CASH MANAGEMENT

Cash Management, Regulation

One giant step to payments innovation? (Part 1) One giant step to payments innovation? (Part 1)

At Sibos 2025 Frankfurt, two clear themes for the payments industry emerged: the need to refresh its foundations and accelerate innovation. In the first of two wrap-ups, flow reports on sessions discussing the balance between a safe financial system and friction-free payments

Cash management, Technology

One giant step to payments innovation? (Part 2) One giant step to payments innovation? (Part 2)

In the second of two Sibos 2025 payments wrap-ups, flow reports on sessions discussing how technological advances – from stablecoins and autonomous payments to artificial intelligence (AI) – are powering tomorrow’s payments innovation

Cash management, Technology

How fintechs are reshaping payments: lessons for corporate treasury How fintechs are reshaping payments: lessons for corporate treasury

As real-time payments, APIs, and digital assets transform how money moves, corporates have to keep up. Reporting from EuroFinance 2025, flow explores how fintech companies SumUp and Bitpanda demonstrate treasury’s power as both enabler and catalyst of this transformation

Cash management, Macro and markets {icon-book}

Navigating geopolitical risks in treasury Navigating geopolitical risks in treasury

With the geopolitical environment getting rougher and corporates rethinking their supply chains, cash visibility and control are more important than ever. flow’s Desirée Buchholz hosts a debate on how uncertainty is impacting liquidity, funding and FX

Cash management

How the EU Instant Payment Regulation impacts corporate treasurers How the EU Instant Payment Regulation impacts corporate treasurers

Following the introduction of the EU Instant Payment Regulation, the volume of real-time payments is increasing. For corporate treasurers this means that they need to review liquidity management, account statement processing, and fraud prevention. But instant payments also create new opportunities, explains Deutsche Bank’s Christof Hofmann

Cash management, Regulation

Trish Sullivan for the people Trish Sullivan for the people

As a former prosecutor, ‘Patricia Sullivan, for the people’ (the standard introduction for prosecutors in US courts) worked on behalf of society bringing cases against violent criminals. A career of fighting financial crime in government and commercial banking roles followed. With global payments set to reach US$250trn by 2027, communities need the lifeblood of liquidity more than ever. She talks to flow’s Clarissa Dann about how proactive institutional cash management can deliver this safely

Cash management

Client focus is a team sport Client focus is a team sport

flow talks to Deutsche Bank’s Global Head of Cash Management and Head of Corporate Bank APAC & MEA, Ole Matthiessen, about his journey from professional football academy to banking, and how team sports influenced his approach to client solutions. We also hear about his vision for the dbX strategic framework, and its potential to transform treasury solutions

Cash management, Technology

Made in Europe: managing payment risk in a fragmented world Made in Europe: managing payment risk in a fragmented world

Maintaining control over national payments infrastructure is part of Europe’s wider strategy to improve security, ease of doing business and competitiveness. Treasury writer Helen Boyd takes a closer look at the bloc’s recent implementations

Cash management, Technology

CBDCs: where do we stand in Europe? CBDCs: where do we stand in Europe?

The European Central Bank (ECB) is moving ahead both with a retail CBDC (the digital euro project) and new ways to settle blockchain-based transactions in central bank money. In a webinar hosted by Deutsche Bank Research, Jürgen Schaaf, Adviser for Market Infrastructure and Payments at the ECB, talks about timelines, goals and the role of banks in the new ecosystem

Cash management, Trade finance and lending

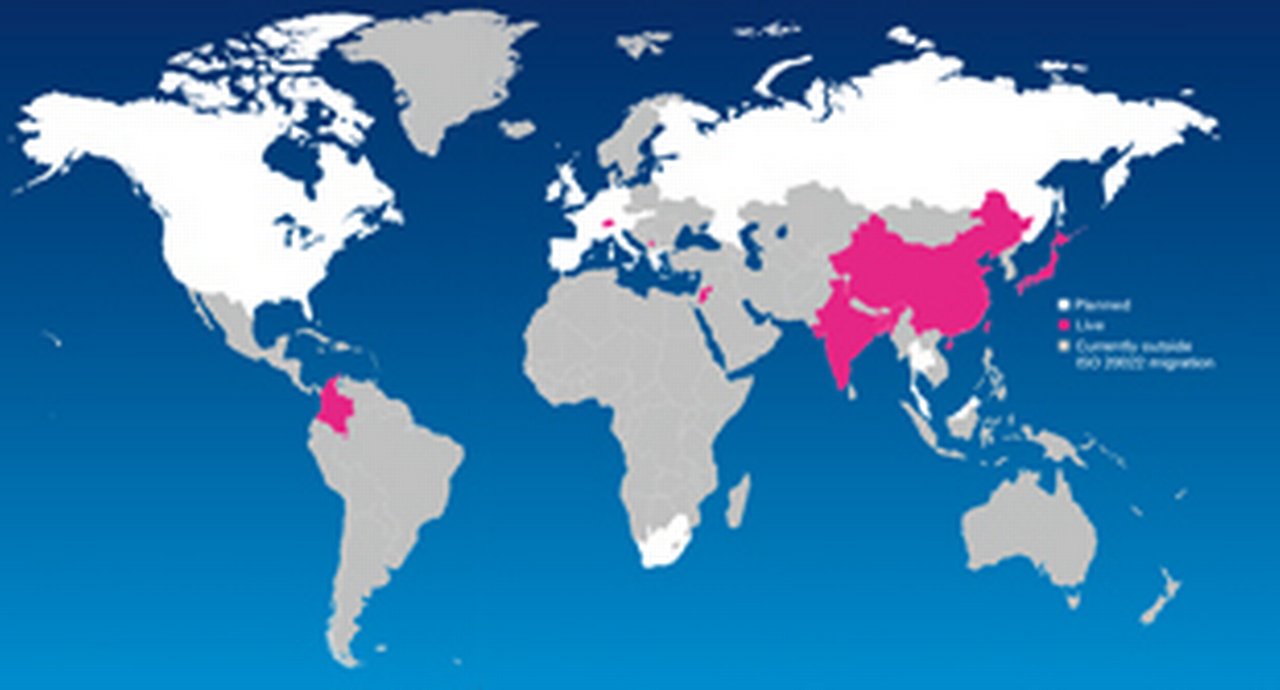

Embracing ISO 20022 for a connected future Embracing ISO 20022 for a connected future

ISO 20022 has the potential to deliver the rich data needed to unlock trapped liquidity, finance trade that could not previously be reached, and deliver huge operational efficiencies. But what is holding back full adoption and how can the Swift community work together to accelerate it? flow’s Clarissa Dann shares answers from the Sibos 2024 Big Issue Debate on Day Three

Cash management, Technology {icon-book}

ECB’s Ulrich Bindseil on the G20 roadmap in action ECB’s Ulrich Bindseil on the G20 roadmap in action

Cross-border payments need to become faster, cheaper, more transparent, and accessible – that’s the homework G20 leaders have given to the financial sector in 2020. Ulrich Bindseil, Director General for Market Infrastructures and Payments at the European Central Bank (ECB), describes collaboration between the private and public actors for achieving these targets – and the scope for further progress

Cash management, Technology, Securities services

Wholesale CBDC projects to follow Wholesale CBDC projects to follow

The digitisation of money is quickly evolving – with central banks now shifting their focus from retail to wholesale applications, as seen in recent initiatives by the Swiss National Bank, the European Central Bank (ECB), and the Bank of International Settlements (BIS). flow’s Desirée Buchholz summarises findings from Deutsche Bank’s Marion Laboure and Manuel Klein

Cash management, Opinion

What’s next for correspondent banking? What’s next for correspondent banking?

Correspondent banking is the backbone of cross-border transactions, but the sector faces pressure from an adverse and evolving risk environment as well as shrinking networks. Deutsche Bank’s Matthew Probershteyn and Vanessa Meister explore how reframing the model around access, resilience and innovation can future proof its longevity

Cash management, Trade finance and lending, Macro and markets

GCC: four trends corporate treasurers should be aware of GCC: four trends corporate treasurers should be aware of

Digital transformation and infrastructure investment are top priorities in the Middle East as the region diversifies away from oil and gas. How does this impact the corporate treasury teams of companies operating in the region? flow’s Desirée Buchholz reports and shares two client examples from the Asia-Middle East corridor

Cash management

Sibos 2024: piecing together the payments puzzle Sibos 2024: piecing together the payments puzzle

Sibos descended on Beijing for the first time this year, arriving with some of the biggest payment topics in tow – from the G20 Roadmap and ISO 20022 to AI and digital wallets. flow explores the latest developments shaping the future of payments

Cash management, Technology {icon-book}

How technology is taking treasury into the boardroom How technology is taking treasury into the boardroom

Corporate treasurers will have to embrace innovative technology to meet new challenges facing their departments and rising expectations from the C-suite. Dr Tobias Miarka draws on Crisil Coalition Greenwich research to explain the practical implications

CASH MANAGEMENT, TECHNOLOGY

EBAday 2024: five topics shaping the future of payments EBAday 2024: five topics shaping the future of payments

Instant payments adoption, digital currencies, correspondent banking consolidation and rising fraud – the payment industry is not short of innovation and challenges. The flow team explores some of the highlights of EBAday 2024 in Lisbon

Cash management, Technology {icon-book}

Automation should come first, AI will follow Automation should come first, AI will follow

Treasurers will benefit from AI, but there are many issues to be fixed before thinking about using this technology, François Masquelier, Chair of the European Association of Corporate Treasurers (EACT) believes. What should intermediary steps look like?

Cash management, flow case studies, Dossier ASEAN {icon-book}

Bridging growth into APAC Bridging growth into APAC

Asia-Pacific remains a top investment destination for European companies. flow’s Desirée Buchholz reports on how the treasury departments of Germany’s HELM and Rehau have big ambitions for the region – and how Deutsche Bank’s Global Hausbank strategy is supporting the growth ambitions of these two ‘Mittelstand firms

CASH MANAGEMENT

In-house banks: a remedy for tough times? In-house banks: a remedy for tough times?

In-house banks (IHBs) come in many different forms. What are the benefits of streamlining corporate treasury operations under one roof? And how does it work in practice? flow reports on an Economist Impact webinar, where three corporate treasurers shared the structure and rationale of their IHB set-up.

CASH MANAGEMENT, TECHNOLOGY

Blockchain-based money from the private sector – an overview Blockchain-based money from the private sector – an overview

What are the differences between stablecoins, tokenised deposits and deposit tokens? Which projects are the most relevant to follow and why? Deutsche Bank’s Manuel Klein shares his thoughts

CASH MANAGEMENT

The power of in-house banking The power of in-house banking

In the face of very challenging macro-economic developments, the need for an automated treasury function is more urgent than ever. How can in-house banks contribute to this goal and increase efficiency, improve headquarter control and lower costs? flow shares three key takeaways from EuroFinance 2023

CASH MANAGEMENT

Why treasurers should consider alternative investments Why treasurers should consider alternative investments

Rising interest rates, resurgent inflation and turbulence in the banking industry mean that liquidity management remains a challenge for corporate treasurers. Is it time for a new approach? flow’s Desirée Buchholz examines the potential of alternative investments

CASH MANAGEMENT

Payments systems in the digital economy Payments systems in the digital economy

David Watson from of The Clearing House reflects on how payments systems are meeting demands from businesses and consumers alike for increased speed and efficiency as the digital economy demands a state-of-the-art payments infrastructure

CASH MANAGEMENT, MACRO AND MARKETS, SECURITIES SERVICES

Digital currencies: the ultimate soft power? Digital currencies: the ultimate soft power?

Central bank digital currencies (CBDCs) are the vehicle for central banks worldwide to develop their own digital payment alternatives. Not only are emerging market economies ahead of developed ones in launching them but CBDCs are also emerging as a soft power tool at a time of geopolitical volatility. flow’s Clarissa Dann provides a summary of a recent Deutsche Bank Research report

Cash management {icon-book}

Siemens and Deutsche Bank co-create a virtual account structure with a difference Siemens and Deutsche Bank co-create a virtual account structure with a difference

The roll out of a virtual account structure for a large corporate client has many advantages, especially when the solution adopted has the extra twist that Siemens and Deutsche Bank have just successfully applied. In an article first published by TMI, Heiko Nix of Siemens and Christof Hofmann of Deutsche Bank talk to TMI Deputy Editor Tom Alford

CASH MANAGEMENT

Treasury management in the new economy Treasury management in the new economy

With the evolution towards borderless business, effective treasury management that takes advantage of enhanced digital capabilities is imperative for new economy companies to address their growth prospects, explains Deutsche Bank’s Kriti Jain

CASH MANAGEMENT

Getting flexible: Treasury’s response to deglobalisation Getting flexible: Treasury’s response to deglobalisation

In an interview with Treasury Management International (TMI), Deutsche Bank’s Christof Hofmann talks to TMI’s Tom Alford about the implications for treasurers of the findings from a recent Economist Impact survey. flow shares the article first published by TMI

CASH MANAGEMENT, TECHNOLOGY

Bridges into the blockchain world Bridges into the blockchain world

More and more companies are testing blockchain applications to automate processes. This is changing the requirements for payment transactions. Treasurers should be aware of the options, says Deutsche Bank’s Christof Hofmann

CASH MANAGEMENT, TECHNOLOGY

Six key takeaways from EBAday 2022 Six key takeaways from EBAday 2022

How will digital currencies, real-time payments and SWIFT initiatives shape the future of payments? The flow team attended EBAday 2022 to bring you its top six highlights – including a wake-up call for an upcoming regulation

CASH MANAGEMENT, TECHNOLOGY

Keeping the SWIFT network secure Keeping the SWIFT network secure

As the number of cyber attacks on financial institutions increases, SWIFT needs to further safeguard its network. flow’s Desirée Buchholz reports on why the Customer Security Programme is key – and how banks should prepare for the upcoming changes in 2022

CASH MANAGEMENT, MACRO AND MARKETS

How sanctions against Russia affect payments and FX How sanctions against Russia affect payments and FX

The United States and the European Union are restricting the use of SWIFT’s payments service for Russia’s banks and freeze the country’s central bank reserves. What will that mean for payments and the FX markets? flow's Desirée Buchholz draws on latest Deutsche Bank Research to summarise the current situation

CASH MANAGEMENT, TECHNOLOGY

Cross-border payments – Incumbents and disruptors Cross-border payments – Incumbents and disruptors

As cross-border payment volumes and values increase, new market entrants are competing but also cooperating with banks to remove friction and improve transparency. How is this benefiting the end customer? flow reports from the recent BAFT 2022 Bank to Bank Forum

Cash management, Regulation {icon-book}

An ecosystem approach to limit de-risking An ecosystem approach to limit de-risking

While important progress is being made worldwide on financial inclusion, de-risking may act as a brake on that progress. Joy Macknight explores what can be done to address banks terminating or restricting activities with clients

Cash management

Realising a market-led open finance ecosystem in Europe Realising a market-led open finance ecosystem in Europe

As preparations for several pan-European payment schemes ramp up, what are the opportunities they offer for merchants and customers? And how can the remaining challenges be overcome to deliver an open finance ecosystem for the future? flow shares an article from Deutsche Bank’s Tino Meissner, first published in the global payments newswire The Paypers

CASH MANAGEMENT, MACRO AND MARKETS

Cash: a dinosaur with longevity? Cash: a dinosaur with longevity?

While the demise of banknotes and coins has long been predicted and the pandemic accelerated the decline, Deutsche Bank Research analysts Marion Laboure and Cassidy Ainsworth-Grace contend in their latest research report that news of the death of cash is greatly exaggerated

CASH MANAGEMENT, TECHNOLOGY

Capturing the e-commerce opportunity in Asia Capturing the e-commerce opportunity in Asia

Merchant solutions are a gamechanger for companies looking to expand their online presence. In an interview with The Asset, Deutsche Bank’s Oliver von-Quadt talks about this means for treasurers in Asia

CASH MANAGEMENT, MACRO AND MARKETS

What do geopolitical challenges mean for treasury? What do geopolitical challenges mean for treasury?

As the geopolitical environment shifts, corporates are becoming more vigilant about supply chains and investments in emerging markets. What does this mean for corporate treasurers’ risk management? flow’s Desirée Buchholz outlines the impact on liquidity, funding and FX

CASH MANAGEMENT, MACRO AND MARKETS

Japan joins the journey to a cashless society Japan joins the journey to a cashless society

Japan might be a relative latecomer to journey towards a cashless society, but it has made swift progress in just five years, as a Deutsche Bank Research paper reports

CASH MANAGEMENT, MACRO AND MARKETS

Cash – the long goodbye? Cash – the long goodbye?

Slower economic growth and rising interest rates have accelerated transition from cash to digital payments. flow reviews the latest recent Deutsche Bank Research report on the future of payments along with the move to digital wallets and IDs

CASH MANAGEMENT, TECHNOLOGY

APIs and the reality of real time APIs and the reality of real time

The vision of the real-time treasury has been on the horizon for years, but today the opportunities – and genuine use cases to meet treasurers’ day-to-day objectives – are manifest. As Helen Sanders reports, the challenge is not the technology, but the shift in mindset and enterprise prioritisation that is required

CASH MANAGEMENT, SUSTAINABLE FINANCE {icon-book}

Are treasurers’ investment priorities shifting as interest rates rise? Are treasurers’ investment priorities shifting as interest rates rise?

With interest rates at their highest level in 14 years and an inflation rate not seen for 40 years, treasurers face a situation that few have witnessed during their careers. Helen Sanders reflects on what this means for treasurers’ short-term investment strategies

Are treasurers’ investment priorities shifting as interest rates rise? MoreCASH MANAGEMENT, MACRO AND MARKETS

Treasury in transition: Reflections on EuroFinance 2022 Treasury in transition: Reflections on EuroFinance 2022

As delegates reconvened in person at EuroFinance 2022 in Vienna following a two-year pandemic-related hiatus, the event’s key themes were treasury readiness to navigate a choppy external environment and harnessing digital developments to improve efficiency, reach and transparency. flow shares reflections from Deutsche Bank participants

CASH MANAGEMENT

Treasury priorities in a post-pandemic environment Treasury priorities in a post-pandemic environment

While Covid-19 infection rates are reducing in many parts of the world, the impact on societies, economies and business models will continue. flow shares key points from the latest Economist Impact report, Manoeuvring uncertainty: Treasury priorities in a volatile, post-pandemic market sponsored by Deutsche Bank

CASH MANAGEMENT, TECHNOLOGY

How new tech and CBDCs can simplify payments How new tech and CBDCs can simplify payments

Managing cross-border payments and cash in Asia-Pacific presents its own specific challenges. How can CBDCs and AI help to remove frictions? flow summarises the four key learning points from a recent Economist Impact webinar supported by Deutsche Bank

Cash management, Technology

E-commerce: separating real growth from glitz E-commerce: separating real growth from glitz

The pandemic has accelerated the rise of e-commerce sales and the potential for further growth is immense for companies ready to be innovative. flow reports on the third publications from Deutsche Bank Research’s series on the future of payments, which distils the realistic options from the hype

E-commerce: separating real growth from glitz MoreCash management, Regulation

Who is your counterparty? Who is your counterparty?

Eliminating duplicative activities is essential for financial institutions seeking to provide added value to clients during the performance of underlying client checks. flow takes a closer look at how the Global Legal Entity Identifier Foundation has come up with a neat solution to address this

CASH MANAGEMENT, TECHNOLOGY

How to prevent payments fraud How to prevent payments fraud

With payments fraud on the rise, how can treasury departments prepare the best line of defence against would-be fraudsters? flow reports on a recent EuroFinance webinar that explored new fraud patterns and how these risks are being addressed

CASH MANAGEMENT, TECHNOLOGY {icon-book}

Going the distance with Swift Go Going the distance with Swift Go

The launch of Swift Go in early 2021 was billed as another milestone for the cross-border payments space. A couple of years on, how has the story developed? flow investigates

Cash management, flow case studies, Technology {icon-book}

Tomorrow’s treasury: what’s the role of real-time? Tomorrow’s treasury: what’s the role of real-time?

The vision of a “real-time treasury” has been around for several years now. But how do instant payments and access to real-time information really change the way treasury is managed? flow’s Desirée Buchholz hosts a debate on the role of real-time in the future of treasury

CASH MANAGEMENT {icon-book}

G20 Roadmap: moving from guidance to action G20 Roadmap: moving from guidance to action

As expectations grow for faster and cheaper cross-border payments, banks and corporates have their work cut out to meet demand. Deutsche Bank’s Marc Recker looks at how the G20 Roadmap contributes to these goals – and what its shortcomings are

CASH MANAGEMENT, TECHNOLOGY

Cross-border payments: Where are we on the G20 roadmap? Cross-border payments: Where are we on the G20 roadmap?

In November 2020, the G20 leaders endorsed a roadmap to make cross-border payments cheaper, faster, more transparent, and accessible by 2027. What has been achieved so far? At mid-term, flow’s Desirée Buchholz shares five key takeaways from the BAFT Europe Bank to Bank Forum in Frankfurt

CASH MANAGEMENT, TECHNOLOGY

CBDCs in Europe: retail and wholesale projects to follow CBDCs in Europe: retail and wholesale projects to follow

The European Central Bank (ECB) has decided to continue its retail CBDC project and began its preparations on 1 November 2023. What does this decision mean for the digital money landscape in Europe? And what are the latest developments with respect to wholesale CBDCs? Deutsche Bank’s Manuel Klein shares some insights

CASH MANAGEMENT, TECHNOLOGY {icon-book}

Fraud and friction – how payment pre-validation can help Fraud and friction – how payment pre-validation can help

Frictionless payments and fraud prevention remain top of mind for corporate treasurers. flow’s Desirée Buchholz and Clarissa Dann explore how account pre-validation is being used to drive efficiencies – and why these services are a pre-requisite for real-time treasury

CASH MANAGEMENT {icon-book}

Getting ISO 20022 over the line Getting ISO 20022 over the line

The ISO 20022 migration weekend of 18–19 March came and went with minimal disruption for clients. Behind the scenes, however, a major internal project was in progress. flow reports on how Deutsche Bank tackled the Herculean task, and the lessons learnt along the way

CASH MANAGEMENT {icon-book}

flow debate: what treasurers really want from their banks flow debate: what treasurers really want from their banks

What do corporate treasurers want from their banks? Apart from the obvious of everything working on time every time, and a trusted partner in good times and tough – the relationship needs to be dynamic and enterprise-wide. Treasury consultant Kate Pohl hosts a flow discussion to find out more

CASH MANAGEMENT

Power of the pyramid in managing treasury risk Power of the pyramid in managing treasury risk

In the current volatile economic and political environment, treasurers are under pressure to adapt their operations in accommodating the unexpected. flow shares insights from an Economist Impact webinar featuring the “reverse pyramid” approach to treasury from food manufacturer Kraft Heinz

CASH MANAGEMENT, TECHNOLOGY

From Open Banking to Open Finance From Open Banking to Open Finance

The arrival of the Revised Payment Service Directive (PSD2) changed the face of European payments, but how far has this taken Open Banking? flow shares an article from Deutsche Bank’s Tino Meissner, first published in the global payments newswire The PayPers

CASH MANAGEMENT

Setting free the cash Setting free the cash

With capital and liquidity management engaging boards with increasing interest thanks to the current economic and political climate, it is no surprise that freeing trapped cash is high on the corporate agenda. flow reports on how technology is providing solutions

CASH MANAGEMENT, TECHNOLOGY

Building a data-driven treasury Building a data-driven treasury

Data is at the heart of treasury decision-making and process automation, so treasurers need to be assured that the data they are using is timely, accurate and complete. This is less than straightforward. flow reports on insights from the recent Global Treasury Leaders Programme webinar, Building a Data-Driven Treasury organised by Economist Impact

CASH MANAGEMENT {icon-book}

Ushering in the ISO 20022 era Ushering in the ISO 20022 era

The migration of ISO 20022 promises to upend payments as we know them. flow looks beyond the upcoming deadlines to explore the long-term vision for the payments standard and the challenges that lie ahead for the industry

CASH MANAGEMENT, MACRO AND MARKETS

CBDCs: what’s not to love? CBDCs: what’s not to love?

As Jamaica prepares to launch its own central bank digital currency and China’s digital yuan is fast gaining traction, Deutsche Bank Research’s recent white paper on the future of cash offers a progress report on CBDC launches and initiatives. flow shares its core findings

CASH MANAGEMENT, TECHNOLOGY

SWIFT Go: Low value payments rethought SWIFT Go: Low value payments rethought

The launch of SWIFT Go is a milestone for the cross-border payments space. As the story continues to develop, flow explores how the industry is driving the initiative forward – and how companies could benefit

CASH MANAGEMENT

Treasurer’s checklist: How to improve cash management in five steps Treasurer’s checklist: How to improve cash management in five steps

Best practice is something every treasurer strives for but getting there is a tough task. Drawing on the results of a benchmark review among 200 corporate treasurers globally, flow outlines five steps that will help to improve cash management

CASH MANAGEMENT

CGI-MP: next level ISO 20022 for corporates CGI-MP: next level ISO 20022 for corporates

The harmonisation of ISO 20022 corporate-to-bank messages for cash management dates back to 2009. Now is the chance to make a step forward, three industry experts argue in an article first published in TMI

Cash management, Technology, Securities services

Three key fintech trends in Europe Three key fintech trends in Europe

Fintechs are revolutionising how consumers pay and invest. While North America and Asia-Pacific are traditionally the largest fintech markets, Europe is catching up. flow’s Desirée Buchholz reviews three key fintech themes in Europe and how they are enabled by the banking sector

Cash management {icon-book}

How treasury can support B2B marketplaces How treasury can support B2B marketplaces

B2B marketplace sales are growing quickly, and so is the number of companies implementing platform-based business models. How can treasury support marketplace success and ensure efficient cash management? A new white paper by TMI and Deutsche Bank provides answers

CASH MANAGEMENT, MACRO AND MARKETS

Three key FX hedging themes for corporates Three key FX hedging themes for corporates

How is uncertainty impacting corporate FX hedging decisions and what will be the key market drivers in 2024? flow reports on a new Deutsche Bank Research report examining the importance of the cross-currency basis, the case for hedging emerging market FX risk and the role of the dollar as a reserve currency

CASH MANAGEMENT

Three key facts on managing liquidity in restricted markets Three key facts on managing liquidity in restricted markets

As geopolitical uncertainties increase risk for businesses around the world, how are corporate treasurers concentrating their cash and managing risk in restricted markets? flow reports on three major talking points from an Economist webinar supported by Deutsche Bank

CASH MANAGEMENT

Sibos 2023: six key payments takeaways Sibos 2023: six key payments takeaways

Sibos returned to the Metro Toronto Convention Centre (MTCC) for 2023, with instant treasury, ISO 20022, interoperability and AI high on the agenda. In one of four post-Sibos reports, flow’s Clarissa Dann explores the conference’s key payment themes.

CASH MANAGEMENT

Managing liquidity in a changing environment Managing liquidity in a changing environment

As interest rates rise to levels not seen since the global financial crisis, returns on cash have also improved. But geopolitical uncertainty and the failure of several major banks put the onus on treasury to plan and manage liquidity. flow reports on a recent Economist Impact webinar where panellists discussed best liquidity management practice

CASH MANAGEMENT

Seven key takeaways from EBAday 2023 Seven key takeaways from EBAday 2023

What are the biggest challenges facing transaction banking? What is the status of both retail and wholesale central bank digital currencies? Can correspondent banking survive the ongoing payment revolution? The flow team attended EBAday 2023 to bring you the top seven highlights

CASH MANAGEMENT

Has cash flow forecasting become obsolete? Has cash flow forecasting become obsolete?

At a time when crises and ‘unprecedented events’ seem to have become the norm, Helen Sanders assesses the value of cash flow forecasting when the future is impossible to predict, and considers what the alternative might be

CASH MANAGEMENT

ISO 20022: to March and beyond ISO 20022: to March and beyond

The upcoming implementation of ISO 20022 in the high value payments (HVP) space is set to unlock a host of benefits for the cross-border payments industry – from improved compliance processes to the creation of innovative products and services. Deutsche Bank’s Joey Han explores how preparations are ramping up – and what we should expect as we transition into the ISO 20022 era

CASH MANAGEMENT

Sibos – unwrapped (Part 1) Sibos – unwrapped (Part 1)

Sibos Amsterdam 2022 returned to an in-person event at the RAI Convention Centre against the backdrop of rising inflation, energy security worries and increased levels of financial crime. In the first of three post-Sibos reports, flow’s Clarissa Dann takes a deep dive into post-pandemic payments

CASH MANAGEMENT, TECHNOLOGY

Striving to be strategic Striving to be strategic

Treasurers see expanded role in their organisation and banks are keen to assist them, says Deutsche Bank’s Claudia Villasis-Wallraff in an article first published by The Asset reproduced here in flow

CASH MANAGEMENT, TECHNOLOGY

Why treasury automation is a must Why treasury automation is a must

Driving treasury automation has taken on added urgency since Covid-19. flow’s Desiree Buchholz and Helen Sanders looks at how the pandemic has altered priorities, why implementing new solutions takes time and how working with fintechs can help to accelerate the process

CASH MANAGEMENT, TECHNOLOGY

Why CBDCs could be a gamechanger for B2B payments Why CBDCs could be a gamechanger for B2B payments

Central bank digital currencies (CBDCs) are gaining traction – but some corporate treasurers are missing a vision for token-based B2B payments, especially in Europe. flow’s Desirée Buchholz hosts a debate on the relevance of digital currencies for companies

CASH MANAGEMENT, TECHNOLOGY

Digital marketplaces – a gamechanger for payments and treasury Digital marketplaces – a gamechanger for payments and treasury

Digital sales are booming. While marketplaces provide new business opportunities for buyers, sellers and operators, they also create new challenges for treasurers. flow’s Desirée Buchholz reports on how treasury can define a new payment strategy

Cash Management, Technology, Trade Finance

What treasurers should know about blockchain payment triggers What treasurers should know about blockchain payment triggers

As companies transfer business processes onto the blockchain, existing payment systems are reaching their limits. Does this mean that corporate treasurers will soon need digital currencies or are payment triggers sufficient? Alex Bechtel, Head of Digital Assets & Currencies Strategy at Deutsche Bank shares his views with flow’s Desirée Buchholz

CASH MANAGEMENT, TECHNOLOGY

Leveraging instant payments and APIs in APAC Leveraging instant payments and APIs in APAC

Driven by local governments’ desire to promote digital economies and financial inclusion, real-time payments are accelerating in APAC. In an Economist Impact webinar supported by Deutsche Bank, two corporate treasurers shared why instant payments and APIs are vital supply chain connectors. flow reports

CASH MANAGEMENT

EIU Perspective: Connected with financial services partners EIU Perspective: Connected with financial services partners

Through a series of surveys and reports over recent years, The Economist Intelligence Unit (EIU) has taken the pulse of corporate treasury; recording its response to both day-to-day challenges and specific events from supply chain disruptions to Covid-19

EIU Perspective: Connected with financial services partners MoreCash management, flow case studies

Boosting treasury in India Boosting treasury in India

German vibrant science and technology company Merck has turned its treasury business in India inside out. Jörg Bermüller tells flow’s Desirée Buchholz how his team reduced FX risks, optimised liquidity and streamlined processes in an award-winning project with Deutsche Bank

Cash management, flow case studies

Superior vision Superior vision

For Swiss multinational healthcare company F. Hoffman-La Roche AG – aka Roche – full visibility over available intraday bank transactions is essential for its treasury department in efficiently managing cash. flow reports on how working with Deutsche Bank enabled the team to develop an enhanced intra-day statement

CASH MANAGEMENT, MACRO AND MARKETS {icon-book}

Central bank digital currencies: the game changers Central bank digital currencies: the game changers

Despite their volatility, cryptocurrencies are gaining acceptability as an alternative asset class. However, mass adoption is unlikely, and in the meantime, central bank digital currencies are gaining traction, reports flow’s Graham Buck

CASH MANAGEMENT. MACRO AND MARKETS

A slow ascent from the Covid-19 ravine A slow ascent from the Covid-19 ravine

Emerging from the economic slump triggered by the pandemic has proved slower and more difficult than original estimates suggested. flow’s Janet Du Chenne and Graham Buck examine the evidence that suggests the long-awaited recovery may finally be underway

CASH MANAGEMENT

Bank-agnostic platforms in Asia − An update Bank-agnostic platforms in Asia − An update

First published in the October 2021 issue of The Asset Magazine, Deutsche Bank’s Raphael Jansa explains how bank-agnostic platforms have regularly demonstrated their value over multiple asset classes and use cases and why he thinks they are here to stay

CASH MANAGEMENT {icon-book}

FX workflow automation: an expected journey FX workflow automation: an expected journey

Colin Lambert reports on how pandemic disruption has impacted corporates’ FX risk management strategies, illustrating this with a profile on Yusen Logistics’ use of automation to meet its new business needs

flow case studies, Cash management, Sustainable finance {icon-book}

Treasury transmission Treasury transmission

An internship with BMW led ElringKlinger’s treasurer, Matthias John, to the automotive component manufacturer, where he centralised its treasury systems and improved free cash flows. He tells flow’s Graham Buck about the importance of giving back

CASH MANAGEMENT, MACRO AND MARKETS

When will digital currencies become mainstream? When will digital currencies become mainstream?

The Bahamas launched the sand dollar, a nationwide central bank digital currency (CBDC) last October. flow’s Graham Buck reports on why its move will be followed by others around the world over the coming months as CBDCs take on cryptocurrencies

CASH MANAGEMENT

Doing more with less Doing more with less

More than a year on since the onset of Covid-19, the pandemic has made centralisation a top priority for many corporate treasurers and strengthened the case for using an in-house bank, reports flow's Graham Buck

CASH MANAGEMENT, MACRO AND MARKETS

Digital currencies, differing motives Digital currencies, differing motives

Until quite recently, the attitude of many of central banks towards digital currencies ranged from antipathy to hostility. Led by China, most are now warming to the concept – or are even actively developing their own. However, as flow’s Graham Buck reports there are a range of motivating factors behind the change in attitude

CASH MANAGEMENT, TECHNOLOGY

A new era for payment validation A new era for payment validation

As payments become increasingly fast, minimising fraud risk and ensuring visibility is gaining importance. flow explores how the faster payments space is evolving and how pre-validation will help financial institutions and corporates

Cash Management, flow case studies

Connecting cash Connecting cash

Wieland is a fast-growing German copper and copper alloy specialist. After a series of M&A acquisitions in the US, the treasury team found the successive legacy cash management systems were impeding efficiency. flow’s Desirée Buchholz reports on the turnaround

CASH MANAGEMENT

CBDCs and the impact on cross-border payments CBDCs and the impact on cross-border payments

A growing buzz around central bank digital currencies (CBDCs) is seeing proofs of concept and pilots worked on by many central banks across the world. As these schemes gain traction, Deutsche Bank’s Bradley Lonnen, Alexander Bechtel and Marc Recker outlined in a webinar how CBDCs could transform cross-border payments

CASH MANAGEMENT, MACRO AND MARKETS

Extending in-house bank services in APAC Extending in-house bank services in APAC

In a webinar hosted by The Economist as part of its Global Treasury Leaders programme and supported by Deutsche Bank, two corporate treasurers shared on the special challenges that the region presents when setting up an in-house bank. flow reports

CASH MANAGEMENT, MACRO AND MARKETS, TECHNOLOGY

FX risk management: Keeping pace with market developments FX risk management: Keeping pace with market developments

A diversity of currencies and regulations can make implementing an FX hedge programme in Asia challenging. Technology is key and this article from The Asset reports that for Deutsche Bank, GEM Connect helps its clients to seamlessly execute FX hedging in an automated and transparent fashion

CASH MANAGEMENT

The drive for five The drive for five

The results of the Global Investor 2021 Beneficial Owners Survey reflect an investor focus on five areas of service differentiation against the backdrop of the stressed market conditions, say Deutsche Bank’s agency securities lending experts Johnny Grimes and Zorawar Singh

CASH MANAGEMENT

Global Treasury Leaders Summit EMEA 2021: a Covid learning curve Global Treasury Leaders Summit EMEA 2021: a Covid learning curve

With the 2020 event focusing on the immediate impact of Covid-19, this year’s online gathering of senior treasurers looked back on lessons learned over the past 18 months

Global Treasury Leaders Summit EMEA 2021: a Covid learning curve MoreCASH MANAGEMENT, TECHNOLOGY

EBAday 2021: Turning point in payments transformation EBAday 2021: Turning point in payments transformation

Disrupted by the pandemic in 2020, the European Banking Association’s EBAday 2021 returned its focus to payments transformation issues such as the migration to ISO 20022, open banking, real time payments and cyber security

CASH MANAGEMENT

Securities lending and repo on the front line Securities lending and repo on the front line

Maurice Leo, a Director in Deutsche Bank’s Agency Securities Lending team, assesses the important role of securities lending and repo in accommodating and facilitating market order and liquidity during pandemic-related volatility

CASH MANAGEMENT

EBAday 2020: Turning point in payments EBAday 2020: Turning point in payments

The European Banking Association’s EBAday 2020 addressed the ongoing payments transformation as the pandemic accelerates digital payment appetite. Delegates at this rescheduled virtual event agreed that Covid-19 has also sharpened resilience in financial services, reports flow's Graham Buck

CASH MANAGEMENT

Digital treasury accelerates in Asia Digital treasury accelerates in Asia

Treasury digitisation across Asia was gaining traction even before Covid-19 struck, but the pandemic has accelerated the process. A recent Deutsche Bank webinar provided a progress report

CASH MANAGEMENT, MACRO AND MARKETS

Cash: resilient or redundant? Cash: resilient or redundant?

Sweden’s economy is on course to become fully digital next year as cash transactions are consigned to history. Elsewhere in the world progress towards the cashless society is uneven but post-pandemic is set to be further accelerated by resurgent inflation, reports flow’s Clarissa Dann

TECHNOLOGY, CASH MANAGEMENT

From the engine room From the engine room

Almost overnight, Deutsche Bank relocated more than 65.000 of its employees to working from home locations ahead of Covid-19 lockdown. flow reports on operational resilience and business continuity management

CASH MANAGEMENT

Cybersecurity and fraud protection: exposing bad actors Cybersecurity and fraud protection: exposing bad actors

As spear phishing, business email compromise and other attacks on corporates increase, the chief information security officer is everyone’s new best friend, report Wade Bicknell and Vanessa Riemer.

NEWS, CASH MANAGEMENT

Supporting corporate treasurers working from home Supporting corporate treasurers working from home

Deutsche Bank’s FX platform capabilities are helping corporates facing exceptional challenges triggered by the global pandemic – from maintaining liquidity to enabling employees to work from home

CASH MANAGEMENT

ISO 20022: stepping in the right direction ISO 20022: stepping in the right direction

Deutsche Bank’s Christian Westerhaus explores the latest ISO 20022 developments in an article for Fintech Futures

CASH MANAGEMENT

Bank support during Covid-19 Bank support during Covid-19

As the Covid-19 pandemic continues its disruption and dislocation of economies, businesses and supply chains, banks are working with governments and their clients to ramp up support initiatives. Here are some examples of Deutsche Bank activity

CASH MANAGEMENT, MACRO AND MARKETS {icon-book}

Leaving Libor Leaving Libor

By the end of 2021, Libor will have all but disappeared. Helen Sanders looks at what treasurers should consider amid the phasing out of this widely used benchmark interest rate

CASH MANAGEMENT

Supporting clean mobility Supporting clean mobility

In December, German automotive component producer Continental agreed a €4bn revolving credit facility with a 27-bank syndicate aligned to sustainability performance. flow’s Clarissa Dann on how the company is navigating Covid-19 and a Tesla-disrupted market place

CASH MANAGEMENT {icon-book}

March to change March to change

Clarissa Dann meets Group Treasurer Soumyo Dutta at the Reliance Industries Mumbai headquarters to discover more about its rapid organic growth, its journey to debt-free status, and how its treasury has aligned along the way

CASH MANAGEMENT

The art, and science, of the possible The art, and science, of the possible

In the face of falling margins and rising competition – including some from non-traditional sources – the payments industry is under pressure to deliver digital, seamless and transparent solutions

CASH MANAGEMENT {icon-book}

Creative sounds Creative sounds

Until Spotify disrupted the music ownership model, the music industry was under siege from piracy. Clarissa Dann reports on how the Swedish audio media phenomenon has applied its corporate treasury infrastructure to support this incredible growth story

CASH MANAGEMENT, TECHNOLOGY

30 minutes or less – the new standard for cross-border payments 30 minutes or less – the new standard for cross-border payments

By the time you have finished reading this article, an international payment will have been made from one company to another via a bank.

CASH MANAGEMENT, TECHNOLOGY

MultiSafepay and “Request to Pay”: open banking comes of age MultiSafepay and “Request to Pay”: open banking comes of age

The implementation of Europe’s second Payment Services Directive (PSD2) has unlocked a number of new open banking solutions, such as Request to Pay (RtP).

CASH MANAGEMENT {icon-book}

One-way ticket One-way ticket

The Covid-19 pandemic forced corporate treasury teams to suddenly adapt to working from home, but not all of them are planning a return journey to the office anytime soon, reports Rebecca Brace

CASH MANAGEMENT {icon-book}

Pollinating payments Pollinating payments

Amid a delicate ecosystem of de-risking and reducing correspondent banking lines, how can the process of making cross-border payments be improved? Ruth Wandhöfer and Barbara Casu have researched market participant pain points and suggest seven scenarios for the future

CASH MANAGEMENT {icon-book}

A healthy approach A healthy approach

German science and technology giant Merck has been developing healthcare solutions for 350 years, and remains at the leading edge of biotechnology. Graham Buck finds out how the spirit of innovation underpins its corporate treasury team

CASH MANAGEMENT {icon-book}

Prescient on payments Prescient on payments

Fifteen years on from its launch, the original business template of payment services and working capital provider Payoneer successfully anticipated today’s growing online business volumes. Graham Buck reports

CASH MANAGEMENT

NIRP: The new rules of the game NIRP: The new rules of the game

The dawn of negative interest rates is nigh. The world appears to be upside down since the Negative Interest Rate Policy (NIRP) – an exceptional monetary policy tool that brings nominal target interest rates below the zero bound – has changed the rules of the interest rate game for financial intermediaries. Anne-Katrin Brehm, Institutional Cash Management at Deutsche Bank looks at what those new rules mean for the transaction banking and cash management business

CASH MANAGEMENT

Resilient treasury factors in a lengthy pandemic Resilient treasury factors in a lengthy pandemic

Rapid changes to treasury strategy introduced in response to Covid-19 appear likely to endure as companies adjust to the pandemic having longer-term impact, the latest Economist Intelligence Unit survey suggests

CASH MANAGEMENT, REGULATION

Open banking – heralding the dawn of open finance? Open banking – heralding the dawn of open finance?

As open banking gains traction, regulators are turning their attention to the next stage of development. Regulatory expert Polina Evstifeeva reviews initiatives

CASH MANAGEMENT, TECHNOLOGY

SWIFT gpi: a progress report SWIFT gpi: a progress report

As SWIFT’s gpi initiative approaches its fifth anniversary, many of its original goals have been achieved since the 2017 launch while more recent fine tuning has enhanced the service. What’s next on the agenda? The flow team reports

CASH MANAGEMENT, TECHNOLOGY {icon-book}

Reimagining the future of payments Reimagining the future of payments

The pandemic has accelerated the pace of change over the past year and bank-led merchant solutions are among the responses to a huge shift in payment methods and the boost to e-commerce, reports Helen Sanders

Cash Management, Macro & Markets

More March of the digital euro

The European Central Bank’s go-ahead for an investigation phase could see a digital currency for Europe issued before the end of 2026, reports flow’s Graham Buck and Clarissa Dann

Cash management, Technology

E-commerce for treasurers: staying ahead of the game E-commerce for treasurers: staying ahead of the game

No industries are safe from digital disruption and the pandemic has accelerated the pace of change in the world of shopping. At a recent webinar hosted by The Economist, treasurers of a B2B and a B2C company outlined the challenges of expanding e-commerce operations, choosing the right platforms and payment providers, and increasing payments digitalisation to support emerging retail trends

CASH MANAGEMENT

Treasury connected Treasury connected

With Covid-19 having sharpened e-commerce appetites, treasurers have responded by optimising their digital payments infrastructure and kept their financial data secure while connecting customers. flow shares key insights the Economist Intelligence Unit in the first of four reports

CASH MANAGEMENT

Goodyear’s new tracks for cross-currency liquidity Goodyear’s new tracks for cross-currency liquidity

Goodyear’s treasury team partnered with Deutsche Bank to introduce an automated cross-currency liquidity structure. flow explores how this new solution helps the treasury team reduce operational risk and bolster operational efficiencies

CASH MANAGEMENT, TECHNOLOGY

Sign of the times Sign of the times

Digital signatures quickly proved popular with major corporates, but the Covid-19 epidemic is now accelerating take up by companies while the service is expanding to more countries

CASH MANAGEMENT

FX risk management: bring on the robots FX risk management: bring on the robots

Automation now enables corporate clients to reduce their FX risk and enhance liquidity management. Ahead of EuroFinance Copenhagen, Graham Buck talks to Deutsche Bank’s VP risk management solutions, Xavier Szebrat

CASH MANAGEMENT {icon-book}

Currency Care Currency Care

Dan Barnes explains how targeted use of derivatives can create more efficient hedging for FX risk, and provide treasurers with an alternative to incurring overnight deposit charges

CASH MANAGEMENT

In the fast lane In the fast lane

With a number of domestic instant payment schemes already in place, the scope of these payments will soon cross borders. Deutsche Bank’s Jose Buey and Paul Cuddihy examine the impact of what has been a consumer phenomenon in the business-to-business space

CASH MANAGEMENT, REGULATION, MACRO AND MARKETS

Asian banks keep up to speed on ISO 20022 migration Asian banks keep up to speed on ISO 20022 migration

The new global language for financial communications is very much a work in progress. In this article written for The Asian Banker, Nancy So assesses how banks across the region measure up

CASH MANAGEMENT

more Covid-19's assault on cash

The journey towards tomorrow’s cashless society has gathered momentum and urgency as a result of the Covid-19 pandemic, reports flow’s Graham Buck

CASH MANAGEMENT

Corporate tips for navigating Covid-19 Corporate tips for navigating Covid-19

COVID-19 has precipitated a global shock that poses significant risk for business. To assist in this situation, Deutsche Bank’s Capital Markets Strategy team provides a detailed checklist for operational, funding and risk management functions

CASH MANAGEMENT, TECHNOLOGY {icon-book}

Filling the data lake Filling the data lake

As real-time cash management shapes the consumer experience and negative interest rates attack passive deposits, corporate treasurers are employing API-enabled analytics in determining what cash needs to move where and to optimise their FX positions, reports Elizabeth Pfeuti

CASH MANAGEMENT

Tomorrow's treasury today Tomorrow's treasury today

At Eurofinance 2018, the 27th conference on International Treasury Management, the cooperation between banks, corporate treasurers and fintechs to achieve common goals of speed and transparency was very much in evidence. Clarissa Dann reports on how buzz words made way for road maps and milestones

CASH MANAGEMENT

Correspondent banking steps into a new era Correspondent banking steps into a new era

In a discussion with The Banker, Christian Westerhaus, Global Head of Clearing Products, Cash Management at Deutsche Bank, explains how the industry is ensuring cross-border payments are keeping up with demand

CASH MANAGEMENT

Regulation driving banking transformation: Second Edition Regulation driving banking transformation: Second Edition

A regulatory environment that supports the safe and robust development of the data economy is essential for banking transformation, says new white paper

CASH MANAGEMENT, TECHNOLOGY

Adding speed to treasury digitisation Adding speed to treasury digitisation

A global pandemic and fast-changing regulation are factors accelerating the digitalisation of treasury ecosystems across Asia, as a recent webinar from The Economist Group and EuroFinance confirmed. flow ’s Graham Buck reports on the main discussion points

CASH MANAGEMENT {icon-book}

Hello SONIA Hello SONIA

As the deadline for the cessation of Libor as the most widely used benchmark for financial products looms ever closer, Graham Buck reports on how SONIA, the Bank of England’s preferred successor, is gaining traction

CASH MANAGEMENT, TRADE FINANCE, SECURITIES SERVICES, TECHNOLOGY {icon-book}

Responsible innovation Responsible innovation

How can you connect four billion accounts across the world in an instant? That is the bold vision of SWIFT’s CEO, Javier Pérez-Tasso. flow's Clarissa Dann talks to him about the responsibilities vested in a cooperative founded to create mutual benefit for the financial community and why a virtual Sibos for 2020 will keep the global financial community engaged

CASH MANAGEMENT

Basel yesterday, today and tomorrow Basel yesterday, today and tomorrow

Prudential regulation in the form of the Basel accords on capital adequacy has been evolving for almost 30 years. Etay Katz and Kirsty Taylor explain this quest for safety and soundness as “Basel IV” awaits agreement

CASH MANAGEMENT

Ten PSD2 essentials Ten PSD2 essentials

PSD2 applies from 13 January 2018. flow summarises how this affects your business and transaction flows

CASH MANAGEMENT {icon-book}

Heart of the enterprise Heart of the enterprise

Business software provider SAP leads a consistent programme of innovation, the latest being its digital boardroom. Head of Global Treasury Steffen Diel demonstrates why leaving one’s comfort zone and being permanently curious can work miracles

CASH MANAGEMENT, MACRO AND MARKETS, COVID-19

Kicking the can: who pays for Covid-19? Kicking the can: who pays for Covid-19?

As cases of Covid-19 surge past 17 million, the global debt mountains that the pandemic expanded seem perpetually unscaleable. flow’s Clarissa Dann and Graham Buck take a closer look at how the rules of macroeconomics are being rewritten

CASH MANAGEMENT

Safety twice Safety twice

With cyber-crime on the rise, and the implementation deadline under PSD2 for Strong Customer Authentication (SCA) in online payments coming up fast, banks and payment service providers are coming up with some innovative solutions. flow reports on what this means in practice

CASH MANAGEMENT {icon-book}

ISO 20022 takes off ISO 20022 takes off

Many of the world’s most important payment market infrastructures are transforming to meet the needs of automation, integration and real-time services. All of this is underpinned by the migration to a new payments messaging standard – ISO 20022. For banks and corporates, this is more than just another IT project; it signals a major opportunity to improve payments processes and reassess business models. Paula Roels looks at the implications

CASH MANAGEMENT

Digital treasury accelerates in Asia Digital treasury accelerates in Asia

Treasury digitisation across Asia was gaining traction even before Covid-19 struck, but the pandemic has accelerated the process. A recent Deutsche Bank webinar provided a progress report

CASH MANAGEMENT

Open banking unwrapped Open banking unwrapped

Neil Frederik Jensen joined the 5000 attendees of Money2020 in its new Amsterdam home and reports a sea-change in bank-fintech cooperation to deliver a better financial services experience to the end user

CASH MANAGEMENT

AFP 2020 conference: looking beyond Covid AFP 2020 conference: looking beyond Covid

The Association for Financial Professionals’ first virtual conference offered a member of former President Obama’s team on post-pandemic developments, and sessions on Fed policy and the rise of blockchain and digital currencies

CASH MANAGEMENT

Why e-FX is rocket science Why e-FX is rocket science

How is technology supporting clients and providers in maximising FX market opportunities? Graham Buck talks to Deutsche Bank’s Head of E-FX David Leigh in the run-up to Sibos London 2019 about FX that knows what corporates need before they do…

CASH MANAGEMENT {icon-book}

Hedge with an edge Hedge with an edge

With geopolitical risk and FX volumes on the rise, flow explores how combining the right technology with trusted market expertise is essential for corporate treasurers

CASH MANAGEMENT {icon-book}

Going against gravity Going against gravity

Over the past four decades, corporate tax rates have been on a downward trajectory. Graham Buck examines why 2020 could mark a watershed when that trend starts to reverse

CASH MANAGEMENT

Correspondent banking 4.0? Correspondent banking 4.0?

One of the unintended consequences of post-crisis regulatory tightening has been a reduction in correspondent banking relationships. But new technologies and a collaborative willingness to keep funds flowing across borders give cause for optimism, reports flow’s Janet Du Chenne