15 September 2022

With capital and liquidity management engaging boards with increasing interest thanks to the current economic and political climate, it is no surprise that freeing trapped cash is high on the corporate agenda. flow reports on how technology is providing solutions

MINUTES min read

Unlocking ‘trapped’ cash from countries that are subject to capital or currency controls has been a longstanding priority for treasurers to optimise liquidity and manage risk. However, currency volatility, elevated geopolitical risk and the renewed focus on managing liquidity in an uncertain economic environment has made trapped cash a more immediate issue. This is particularly relevant in Asia Pacific given the range and diversity of regulatory constraints that treasurers need to contend with.

“Treasurers want to be ready with a strategy to access funds from restricted or semi-restricted markets”

Integrating restricted markets into a global liquidity strategy

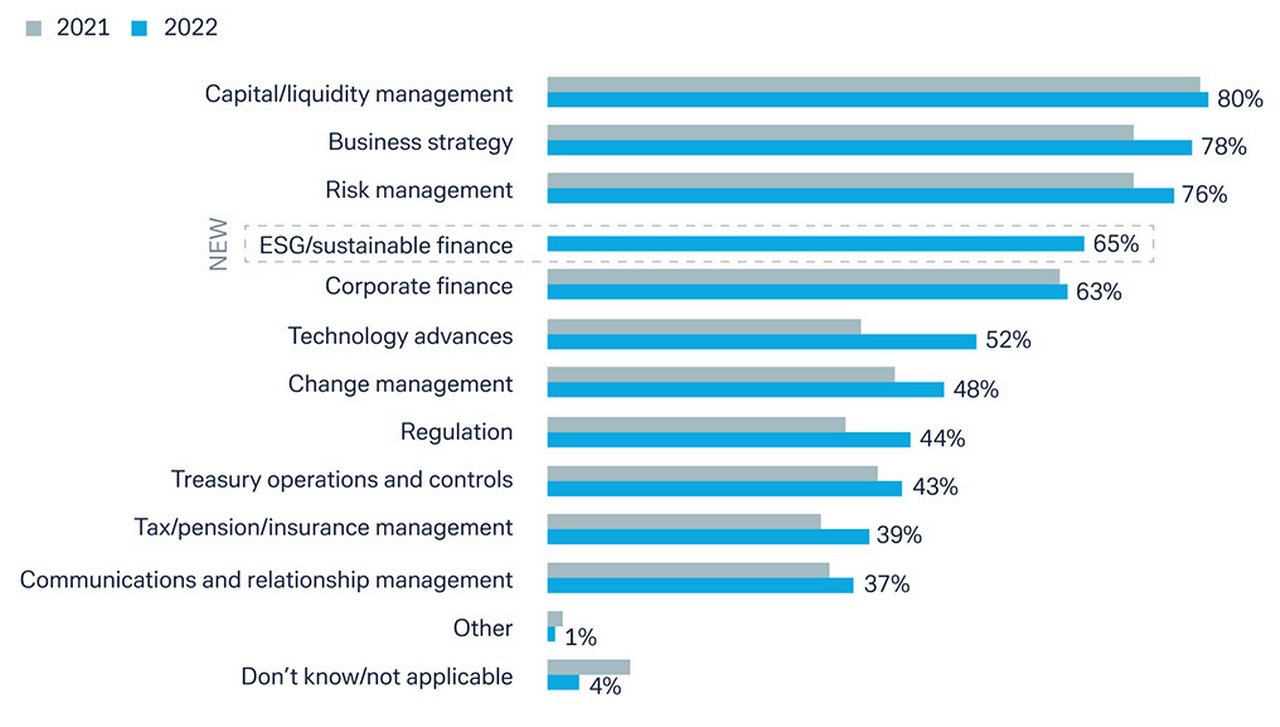

Boards and senior managers of multinational corporations headquartered outside Asia Pacific are asking more questions about the potential to repatriate funds, even if it is not an immediate requirement. As the ACT’s Business of Treasury 20221 illustrates, more than 80% of boards have shown a particular interest in capital and liquidity management over the previous six months. See Figure 1.

Figure 1: Where boards show interest

When asked where boards have shown interest over the past six months, treasurers say capital and liquidity, strategy and risk management

Source: Treasurers on high alert – The business of Treasury published by the Association of Corporate Treasurers

Juliette Yim, Deutsche Bank’s Head of MNC Regional Cash Management Sales, APAC reflects on these findings, “Treasurers want to be ready with a strategy to access funds from restricted or semi-restricted markets, and treasurers are therefore planning their trade payment, funding and liquidity management activities in these markets accordingly.”

How does cash get trapped?

Typically, ‘trapped’ cash refers to funds that cannot easily be transferred cross-border for regulatory or tax reasons. For example, some countries, particularly in emerging markets, restrict the ability for accounts held in country to be included in cross-border cash pools, or companies may be obliged to maintain a certain level of reserves in-country. Lack of currency convertibility, withholding tax and restrictions on share and capital repatriation add further complexity.

When considering how to unlock liquidity, India and China are typically the first priorities given the value of business that many multinationals do in these markets; however, Deutsche Bank’s solutions are also gaining considerable traction in Korea and markets in South-East Asia.

Treasurers have a variety of options to unlock (or avoid) trapped cash, including on behalf of payments and collections and intercompany netting to minimise cash held in country, interest optimisation structures to leverage the value of funds that are otherwise locked, dividends and intercompany loans/transfers. However, these methods are not always available or tax efficient.

Digitising workflows to reduce friction

Despite the difficulties that have plagued treasurers for many years, opportunities to address the trapped cash challenge in Asia Pacific are now increasing. Although the regulatory conditions have remained largely unchanged in many of these markets, regulators and governments have implemented a variety of digital developments to help streamline processes and documentation required to transfer cash cross-border. Chintan Shah, Head of Corporate Coverage, APAC at Deutsche Bank explains, “In India, for example we can now extract data directly from the government website which enables us to provide a more convenient, transparent and efficient solution for clients.”

As a result of digitisation and better information and transparency, banks are building new solutions that make existing methods of unlocking trapped cash faster, more efficient and less resource intensive. For example, Deutsche Bank’s WorkFlow Solutions (WFS2) bring together cross-border payments and collections and associated documentation, funding, FX execution and hedging, liquidity management, and efficient connectivity into a single digital platform.

Chintan Shah notes, “While there are unique nuances in each country, our solution enables us to provide a fully automated solution that harnesses data, rule-based execution, API-based connectivity and automated FX and hedging to create an integrated, end-to-end solution for clients’ cash repatriation needs.”

Clients use WFS in different ways depending on their specific needs and the regulations that apply. Some, for example, use the solution to automate target balancing to minimise onshore liquidity and process payments offshore, and/or automate FX conversion and hedging based on the value of warehoused invoices and account balances. Others aim to reduce their open market risk by aligning onshore cash transfers with offshore hedge execution.

Solution in practice

The solution is already in live operation in countries such as India, Korea, China, Indonesia and Thailand, and delivering value to clients, as Merck’s success in the 2021 Adam Smith Awards Asia3 demonstrates. Working with Deutsche Bank, Merck pioneered the solution to streamline and automate cross-border flows, integrate FX execution and hedging, and cut costs through reduced administration and integration of cross border spot with central FX risk management to eliminate basis risk.4

The majority of Merck’s cross-border flows into and out of India are intercompany payments. These were previously invoiced in USD or EUR, but Merck made the decision to switch to INR (i.e. local currency) invoicing to transfer the FX risk to the company’s headquarters, (which is a trend seen across a range of clients). To keep hedging costs low, Merck implemented an automated payment process including hedge adjustments. WFS supported this process through its rule-based, automated workflow, based on robotic process automation (RPA) together with target balancing linked to open invoices due on a FIFO (first in first out) basis. Rather than producing extensive manual documentation to support these transfers, Deutsche Bank collects customs data digitally from a government repository and proposes the relevant transfers. These are then accepted and the resulting transfers reconciled automatically.

Arno Classen, Senior Manager, Merck Group Treasury told Treasury Today (see note 3), “The journey has accomplished substantial financial savings, the automation of processes and the prevention of fraud. Through cross-functional collaboration and harnessing of new technology, the project transformed our India treasury processes into a state-of-the-art organisation.”

Sharing advice

While companies with long-established operations in restricted or semi-restricted markets are seeking to streamline cross-border transfer of value, newer businesses, particularly digital natives that are expanding into these markets for the first time are approaching Deutsche Bank to find ways to avoid this becoming an issue at all. Shah emphasises, “These companies want deep global network connectivity but without the need to set up legal entities, or even a physical presence at all in new markets.”

The bank is helping these clients through solutions such as on behalf of payment and collection models, and local currency invoicing to achieve a light touch organisational and financial structure, whilst complying with local regulations. Yim concludes, “The right banking partner is essential for both new and established businesses to help create the right organisational, banking and liquidity management structures, and leverage these successfully to unlock liquidity to meet companies’ operational and strategic objectives.”

Note: The EuroFinance Discovery Lab session, ‘Caught in a cash trap’ takes place at 14.00 hours CET in Vienna, Austria, on Thursday 22 September. Panellists are: Darrell Thomas, former VP and Treasurer, Harley Davidson, Inc; Juliette Yim, Head of MNC Regional Cash Management Sales APAC at Deutsche Bank; and Sekar Sundaram, Executive Director and Assistant Treasurer, Parexel

Sources

1 See treasurers.org

2 A video on Deutsche Bank’s WorkFlow solutions can be viewed here

3 See treasurytoday.com

4 See "Boosting treasury in India" at flow.db.com

Cash management solutions Explore more

Find out more about our Cash management solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

Cash management, flow case studies

Boosting treasury in India Boosting treasury in India

German vibrant science and technology company Merck has turned its treasury business in India inside out. Jörg Bermüller tells flow’s Desirée Buchholz how his team reduced FX risks, optimised liquidity and streamlined processes in an award-winning project with Deutsche Bank

Macro and markets, Cash management, Trade finance and lending

Asia – a precarious recovery Asia – a precarious recovery

With the prospect of recession nearing in North America and Europe, what does this mean for Asia’s recovery? Drawing on Deutsche Bank Research insights, flow takes a closer look at how the turbulent global economic climate is slowing growth and how corporates should respond

CASH MANAGEMENT

Treasury priorities in a post-pandemic environment Treasury priorities in a post-pandemic environment

While Covid-19 infection rates are reducing in many parts of the world, the impact on societies, economies and business models will continue. flow shares key points from the latest Economist Impact report, Manoeuvring uncertainty: Treasury priorities in a volatile, post-pandemic market sponsored by Deutsche Bank