14 June 2021

Novartis is taking bold steps to increase access to medicines and tackle complex global health challenges. flow’s Janet Du Chenne explores how a social bond focuses the pharma company on achieving ambitious targets for getting medicines to low- and middle-income countries

Covid-19’s dominance of the global healthcare agenda continues to hinder access for low- and middle-income countries (LMICs) to prevention and treatment efforts for many other diseases. Two billion people worldwide have no access to basic medicines and healthcare,1 while a World Trade Organization/World Bank study found that, even before the pandemic, 100 million people each year were impoverished by healthcare expenditure.2 Weak healthcare systems in LMICs also hinder timely diagnosis and treatment. Swiss pharma company Novartis is focused on tackling these challenges.

In September 2020, as part of its environmental, social and governance (ESG) agenda (based on ethical standards, pricing and access, global health challenges and responsible citizenship), the company issued a sustainability-linked bond (SLB) with specific targets for global health and access to medicine. It is aiming to increase the number of patients in LMICs reached by its innovative therapies by 200% by 2025, and by its treatments for leprosy, malaria, sickle cell disease and Chagas disease by 50% over the same period. More than 24 million additional patients could be reached if Novartis achieves both targets.3

200%

The Novartis 2025 target for increasing patient reach with its strategic innovative therapies

In the bond’s prospectus, the company says that the eight-year, €1.85bn SLB creates a direct connection between progress towards achieving these targets and its funding strategy and cost of capital.4 Bernd Bohr, Partner at Mayer Brown, Novartis’s legal counsel on the bond issuance, comments on this rationale: “We’re still not at a point where there are any real commercial advantages for issuing an SLB,” he explains. “Historically, AA-rated issuers such as Novartis could raise money in the capital markets whenever they wanted to at very low interest rates. The company issued this bond at a zero coupon, so it is paying no interest, but the bond is core to Novartis’s vision of reimagining medicine to improve and extend peoples’ lives and finding areas where they can add the most value to society.” Novartis enlisted Deutsche Bank as one of the managers, as well as fiscal agent and principal paying agent on the bond, which priced at 99.354% of the aggregate principal amount.

The bond was only the second to be based on the International Capital Market Association’s (ICMA’s) SLB Principles5 (published in June 2020), and the first to be linked to achieving social sustainability performance targets. “Unlike energy utilities such as Enel, which [in September 2019] issued the first bond linked to renewable energy targets and the reduction of greenhouse gas emissions, Novartis picked social sustainability performance targets that are core to its business as a medicines company,” says Bohr.

Building trust with society

The targets are thus linked to one of Novartis’s five strategic priorities: building trust with society. (The other four are unleashing the power of people, delivering transformative innovation, embracing operational excellence and going big on data and digital.)

One of the ESG key performance indicators (KPIs) is based upon Novartis reaching carbon neutrality across its entire supply chain by 2030. In November 2020, the company signed five virtual power purchase agreements (VPPAs) with three developers – Acciona SA, EDP Renewables and Enel Green Power – committing it to offtake to the electrical grid more than 275 megawatts [WM1] of clean power produced by six new wind and solar projects located in Spain.6 This move means that Novartis is set to be the first pharmaceutical company to achieve 100% renewable electricity in its European operations through VPPAs.

Novartis is set to be the first pharmaceutical company to achieve 100% renewable electricity in its European operations through VPPAs

Source: alamy

Reimagining medicine

These KPIs are aligned with Novartis’s vision of “reimagining medicine to improve and extend people’s lives”. As a leading global medicines company, it uses innovative science and digital technologies to create transformative treatments in areas of great medical need.

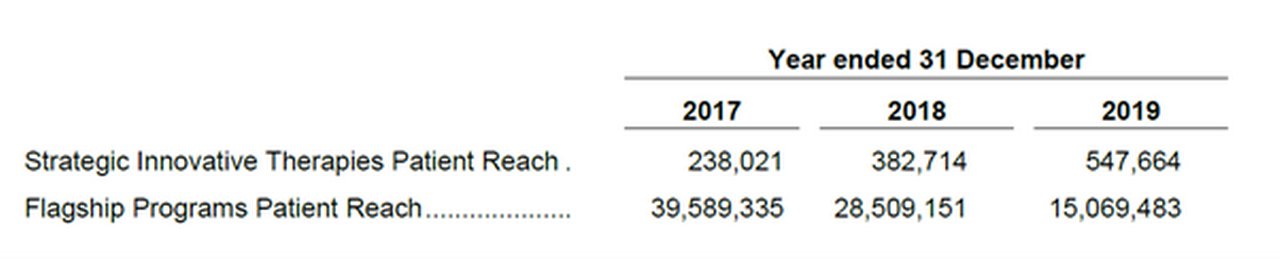

For the SLB, Novartis chose two KPIs – reaching more patients with its flagship programmes, and improving access to innovative therapies in LMICs – that are based on its 2025 patient access targets and are key parts of the aim to reach patients in various demographics and geographic areas (see Figure 1). The flagship programme target builds on Novartis’s approach to transforming health in lower-income populations by addressing major, unresolved global health challenges. Novartis is researching and developing a portfolio of drug candidates for the treatment of neglected tropical diseases that afflict around 1.6 billion people worldwide, as well as for sickle cell disease.

This flagship programme KPI reflects the approach to healthcare that Novartis adopts in its core business. For example, the company is using remote diagnostics and mobile phones to detect, prevent and treat the rising number of cases of leprosy in the Philippines in communities that are often hard to access[WM1] . The detection system enables frontline healthcare providers to send images of suspected leprosy lesions and symptoms to a specialist via SMS or an app.7 The company is also investigating the role of the P-selectin protein in sickle cell disease, developing innovative new medicines to treat the disease, and working to expand people’s access to diagnosis and treatment.[WM2]

Bohr describes how the approval process for medicines in certain regions adds a layer of complexity and risk to the bond’s KPIs. “Pharma companies such as Novartis need to get the drugs approved in these countries and work with local insurance companies, health ministries and non-profits to familiarise doctors with the product so that they can prescribe and administer them.”

Novartis picked social sustainability performance targets that are core to its business as a medicines company

Novartis’s second KPI is designed to address unequal access to the latest medicines. This challenge has come into sharp focus since the beginning of the Covid-19 pandemic, with the affordability of vaccines affecting LMICs’ ability to access them. Local regulations and weak healthcare systems in certain countries may also impede the approval and distribution of such medicines.

Given these disparities, in the past, pharma companies have often decided to focus on getting their medicines approved first in commercially attractive markets such as the US, Europe and Japan, neglecting access strategies for LMICs. “The unfortunate reality is that there has historically been a massive gap between when new drugs get admitted in these markets and in the LMICs,” says Bohr.

Figure 1: Patients reached with innovative and generic Novartis therapies

Source: Novartis

Novartis is looking to reduce the launch time lag between developed and developing markets for its innovative therapies by systematically integrating these access considerations into its launch process. Specifically, it is implementing affordability strategies and health system strengthening programmes and pursuing adaptive research and development for LMICs. In addition, it is using e-commerce and online pharmacies to lower distribution costs.

Measuring target relevance

Novartis received second-party opinions on its bond from the Access to Medicine Foundation and from ESG ratings and benchmarking consultancy Sustainalytics to validate the robustness and relevance of the bond’s KPIs and targets based on the ICMA SLB principles.

Lili Hocke, Product Manager, Sustainable Finance Solutions [WM1] at Sustainalytics, shares insights on how these principles were applied to the KPIs. “As an independent party, we assess if the bond is aligned with market expectations; that is, how well it is aligned with the relevant principles that have been put in place in the market by the buy side and the sell side. The alignment with the principles forms the common denominator of what we can consider to be relevant to assess.”

In the first part of the assessment, Sustainalytics considered whether the patient access targets on which the KPIs were based were material, relevant and ambitious (i.e. whether they build on business as usual) and linked to the issuer’s sustainability strategy. Hocke explains: “Since access to medicine targets are reported differently by each company, we based our assessment of ambitiousness on the comparison of the target with Novartis’s historical performance on the KPI. We assessed whether the current target goes beyond the historical performance trend.” In an ideal scenario, a KPI is also comparable to peers’ performance and to system boundaries.

In addition, since the SLBs are a performance-based instrument, issuers need to link the bond’s financial or structural characteristics to the achievement of the targets: “It’s about what we can expect when they achieve these access to medicines targets, and what happens should they fail.” While the bond runs to 2028, Novartis will increase the coupon by 0.25% if the company fails to meet both 2025 patient access targets.

The second part of the assessment is focused on what Sustainalytics deems relevant in enabling investors to decide whether to invest in Novartis’s bond beyond the alignment with the relevant market principles. “Here we look at the strength of the sustainability strategy of the issuer, where the company is in its sustainability journey, how well it is managing overall risks that are related to sustainability, and how important these medicines are in the areas that are targeted by Novartis,” says Hocke.

Resetting pharma’s reputation

Novartis’s passion to deliver medicines to LMICs saw it carving out a specific role for itself during the Covid-19 crisis. Vas Narasimhan, CEO of Novartis, noted the general effects of Covid-19, which affected patient visits, and that some therapeutic areas were more impacted than others. During a CNBC interview in January 2021,8 he observed that “there’s a second pandemic ongoing, or a syndemic,9 so to speak, that’s really impacting patients’ ability to get non-communicable disease treatments in a timely manner.”

He added that “the pandemic has been a reset for pharma’s reputation”. Here, the company is doing its job of supporting LMICs in achieving herd immunity by expanding access to medicines. Instead of developing its own vaccine (having sold its vaccines unit to GlaxoSmithKline in 2015), Novartis is helping other companies to make them and signed an initial agreement in January 2021 to provide manufacturing capacity for the Pfizer-BioNTech vaccine.10 It will take bulk mRNA active ingredients from BioNTech and fill vials under aseptic manufacturing facilities at its site in Stein, Switzerland for shipment back to BioNTech for distribution to healthcare system customers around the world.

In March 2021, Novartis signed an agreement to manufacture the mRNA and bulk drug product for the Covid-19 vaccine candidate CVnCoV from CureVac, and it will supply up to 50 million doses by the end of 2021 and up to a further 200 million doses in 2022.11 Delivery from its manufacturing site in Kundl, Austria is expected to start in summer 2021.

In addition, Novartis is making 15 drugs that treat key symptoms of the virus available to LMICs at zero profit until a vaccine or curative treatment becomes available.

Going forward, with the confluence of Covid-19 and other diseases, Novartis is seizing the moment to build trust with society as countries race towards recovery. And, with its patient access targets aligned to its core business and ESG objectives, it aims to ensure that in that race, no patient gets left behind.

Sources

1 See https://bit.ly/3zqxZIH at who.int

2 See https://bit.ly/2Svlo5q at who.int

3 See https://bit.ly/3vOsFwa at novartis.com

4 See https://bit.ly/3lG6wvl at novartis.com

5 See https://bit.ly/2OWT4XZ at icmagroup.org

6 See https://bit.ly/2OP9mCo at novartis.com

7 See https://bit.ly/314T4b1 at novartis.com

8 See https://bit.ly/3c7YaJC at youtube.com

9 A synergistic epidemic (or syndemic) is the aggregation of two or more concurrent or sequential epidemics or disease clusters in a population with biological interactions

10 See https://bit.ly/3vSgJcD at novartis.com

11 See https://bit.ly/3cT6YT6 at novartis.com

You might be interested in

Sustainable finance, Trade finance and lending, flow case studies

Baby steps Baby steps

When emerging economies build for the future, they need modern and efficient maternity care. flow reports on why the structured export financing of Argentina’s Hospital Provincial Nueva Maternidad Felipe Lucini was a turning point in sustainable finance

TRUST AND AGENCY SERVICES {icon-book}

The personal touch The personal touch

Twenty-one years after it was established, the UK-Swedish biopharma company AstraZeneca is one of the first developers of a candidate vaccine against Covid-19. flow's Janet Du Chenne finds out how a people-centred mindset makes a difference in scientific innovation

TRUST AND AGENCY SERVICES {icon-book}

Antibody builders Antibody builders

Following the success of the blockbuster anti-cancer drug DARZALEX (Daratumumab), Genmab is developing a pipeline of proprietary antibodies. Anthony Pagano, the Danish firm’s new CFO, tells flow’s Janet Du Chenne how the company’s US capital raising fits that strategy