19 March 2021

As the pursuit of alignment with ESG considerations is increasingly shaping investor fund management strategies, flow talks to Deutsche Bank’s Global Head of ESG for Company Research Debbie Jones on what this means for market sector analysis and how regulation is shifting capital towards more sustainable investment objectives

MINUTES min read

Deutsche Bank Research has been expanding its capabilities in environmental, social and governmental (ESG) analysis across all asset classes as clients served by Deutsche Bank steadily incorporate sustainability considerations into their frameworks. This article takes a closer look at investor behaviour, market structures and regulatory responses at a time when more and more funds and stocks are assessed against ESG criteria.

Determining sustainability objectives

“In Company Research we are focused on building an analyst centric approach to incorporating ESG discussion and analysis into our product rather than relying solely on a top down strategy,” explains Debbie Jones, Deutsche Bank’s Global Head of ESG for Company Research.

Who better to address sustainability considerations for an industry or company than the person or team that can leverage deep understanding of the industry, financial knowledge and access to company management? In her opinion, she adds, “the dedicated sector analyst is in the best position to communicate the impact of relevant ESG considerations to investors as well as determine which management teams are pursuing the optimal sustainability strategies”.

Jones took up the post on 20 January 2021, but has worked for Deutsche Bank since 2006 – her most recent role being the Bank’s senior Paper & Packaging Analyst. Her time studying an industry that is reliant on natural capital and has been tasked with mitigating its environmental impact before ESG was an acronym has provided a solid grounding on investor standards when it comes to sustainability. She believes that capital is shifting towards more green investment objectives in many industries, but she notes that is not just about the “E”. “Many investors are squarely focused on the impact of increasing global regulation aimed at the transition towards net zero carbon emissions, while others have a more comprehensive approach or enhanced objectives around supply chain management, corporate governance and issues such as social inequality. The challenge is to help investors with a different sets of ESG of objectives and frameworks, “she explains.

ESG for investors

During her tenure as an analyst, Jones helpfully set out in her report, ESG Primer Volume 1 (15 July 2020) what investing in sustainable stocks entails. At the outset she deals with the semantics. “We do use the terms ESG and sustainability somewhat interchangeably,” she reveals. “Their definitions are, in fact, different though not always entirely consistent. Frankly, many investors use these terms homogeneously.”

“Management has to consider the environmental and social impact of their strategic decisions”

The report then goes on to tackle what corporates should do to be considered truly ESG friendly for investment purposes. She explains, “Management has to consider the environmental and social impact of their strategic decisions and they need to have good governance practices – and disclose them. They should also foster a culture that invites ethical decision making. In doing this, they will likely develop more sustainable entities over the long run, thus eliminating risk for stakeholders, especially long-term investors.”

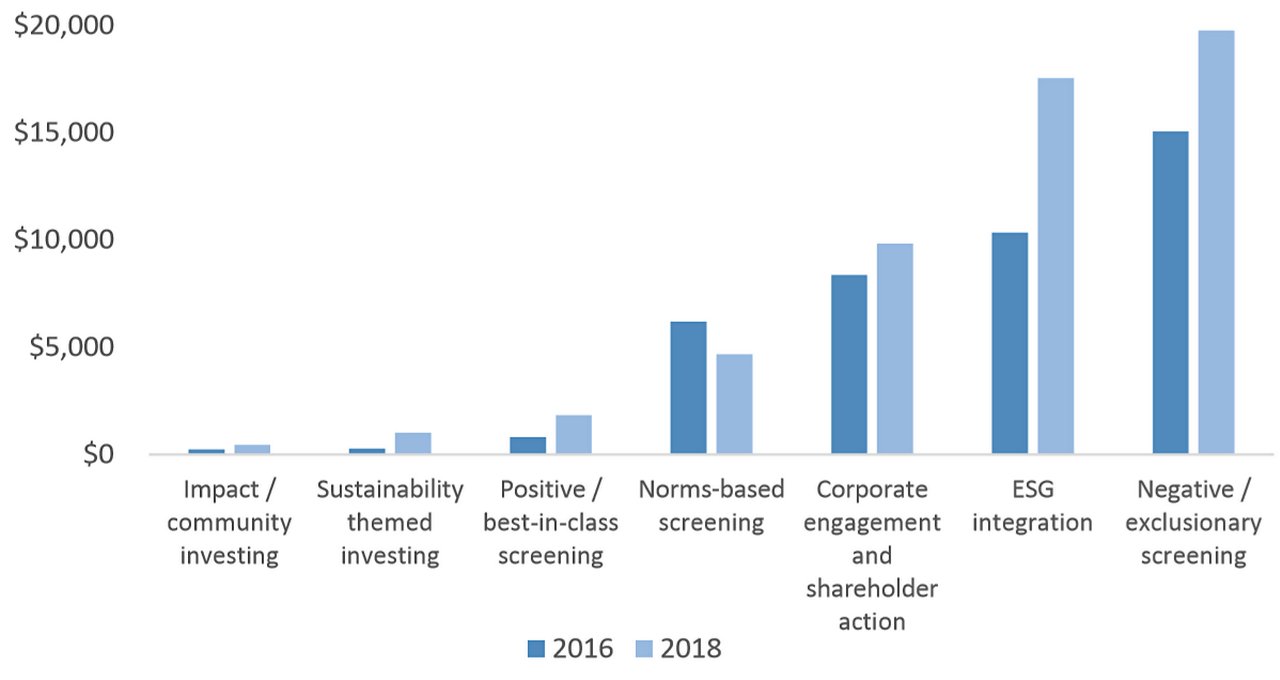

Jones shares how The Global Sustainable Investment Alliance (GSIA)1 – a coalition of the world’s seven largest sustainable investment membership organisations – sets out seven specific types of investment strategies with "sustainability" as the overarching umbrella:

- Negative/exclusionary screening: based on specific ESG criteria.

- Positive/best-in-class screening: stocks selected from a defined universe for positive ESG performance.

- Norms-based screening: screening for compliance with international norms or standards.

- ESG integration: consideration of environmental, social and governance factors into financial analysis.

- Sustainability themed investing: typically themes that address climate change, food, water, renewable energy, clean tech, diversity and agriculture.

- Impact/community investing: targeted at solving social or environmental problems.

- Corporation engagement and shareholder action: shareholder power to influence corporate behaviour.

“The two most used strategies are highlighted as negative/exclusionary and ESG integration, with the former more popular in Europe and the latter more popular in the US,” she observes.

Figure 1: Global sustainable investing strategies (US$bn)

* Survey of investment firms in Europe, the US, Canada, Australia, New Zealand and Japan Source : Global Sustainable Investment Alliance, Deutsche Bank

From market studies of regional sustainable investment forums from Europe, the United States, Japan, Canada, Australia and New Zealand, the GSIA provides a snapshot of sustainable investing every two years, drawing on the regional and national reports of its members. The 2020 Global Sustainable Investment Review is due for publication on the GSIA website during H1 2021. Figure 1 is based on the 2018 report.

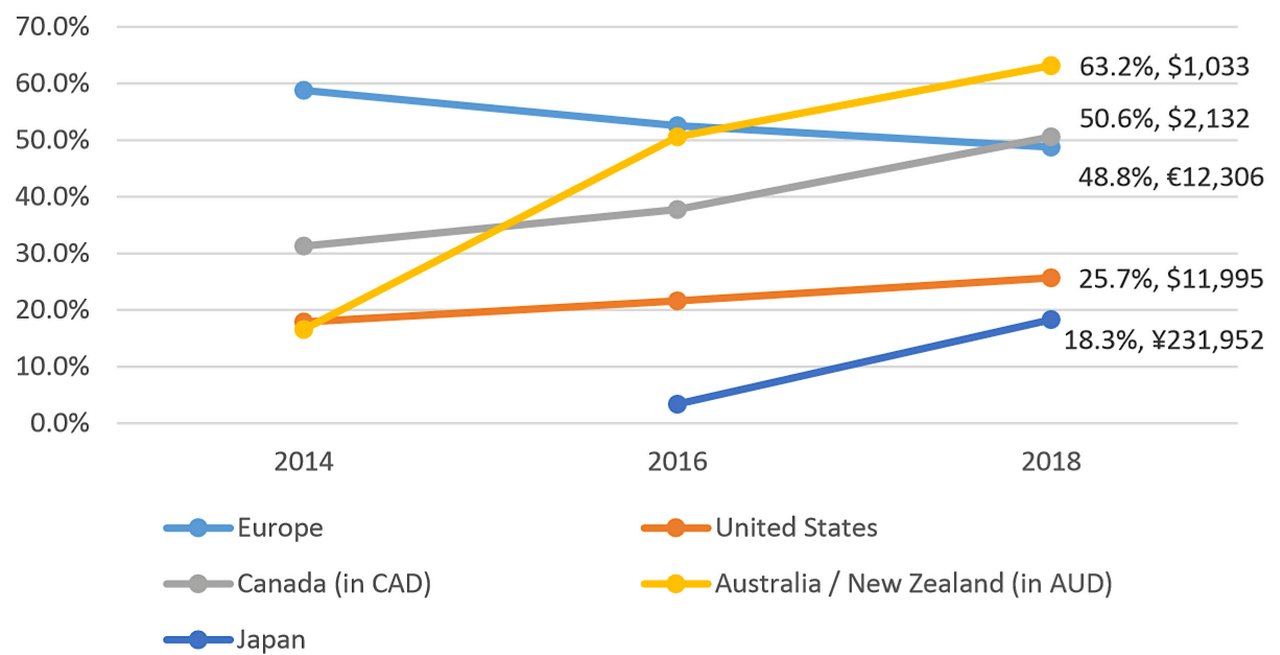

Figure 2: Proportion of sustainable investing relative to total managed assets (US$bn)

* In 2014, Japan was combined with Asia, which is why information is not available.

** Asset values in billions. 2018 values as of 12/31/17, except Japan whose assets are as of 3/31/2018

Source : Global Sustainable Investment Alliance, Deutsche Bank

The 2018 GSIA Global Sustainable Investment Review concluded that almost half of professionally managed assets in Europe embed ESG into their investment process. And for the US, the estimated figure is 26%. Just over the half of the invested funds were made up of public equities.

Many investors, adds Jones, who have ESG mandates have signed the UN’s Principles for Responsible Investment (UNPRI) and are in the early stages of adoption and formalising their strategies.

Regulatory momentum

The primer also reminds us that the European Union’s sustainable finance disclosure regulation will ultimately require European fund managers to reveal the portion of sustainability-aligned investments in their portfolios using the EU Taxonomy framework. In addition, European corporates with more than 500 employees will have to disclose the portion of revenues and capital expenditures aligned to this taxonomy from 2022.

The EU explains, “By providing appropriate definitions to companies, investors and policymakers on which economic activities can be considered environmentally sustainable, it is expected to create security for investors, protect private investors from greenwashing, help companies to plan the transition, mitigate market fragmentation and eventually help shift investments where they are most needed".2

On 1 March, global sustainability regulation was among the topics discussed at the inaugural virtual DBAccess ESG Conference. Among the speakers was Nathan Fabian, Chief Responsible Investment Officer for the UNPRI and Chairperson for the European Platform on Sustainable Finance, who made the point that “the fundamental driver of ESG regulation is the resource constraint in terms of climate, biodiversity, and natural resource availability, flowing into international agreements and national commitments that have moved beyond a long term optimistic view of a future state to start to have quite discrete goals, time-bound objectives which reflect underlying environmental constraints".

He added that governments are seeking to share the burden of meeting sustainability objectives with the private sector, and for this reason there is more “goal orientation” in government policy flow into specific obligations for investors, financiers and corporations. “The easiest way to do that is to come through the disclosure obligations reporting regime in corporate law. That is what we are seeing”.

Fellow panellist was Dr Todd Bridges, Global Head of Sustainable Investing and ESG Research at global data provider Arabesque S-Ray, which analyses quantitative ESG data and provides portfolio screening tools. He noted the other systemic driver, which is that “everyone from core institutional architects of regulation sees ESG as directly linked to the financial stability of the economy and investment portfolio returns”. Bridges added that although the data was “imperfect”, academic studies indicate the link. “You are seeing the flows into ETFs and indexed assets. Chief investment officers are convinced, central banks are convinced – and there is a structure shift,” he concluded.

In a subsequent podcast reflecting on the themes covered at the conference,3 Jones said that corporates outside the EU wanting to access capital will not only face EU sustainability regulation on transparency and disclosure, but must contend with the fact that European regulation is objective, goal-based and intended to drive capital towards green objectives.

Positive direction of travel

At present, notes Jones, only a small proportion of company turnover looks likely to meet the EU taxonomy threshold. “A lot of funds will have a very low reported percentage of alignment (e.g. 5-12%), this is a source of concern to investment managers we speak to”. In her view this will create an incentive for improving on that position by pushing them to invest in companies with a transition plan or a commitment to reducing emissions.

She also believes that if the US – and other countries not currently participating in global framework discussions – want to be part of the conversation to create a global framework they have an opportunity to do so. If they fail to take it, “they risk climate policy being dictated by Europe”.

On 4 March, a significant step forward for America was the announcement from the US Securities and Exchange Commission (SEC) of its Climate and ESG Task Force in the Division of Enforcement. Its team brings together a broad array of experience and expertise, “which will allow us to better police the market, pursue misconduct, and protect investors”, said its designated leader, Deputy Director of Enforcement Kelly L. Gibson.4

Deutsche Bank Research materials referenced

DB Paper & Packaging ESG primer - volume I (15 July 2020) by Debbie Jones, Kyle White and Matthias Pfeifenberger

Podzept: dbSustainability: Insights from the db ESG conference with Debbie Jones and Deutsche Bank Analyst Brian Bedell

dbAccess ESG Conference, held 1 March 2021 by dbSustainability. See https://www.dbresearch.com/dbsustainability for video recordings of selected panel sessions

Sources

1 See https://bit.ly/3ltFKGf at gsi-alliance.org

2 See https://bit.ly/3rYuQuQ at ec.europa.eu

3 See https://bit.ly/3lsvdv2 at dbresearch.com

4 See https://bit.ly/38V9ve7 at sec.gov

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

MACRO AND MARKETS

ESG investing: roots to return ESG investing: roots to return

Covid-19 has changed the way investors view ESG, focusing more on performance than altruistic merit. flow’s Janet Du Chenne analyses Deutsche Bank research on what investors look for and the trends that are shaping the tools for predicting return

MACRO AND MARKETS {icon-book}

An ESG lens to identify r!sk An ESG lens to identify r!sk

Balance sheets and bottom lines are vital tools, but do they show a company’s biggest risks? Elizabeth Pfeuti reports on how Covid-19 has forced the C-suite to pay more attention to environmental, social and governance themes, so their businesses can survive

Sustainable finance

Eight ESG trends to watch in 2024 Eight ESG trends to watch in 2024

What is next for ESG in 2024? From the greater focus on the impact and execution of sustainability targets, to new geopolitical and regulatory priorities, flow explores eight key sustainability themes that corporates should watch out for