September 2020

Fifteen years on from its launch, the original business template of payment services and working capital provider Payoneer successfully anticipated today’s growing online business volumes. Graham Buck reports

Many businesses derive success from meeting today’s needs; others build their reputation on anticipating what tomorrow’s needs will be. The latter course has been successfully pursued over 15 years by digital payments platform Payoneer, which has established itself as a major name in online money transfers, cross-border payments and working capital provision.

Payoneer’s CEO, Scott Galit, has described its mission as “to empower global commerce by enabling businesses and professionals to pay and get paid globally as easily as they do locally”. Users of its services can pay and receive funds via several methods, including credit cards, debit cards, electronic wallets and bank transfers.

The company works with businesses of all sizes to help them make and receive payments, ranging from an individual

service provider in Ukraine, or a Chinese e-commerce company with hundreds of employees, to the world’s largest brands such as Amazon, Airbnb, Google, Facebook and Upwork.

Through partnerships with such global platforms, covering both big businesses and the merchants and service providers they pay out to, Payoneer believes it has positioned itself to make international payments “seamless, secure, and fit for the digital age”.

Before launching Payoneer in 2005 its founder and president, Yuval Tal, had already developed one of the first internet payment solutions companies, E4X (later renamed Borderfree), which today is part of US mailing technology firm Pitney Bowes. Payoneer aimed to provide companies with secure online cross-border payment solutions at a time when expensive wire

transfers and analogue routes were the primary means for international payments. While the proliferation of online marketplaces and fintechs was yet to happen, the trends that led to their creation were already evident, says Jody Perla, Managing Director of Global Banking and Payment Infrastructure at Payoneer.

Democratisation of access

Having recently looked back at the company’s first marketing presentations, Perla recounts that “the themes we identified in the early days are still very much around today, but in a more exaggerated way.

“Businesses of all sizes are increasingly global, demonstrating the ease of access made possible by the internet and technology,” she adds. “This has transformed communication, interaction and the business of buying and selling.

The democratisation of access means that wherever you live and whatever your size, now that borders have come down, you can create a business.”

The move to online further accelerated early this year with the coronavirus shock, as lockdowns worldwide made working, shopping and conducting other transactions from home a necessity rather than an option. “Having experimented over a long period of time, with individuals and business tentatively dipping a toe in the water, the change in behaviour on both buyer and seller side has sped up,” Perla confirms. “It has been a changing reality, but while the cause was unexpected, we anticipated these general trends – including the need for supply chain diversification. Relying on a single supplier or source is no longer sustainable, so we have seen huge growth in cross-border activity.”

Financial inclusion

Payoneer’s clients, ranging from major multinationals to small businesses and freelancers, are offered a one-stop shop for both sending and receiving payments, as well as providing working capital. Success stories on its website include Softogix International, an e-commerce company with offices in Dubai, UAE and Lahore, Pakistan, which also helps new e-commerce businesses grow.1 Founder and CEO Muhammad Sabbayal started the business from scratch a couple of years ago from his Lahore home and now has an 18-strong team.

“The biggest problem is that you can’t receive all payments in the same place; either you have to open several bank accounts, or you have to use different services,” he explains. “I needed a payment solution which could help me receive all my payments in one place and be able to connect to all my online stores. With Payoneer, I can receive payments from all the platforms we are selling on, into one account.”

Another customer is Jae-seop Lee, CEO at Krade International, a trading company that sells products from Korean small and medium-sized enterprises (SMEs) to global online markets such as Amazon, eBay, Rakuten and Qoo10. Since 2009, it has worked with its business partner in Australia to export fashion accessories from local markets in Dongdaemun and Namdaemun, in the South Korean capital Seoul.2

“Taking a closer look at our exporting business model, we realised that it could be more lucrative with accessories. So we started selling in global online marketplaces, starting with eBay,” explains Lee. “With the expansion of the e-commerce industry, local sellers find it increasingly challenging to stand out from other brands in the market. At Krade International, we take care of the branding and marketing activities for these SMEs to increase their global appeal and demand.”

In the past, these SMEs had difficulties getting paid from overseas marketplaces. “Establishing a legal entity overseas was pretty much the only way to receive funds from companies operating in a different country,” adds Lee. With a single Payoneer account, the company was able to get paid from all Amazon marketplaces, including Amazon UK and Japan. “Payoneer has helped us minimise overseas business travel, as we no longer have to deal with the hassle of creating multiple bank accounts,” he says.

Figure 1: About Payoneer

Source: Payoneer

Growth journey

“Back in 2005, our way of helping clients was through a prepaid debit MasterCard, which kick-started the business,” recalls Perla. “It provided a range of options for payment recipients, who could access the money via an ATM or use the card online or at any point of sale. Over the years, the card has become more of a niche product, and today we provide a full range of financial services for businesses of all sizes.

“Payoneer has focused on both established markets and developing countries, with their new ranks of freelancers and digital entrepreneurs. The gig economy and small businesses have grown strongly in recent years, a trend that is further accelerated this year by the shift to remote work for professionals all over the world.”

The company’s customer base has grown to around four million, from freelancers to major multinationals in over 200 countries. With its head office still in New York and its research and development centre in Israel, Payoneer’s global network now extends to 21 locations and a workforce of around 1,500 employees. The company aims to bring them all together once a year, although the pandemic makes it impossible to do so in 2020, except virtually.

“We have people all over the world who look at the specific needs of each individual market,” explains Perla. Half of the management team is female and she says that recruitment of “smart and motivated women” has always been part of the company’s culture. “Many of the requests we see coming in are for regulated settlement, reflecting the fact that moving money around the world is a highly regulated activity – and that regulatory burden has steadily increased,” she adds. “Payoneer can manage it. Our plug-ins for payment orchestration for both receivables and payables allow us to operate as a one-stop shop.”

In 2019, Payoneer began offering working capital to Amazon and Walmart sellers and was able to use its insights into their sales to assess risk and extend the funds these companies need to grow. Last December, as part of its continued growth, it purchased German company optile, a cloud-based open payment orchestration platform for businesses to quickly expand into new overseas markets by adding new partners and payment options for receiving and collecting funds globally and locally.3

“The rationale for the optile acquisition was to access its technology and platform,” Perla says. “optile, as a payment orchestration platform, is very synergistic with our core value proposition and helps propel us to expand into a full receivables platform as well.”

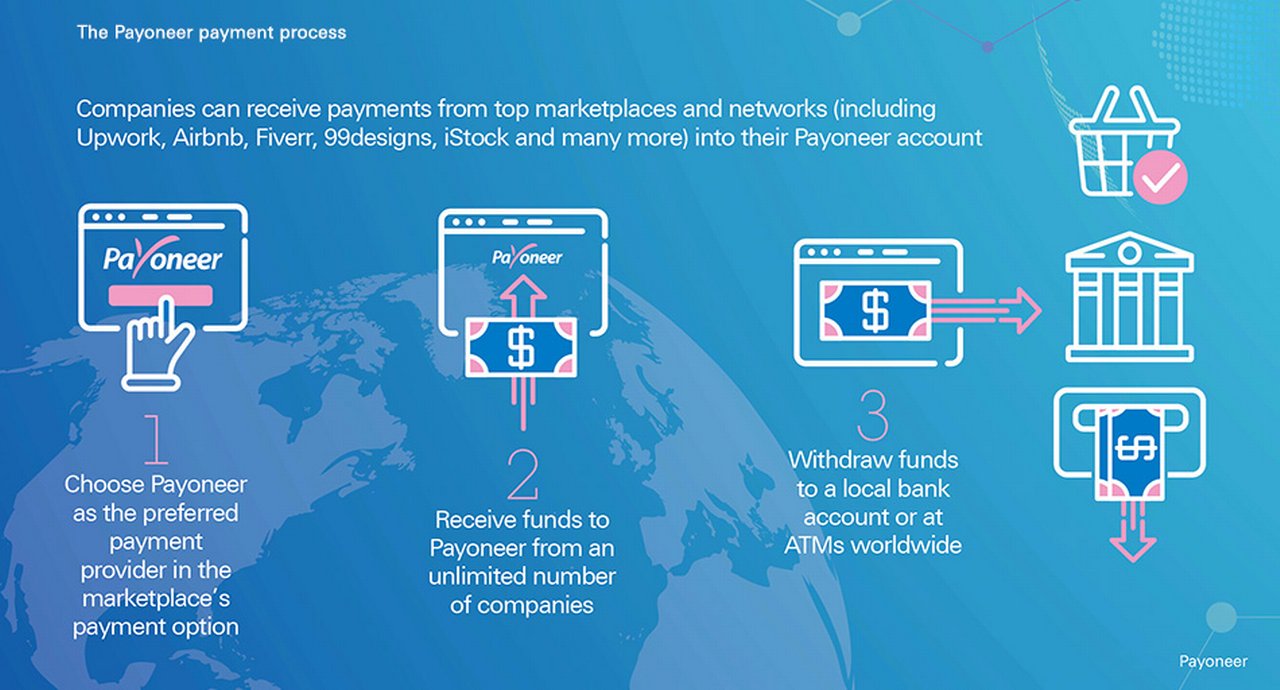

Figure 2: The Payoneer payment process

Source: Payoneer

"Our plug-ins for payment orchestration for both receivables and payables allow us to operate as a one-stop shop"

Changing behaviour

Expansion also enables the company to access detailed data on money movement and provide research on topics ranging from Covid-19’s impact on freelance workers to e-learning. In the case of the former,4 Payoneer canvassed views from over 1,000 freelancers across more than 100 countries, asking them to share how the pandemic had impacted demand for their services, their hourly rates and what opportunities and risks they expected to arise from the crisis. Its findings were more upbeat than might have been anticipated: despite a short-term fall in demand, freelancers’ hourly rates had proved fairly resilient and their post-pandemic prospects remained promising.

“Research reports are something we plan to do on a more regular basis, as everyone is desperate for accurate data and information,” says Irina Marciano, Payoneer’s Director of PR and Communications. “As the pandemic has shown, you can’t predict accurately when your insights are based on past behaviour that has now become largely irrelevant.”

Perla adds that the company has already proved adept in its ability to “pivot, react and respond” to unexpected events such as Brexit, extreme currency fluctuations, geopolitical issues, trade tensions and economic instability in emerging markets. “Each individual payment has its particular attributes, including the method of delivery, the purpose of the payment, the country in which it originated, where the funds are being delivered and more – it’s the ‘secret sauce’ of online banking and payments. We’re connecting dots around the world and complying with the regulatory requirements of each region.”

A passage to India

The growth of Payoneer’s global network included a move into India in April 2016, following a partnership with Pune-based IndusInd Bank and expressions of interest in its services from more than 10,000 freelancers and small businesses across the country. Reports such as a 2018 PayPal study suggest that India’s freelancers represent around one quarter of the world’s gig workforce and, according to Payoneer’s 2020 Freelancer Income Report, work for an average hourly rate of INR1,282 – just over US$17, against a global average of US$21.5

However, earlier this year Rohit Kulkarni, Payoneer’s Regional Head for South Asia, reported that in 2019, Indian freelancers enjoyed year-on-year revenue growth of 29% and increasing numbers of those aged under 35 were joining their ranks.

Kulkarni comments that the company arrived in India ahead of a “watershed moment” for the country: the abolition in November 2016 of INR500 and INR1,000 banknotes, the highest denominations. “It marked a sea change for a country that has always had a large cash-based economy,” he confirms.

“Many everyday payments have since gone digital, helped by the growth of digital wallets and the Unified Payments Interface [the realtime payments system developed by National Payments Corporation of India to facilitate bank-to-bank transfers]. Both have seen tremendous growth over the past three years, and over that period the number of Indians with bank accounts has almost quadrupled, from around 200 million to 750 million.”6

400%

In August 2019, Payoneer announced a year-on-year increase of 400% in its customer base and a threefold increase in payment volumes processed in India. It added that it was in talks with banks and non-bank financial companies to add working capital products to its payment services, although negotiations to gain the necessary regulatory authorisation have since been delayed by Covid-19.

In the same month, working with Deutsche Bank, the company launched digital Foreign Inward Remittance Certificates (FIRCs) for its sellers and service providers receiving payments from abroad. FIRCs are documents used as proof of foreign transfers and are accepted by authorities to evidence that an individual or business has received a payment from abroad in a foreign currency.7 Payoneer was the first company to make this process digital.

As Yoon Choi, Global Fintech Cash Management Sales specialist at Deutsche Bank, notes, the partnership with Payoneer underlines the collective commitment to a “frictionless collection experience for the sellers and brings efficiency in the last mile of the payment value chain”.

“India is an FX-thirsty country which imports more than it exports,” says Kulkarni. Indeed, OECD data for 2018 showed total exports at US$326bn and imports at US$492bn, an imbalance of US$166bn. “If you’re an exporter and want to be compliant, you need to complete the documentation, but until recently it took months to complete a transaction. The banks also charged hefty fees that reflected the large amount of physical work involved and the rather chaotic process.

“Digitisation makes the job much easier – the documents can be downloaded, sent to the bank and the whole process completed within seconds, which helps merchants considerably.” The achievement was recognised when Payoneer won in the Best Payments and Collections Solution category in The Asset’s Treasury, Trade, SSC and Risk Management Awards 2020.

"India is an FX-thirsty country which imports more than it exports"

Supporting India’s recovery

At the time of writing (July 2020), the Covid-19 pandemic was growing steadily more serious in India, with the number of reported cases exceeded only by the US and Brazil. Covid-19 threatens the Modi government’s target to reach US$5trn GDP by 2024, with an early lockdown pushing the country into recession without arresting the spread of the virus.

Kulkarni says that, as many of Payoneer’s customers already worked from home, they suffered little disruption from the lockdown and in the early stages were able to maintain, or in some cases marginally increase, their business. In the long term, many questions remain. “Freelancers and SMEs will come under pricing pressure. Those with unique skill sets and good customer contacts should continue to do well, but others may find themselves undercut by workers in Bangladesh and other English-speaking regions, who may offer their services more cheaply.”

If a second – or third – wave of the coronavirus proves more muted, India’s long-term prospects are still strong, but the path back to growth could be a lengthy one.

Digital marketplace growth

The Payoneer story, says Choi, is a good example of how Deutsche Bank has not only been a strong banking partner to the fintech, deploying agile payment and FX solutions via the bank’s global network, but is plugged into today’s digital marketplaces.

“As demonstrated by our FIRC solution in India, we will continue to invest in our technologies and digital product offerings globally. We look forward to collaborating with Payoneer further as it expands its digital payment platform and product offerings,” he adds. Based on the company’s growth over its first 15 years, the journey ahead looks set to be an exciting one.

Sources

1 See https://bit.ly/3gE0Tuh at payoneer.com

2 See https://bit.ly/3gE15cZ at payoneer.com

3 See https://bit.ly/3fJHnv8 at globenewswire.com

4 See https://bit.ly/31ED9Qv at payoneer.com

5 See https://bit.ly/30Gj0tS at payoneer.com

6 See The five trillion dollar challenge at flow.db.com

7 See https://bit.ly/3acfGtV at blog.payoneer.com

You might be interested in

CASH MANAGEMENT

Digital treasury accelerates in Asia Digital treasury accelerates in Asia

Treasury digitisation across Asia was gaining traction even before Covid-19 struck, but the pandemic has accelerated the process. A recent Deutsche Bank webinar provided a progress report

CASH MANAGEMENT, TECHNOLOGY

Adding speed to treasury digitisation Adding speed to treasury digitisation

A global pandemic and fast-changing regulation are factors accelerating the digitalisation of treasury ecosystems across Asia, as a recent webinar from The Economist Group and EuroFinance confirmed. flow ’s Graham Buck reports on the main discussion points

Cash management, flow case studies, Technology {icon-book}

Tomorrow’s treasury: what’s the role of real-time? Tomorrow’s treasury: what’s the role of real-time?

The vision of a “real-time treasury” has been around for several years now. But how do instant payments and access to real-time information really change the way treasury is managed? flow’s Desirée Buchholz hosts a debate on the role of real-time in the future of treasury