12 July 2022

What holds 21 million mortgage files with a follow-the-sun team that can handle as many as 30,000 to 40,000 loan reviews in one day? flow takes a closer look at Deutsche Bank’s Document Custody service located in Santa Ana, California and its central role in supporting the US mortgage market

MINUTES min read

The US real estate market has seen significant changes since the 2008 downturn that translated into a broad financial crisis. From significant government action to industry reformation, from better underwriting standards to instituting guard rails through legislative reforms like Dodd-Frank and the Housing and Economic Recovery Act of 2008, these various initiatives have gone a long way to restore confidence in this asset class for investors.

A changing landscape

As Gary Vaughan, Deutsche Bank’s Head of Corporate Trust Americas, reflects, “As a result of the credit crisis, the mortgage market changed dramatically with the GSEs (government sponsored entities) taking a much larger role in the mortgage industry to stabilise things. This model has proven to be very successful and is why these agencies are in existence.”

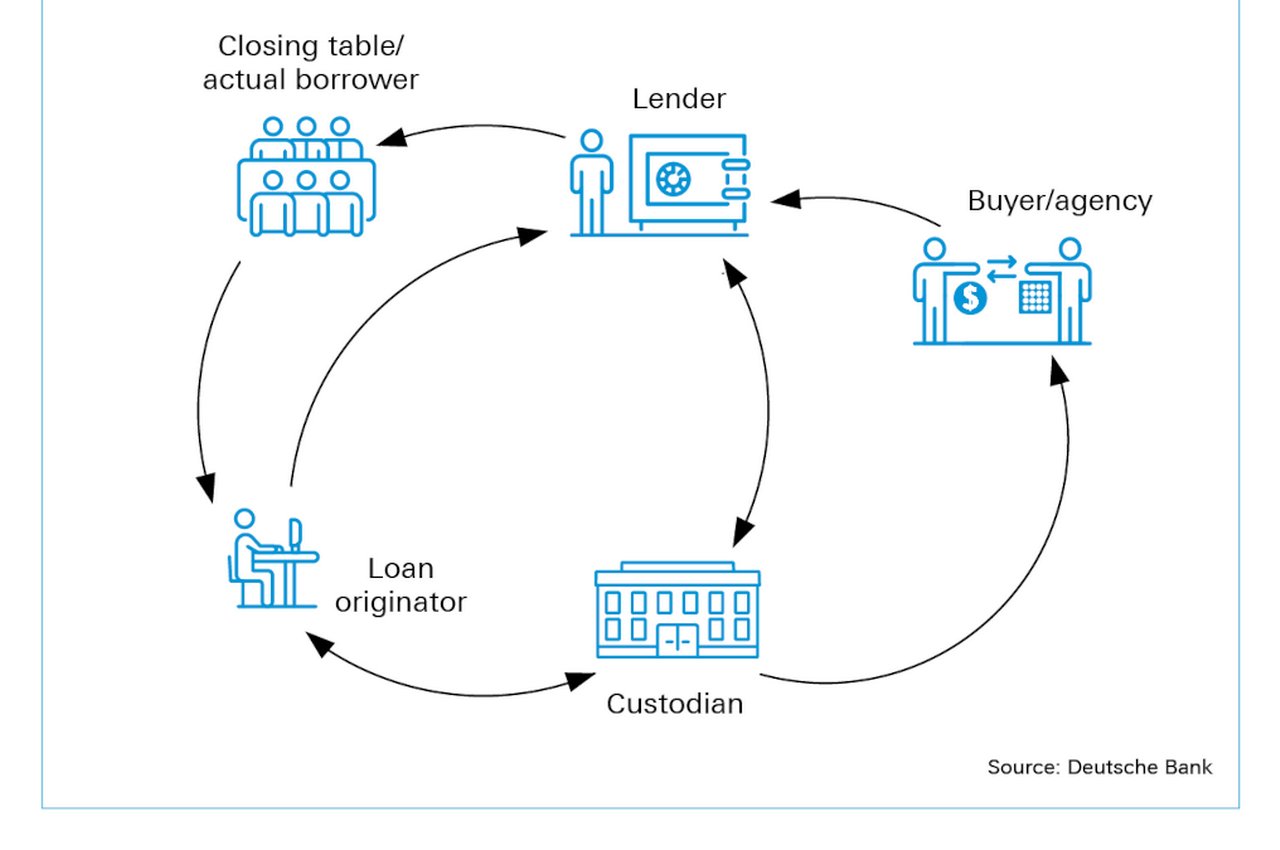

This article provides further insights into the secondary mortgage market and what is involved in managing loan documents across the range of parties involved in origination, warehouse lending (funding facilities for non-bank mortgage originators) and securitisation over the life of these loans. The role of the document custodian is a critical one and it remains pivotal as it facilitates the secure storage and retrieval of loan documentation on behalf of the stakeholders.

“This is a paper-intensive business with thousands of packages arriving daily that require same-day review”

Deutsche Bank has built a commanding presence in the US document custody market over the past three decades, where buy-side and sell-side communities dealing in loans look to Deutsche Bank to independently review, report and safeguard their physical and electronic loan documents. One indicator of the document custodian’s importance to the US mortgage market was the fact that during the pandemic, when most people were working from home, more than 700 operations staff physically processed around 4,000 overnight packages from FedEx and UPS each day, on average. “This is a paper-intensive business with thousands of packages arriving daily that require same-day review. We were physically on the premises for our clients during the pandemic when it mattered the most to them. This really solidified our standing in the space,” says Vaughan.

US primary and secondary mortgage- and asset-backed securities markets

Generally, when a US borrower applies for a first home loan purchase or refinancing from a lender, this liability winds up as part of a bond offering (pool of mortgages) to the primary securitisation market. The sale of mortgage bonds, mortgage servicing rights, repurchases, etc, makes up the secondary market that is very liquid.

The secondary market arises when, as explained in a US government paper called An overview of the Housing Finance System in the United States (Congressional Research Services, January 2017)1, the originator of the mortgage sells it or securitises it. When a mortgage is securitised, it is pooled into a security with other mortgages, and the payment streams associated with the mortgages are sold to investors. Thousands of contracts can therefore be bundled together and then marketed as a bond offering to investors. Other loans, such as automotive lending and credit card debt, are also securitised; asset-backed securities (ABS) occupy a smaller yet meaningful proportion of Deutsche Bank’s Document Custody overall business.

The US housing market is largely supported by three agencies operating under one central charter: to foster home ownership throughout the country. Fannie Mae (FNMA) and Freddie Mac (FHLMC) are categorised as GSEs under the conservatorship/guardianship of the Federal Housing Finance Agency. Ginnie Mae (GNMA) is seated within the Department of Housing and Urban Development (HUD), where its mortgages are insured and guaranteed by the federal government.

None of these agencies originate or service the mortgages in their securitised pools. However, these agencies do set standards, provide oversight and manage service providers, as well as issuers and other service providers associated with these securitisations. The three agencies comprise around 90% of the secondary marketplace. According to the Congressional research paper: “What happens to a mortgage in the secondary market is partially determined by whether the mortgage is government-insured, conforming, or non-conforming. Depending on the type of mortgage-backed security (MBS) or mortgage purchased, investors will face different types of risks.”

While the lender retains the direct relationship with the borrower or homeowner, they often finance the lending through other financial institutions, often referred to as ‘warehouse lenders’ or ‘interim funders’. The mortgages are then securitised and/or sold to third parties, providing the mortgages qualify and there are no exceptions against the criteria established in agreements. Securitised loans wind up either in agency pools or non-agency (private) deals.

“Now, lending is a well-disciplined market and underwriting standards are solid”

Total outstanding mortgage debt is broadly estimated at around US$17.6trn in the US. Elevated inflation and higher interest rates are expected to weigh on economic growth and home sales in 2022, according to the Fannie Mae (FNMA/OTCQB) Economic and Strategic Research Group forecast.2

“We have come a long way from the pre-crisis,” says Deutsche Bank’s Document Custody Client Services Co-Head, James Macmillan. He adds: “Now, lending is a well-disciplined market and underwriting standards are solid. Furthermore the housing market will remain strong, primarily because of historically low delinquencies, low inventory and a high ownership demand, notably from millennials.”

Managing the documentation

Managing loan documents across the range of parties involved in origination, warehouse lending and securitisation over the life of the loan is not straightforward. Not only does each underlying loan have its own contract or file (a home loan produces a file of key documents such as a note, mortgage and title, for example), the physical possession of the collateral file is also fundamental to the financing of the loan. Each time a security changes hands, further documentation is generated and layers are added to the chain-of-custody and secured interest assignments. Despite significant moves towards digitisation, the US real estate industry nevertheless generates vast quantities of paper documentation. It operates across more than 3,000 County Recorder offices, allowing for varying degrees of electronic documentation, and is governed at the state level by separate bodies, resulting in inconsistent rule-making across the country.

Since 2014, Deutsche Bank’s Document Custody has modernised and invested in a suite of technology platforms. These include:

- Providing clients with secure web portal access to their accounts through DB Autobahn into Document Custody Manager

- The roll-out of Deutsche Bank’s licensed eVault in 2018 to allow full participation in the expansion of the eNote adoption in the marketplace

- Investment in high-speed scanning and electronic image processing

- Use of Intelligent Character Recognition (ICR) and Optical Character Recognition (OCR) technologies, with an emphasis on machine learning (ML) and artificial intelligence (AI) to perform data analytics and document classification within its operations group

In addition, newer initiatives have included client-by-client Application Programming Interface (API) web services, Radio Frequency Identifiers (RFID) for file tracking and the ongoing expansion of the ML and AI, and the expansion of eVault services for specific use cases.

Alongside these technology investments, Document Custody has expanded its physical footprint by increasing its Santa Ana file room capacity, and acquiring a second facility 50 miles away with multiple file room chambers.

Following the eVault launch in 2018, Deutsche Bank now handles the majority of eNotes in the US, and partners with large lenders and agencies that have made eNotes part of their roadmap and overall strategy. The bank’s online Document Custody Manager tool allows clients to query the status of their collateral, generate reports, and source and download images of their documents – an increasingly industry-wide requirement.

The combined pillars of a loyal workforce and intuitive technology have put the business in a good position. Deutsche Bank Corporate Trust Director Chris Corcoran reflects: “Our seasoned, knowledgeable staff and our embracing of eNotes have strengthened our relationships with Fannie Mae, Freddie Mac and GNMA, making us the largest third-party custodian for all three entities.”

Trusted repository

All participants, from loan originators to warehouse lenders, need evidence that each underlying loan complies with the underlying custodial agreement shared between all parties. “In the mortgage world right now we exist to provide review, certification, safekeeping, wire disbursement and securities settlement services, so that warehouse lenders can finance the mortgage companies,” says Deutsche Bank’s Vaughan.

While some banks that lend directly to borrowers may retain their own documentation, Deutsche Bank is the largest service provider to non-bank lenders, servicing around 40% of the US housing market that is securitised. “Our file room in our building in Santa Ana, together with the sister facility in Redlands, California, currently holds more than 21 million loan files in safekeeping,” says Macmillan.

Figure 1: Summary of documentary custody interactions

Outlook for document custody business

“The technology required to develop initiatives such as Deutsche Bank’s eVault file tracking allows us to process significantly more loans on a daily basis than we were able to before, and we are continually looking at how to expand the technology to make the process even more efficient,” says Vaughan. The technology focus is one of the three pillars of this business – the other two are its people and facilities – that have supported 25% year-on-year average growth from 2009 to 2021.

Vaughan believes that being a successful document custodian requires fostering a client-centric culture, establishing a proven track record built on longstanding relationships and networks, and technological innovation, as digital and automation solutions emerge. It remains an institutional banking solution, given the need to safeguard and preserve the original note/contract, as well as other important documents.

He adds: “It is not and will never be a storage solution. It requires the custodian to know and understand the documents and their provenance and adhere to warehouse lender criteria and agency guidelines. This is accomplished by following policies and procedures, with proper audit trails and maintaining client chain-of-custody.”

The Santa Ana file room in the Deutsche Bank California office

Sources

1 See https://bit.ly/3IthpvO at crsreports.congress.gov

2 See https://bit.ly/3Rn7RXo at fanniemae.com

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

TRUST AND AGENCY SERVICES

Digital mortgages come of age Digital mortgages come of age

flow’s Janet Du Chenne assesses how the pandemic and structural changes in the US residential mortgage industry have accelerated the shift from a manual, paper-oriented and in-person set of practices to a process that utilises digital technologies

TRUST AND AGENCY SERVICES

CLOs – a continued growth trajectory CLOs – a continued growth trajectory

Against a backdrop of geopolitical and economic volatility, flow attended a recent Deutsche Bank Trust and Agency Services sponsored conference on European collateralised loan obligations (CLOs) and leveraged loans. The team found that most were optimistic about the resilience of this remarkable asset class

Trust and agency services, Sustainable finance

A CLO renaissance A CLO renaissance

In the midst of the CLO market’s current ‘golden hour’, flow attended the Creditflux CLO Symposium in London, and now shares insights into both the fundamentals underpinning the market’s current success, and the intensification of demand for ESG transparency among the asset class’ investors