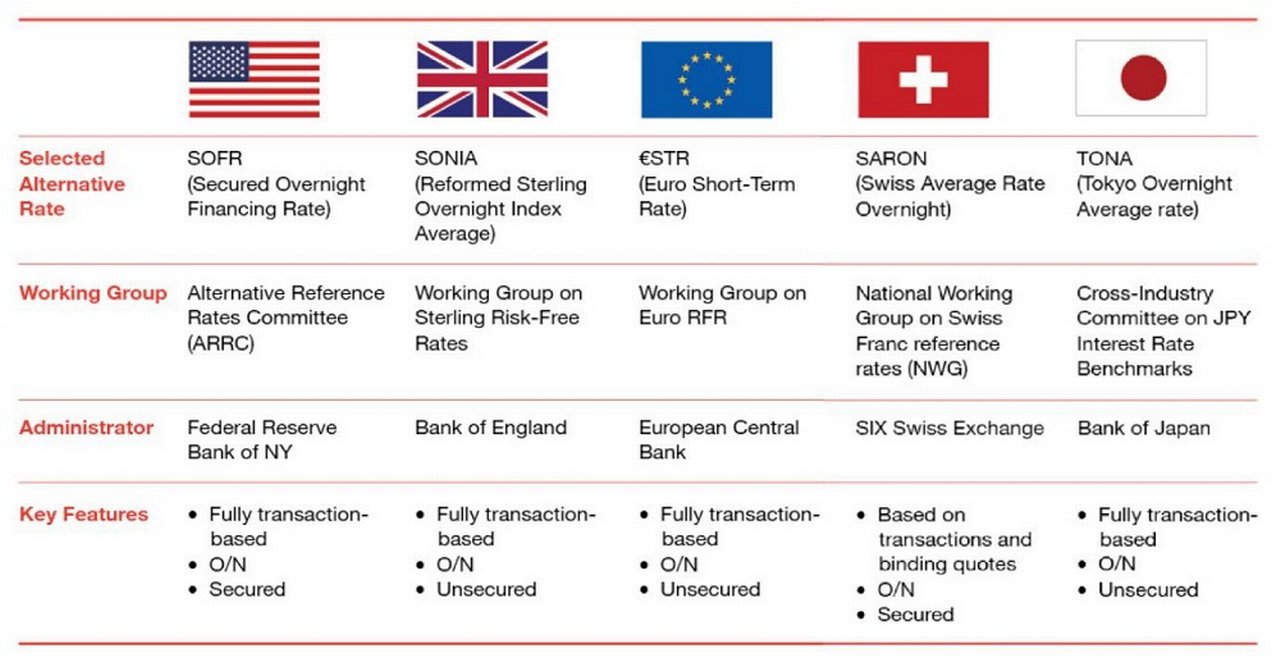

In preparation for leaving Libor, industry working groups - including the International Capital Markets Association (ICMA) and the Loan Market Association (LMA) - have been looking at the adoption in their markets of calculations based on Risk Free Reference Rates (RFRs) (see figure 1).

When using overnight RFRs, the calculations for interest payable over a period are quite different to using the Libor term rates. It is crucial to understand the calculation methodology between Libor and the proposed RFR to determine any changes to the pricing.

Figure 1: Alternative reference rates

Source: PWC

Buckling up

With an estimated US$870bn in outstanding bonds that have a tenor beyond 2021 which reference Libor across five currencies, reducing the stock of outstanding bonds will not be an easy feat.

It is essential that issuers, borrowers and other market participants with impacted financial instruments where interest rates are based on Libor check the fallback provisions of their contracts to ensure they understand how these will operate.

Provisions within the agreements may need to be amended to provide for new calculation methods and/or fallback provisions. The general market consensus on the reference bank method of obtaining quotes is not feasible without actual transactions underpinning the quoted rate. Defaulting to the last known rate may not be palatable to issuers and noteholders from a commercial perspective.

Lender/noteholder approvals may be required and unexpected costs may be incurred. More recent contracts may have the benefit of additional provisions permitting the lender/issuer or an independent agent to determine a new rate and relevant adjustments to contract terms.

Regulators are strongly advocating a proactive move to the new RFRs rather than relying upon fallback provisions. Andrew Bailey, chief executive at the FCA’ further describes fallback provisions as a “‘seat belt’ in case of a crash when LIBOR reaches the end of the road. But fall backs are not designed as, and should not be relied upon, as the primary mechanism for transition. The wise driver steers a course to avoid a crash rather than relying on a seatbelt".

Libor checklist

Deutsche Bank encourages market participants to act now on any impacted deals. The check list below provides some practical steps to reviewing your current portfolio. Contact your Trust and Agency Services representative for further information on how consent solicitation and tabulation agency services can help you.

- Identify any impacted transactions and their contractual fallbacks for notes and loans with maturities ending after the expiry of their relevant benchmark

- Consider valuation and accounting implications on floating rate instruments

- Consider appropriate replacement rates and ensure your cashflow models are adjusted accordingly for your deal structure

- Consider engaging a consent solicitation and tabulation agent

- Involve your trustee and agent where necessary

- Work closely with your calculation agent and investors for a smooth transition

Sources

1 See https://bit.ly/2XDQuH3 at risk.net

2 See https://bit.ly/38JmBva at bankofengland.co.uk

3 See https://bit.ly/3nMwxs5 at gov.uk

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

TRUST AND AGENCY SERVICES, TECHNOLOGY

Eye of the Tiger Eye of the Tiger

The mass affluent in China are turning to global stock markets, helped by online trading platforms such as Tiger Brokers. flow looks at how the fintech’s Deutsche Bank-sponsored American Depository Receipt programme is further fuelling these investors’ ambitions

TRUST AND AGENCY SERVICES {icon-book}

Digital homes Digital homes

eNotes are driving the surge in digital mortgages for residential housing. BAML’s Eileen Albus tells Janet Du Chenne how new innovations are helping to improve the consumer experience and lower lenders’ costs

TRUST AND AGENCY SERVICES {icon-book}

Safe as houses Safe as houses

What holds 21 million mortgage files with a follow-the-sun team that can handle as many as 30,000 to 40,000 loan reviews in one day? flow takes a closer look at Deutsche Bank’s Document Custody service located in Santa Ana, California and its central role in supporting the US mortgage market