20 March 2023

In the current volatile economic and political environment, treasurers are under pressure to adapt their operations in accommodating the unexpected. flow shares insights from an Economist Impact webinar featuring the “reverse pyramid” approach to treasury from food manufacturer Kraft Heinz

- Treasurers are facing a highly volatile period – putting risk management front and centre

- Proactively modelling a host of different scenarios is where treasurers are adding significant value for their businesses

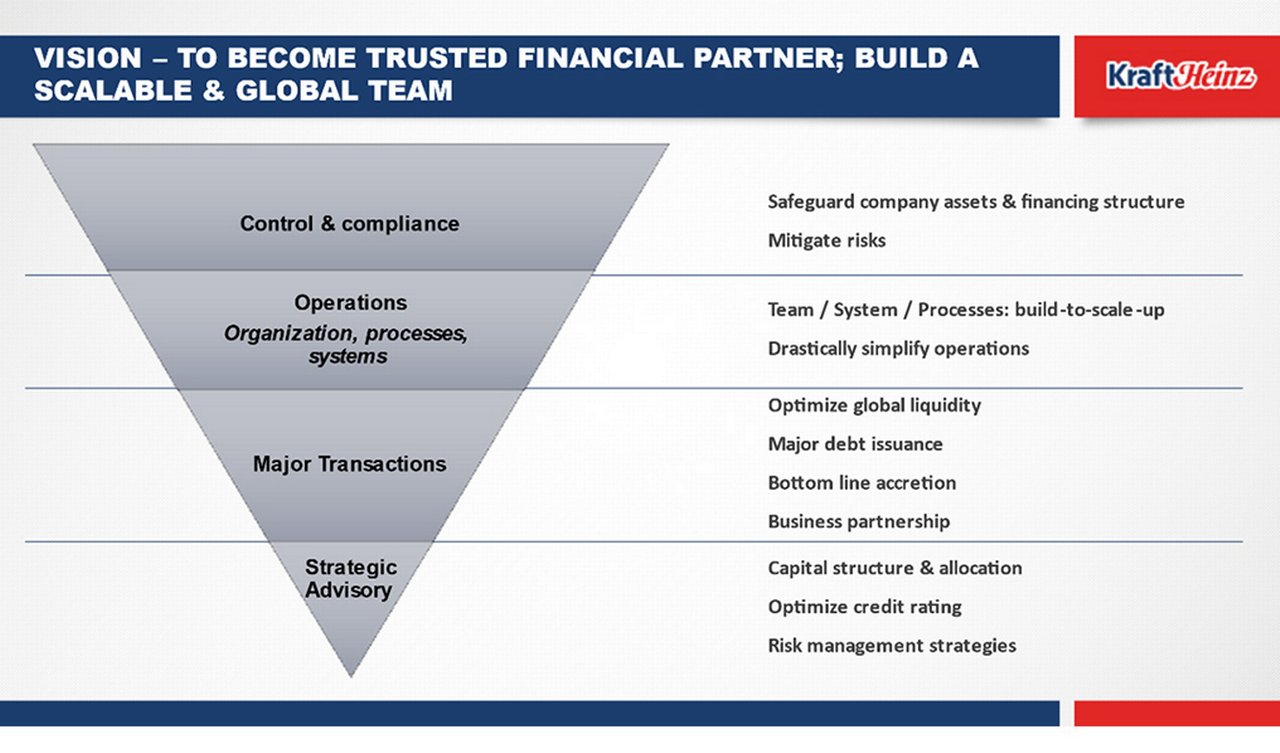

- Kraft Heinz follows a layer-by-layer approach to its treasury operations, with a solid foundation of control and compliance leading towards value creation and strategic advisory at the top

Today’s treasurers face a myriad of new challenges, coupled with several more familiar ones. Interest rates are at their highest level since the 2008 crisis and the current level of inflation was last seen in the early 1980s. At the same time, supposedly rare ‘Black Swan’ events have become regular occurrences with treasurers – on the tails of Brexit, US-China trade wars and Covid-19 – having to deal with the combined impact of the energy crisis, the Russia-Ukraine war, post-Covid monetary policy tightening and a potential global recession. The result is a highly volatile operating landscape – one that is “taking no prisoners across currencies, commodities and interest rates”.

Navigating the perfect storm

This was the scene set by Lisa Dukes, Co-Founder of consultancy Dukes & King and former Corporate Finance Director and Treasurer at Drax Group, the UK-headquartered power generation company. She chaired the webinar, Risk management in times of high volatility and inflation hosted by Economist Impact and supported by Deutsche Bank. “With such extreme moves in market dynamics, companies have been considering how to manage both the risks and the opportunities arising from their exposure to these markets,” said Dukes. This includes reviewing the cost of capital and capital allocation, among other policies, to ensure they are fit for purpose “both reactively but also proactively, not just for current environments but looking to the future”.

“We have seen more tail risks materialise in the market than ever before – at least in my 20-year career in the business,” said panelist Todd Yoder, Global Managing Director of Strategy Finance of the engineering, procurement and construction (EPC) company Fluor Corporation. He went on to highlight the energy crisis, and how power and food costs “hurt those who are least able to deal with non-core inflation”.

“There are a lot of things we, as treasurers, can do to be able to anticipate changes and be proactive,” continued Yoder. “Modelling these tail risks, for example, is where treasurers can add considerable value.”

Krafting an effective approach

How is treasury adjusting to the new environment? Speaking on the panel, Yang Xu, Senior Vice President, Global Finance and Treasurer at Kraft Heinz – a multinational food company active in more than 130 countries and with a host of globally recognised brands – explained that mitigating the impact of volatility is certainly high on the agenda.

As a global consumer goods producer, Kraft Heinz has felt the effects of resurgent inflation, not least because pricing its products is closely linked to the cost of raw materials. At the same time the energy crisis is impacting the company’s day-to-day operations, as well as sectors that are integral to its supply chain, such as packaging. Given its global presence, a steady depreciation against the dollar for many emerging market currencies is also an ongoing challenge for Kraft Heinz.

The impact of the prevailing environment is felt not only by companies, but by consumers as well. The cost-of-living crisis is hitting people’s wallets and changing their purchasing behaviours. At the same time, companies are looking to pass on some of the inflationary pressure to their end customers, which is introducing a difficult dilemma as to how changing demand and rising prices can be effectively managed.

For treasury to play a role in managing these dynamics, it needs to be extremely connected to the business’s performance. As a result, Kraft Heinz does much scenario planning – delving into how the business will perform and whether the existing capital structure remains appropriate.

As Xu noted, “I think the volatility will always be there, just to varying degrees. But what is always important is being able to see and project where the volatility is going to be impacting the business – whether positive or negative – and to plan for all kinds of different scenarios.”

“You cannot move on to the top without having an extremely strong foundation”

The pyramid of treasury

When communicating the responsibilities of treasury to her team, Xu uses what she calls the ‘reverse pyramid’. As she explains, “I call it a reverse pyramid because you cannot move on to the top without having an extremely strong foundation” (see Figure 1).

Figure 1: The inverted pyramid of treasury responsibilities

Source: Kraft Heinz

Layer 1: Control and compliance. As Kraft Heinz makes use of derivatives and moves a significant amount of money around the world, this layer needs to be bulletproof – and no news is often good news. For Xu, regardless of the prevailing environment, this will always be the number one layer: “I don't think the importance of this layer will change and heightened volatility simply means we need a heightened view of what is going on to ensure our foundation is rock solid.”

Layer 2: Processes. Here, the focus is on ensuring that treasury adopts the right technologies and systems to improve processes and drive efficiencies. This could, for example, include incorporating tools that provide treasurers with real-time cash balance reporting, automated cash pooling, virtual accounts, or a new treasury management system (TMS).

“With the heightened volatility, visibility is more important than ever – and I ideally need to see where my cash is daily,” explained Xu. “Right now, through my TMS, I have full visibility over 90% of my cash balance, which allows me to make real-time decisions to meet our treasury needs.”

Layer 3: Major transactions. The third layer addresses major transactions – from accessing the debt capital markets to coordinating in-the-money monetisation of certain swaps. It focuses on adding value: “Once you can protect the risk for the company then you can take a step back to ask, ‘how do we seize these windows of opportunity?’,” added Xu. It requires treasury teams to remain extremely agile and in-sync with market dynamics.

In the early months of the Covid-19 pandemic, for example, when Kraft Heinz was assessing its potential impact, the company chose to restructure its debt portfolio. The company achieved this by reducing its exposure to near-term debt through either pure liability management or tenor refinancing, which, in turn, allowed the treasury team to pivot to longer tenor, fixed rate debt. “Right now if you look at our debt portfolio, we are 10 years out of the tenor and over 90% of it is fixed,” said Xu. As a result of this approach, the company’s liquidity needs in the near term are significantly lower– and this is creating considerable flexibility in terms of how they tap the market.

Layer 4/tip: Strategic advisory. This is what Xu describes as the value creation strategic advisory layer. Treasury teams should engage in regular dialogue with a host of different actors – including the board of directors, banking partners, investors and credit rating agencies – to ensure that the capital allocation tallies with the prevailing economic cycle, and the trajectory of the business.

“For me it remains a layer-by-layer approach,” concluded Xu. “I don’t expect those layers to change through the cycle, but I do think that during a volatile period – such as the one we are experiencing now – it important to have an even more heightened focus on the steps and greater levels of agility.”

The Economist Impact webinar “Risk management in times of high volatility and inflation”, supported by Deutsche Bank, was held on 9 February 2023. To watch the panel session please click here.