28 October 2021

In the midst of the CLO market’s current ‘golden hour’, flow attended the Creditflux CLO Symposium in London, and now shares insights into both the fundamentals underpinning the market’s current success, and the intensification of demand for ESG transparency among the asset class’ investors

MINUTES min read

Anyone thinking that much of the global economy has been mothballed since the onset of the Coronavirus pandemic has not seen the activity in the market for collateralised loan obligations (CLOs).

Furthermore, if their awareness of CLOs only dates from the time of the global financial crisis (GFC) – when CLOs were somewhat tainted by association with collateralised debt obligations – they will not have seen CLOs become the trusted, resilient, and highly successful mainstream investment structure that they are today.

Creditflux’s CLO Symposium, held in London on 8 September 2021 and attended by Deutsche Bank’s Trust and Agency Services team, was the first such CLO event since 2019 and provided an opportunity to take stock. This article examines the panelists’ thoughts on the fundamentals of CLOs in Europe and the US, the impact of environmental, social, and corporate governance (ESG) investing and reporting on CLOs across both regions, and potential future risks to the CLO market.

Record year

Benign market conditions and the possibility of central banks increasing interest rates from their historic lows made 2017 and 2018 bumper years for leveraged loans and refinancings, as corporates in Europe and the US sought to capitalise on the favourable fundamentals. On the back of a not-so-quiet summer, year-to-date CLO sponsored deals have been such that 2021 year-end figures may even surpass those of before the pandemic.

Conor O’Toole, Head of European Securitisation Research at Deutsche Bank, envisaged “a busy end to 2021, with the market expecting north of US$30bn of new CLO deals by year end”. In the interim the CLO market has shrugged off some of the key concerns which abounded in 2019. These concerns – regarding Japanese risk retention rules, the EU’s then-new Securitisation Regulation, and the Volcker Rule – were all taken in the CLO market’s stride. Speakers praised arranging managers, credit rating agencies, CLO managers, and trustees alike for their ‘innovation’ and ‘adaptiveness’ in what has been an 18-month period hardly bereft of challenges. But what underpins this robustness?

"Investors… have great confidence in this asset class"

Market resilience

One reason flagged for the resilience of the CLO market is its battle-hardened condition. The GFC, and two subsequent down-cycles (if one factors in commodities and oil) all meant that – bar a slight pause in March 2021 as everyone tried to get their bearings – Covid caused barely a blip in the market’s demand, supply, or functioning. So, while the market took a couple of years to recover from the GFC, it only took a couple of months to bounce back from Covid. Each such challenge, from the 2008 to 2021, has served to help tighten up the standardisation of CLO documents, creating a virtuous cycle which gives participants further comfort in the investment structure and market.

“CLOs have proven to be incredibly resilient through the GFC and COVID. Investors have great confidence in this asset class and the demand remains strong,” said Jason Connery, Head of Trust and Agency Services EMEA, Deutsche Bank told flow afterwards.

European outlook

Trends such as low default rates and a decline in volatility (especially when compared to bonds or cryptocurrencies) have compressed CLO yields in the secondary market where, as one panelist put it, “everything is heading back to par”.

However, investors therefore going to the primary market to find relative value are spoiled for choice today. CLOs now constitute a US$1trn market globally and have a strong pipeline for European issuance. That high level of demand is expected to continue, further supporting current pricing, deals, and warehousing. Deutsche Bank’s CLO Default Tracker tool indicates the scant number of recent European and US CLO defaults.1 Putting this low number in context, Deutsche Bank’s O’Toole noted that most were in the oil and gas sector and had already taken a hit in that market’s downturn, with Covid merely accelerating the inevitable end for those corporates concerned. He added that along with these casualties “in a US$1trn market there will be some underperformers”. Deutsche Bank’s Research therefore upholds a positive outlook, forecasting a very benign credit environment for the next 12 months and only a 1–2% default rate for European leveraged loans.

"There has been no let-up in the pace of primary CLO activity"

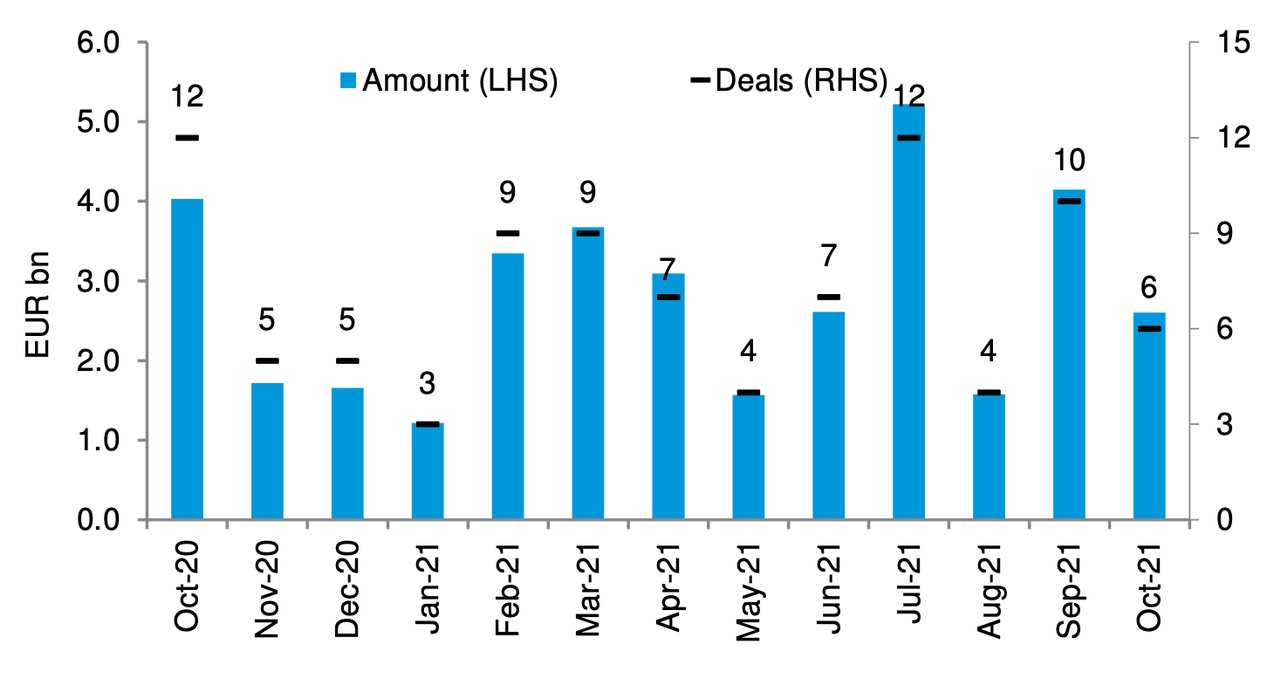

A month after the Creditflux event, in the 20 October Deutsche Bank Research report European CLO Monthly: Euro CLO pricing on the move, O’Toole observed, “There has been no let-up in the pace of primary activity. October is shaping up to be another strong month and already across new issue, we have seen five deals and €2.6bn versus 10 deals and €4.2bn for the full month in September.” See Figure 1

Figure 1: Monthly CLO issuance

Source: Deutsche Bank, S&P LCD

US outlook, and the US mid-market

Panelists analysing the US market noted that the last year or so had produced an “aha” moment, with a variety of new banks, issuers, and family offices all realised the optionality of CLO structures – and reflected CLOs having become a mainstay of portfolios.

This revelation, and the fact that CLOs performed very well (across Z-scores, yields, and a host of other performance metrics) in 2020 notwithstanding the uncertainty caused by Covid, all helped to entice new buyers into the market at every level. For example, the market had indicated its dislike for BBBs in 2019, given their preponderance. However, analyses have shown that BBBs always outperform tranches of other ratings – and this was so even during the GFC. Given also the record number of underlying US loans, it was noted that there are now growing queues to get CLO deals done. While some considered that the capacity of the US market had always been slightly tighter than that in Europe, panelists noted that – since deals beget deals which in turn beget refinancings and resets – US teams are prudently staffing up to address that market’s capacity challenges. With panelists noting that the robust pipeline is being met not only by increased sums (from a wider array of investors) but also increased allocations to the asset class, it was clear to delegates that the US CLO market is here to stay.

The confidence palpable at the Symposium was similarly evident in the US mid-market CLOs, which constitute around 10% of the total market. Compared to the broadly syndicated loan (BSL) CLOs that comprise the remaining 90%, the relative value of the mid-market might appear limited given that Covid has compressed the spread differential between the two sub-markets. However, panelists extolled the wider and perennial merits of mid-market CLOs.

Regarding (potential) distress, loans in this space typically have covenants across most assets. Also, being originated by a smaller group of lenders than BSLs makes reaching a consensus easier should a work-out be required with the corporate. As for the upside, loans in this space typically have a higher London Interbank Offer Rated (LIBOR) floor,2 and the illiquidity premium of around 150bps is essentially ‘free money’: liquidity is superfluous given the CLO structure enables these assets to be held to maturity.

Added to these inherent advantages, panelists concurred that the current mid-market and BSL market are almost ideal from an asset, liability, and equity perspective. US default rates are low and projected to remain so, there is great demand for CLO debt securities rated AAA to BB, and there is also the ability to do refinancings and resets. Added to that a robust pipeline for mid-market and BSL issuances alike, means there are thus plenty of loans for CLO managers to choose from, and panelists were keen to be as active as possible in the market, given the current advantages of being invested in CLO assets up and down the capital stack.

Environmental, Social and Governance (ESG)

One area where there appears to be some difference between the US and European CLO markets was ESG, but only insofar that ESG has a longer track record in Europe.3 Beyond this, the broad trends are similar. Speakers observed that ESG, however defined, is now firmly established. Such is the goodwill from both individuals and organisations, such is the demand from investors, and such is the momentum from regulatory authorities that this trend is unstoppable. Regulatory frameworks range from the light touch, such as the UN’s Global Compact4 and industry-specific guidelines, to the more prescriptive, such as the EU’s ‘Action Plan on Sustainable Finance’, which features the now operative regulations on Low Carbon Benchmarks, Sustainable Finance Disclosure, and Taxonomy.5 So mainstream is ESG becoming, panelists suggested in due course it will be difficult for corporates to obtain finance unless they are adhering to ESG. What those ESG metrics look like is another matter as investees and investors develop their transition roadmaps.

Panelists and audience members alike observed that there seemed to be much more of an emphasis in the CLO market on the E element than the S and G, although others pointed out that gender pay gaps and breaches of human rights law and corporate governance codes could also be quantified and monitored.

Notwithstanding varying definitions and emphases, there is a surfeit of ESG data, which could help address the transparency desired by CLO investors – were it not for a few initial hurdles. The fragmented and unstructured nature of that data needs to be parsed and analysed, with artificial intelligence (AI) being championed as the main solution for this task. Once the data has been mustered, it must be inspected and ranked – but the plethora of viewpoints on what constitutes the appropriate ESG standard does make this less than straightforward. However, all panelists agreed that the CLO market would coalesce over time around a set of ESG standards. While credit rating agencies may seem like the obvious solution, these only look at ESG from the perspective that it impacts upon credit risk, although some, such as Standard & Poor’s have started offering ESG audits to corporates; with private equity houses (for example, Advent International) rolling this offering out to their portfolio companies.

Having data to verify the carbon-intensiveness of a company’s product is one thing. It is quite another to know what the company is doing to offset it and satisfy recognised ESG criteria so that a decision can be taken as to when and how one should integrate that company’s loans into CLO portfolios. All CLO investor panelists admitted that until a market consensus develops, they need to conduct their own ESG sector-level screening and issue-level due diligence, as responsible investing becomes the new normal.

Outlook for the CLO market

When asked by moderators to identify causes for future concern, speakers struggled to envisage factors that might in the short- to medium-term upset the CLO market’s current golden era. Four minor factors did emerge here.

- The transition in benchmark reference rate for CLO deals from LIBOR to the Secured Overnight Financing Rate (SOFR) at the end of 2021 was seen as having the potential to ‘ruffle some feathers’. However, most panelists considered the market had already adapted to this change, seeing this as just another reference rate to incorporate into documents and analyses.

- Conor O’Toole of Deutsche Bank considered it a possibility that the US Federal Reserve, European Central Bank, or Bank of England will increase their base rate, but not until some point in 2022. However, prudent players noted the importance of continually making one’s CLO portfolio future-proof – and that more than a decade of shocks from the GFC to Covid-19 had made such resilient thinking second nature in the CLO market.

- One panelist sounded a note of caution regarding leverage and inflation. While gross leverage had decreased in Q2 of 2021, there has been an uptick since then. When combined with some aspects of CLO loan documentation becoming slightly looser, this could cause hiccoughs for investors in a more turbulent market. Likewise, inflation in raw materials may cause problems for some corporates operating in sectors where the pass-on of those costs is not possible.6

- Some US issuance will need to switch jurisdiction to satisfy the EU’s likely change in its treatment of Cayman Islands-based structures. However, such future US-based CLO issuances can easily be switched to Bermuda, BVI, or Delaware structures, which each have highly sophisticated ecosystems to service the requirements of the CLO market.

Notwithstanding the four minor factors outlined above, the overall consensus at the Symposium was therefore highly positive – with all agreeing that the CLO market is in a good place right now and that this looks set to continue for the short- to medium-term. As one panelist put it, “Now’s as good a time as ever to be a CLO investor.”

The Creditflux’s CLO Symposium was held in London on 8 September 2021 and virtually

Sources

1 See CLO Global Default Tracker at research.db.com

2 But note the IBOR transition timings – see https://corporates.db.com/publications/White-papers-guides/a-guide-to-ibor-transition at corporates.db.com

3 As explained in the flow article ‘Journey to green in ESG transformation’

4 See https://www.unglobalcompact.org/take-action/action/private-sustainability-finance at unglobalcompact.org

5 <emSee https://ec.europa.eu/info/publications/sustainable-finance-renewed-strategy_en at ec.europa.eu

6 The flow article ‘Inflation: where next’ based on Deutsche Bank Research analysis develops this further

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

SUSTAINABLE FINANCE

Green decision-making Green decision-making

As green investment taxonomies emerge across markets, market participants are calling for regulators to create a more level playing field. But is a globally recognised and harmonised framework possible? flow reports on insights from the Sibos 2021 conference panel session

TRUST AND AGENCY SERVICES

European structured finance remains resilient European structured finance remains resilient

Securitisations are going through a volatile period, but markets have begun to stabilise. flow reflects on recent Global ABS and Creditflux discussions and examines Deutsche Bank Research findings to assess the major trends impacting the securitisation markets and the outlook

Sustainable finance, Regulation

Journey to green in ESG transformation Journey to green in ESG transformation

As capital pours into ESG investing, how are regulatory frameworks developing to support this growth? flow’s Clarissa Dann focuses on key points from dbSustainability Research analysis