26 November 2020

Covid-19 has changed the way investors view ESG, focusing more on performance than altruistic merit. flow’s Janet Du Chenne analyses Deutsche Bank research on what investors look for and the trends that are shaping the tools for predicting return

For many investors, sophisticated algorithms can help to predict how a stock will perform. With environmental, social and governance (ESG) investing, this is less formulaic and that’s just the way it is. Or at least the way it was: investor appetite has changed and they are demanding similar measurements to experiment with return.

Stakeholder economy

Some experts believe these measurements are not far off. Kamran Kahn, Deutsche Bank Corporate Bank’s Head of ESG in Asia says that the point of ESG’s arrival in financial service, will be “when it gets treated in the same way as any other asset class and performs as well as others”. Kahn, who has led investments in sustainable development, says this will be at the exact moment when stocks trade in the secondary market based on the quality and the economics – and when the value of that instrument and the quality of the data impacts the price (and performance) of that asset.

Driving this measurement momentum, says fund manager DWS’s Head of ESG Thematic Research Michael Lewis, is the increasing acceptance that we’re in a stakeholder economy. In Stakeholders and shareholders1, he explains why economist Milton Friedman got it wrong in his September 1970 essay for the New York Times when he wrote that “The social responsibility of business is to increase its profits2. Instead he argues that given the Covid-19 pandemic’s impact on all sectors of the economy and society, companies’ responsibilities extend beyond the shareholder to the stakeholder.

Recent decades have added weight to his argument. Battered by accounting scandals, incidents of negligence related to oil spills and toxic chemical releases, corporates seized the opportunity to win back stakeholder trust by integrating ESG into non-financial reporting statements.

This stakeholder economy has enabled corporates to show investors they are doing more than just making profits, says Lewis, and provide the data points for determining that an ESG stock will do just as well, if not better than any other. The idea is that a company’s operations that bare risk to stakeholders could impact negatively on return, while stocks based on operations that are stakeholder friendly and risk-sensitive should perform well.

This article looks at how investors are assimilating these measurements, transforming ESG investing from a soft skill into a science for determining performance. It also considers the role of companies’ operations and the way they are financed in combatting greenwashing (filing disclosures related to sustainability as a PR exercise).

Metrics and goals

With the pandemic ushering in a stakeholder economy, investors are focusing more on how companies operate and the contribution they are making towards post-Covid recovery. Henrike Pfannenburg, Head of the ESG Competence Centre in Deutsche Bank’s Corporate Bank, notes more conversations now about the purpose of companies. “We’re seeing ESG factors have a material effect on their relationships with all stakeholders. Furthermore, the pandemic has brought into sharp focus the fact that E, S and G are all interlinked, such as the social impact of pollution or the loss of biodiversity.”

Companies and investors have adopted sustainable goals and KPIs, helped by initiatives such as the EU taxonomy for defining sustainable criteria. Similarly, the United Nations’ Sustainable Development Goals (SDGs) and UN Principles for Responsible Investment (PRI) (now guiding more than US$100trn of institutional assets under management) are pressing the need for meaningful information on how companies plan to reduce their reliance on carbon and improve their diversity.

Data drives performance

These developments, says Kahn, makes 2020 the year of KPIs, taxonomies and standards in ESG as performance is increasingly aligned with a company’s strategic commitments. The amount of data on this has sated investors’ demand for performance, adds Adrian Whelan, Head of Global Regulatory Intelligence, Brown Brothers Harriman. Speaking at Sibos 2020, he said companies are less able to hide behind greenwashing as ESG becomes baked into business as usual. “Simply ‘talking the talk’ can prove damaging for a company as it’s a strategy that can quickly backfire. Institutional investors are increasingly inquiring about the company’s performance, so when we do sustainable finance it has to be credible,” said Whelan.3

The more data there is that evidences companies’ operational ESG impact, the more this helps investors’, according the Deutsche Bank Research team. In Konzept’s Big data shakes up ESG investing4 Jim Reid notes how data has finally given ESG investors a channel through which to incorporate valuable ESG information into their stockpicking decisions and how ESG funds have underperformed the market, enabling investment analysts to translate non-financial ESG information into investible data. “Big data catches out ‘greenwashing’ and provides forward-looking market signals that outperform the market. This is a boon for investors who want to determine how ESG issues affect the fair value of stocks.”

Reid adds that machine learning tools can infer the context of an ESG report after scouring data from more than 1,000 organisations. “When this information is used to determine fair value, using data to generate ‘buy’ and ‘sell’ signals, it generates strong outperformance,” he says. Reid also maintains that big data can help investors wade through the tide of greenwashing and negative press or attention received by companies with complex supply chains, which has an effect on fair value.

“ESG leaders have outperformed benchmarks in the volatile markets, demonstrating that ESG information can improve financial performance”

Investors want more

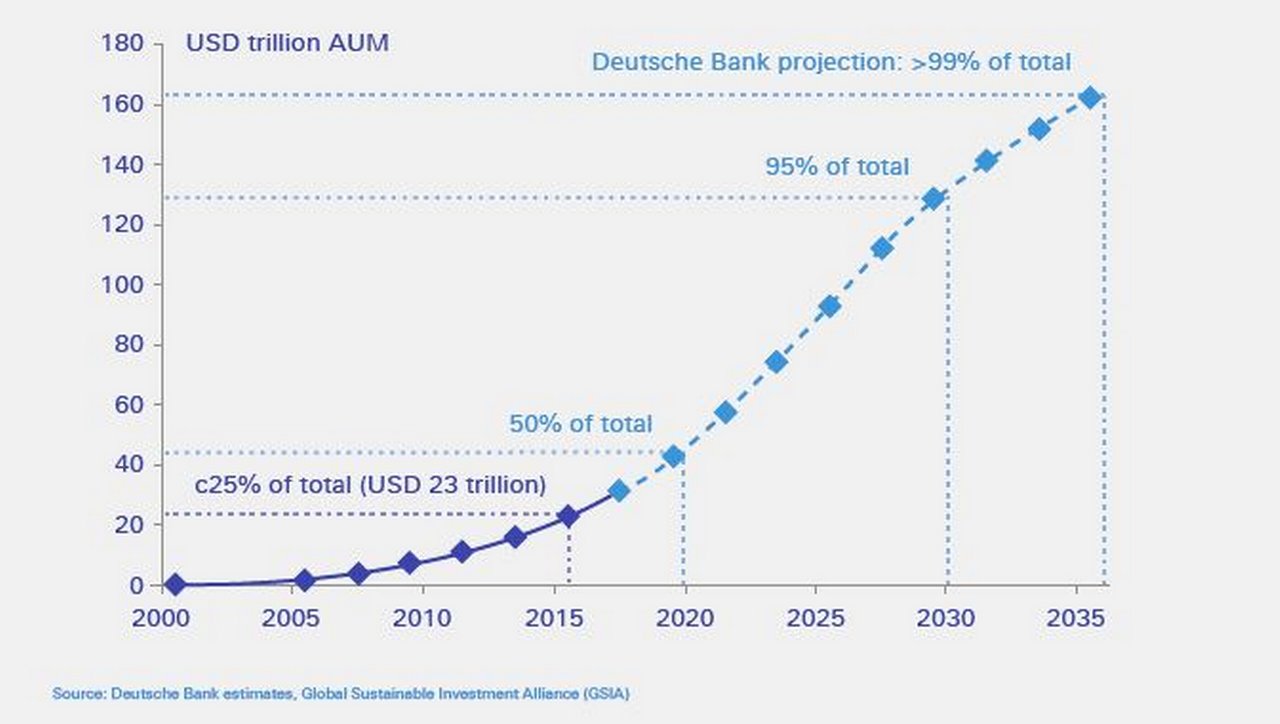

Equity investors are increasingly incorporating ESG tar¬gets into their investment decisions, using them to assess fair value, notes the Big data shakes up ESG investing report. About one-quarter of global assets under management (AUM) are governed by an ESG mandate. Given current growth rates, 95% of AUM, or US$130trn, will have fallen under this umbrella by 2030 (see Figure 1). “As the growth in ESG investing balloons, investors are likely to become far more discriminating if the performance of ESG compliant funds continues to be poor,” notes the report.

Figure 1: Asset under management with an ESG mandate

One of the most important drivers of this trend, says Gerald Podobnik, Head of ESG at Deutsche Bank Corporate Bank is an increasing recognition that ESG investment makes sense; not only to broader stakeholders, but also in economic terms. “There is growing empirical evidence that incorporating ESG-related information into decision-making enhances the risk-return considerations for specific investments. Therefore, investors are increasingly asking for ESG data.”

Podobnik explores the issue further in An ESG lens to identify risk, reminding companies that ESG factors are risks that have to be managed in as they impact investor return. “You cannot ignore them as they can present hard edges for your business,” he says.

Sustainable recovery and outperformance

The availability of this data is one reason why, even in today’s uncertain and volatile markets, investors have not dropped the ball on ESG and are using it as a long-term indicator of a company’s growth. Introducing the latest issue of Konzept, What we must do to rebuild, Reid uses an example of equality to demonstrate the steps companies should take amid increased investor focus. “More broadly, the pandemic has revealed a great range in fortunes for those with and without reliable technology connections. We detail what must be done to achieve a society where connectivity is a fundamental right.”

Elucidating this in Rebuilding better economies and businesses – lessons from luxury, Luke Templeman, Deutsche Bank Research Analyst, notes just how prominently a company’s operations have featured in the minds of customers and investors this year. Firms will have to produce less, avoid waste, and build products that last forever, he says. “In short, companies should: set the new trend; produce less, shop less, shop better; rethink the supply chain; spoil their local customers; reset the distribution footprint; build scale or be small and deal with second hand and rental models.”

In addition, Podobnik notes how investors focus on “S(ocial)” has risen in prominence since the start of the pandemic: both for crisis management and the recovery (such as customer and supply chain management, workplace and employee safety). “This has for example also been expressed in a growing demand for social bonds. Furthermore ESG leaders have outperformed benchmarks in the volatile markets, which once more demonstrates that the integration of ESG information into investment management can improve financial performance.”

Primetals electric arc furnace (© Primetals Technologies)

For this reason, many companies are upping their commitment to ESG with sustainable financing tied to performance. For example, Germany’s auto parts producer Continental leveraged sustainability components for a new €4bn credit line aligned to agreed sustainability performance, and chemicals company Lanxess signed a €1bn revolving credit linked to sustainable conditions including the successful reduction of its greenhouse gas emissions and an increased proportion of women on the top three management levels.5 Technology companies have also transcended ESG principles into their operations. For example, Primetals Technologies recently reached an agreement6 with Deutsche Bank to hedge its currency risk with FX options over a period of four years. Should Primetals fail to meet the agreed sustainability targets, the company must pay a predefined sum to a contractually defined non-governmental organisation.

ESG performs during the pandemic

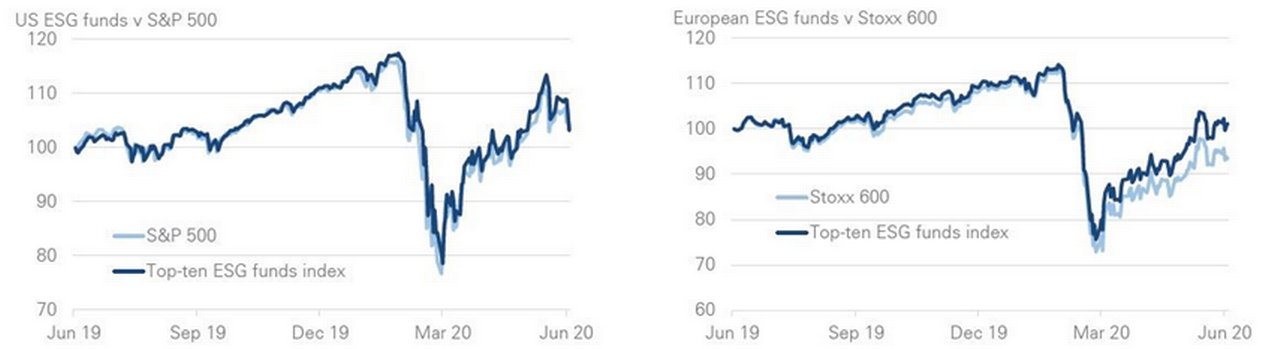

The performance of ESG funds throughout the pandemic has also been encouraging. An issue of Konzept Life after Covid-19 highlighted investors’ increasing attention on ESG, focussing their minds on asset classes they know will produce a good return. The Deutsche Bank Research team’s analysis of four key regions in Bloomberg’s global universe of ESG and sustainability themed ETFs in the US, shows that ESG-themed funds in the US have returned very similar performance to those of the broader market over the period.

The findings indicate that increasingly ESG is judged on the same merit as traditional asset classes. Templeman noted stocks that exhibit a deterioration in their climate change news flow exhibit outperformance when overall share markets are falling. “The theory was that investors care less about “doing good” during a crisis,” says Templeman, adding that in all four regions ESG funds either outperformed or showed equal performance as their respective benchmarks during the stock market crash of March 2020 (see Figure 2). “This gives additional weight to the argument that investors are judging ESG stocks and funds based on their financial merits, rather than an altruistic merit that accepts underperformance.”

Figure 2: US ESG funds track the market, while more diverse European funds outperformed

Source: Bloomberg Finance L.P., Deutsche Bank

Templeman adds that “positive results for ESG stocks during the Covid-19 crisis is an encouraging sign that investors see a focus on ESG as being a signal of a stock’s financial returns”.

“Whether you're a sceptic or not, that outperformance certainly draws you in to at least find out what's going on”

More than just a cost

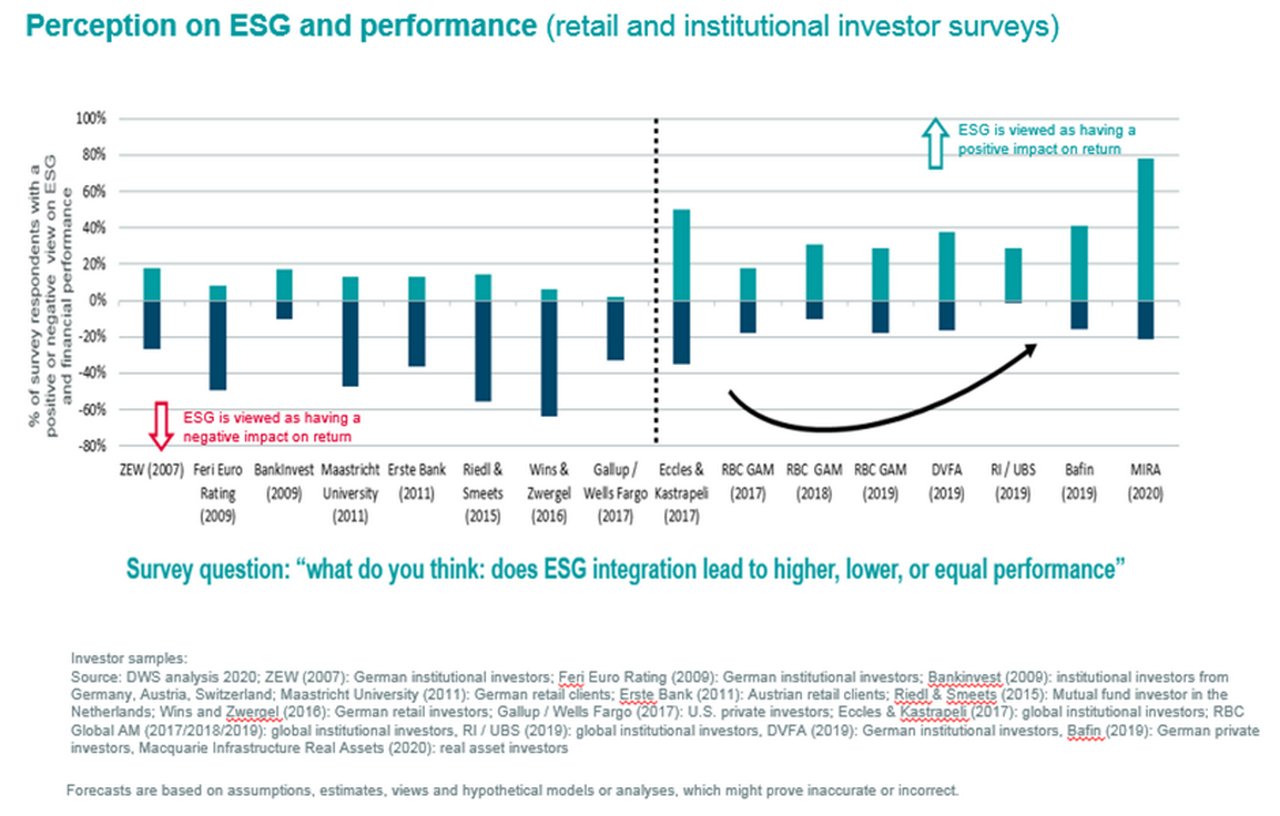

Assessing the evidence between ESG and financial performance, DWS’s Lewis shows how the investor perception towards ESG has changed dramatically over the past few years (see Figure 3). He identifies 2017 as the year when more investors came to believe that ESG integration can lead to higher financial performance than those believing that ESG integration leads to lower performance. “When asked, an increasing majority of investors are seeing ESG as a benefit as a positive impact on return, rather than a cost,” he says.

Figure 3: Investor perception on ESG is changing

Source: DWS Investment GmbH (November 2020)

Covid-19 has “accelerated that perception”. “If you look at the ESG indices and the performance of those ESG ETFs and products, they have significantly outperformed their traditional benchmarks,” says Lewis. ESG indices were underweight in energy, which helped them during the oil market share battle between Russia and Saudi Arabia in Q1 20207 and they were overweight in healthcare and technology. “There’s evidence that the better quality names from an ESG perspective were outperforming while non ESG funds saw huge outflows.”

Measuring performance with the 4Rs

Lewis identifies four trends (4Rs) that have informed the science of ESG investing:

- Risk which investors are re-pricing. For example, there's a perception that fossil fuel assets are riskier now, and Covid-19 implies oil demand may have peaked already, which mean further write downs, more dividend cuts and additional capex impairment all of which impacting returns.

- ESG stocks have outperformed others in terms of return, “so whether you're a sceptic or not, that outperformance certainly draws you in to at least find out what's going on because of that performance”.

- A company’s reputation on race, diversity and other social issues have also influenced investors’ perception of return. “Corporates should be thinking in terms of creating value together with other stakeholders. The executives who manage the firms create value not only for capital providers, but also for customers, suppliers, employees, and/or communities,” says Lewis.

- Recovery, aided by government stimulus, has positioned energy efficient projects such as renewables as good job creators when deploying capital. “Companies are creating three times as many jobs in energy efficiency per US$1 million of spend than in the fossil fuel sector,” says Lewis. “Today, ESG is seen as the solution to job creation and getting us out of the mess and at the same time it’s compatible with climate action. There are positive return implications.”

In How Covid-19 could shape the ESG landscape for years to come8 Lewis and his team consider the integration of social issues into the investment process. They cite research from JUST Capital9, whose annual list of 100 of America’s most just companies showcases not only how they are prioritising stakeholder capitalism but have gone above and beyond to support their workforces over the past year. “Looking at the average JUST 100 company we see significant alpha relative to the average company in the Russell 1000 universe (see Figure 4),” says Lewis.

Figure 4: Sustainable companies outperform the market

These four trends play advocate to the stakeholder economy and the basis on which corporates are being judged. But is there a science to it in terms of investing? Lewis believes there is, at least for those companies that publish information material to the period of operation. For example, an oil and gas company can talk about a high carbon asset portfolio and what it's doing to change its strategy around those sort of issues, which is significantly material to financial performance. “It’s about showing that you’re part of the solution, not publishing data about the problem,” he concludes.

Deutsche Bank research publications referenced

What we must do to rebuild, Konzept magazine by Jim Reid and Luke Templeman (November 2020)

Stakeholders and shareholders, by Michael Lewis and Murray Birt (September 2020)

Life after Covid-19, Konzept magazine by Luke Templeman (June 2020)

How Covid-19 could shape the ESG landscape for years to come by Michael Lewis and Murray Birt (April 2020)

Big data shakes up ESG investing, Konzept magazine by Jim Reid and Jan Rabe (October 2018)

Sources

1 See https://bit.ly/39bprK at dws.com

2 See https://nyti.ms/2J8RL4Q at nytimes.com

3 See also ESG on the ground at flow.db.com

4 See https://bit.ly/39b3tad at dbresearch.com

5 See https://bit.ly/378lXW6 at lanxess.com

6 See https://bit.ly/396FKbg at db.com

7 See https://bit.ly/3nUTY3g at oilprice.com

8 See https://bit.ly/3nTbTaw at dws.com

9 See https://bit.ly/35YjWwm at justcapital.com

Corporate Bank solutions Explore more

Find out more about our Corporate Bank solutions

solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

Sustainable finance {icon-book}

The price of CO₂ The price of CO₂

Carbon pricing is essential to combat climate change as it incentivises companies to reduce greenhouse gas emissions. flow’s Desirée Buchholz looks at how regulatory initiatives in the EU could impact global investment flows – and the role voluntary carbon markets play in reaching net-zero commitments

SUSTAINABLE FINANCE

Building ESG investor frameworks Building ESG investor frameworks

As the pursuit of alignment with ESG considerations is increasingly shaping investor fund management strategies, flow talks to Deutsche Bank’s Global Head of ESG for Company Research Debbie Jones on what this means for market sector analysis and how regulation is shifting capital towards more sustainable investment objectives

Macro and markets, Trade finance and lending

Post-Brexit TCA: fit for purpose? Post-Brexit TCA: fit for purpose?

flow reports on responses to the long-awaited EU-UK trade deal, concluded just days before the transition period expired on 31 December 2020