09 July 2020

More countries are relaxing or abandoning Covid-19 containment restrictions despite the spectre of new virus variants. flow's Clarissa Dann reflects on vaccine policies, normalcy indicators, and what this means for economic growth going forward

MINUTES min read

During 2020, flow published several articles assessing how well the world was responding to the biggest health crisis for 100 years. Our 19 November update, Climbing out of Covid: Nearly there?, forecast that “some form of normality could return sooner rather than later” but that “scalability, distribution priorities, and trust in governments are among the factors that will determine the speed”.1 This is exactly what has happened over the eight subsequent months, with coronavirus restriction fatigue even having an impact in regions that were relatively Covid-free until now2.

Living with the virus

Halfway through 2021 there is no early end to the pandemic yet in sight; economies are seeking other ways than the imposition of ongoing restrictions to navigate the virus. As Deutsche Bank’s Jim Reid points out in his 30 June report, Thematic Research: DB CoTD: Delta Force, “Assuming all [UK] restrictions are lifted [19 July], it will be a test case for the world as to how prepared highly vaccinated citizens, and politicians, are to live with a virus still circulating at relatively high levels in the population.”

David Folkerts-Landau, Group Chief Economist at Deutsche Bank Research (The House View, Reopening the Global Economy, 6 July) forecasts that “Covid-19 will remain in the spotlight, particularly as the global decline in cases since late-April has now stalled and the more-infectious delta variant has emerged. With vaccination rollouts now in an advanced phase across many developed countries, one of the biggest questions soon will be the extent to which governments and citizens are prepared to live with the virus. That answer will have crucial implications for the shape of the recovery and the new steady-state we’re heading to.”

In its 3 July leader ‘The long goodbye’, The Economist returns to the theme of vaccine and treatment inequality, “as vaccines and treatments become more plentiful in rich countries, so will anger at seeing people in poor ones die for want of supplies”.

This newspaper also reflects on how the Covid-19 legacy will “follow the pattern set by past pandemics”, citing Nicholas Christakis of Yale University, who identifies three shifts: the collective threat that prompts a growth in state power; the overturning of everyday life that leads to a search for meaning; and the closeness of death which brings caution while the disease rages, spurs audacity when it has passed. “Each will mark society in its own way,” predicts Christakis.

At what amounts to an inflection point as governments look beyond a stop-start approach to managing Covid-19 this article provides an update of vaccine progress so far, and what “back to normal” really means in a post-pandemic world.

Vaccine roll-outs

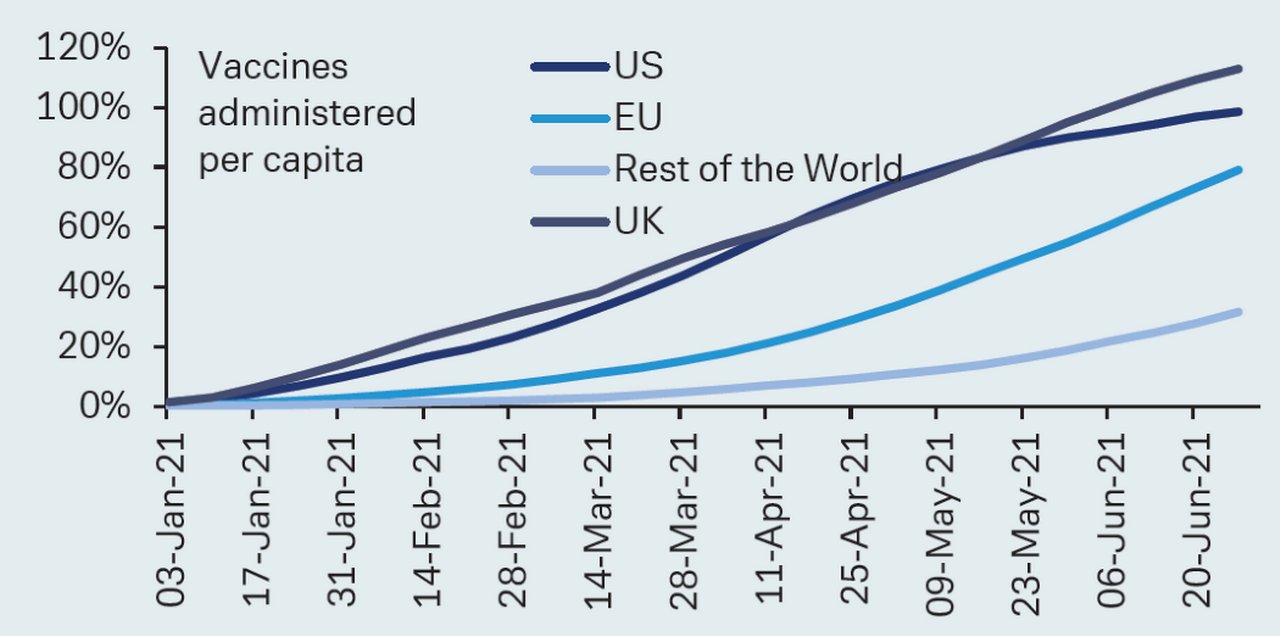

Figure 1: US and UK making faster vaccine progress than other regions

Source: Deutsche Bank Research

In their 6 July House View, Deutsche Bank Research’s Jim Reid, Henry Allen and Marion Laboure report that the US and the UK are setting the benchmark for vaccine rollout; followed by the EU (see Figure 1). “The US and Europe should hit 70-80% herd immunity thresholds by late summer. Vaccination rates in the rest of the world are negligible so far.”

However, the Delta variant first detected in India, they add, is now dominant in the UK. “Already gaining a foothold in the UK, the variant is spreading rapidly in the US and the EU. The variant is significantly more transmissible and somewhat more vaccine-resistant than previous variants.”

Israel, which has vaccinated more than 5.63 million citizens (61% of the population), and enjoyed fleeting fame on 24 April when it recorded no daily deaths for the first time in 10 months3, is now recording a rise in serious cases of almost 50% in a week, according to Israeli Health Ministry data.4 On 25 June mask wearing indoors was re-imposed only 10 days after the measure was lifted, reported The Guardian.5 In other words, the vaccine cannot be relied upon to protect against getting symptoms or carrying the virus, but reduces the severity of its impact on those infected and resulting demand for intensive care provision.

The risks inherent in the UK’s new strategy of learning to live with coronavirus in much the same way as seasonal influenza were analysed by The Guardian’s science editor, Ian Sample6, on 5 July. The success of the vaccination campaign has, explained Semple, tended to hide the fact that vaccines do much more to prevent deaths from Covid than transmission of the virus, so the daily total of new cases is expected to keep rising for some time. “The larger the epidemic grows, the more chance the virus has of finding vulnerable people who have not had their shots, or are not sufficiently protected by the vaccine.” He added “while the vaccines dramatically weaken the link between cases and deaths, they are unlikely to break it entirely.”

"It will be imperative for the government to ensure that the daily vaccination average does not fall below five million doses"

Meanwhile, India’s government is beefing up its vaccination programme, having introduced a new policy of buying Covid-19 jabs from manufacturers and supplying them to state authorities. As one of the world’s largest vaccine makers, India found its own vaccination programme lagging those of countries it was exporting to.

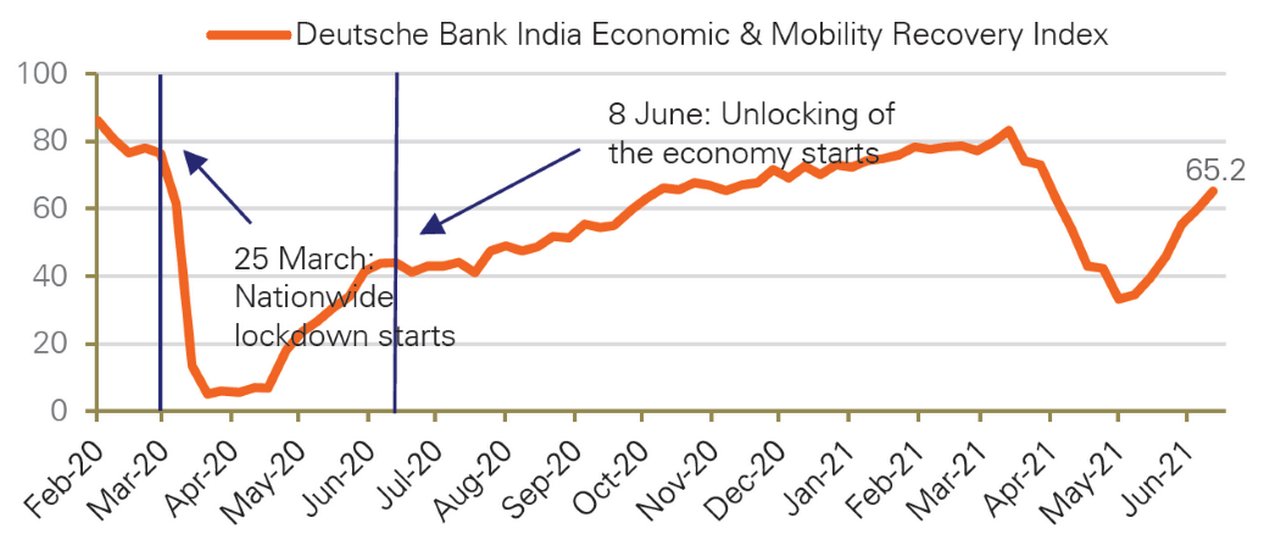

“It will be imperative for the government to ensure that the daily vaccination average does not fall below five million doses, which was achieved in the previous two weeks, to protect people from risks of a wider spread of Delta+ variant and a possible third wave sometime in October, coinciding with the festival season,” notes Deutsche Bank Research India Chief Economist Kaushik Das in his 5 July update, India Covid-19 update two months post the peak of the second wave. While India’s recent surge in Covid infections adds uncertainty to the domestic growth outlook, indicators suggest that economic and mobility activity is nonetheless normalising (see Figure 2).

Figure 2: Deutsche Bank India Economic and Mobility Recovery Index

Source : Deutsche Bank Research, POSOCO, CMIE , CEIC , Apple Mobility Index and Google Mobility report. Note: Index has been calculated based on Oxford Stringency Index, electricity consumption, unemployment rate, labour participation rate, E-Way bills, 2 parameters of Apple Mobility Index and 6 parameters of Google Mobility report.

Lower income countries

According to Gavi, the vaccine alliance, COVAX, set up to distribute vaccines to poorer countries, has so far shipped more than 95 million Covid-19 vaccines, against ambitious initial goals to provide two billion doses of vaccines worldwide in 2021, and 1.8 billion doses to 92 poorer countries by early 2022.

"In low and lower-middle income countries, vaccine supply has not been enough to even immunise health and care workers"

On 14 May, Director General of the World Health Organization Tedros Adhanom said, “At present, only 0.3% of vaccine supply is going to low-income countries. Trickle down vaccination is not an effective strategy for fighting a deadly respiratory virus.”7

He added that while recognising “why some countries want to vaccinate their children and adolescents, right now I urge them to reconsider and to instead donate vaccines to COVAX. Because in low and lower-middle income countries, vaccine supply has not been enough to even immunise health and care workers, and hospitals are being inundated with people that need lifesaving care urgently.”

Just before the G7 Summit in Carbis Bay on 11 June, the US and the UK pledged to donate 500 million and 100 million doses respectively to COVAX.8 Germany, France, Italy and Sweden have promised at least 100 million doses.

Mobility and normality indicators

In Exiting the Covid-19 ravine (June 2020), flow reported on how Google Community Mobility Reports, based on anonymised aggregated feeds via Google Maps could “chart movement trends over time by geography, across different high-level categories of places such as retail and recreation, groceries and pharmacies, parks, transit stations, workplaces, and residential”, which provided some clues to a gradual opening up – before the second wave hit last autumn.

As the article described, users can download a particular country and then view whether there have been more or fewer people across the listed place categories since the beginning of the reporting, to capture mobility trends.

It is then possible to compare countries across each of these places. Figure 3 shows five examples of how far from the baseline position those countries were for Retail and Recreation in 2020 and how that reduced over the following 12 months.

Figure 3: Comparison of Google retail and recreation mobility data June 2020 and June 2021

Source: Google Community Mobility Reports

In its 3 July issue, The Economist shared a new “normalcy index” assessing how far countries have returned to normalcy where pre-pandemic levels are equal to 100.9 This tracks the subsequent impact on things that make up everyday life such as flights, traffic and retailing across 50 countries that collectively represent 76% of the world’s population. The normalcy index currently stands at 66, evidencing that life is far from returning to the conditions of 18 months ago but almost double the level of April 2020 when the pandemic’s first wave had brought much of life to a standstill. Despite its carefully worded statistical caveats, and the fact that “normalcy is also influenced by factors unrelated to the pandemic,” this is a useful barometer.

China was first to lock down, so its index score had already fallen to 80 in March 2020. As the disease spread it reached a low of 35 and since last July has oscillated around 60. “It now sits at 66, implying that only half of the disruption caused by covid-19 has been reversed,” The Economist adds.

Most Western countries are also close to this average, with current readings of 73 for the US, 71 for the EU, 70 for Australia and 62 for the UK. Elsewhere the range is wider; at the top of the scale Hong Kong and New Zealand lead with respective scores of 96 and 88 as both enjoy nearly full normalcy. At the other end, Malaysia’s index rating has fallen from 55 in April to 27 as the country endures a wave of Covid infections six times more deadly than the surge in January, reflecting new variants of the virus and the slow progress of the country’s vaccination rollout.

Strong rebound but…

Returning to the Deutsche Bank House View, the overall outlook is positive, despite downside risks of what the Delta variant of the virus might do and whether central banks can keep a lid on inflation.

In the Euro area, the successful vaccine roll-out does, note the report’s authors, “open the door to a strong economic rebound” and they expect GDP growth of 4.6% to 4.8%. As for the US, “thanks to massive fiscal stimulus that is projected to move GDP well above its pre-virus path, we project annual 2021 growth of +7.0%, the strongest pace since 1984”. They add that unemployment should fall to below 4.5% by the end of the year, but anticipate “a significant moderation in growth as fiscal stimulus wears off”.

As for downside risks, there are question marks over what damage Covid mutations might do to set back the point at which herd immunity is reached, and, as ever, “higher than expected inflation” remains a concern because “a persistent overshoot of inflation into the 3-4% range would elicit a strong response from the Federal Reserve that would hit global financial markets and a number of emerging market economies hard, very possibly moving the global economy into recession”.

It will be an interesting second half of the year. While economic consequences can be tracked in monthly datasets, how societies and industries (such as travel and retail) will be marked as a result of the pandemic, to reprise Yale’s Christakis, remains an ongoing question.

Deutsche Bank Research report referenced:

Early Morning Reid – Macro strategy by Jim Reid (6 July)

The House View: Reopening the global economy (6 July) by Marion Laboure, Jim Reid and Henry Allen

India Covid-19 update: two months post the peak of the second wave, by Kaushik Das (5 July)

Sources

1 See Climbing out of Covid: Nearly there? at flow.db.com

2 See https://bit.ly/3qTctI1 at newscientist.com

3 See https://bbc.in/3xxhcSg at bbc.com

4 See https://bit.ly/3dYvm77 at haaretz.com

5 See https://bit.ly/2TRWBsZ at theguardian.com

6 See https://bit.ly/3qUAEWk at theguardian.com

7 See https://bit.ly/2TNMB46 at who.int

8 See https://bbc.in/3xsQKsT at bbc.com

9 See https://econ.st/3AIxIkg at economist.com

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

Macro and markets, Trade finance and lending {icon-book}

Italy’s mighty mid-caps Italy’s mighty mid-caps

Thanks to the European policy response to Covid-19, Italy moved from economic headwinds to tailwinds. But can it stand on its own feet? flow shares some perspectives on Italy’s prospects for growth and its thriving corporate sector

MACRO & MARKETS, CASH MANAGEMENT

Inflation: where next? Inflation: where next?

As inflation moves upwards, central banks continue to assert that the increase is transitory. Yet a return to “uncomfortable levels” is a very real prospect as the US economy undergoes its biggest shift of direction in four decades and others follow its lead, reports flow’s Graham Buck