7 September 2022

With the prospect of recession nearing in North America and Europe, what does this mean for Asia’s recovery? Drawing on Deutsche Bank Research insights, flow takes a closer look at how the turbulent global economic climate is slowing growth and how corporates should respond

MINUTES min read

“The global backdrop for Asian corporate activity is set to remain challenging, with recession risks on the rise in US and Europe, and China’s growth recovery yet to find a firm footing”

When the first wave of the Covid-19 pandemic spread globally, China’s economy, along with those of several of its neighbours from the Association of South-East Nations (ASEAN), proved more resilient than other leading economies. While countries suffered contractions of varying depth, The IMF recorded China’s GDP growth of 2.3% in 2020 and rising to 7.9% last year.1 In March 2022, Beijing set a more modest growth target for 2022 of 5.5%.2

Not yet on a strong footing

However, the outlook for both China and the ASEAN region generally has clouded over as the year has progressed. In March 2022, China recorded the highest incidence of new Covid-19 outbreaks since the first months of the pandemic and a series of lockdowns were imposed on major cities. The In their report, China market perspectives: A test of stamina in H2, the Deutsche Bank Research team point out that after year-on-year growth of 4.8% for Q1 2022, the pace slowed to just 0.4% y-o-y in Q2 to give a first half growth figure of 2.5%. With a prolonged drought this summer forcing industry shutdowns and the country’s property market increasingly volatile, the 5.5% growth target looks increasingly unobtainable. “The recovery is not yet on strong footings. Consumer sentiment remains weak, especially in the housing market. Additional policy support would be necessary to sustain China's recovery in the second half,” notes the report.

The Q3 Asia Corporate Newsletter (the Newsletter) published by Deutsche Bank Research is subtitled ‘Q3 2022: Hiking into a slowdown’, in which its Asia micro strategist, Mallika Sachdeva, observes that the world’s central banks are likely to continue their policy tightening of recent months as they prioritise tackling resurgent inflation over economic growth. “Asian central banks have tightened much less than the Federal Reserve and other emerging market (EM) regions thus far, but currency pressures could force aggressive front-loading in the coming months,” she reflected.

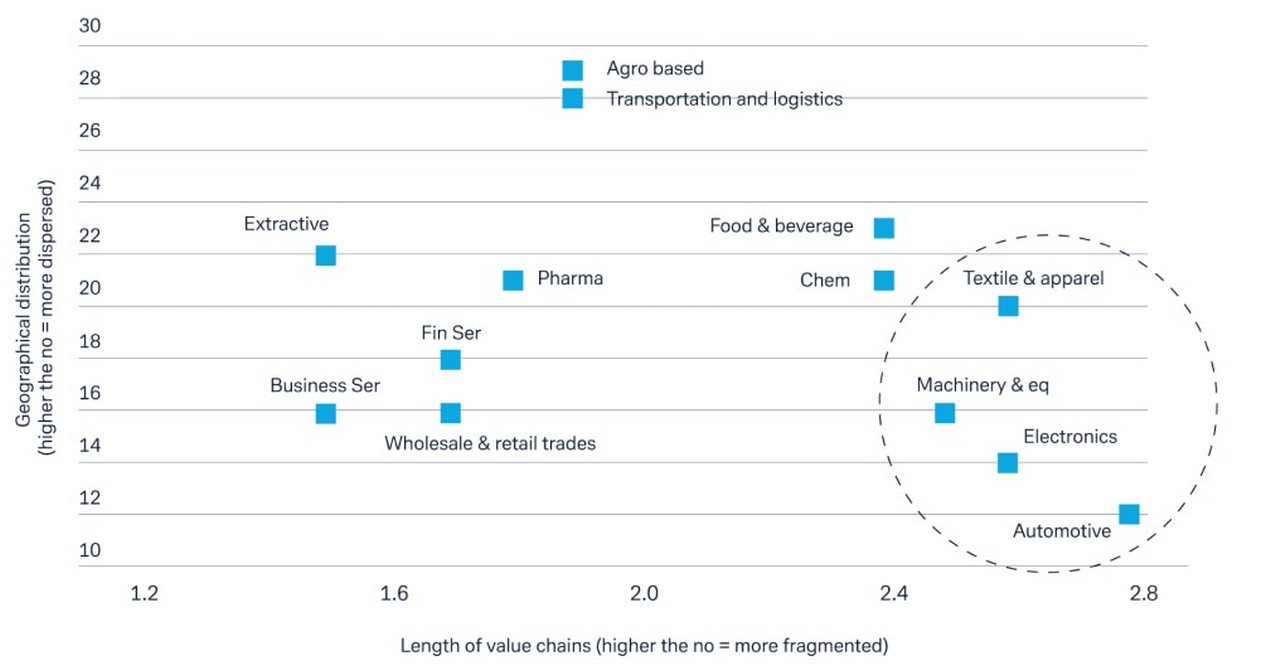

Looking further ahead, trade tensions between China and the US that pre-date the pandemic have not dissipated. The shift in US-China relations over the past five years have been followed by the twin shocks of the pandemic and the Russia-Ukraine conflict, each of these exposing the vulnerabilities of globalised supply chains.

“Corporates are re-examining their reliance on concentrated manufacturing bases and distant suppliers, and considering different options such as onshoring, dual sourcing, and regionalisation,” says Sachdeva. This means a continuing diversification in manufacturing away from China, with the ASEAN region likely to be the primary beneficiary of the trend.

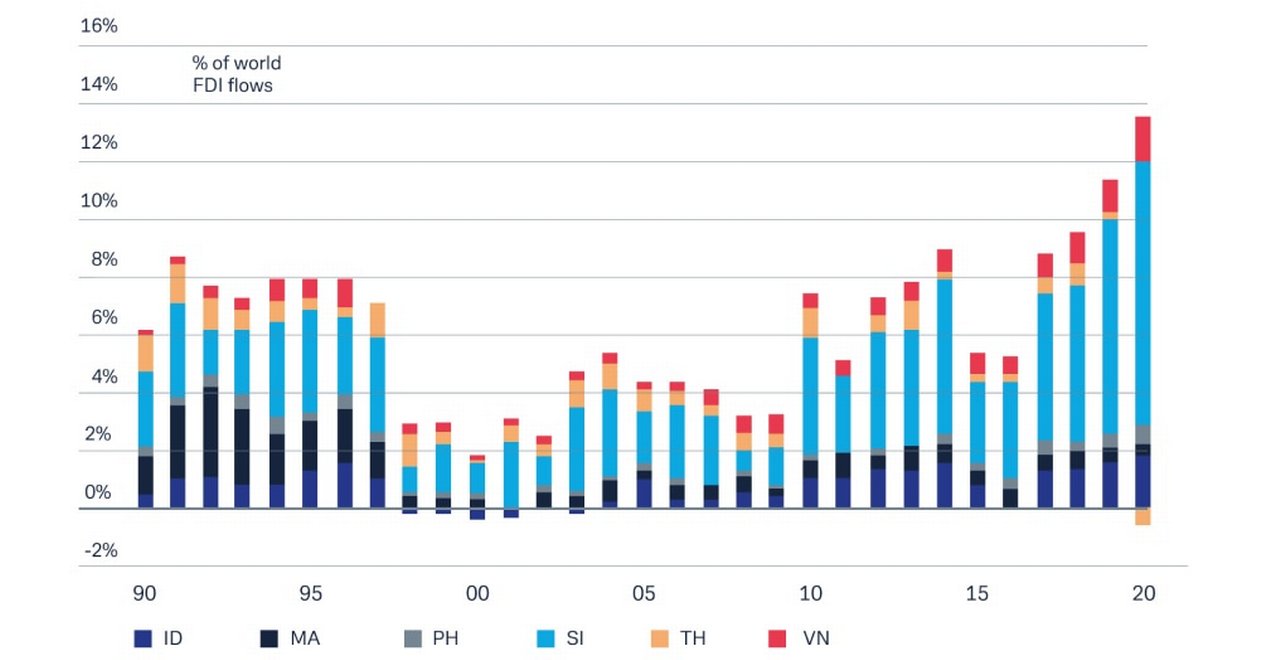

ASEAN’s share of global exports has already been rising, while foreign direct investment (FDI) flows to the region, which rose by 30% over five years, should resume their climb post-Covid towards the all-time peak of US$182bn reached in 2019. The Newsletter singles out four countries as those best placed to benefit:

- Vietnam in electronics;

- Thailand and Indonesia in electric vehicles (EVs); and

- Singapore in semiconductors.

Figure 1: Four sectors likely to see the most reconfiguration – and ASEAN will benefit from the shift

Source: Deutsche Bank

Figure 2: FDI flows into ASEAN now make up 13% of total FDI inflows and are likely to continue to rise

Source: Deutsche Bank

The resulting benefit to trade surpluses as production and exports pick up should, in turn, see their currencies appreciate and see policymakers become more comfortable with FX flexibility if a greater degree of volatility also results.

“Corporates should adopt more proactive hedging policies in ASEAN FX and could consider using recent currency weakness to position for medium-term strength via long-dated hedges for anticipated investments,” comments Sachdeva.

Supply chain spillovers from the crisis

The conflict in Ukraine and ensuing financial sanctions imposed on Russia have caused supply chain disruptions globally and is likely to see Asian countries realigning their trade and investment corridors. The Newsletter singles out the following three to watch:

- The Korea-Gulf trade corridor: As Europe’s appetite for Russian gas shrinks and global demand for cleaner fuel increases countries such as Korea, which increasingly depend on liquified natural gas (LNG), will look to secure future supply from the Middle East. Rising LNG demand globally will also benefit Korean shipbuilding and impact on both Korean won (KRW) spot and the longer-dated forwards/carbon capture and storage (CCS) market

- ASEAN and Australia food trade corridor: Rising food prices due to the Ukraine conflict have motivated Asian governments to ensure more reliable supply of wheat and other items. Australia could be a preferred partner given its proximity to ASEAN as well as the November 2020 Regional Comprehensive Economic Partnership (RCEP) which should result in tariff reductions over time, making Australian products cheaper

- North Asian mineral investments in Indonesia: As the global shift towards clean energy and drive to regionalise supply chains accelerate, North Asian corporates as the biggest EV battery makers will look to secure critical metals supplies from Indonesia which has the world’s largest reserve of nickel. Investment flows to Indonesia are already rising with 75% coming from Asian countries

Mobility trends in China

Deutsche Bank Research’s ‘China Mobility Monitor’, a data set gauging movement across the country, suggests that domestic mobility has recovered rapidly after Shanghai emerged from two months of anti-Covid lockdowns at the end of May. Cities accounting for 86% of GDP are now in “normal mobility” mode. Earlier findings indicate that every 1% rise in mobility corresponds to a 0.4% increase in retail sales growth rate. This suggests that China’s consumption and services sectors should be supported if domestic mobility stays at its current levels or inches higher.

However, China’s cross-border mobility is still subdued with passenger volume below 2% of pre-Covid levels. A World Trade Organisation (WTO) study3 concludes that sealed borders heavily limit services trade, which needs physical proximity between producers and consumers. Even intra-company cross-border collaboration could become less efficient if the current situation lasts, suggests a Working From Home (WFH) study published by Deloitte.4

The picture could change more radically, reflects the Newsletter, in the event of:

- A shift in China’s Covid policy;

- A ‘significant’ increase in vaccination rates, especially for the elderly;

- The approval of new mRNA vaccines; and/or

- Greater general public willingness for “living with Covid” as is happening in many other countries.

Three recommendations for corporates

With central banks continued prioritisation of elevated inflation and the US dollar’s climb against other currencies looking set to continue as the Fed tightens further, the Newsletter recommends that this autumn corporates focus on three main areas in Asia:

- Manage USD hedges more actively, balancing declining hedging costs with longer-term valuation signals;

- Explore cheaper local currency financing options, and local rates hedges; and

- Identify higher-return asset options for their excess USD deposits.

While the short-term picture is once of uncertainty, the Newsletter still forecasts that Asian growth will slow only to 4.4% in 2022 before rebounding to 5.2% in 2023. The slowdown is driven by the “deceleration across the US, Europe and China which will impact export-sensitive economies”. In addition, it says that Asian central banks “will continue hiking rates, with the risk of earlier, more front-loaded and aggressive hikes, particularly in South Asia.

Deutsche Bank Research report referenced:

Asia Corporate Newsletter Q3 2022: Hiking into a slowdown by Mallika Sachdeva, Sameer Goel, Linan Liu, Perry Kojodjojo and Bryant Xu (July 2022)

China market perspectives: A test of stamina in H2 by Linan Lu, Yi Xiong, Perry Kojodjojo, and Lucia Kwong (20 July 2022)

Corporate Bank solutions Explore more

Find out more about our Corporate Bank solutions

solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

MACRO AND MARKETS {icon-book}

The road from Shanghai The road from Shanghai

Over the past 44 years, China has emerged as a global economic superpower. flow’s Clarissa Dann explores its growth trajectory, and reflects on how Deutsche Bank’s own history in the region has come of age in corporate banking

CASH MANAGEMENT

Treasury priorities in a post-pandemic environment Treasury priorities in a post-pandemic environment

While Covid-19 infection rates are reducing in many parts of the world, the impact on societies, economies and business models will continue. flow shares key points from the latest Economist Impact report, Manoeuvring uncertainty: Treasury priorities in a volatile, post-pandemic market sponsored by Deutsche Bank

Corporate Bank solutions

Deutsche Bank Research launches new Asia Corporate newsletter from Q3 2022 Deutsche Bank Research launches new Asia Corporate newsletter from Q3 2022

With the global backdrop for Asian corporate activity remaining challenging – recession risks on the rise in the US and Europe, and China’s growth recovery not yet on a firm footing – information help is at hand