7 December 2022

With geopolitical, economic and energy challenges taking centre stage, and difficult discussions on who is financing climate adaptation and mitigation, what does this mean for ESG priorities? Helen Sanders, together with Deutsche Bank’s Lavinia Bauerochse, reflect on corporate ESG strategy in the context of the recent COP 27 event

MINUTES min read

While the recent United Nations Climate Change Conference (27th session of the Conference of the Parties of the UNFCCC or COP 27) received mixed headlines, the commitment remains unchanged: to limit global warming to 1.5 degrees Celsius as set out in the 2015 Paris Agreement. As Lavinia Bauerochse, Deutsche Bank’s Global Head of ESG reflects, “While there are undoubtedly challenges and difficult conversations ahead, I continue to be inspired and excited by the innovation, commitment and diversity of perspectives that come together in the UN Climate Change Conference.”

These obligations are not restricted to national leaders or non-government organisations. Nor is environmental, social and governance (ESG) an addendum to corporate strategy. Rather, it is integral to it.

Has interest in reducing climate change cooled?

At a global level, environmental and social responsibility continues to be as important as, and integral to addressing geopolitical and economic challenges. While media attention at COP 27 has been more muted than COP 26, this is largely because of the way that COP is structured. At COP 26 in Glasgow, world leaders and key institutions made various pledges in addition to the Kyoto protocol, whereby at COP 27 the focus has been on implementing previous commitments. At implementation COPs, stakeholders discuss what has happened, what needs to be clarified, and where the gaps are.

Although possibly less headline-worthy, these events are just as important as the “pledge” years. As the COP 27 text states, the conference reaffirms participants’ “commitment to collective global response to climate change … recognising the threat posed by climate change, acknowledging that such threat calls for the widest possible international cooperation in the context of sustainable development and poverty eradication and through just transition pathways”. 1

Even though COP27 highlighted the disagreements between developed and developing nations, Bauerochse emphasises, “I was positively surprised by participants’ clear recognition that no single discipline or country will change the world. Instead, stakeholders appreciated that partnership drives impact, bringing together diverse skills and experiences to solve problems. This is not something we would have seen 20 years ago.”

This sense of environmental and social responsibility, and an appreciation of the value of collective endeavours, is also apparent in corporate treasury. Despite the demands created by inflation, rising interest rates and a cost-of-living crisis, which are causing many companies to rethink their corporate strategies and forecasts, the Economist Impact findings indicate that ESG targets remain a priority.

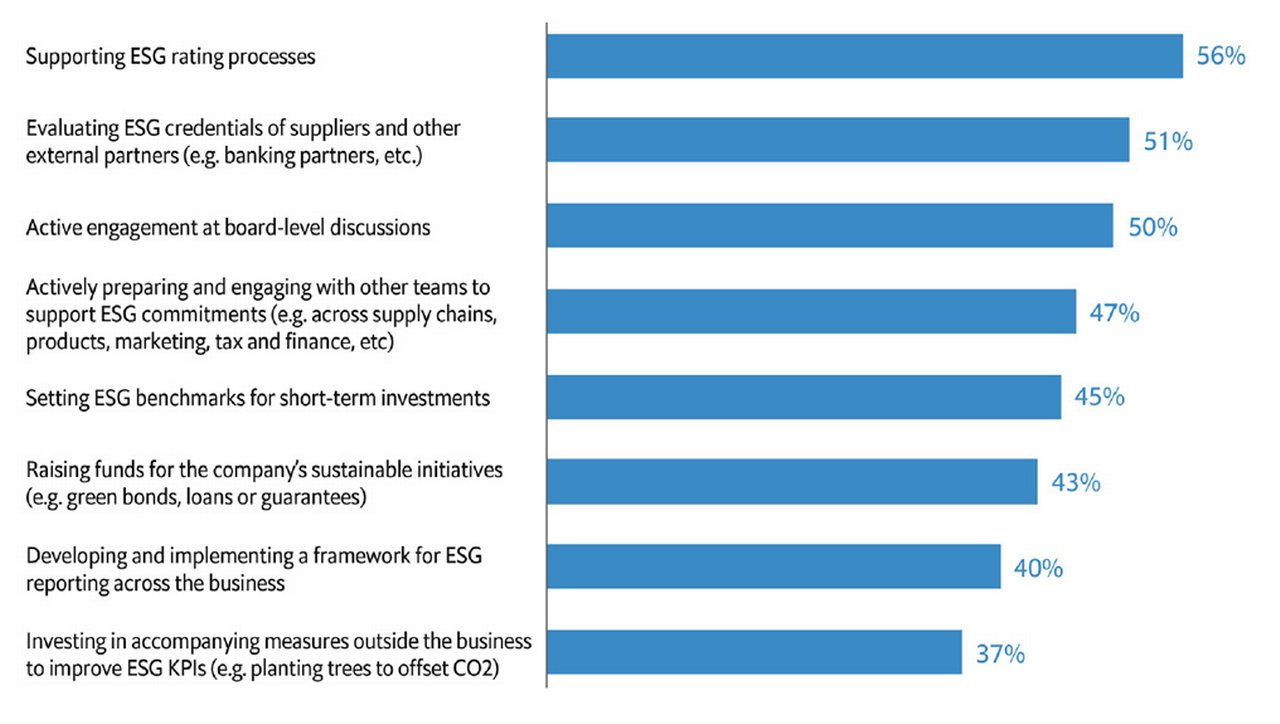

Figure 1 shows that over half of treasurers (56%) already support the company’s ESG rating processes and evaluate suppliers’ and partners’ ESG credentials (51%), to ensure that environmental, social and financial sustainability considerations are appropriately balanced, measured and monitored in a transparent way. Half are engaged in Board level discussions on ESG matters.

Figure 1: Treasury ESG strategies already implemented

Source: Economist Impact survey September 2022

Bauerochse is reassured by the findings, “ESG has not been de-prioritised, despite the immediate economic and geopolitical challenges with which treasurers and CFOs are faced. However, investment budgets are tight, and there are competing demands for resources.”

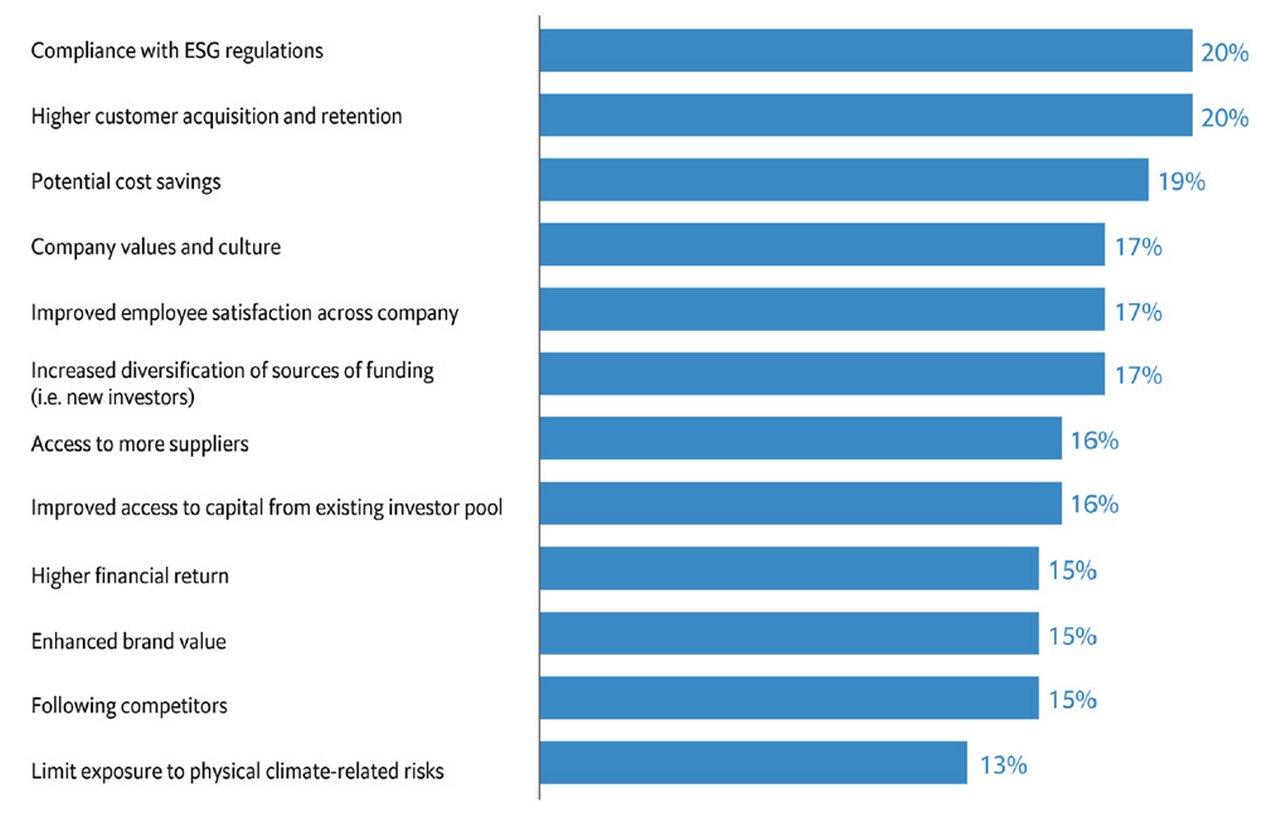

The reasons for treasurers to engage in the company’s ESG strategy are compelling, both from an ESG and economic perspective. As the 2020 CDP’s Global Climate Change Report explains, companies face an estimated US$120bn in additional costs arising from environmental risks in their supply chains over a five-year period . The Economist Impact survey emphasises that cost savings are the third most significant driver of treasurers’ ESG focus (19%), but regulatory compliance and customer reputation are marginally more important, each at 20% respectively (see Figure 2). It is interesting that only 13% noted that limiting exposure to climate-related risks was an ESG driver; however, it is possible that this is less within treasurers’ remit than it is for other business functions.

Figure 2: Drivers of treasurers' ESG focus, Aug–Sept 2022

Source: Economist Impact survey September 2022

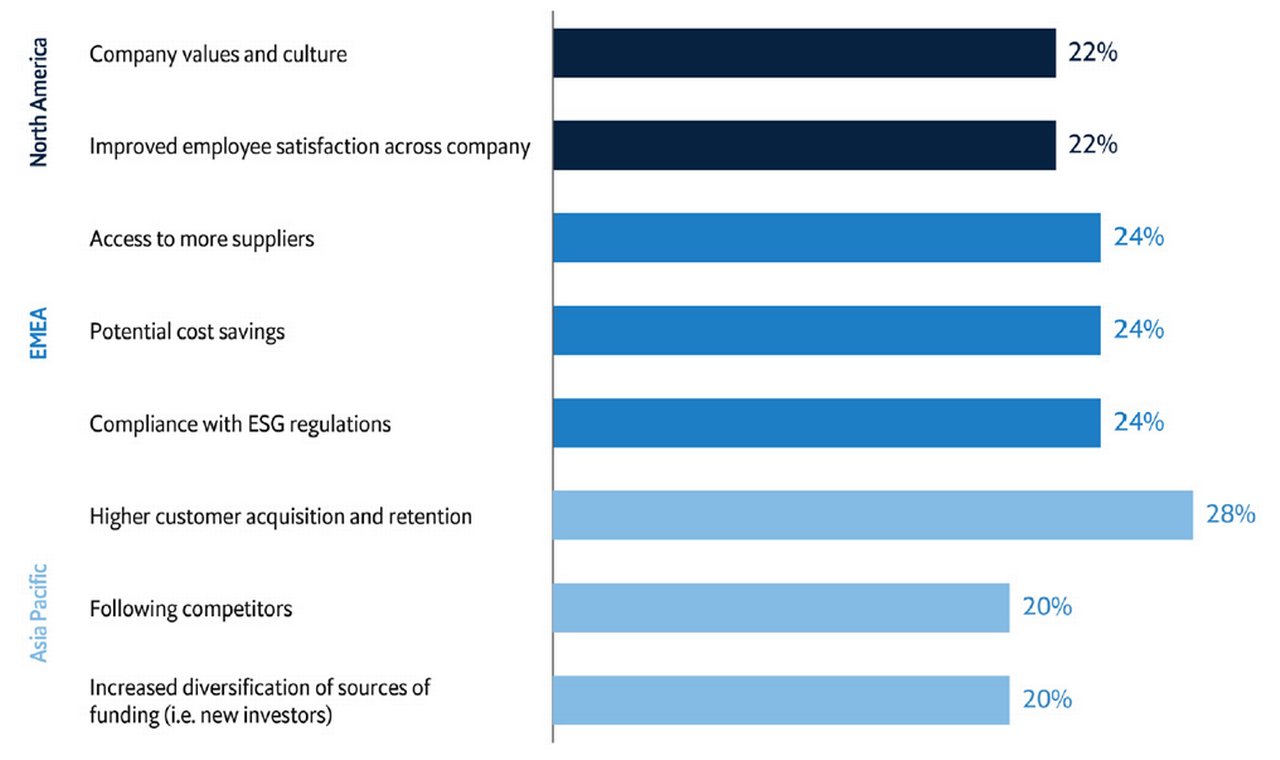

Within these broad trends, there is some variability across regions. Figure 3 illustrates how treasurers in North America, for example, are more motivated by values and employee concerns than in EMEA, where access to suppliers, cost savings and regulatory compliance are higher priorities.

Figure 3: Drivers of treasurers’ ESG focus, by region

Source: Economist Impact survey September 2022

Treasurers’ ESG strategies

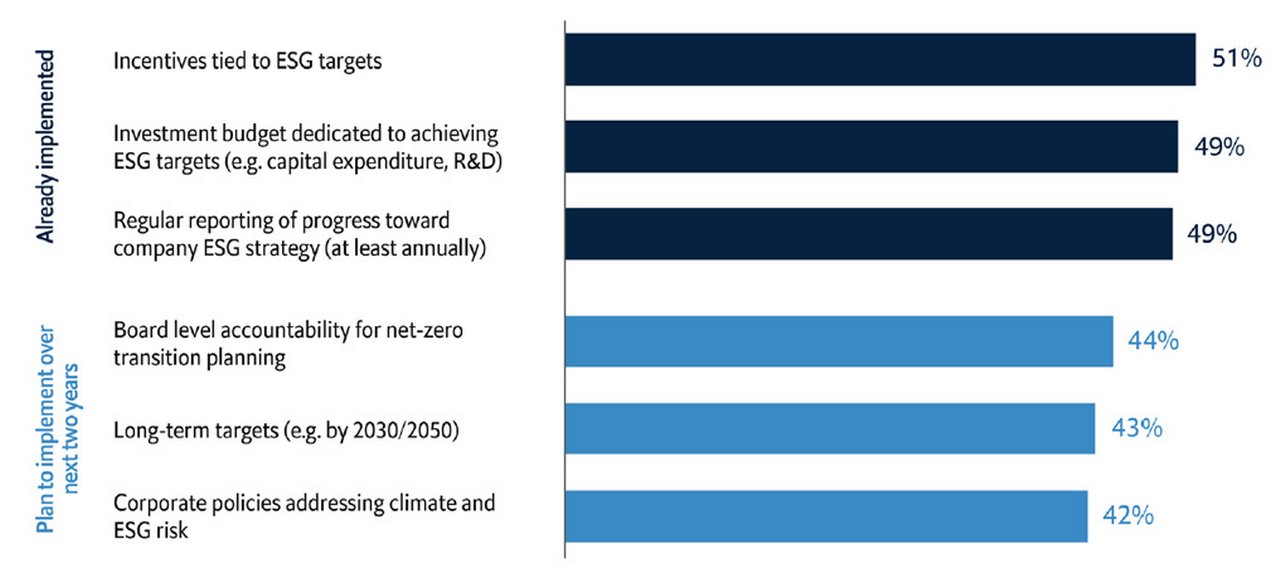

ESG may be a relatively new pillar of treasury strategy, but treasurers are embracing the ESG agenda in a variety of ways. 51% are already focused on incentivising good environmental and social performance amongst suppliers through sustainable supply chain finance (SCF) programmes (see Figure 4) while only slightly fewer (49%) have an investment budget dedicated to achieving ESG targets and reporting progress on ESG performance. Looking ahead, they expect to have a more defined role in supporting the Board’s net zero transition planning and achieving long-term targets.

Figure 4: Current and planned ESG strategies, Aug-Sept 2022

Source: Economist Impact survey September 2022

The most prevalent ESG strategies already engaged by treasurers are to implement incentives linked to ESG targets (51%) such as sustainability-linked supply chain finance programmes.

While the most immediately obvious way that companies can participate in the company’s ESG strategy is through green or sustainable investments, there is a limited supply. Likewise, while issuing green or sustainable bonds or other financing solutions is attractive, only certain corporate activities can be funded in this way.

In contrast, sustainable SCF programmes, and using ESG performance to influence the selection of suppliers and partners, lack these capacity constraints. Consequently, we are seeing growing interest and implementation of sustainable SCF programmes, pioneered by companies such as Henkel, in partnership with Deutsche Bank.2

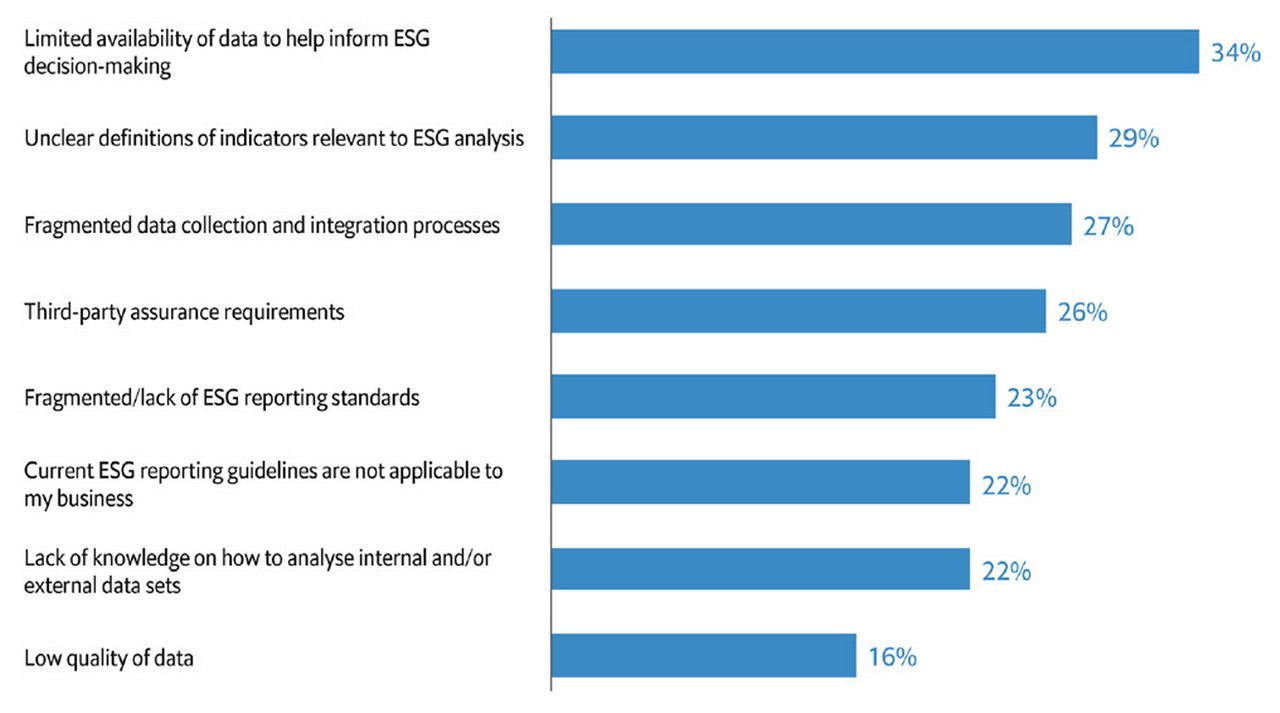

Even so, there are remain challenges. Specifically, the majority of issues highlighted in Figure 5 relate to the quality, availability and consistency of ESG data. This brings particular difficulties for multinational businesses with complex supply chains which lack the ability to measure, monitor and report on the environmental and social performance of their supply chains in a transparent and reliable way.

There are regulatory initiatives underway to provide more consistent taxonomy and detailed measurement of ESG metrics, such as in the European Union, but these will take time to implement, and inconsistencies across regions to be addressed.

Figure 5: Most significant challenges impacting on treasurers’ collection and reporting of ESG data, Aug-Sept 2022

Source: Economist Impact survey September 2022

Despite challenges in data quality, treasurers and their internal and external partners and counterparties, need to use the data they do have in an intelligent way. ESG is therefore becoming more closely aligned with treasury and supply chain digitisation initiatives.

“We will continue to see an acceleration of renewable build-out”

Looking ahead to COP 28

Looking ahead, COP 27 signposted some interesting developments that are likely to fuel further discussions at COP 28 in Dubai and those to follow. Bauerochse explains, “As energy security was a prevailing concern throughout 2022, we will continue to see an acceleration of renewable build-out, while the reliance on fossil fuels will remain in the short-term. Next year's COP will be expected to make more progress on commitments supporting greater fossil fuel phase-out.”

Realising this potential, however, will require unprecedented co-ordination of strategy, implementation, and financing to support sovereign governments and communities to deliver clean energy and drive growth.

The concept of sustainable finance is also shifting in emphasis. Transition finance continues to play a central role in enabling companies, institutions, and countries to achieve their COP 27 pledges. In addition, however, there are now more discussions amongst sovereigns and philanthropists, amongst others, about adaptation finance. This has a different risk profile to transition finance and is more targeted at supporting communities that are most vulnerable to the impact of climate change, such as rising sea levels, or flood and drought events.

There are also some exciting innovations that will help shape future national energy strategies. One announcement that particularly resonated with me was the German Chancellor, Olaf Scholz’s announcement of Germany’s increased investment in green hydrogen through additional funding of EUR4bn for H2Global 3.

“Green hydrogen is the key to decarbonising our economies, especially for hard-to-electrify sectors, such as steel production, the chemical industry, heavy shipping and aviation” he said. H2Global 4, of which Deutsche Bank was a founding member, was established in 2021, to promote the production and use of green hydrogen and other climate-neutral energy carriers (climate-neutral or defossilised energy carriers). This includes both production and import of green hydrogen and Power-to-X (PtX) products in Europe.

These developments have the potential to have a significant impact on treasurers in relevant sectors, as they look at new ways to support and elevate their profile in achieving the company’s ESG agenda, supporting transition and adaptation strategies, and helping to deliver on net zero targets.

Helen Sanders is a consultant to the financial services sector, and former Editor of Treasury Management International

Lavinia Bauerochse

Global Head of ESG Corporate Bank at Deutsche Bank

Trade finance solutions Explore more

Find out more about our Trade finance solutions

solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

SUSTAINABLE FINANCE, TRADE FINANCE, MACRO AND MARKETS

Europe’s energy crisis: Ten green bottlenecks Europe’s energy crisis: Ten green bottlenecks

Winter is coming and what will bridge the energy gap created by the recent shutdown of Russian gas supplies and challenging emissions reduction targets, asks Deutsche Bank Research. flow shares some key points of a new report on Europe’s energy crisis

Sustainable finance, Trade finance and lending

How to manage transition to net-zero How to manage transition to net-zero

As economies around the world pledge their commitment to net-zero emissions by 2050, companies need to step up their decarbonisation plans. Deutsche Bank’s Lavinia Bauerochse reflects on how this is changing the role of banks and why transition is becoming a core element in client conversations

Sustainable finance, Trade finance and lending

EU tightens the ESG reins in supply chains EU tightens the ESG reins in supply chains

The European Commission has proposed a new regulation to foster sustainability in corporate supply chains. If enacted, companies will be required to ensure that human rights are respected, and environmental impacts are reduced in their own operations and value chains. flow’s Desirée Buchholz examines what this means in practice