September 2019

By the end of 2021, Libor will have all but disappeared. Helen Sanders looks at what treasurers should consider amid the phasing out of this widely used benchmark interest rate

For the past 40 years, the London Interbank Offered Rate (Libor) has been the touchstone for financial instruments, the world’s most widely used benchmark interest rate, reflecting the reference rate at which banks lend and borrow between themselves. By the end of 2021, Libor will disappear, if not completely then at least effectively. Libor’s retirement has repercussions that reach significantly beyond the interbank market. Libor is the basis of around US$200trn of loans and derivatives (10 times the size of US GDP1), from variable rate loans to interest rate swaps, and is referenced in both financial and commercial contracts globally.2 For corporate treasurers, the impact is extraordinary, from the legal validity of contracts to the cost of borrowing, hedge effectiveness of derivatives and the wider accounting implications of changes to the reference rate. Effectively, the end of Libor is one of the most significant events of most treasurers’ careers.

Tolling the Libor bell

Despite its dominant position, Libor’s change in fortune looked likely as early as 2008. Libor is based on daily submissions of estimated borrowing rates by a panel of banks, as opposed to actual transactions, so its calculation includes an element of judgement of banks’ credit risk. Following the global financial crisis, banks gradually came to rely less on the interbank lending market, so the market on which Libor rates are measured became less active, and therefore the rate itself less relevant. Furthermore, financial and commercial counterparties increasingly questioned whether the interbank rate was a meaningful benchmark for entirely different transactions. Confidence in Libor was also significantly eroded following the high-profile rate-rigging incidents that came to light in 2012, and banks themselves became less comfortable with submitting data for the Libor calculation.

In 2017, with Libor increasingly seen as an anachronism – albeit one which was still heavily used – the governing body for the regulation of Libor, the UK’s Financial Conduct Authority (FCA), announced that banks would no longer be compelled to submit data for the purposes of calculating Libor from 2021.3 Consequently, even if it continues to exist in some form, Libor will no longer be a viable benchmark interest rate.

While the 2021 date is most commonly cited, the risk of the UK leaving the EU with ‘no deal’ in October 2019 could complicate these timelines. If the UK becomes a ‘third country’ with no equivalence, the FCA would need to reapply under recognition or endorsement options within the EU Benchmarks Regulation before 1 January 2020, when transitional provisions expire, to avoid EU-supervised entities becoming unable to use Libor.4

Review, revise, renegotiate

Consequently, treasurers and their partners have only 18 months – or less – to review, revise and potentially renegotiate hundreds, maybe thousands, of commercial and financial contracts that mature after 2021. They also need to model the potential impact on accounting, hedge accounting and corporate earnings. While some have already embarked on a transition programme, others will need to step up the pace and prioritise. In many cases, treasurers may need to upgrade or modify systems to support multiple benchmark rates, and model different benchmark rates in parallel, which adds further pressure on timelines.

Some contracts will have fallback provisions to transition to a different reference rate if the benchmark rate stipulated in the contract is no longer viable. This is the most benign – but not the most common – situation. Looking at debt contracts, for example, fallback provisions are not consistent across jurisdictions or financial institutions. Treasurers and internal business partners also need to ensure that the fallback provision is reflected in financial and commercial systems so that interest, penalty and other payments are correct.

In other cases, the contract clause which refers to the reference rate becomes null and void, while the rest of the contract remains in force. This might appear to be a reasonably acceptable situation until it becomes clear that, without provision for the calculation of variable interest rates or penalty clauses, the contract has little purpose, and is certainly ambiguous and high-risk. This affects not just financial contracts, but also supplier, contractor and customer contracts that have late payment penalty clauses that reference Libor. Similarly, discount rates on leases, commodity futures and impairment testing of non-financial assets such as goodwill also frequently reference Libor.

"Treasurers have 18 months – or less – to review, revise and potentially renegotiate commercial and financial contracts that mature after 2021"

Commonly, however, contracts simply become null and void, leading to substantial business and financial risk if these are not revised or replaced to transition to a new reference rate. In the case of a debt agreement, if the change is significant enough it may be considered from an accounting perspective under the US Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) to be a termination of a previous loan and creation of a new one, potentially resulting in a gain or loss on the income statement.

Modelling market value

The potential impact on adopting a new reference rate is financial as well as contractual. Libor’s replacement rates, such as Sofr (Secured Overnight Financing Rate) for US dollars (first published in April 2018) and €str, the Euro Short-Term Rate (confirmed in September 2018), are calculated quite differently to Libor, which could result in a change in interest and other payments. While Libor is a forward-looking rate published over multiple periods – for example one, three and six months – and fixed at the start of the interest period, Sofr is an overnight, backward-looking reference rate (risk-free rate or RFR) that does not include a credit element as they are based on actual transactions. RFRs are more closely correlated with other money market rates. Fixings on RFRs such as Sofr and €str tend to be lower, so the value of variable rate instruments will change. There may also be some initial constraints on liquidity in RFR markets given their immaturity. Treasurers therefore need to consider both the valuation and liquidity implications of variable rate financial assets and liabilities.

Redesignating hedge relationships

The hedge accounting headache has afflicted treasurers for years, and the retirement of Libor will not help to alleviate this. Many treasurers have set up rigorous systems, processes and reporting to achieve hedge accounting treatment on derivatives such as interest rate swaps that lock in the value of variable rate borrowings. However, under US GAAP and IFRS rules, if the terms of a derivative, such as the interest rate on which it is based, change, it may need to be de-designated and the hedge is no longer deemed effective. It could also be difficult to prove that hedges are effective at inception and on an ongoing basis. When using regression testing, for example, data points for an RFR such as Sofr are not available before April 2018. There are also the implications of Sofr and €str being overnight rates rather than longer-term tenors for borrowings and associated derivatives. At the very least, therefore, treasurers need to review, remodel and consider the implications of the Libor retirement on each of their variable rate borrowings and the derivatives that are linked to them.

Collaborate and consult

The shift from Libor to RFRs such as Sofr and €str is an industry-wide transformation, so treasurers do not need to face it alone. The US-based Alternative Reference Rates Committee published a Paced Transition Plan5 to help entities to transition from Libor to an alternative RFR, including guidance on fallback provisions and other issues. However, treasurers need to align and coordinate closely with external financial and commercial counterparties and technology vendors, as well as internal business partners in legal, treasury, information technology, procurement, sales and other business functions to understand the implications of Libor’s retirement and plan their transition.

Helen Sanders is a freelance financial journalist and former Editor of Treasury Management International

Sources

1 See https://nyfed.org/2LEWY4x at newyorkfed.org

2 See https://bit.ly/2K7I0ka at fca.org.uk

3 See https://bit.ly/2v5KPwr at fca.org.uk

4 See https://bit.ly/2Ykow0X at natlawreview.com

5 See https://nyfed.org/2Kj5TWr at newyorkfed.org

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

CASH MANAGEMENT

Supporting clean mobility Supporting clean mobility

In December, German automotive component producer Continental agreed a €4bn revolving credit facility with a 27-bank syndicate aligned to sustainability performance. flow’s Clarissa Dann on how the company is navigating Covid-19 and a Tesla-disrupted market place

CASH MANAGEMENT {icon-book}

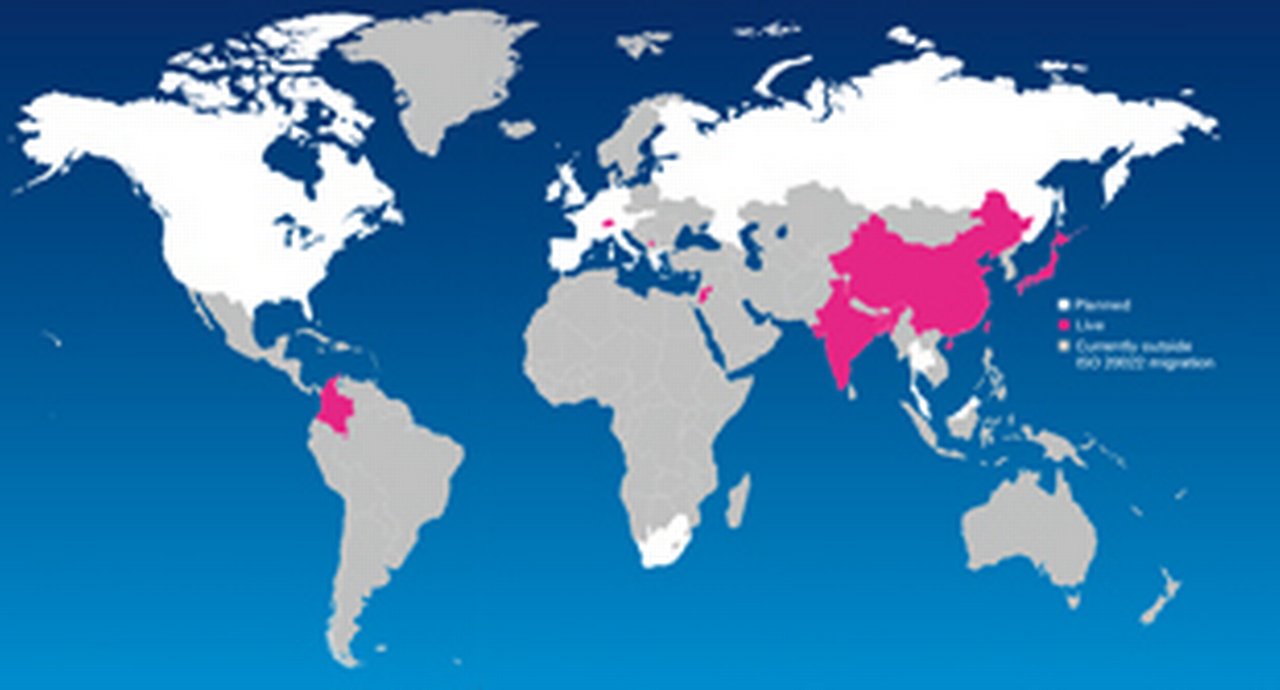

ISO 20022 takes off ISO 20022 takes off

Many of the world’s most important payment market infrastructures are transforming to meet the needs of automation, integration and real-time services. All of this is underpinned by the migration to a new payments messaging standard – ISO 20022. For banks and corporates, this is more than just another IT project; it signals a major opportunity to improve payments processes and reassess business models. Paula Roels looks at the implications

Macro and markets, Cash management, Trade finance and lending {icon-book}

US-German trade ramps up US-German trade ramps up

As the US overtakes China to become Germany’s top non-European FDI destination, financial journalist Ivan Castano Freeman provides a deep dive into these burgeoning corridors, drawing on insights from Deutsche Bank experts and the German American Chamber of Commerce, Inc. (GACC New York)