23 October 2020

As climate change voices shout louder than ever, flow reports on how engagement in society could turn the tide with examples of recent transactions, reflects on further Sibos 2020 ESG discussions, and highlights Deutsche Bank Research findings on blockchain as a sustainability enabler

On 4 October 2020, streaming channel Netflix published a documentary film by celebrated naturalist Sir David Attenborough. Unlike many of his nature programmes, A life on our planet is a mission statement in which the 94-year old reflects upon both the defining moments of his lifetime and the devastating changes to the ecosystem he has seen. “The living world is a unique and spectacular marvel. Yet the way we humans live on earth is sending it into decline,” he says.

Sir David mourns the destruction of biodiversity from industrial progress. He predicts that rather than permanently kill nature (which can regenerate over time), this will kill the human species who depend on the planet’s food sources and its protection by absorbing carbon dioxide and lethal methane gas. He provides a snapshot of global nature loss in a single lifetime as the camera pans over coal-fired power plants spewing these substances into the atmosphere.

Yet with this alert comes a powerful message of hope for future generations as he reveals the solutions that could help save the planet from disaster. Plant-based diets, reducing coal-fired power plants, halting deforestation and using more renewable energy sources are some of his recommendations. He also takes carbon-heavy industries, and the banks that finance them, to task for not doing more.

Fittingly, Sir David’s mission statement chimes with the increasing focus on climate change as environmental, social and governance (ESG) themes ascend the boardroom agenda. Battered by accounting scandals, incidents of negligence leading to oil spills, toxic chemicals released in the environment, and unforeseen devastating side effects of drug trials, corporates seized the opportunity win back stakeholder trust by integrating ESG into non-financial reporting statements.

This article takes the pulse of ESG’s impact, the levels of engagement in society to transform towards a more sustainable future and how new data-driven technology such as blockchain can help in the reduction of ‘greenwashing’ by driving transparency.

Covid-19 accelerates sustainability agenda

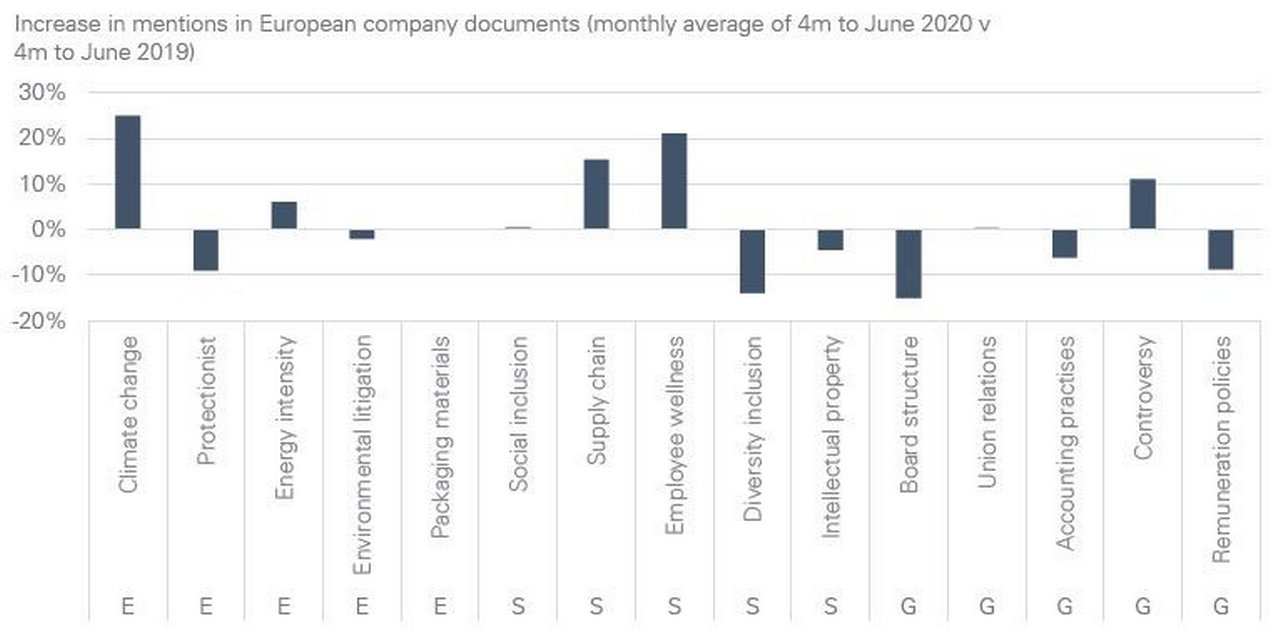

The disruption caused by Covid-19 has reframed society’s focus on what is important as it moves towards a sustainable recovery. In ESG grows up during the pandemic, flow analyses Deutsche Bank research, which finds the global nature of the pandemic and the disruption to economies and society at large, has transported sustainability into a new phase and people approach it with a different attitude. Analysing investor sentiment and board room data, the team found that climate change is still a top priority for corporates (see Figure 1) as companies discuss how to ensure their investment in the economic recovery is as ‘green’ as possible.

Figure 1: Climate change increases in visibility during the pandemic

Source: AlphaSense, Deutsche Bank

Gerald Podobnik, Head of Sustainability and CFO at Deutsche Bank Corporate Bank reflects on the momentum following after the initial Covid disruption. “Quite quickly after we saw that the political pressure (for sustainability) is not going away. On the contrary, this might even intensify, because if we learned one thing from the crisis it’s our economies’ lack of resilience. This, in addition to the overall pressure to combat climate change, and the recovery programmes mean you have a clear ESG element.”

With the Paris Climate Agreement, the supplementary One Planet Summit in 2017 and the European Commission’s Sustainable Finance Strategy, and the EU taxonomy setting sustainability standards1, corporates are employing their own sustainability targets and key performance indicators with a set of criteria governing how they operate within a sustainable framework.

This pressure for change won’t let up as Podobnik notes that sustainability has moved beyond the PR exercise. In a flow podcast, he says that substantial changes are required for both infrastructure and for the economy in order to effectively combat climate change. “I think there is widespread acceptance that beyond the potential short term financial impacts, there is the long term risk impact and strategic imperative that will define the licence to operate,” he adds.

Moving sustainability forward

In addition to integrating sustainability into their reporting many corporates are employing sustainability metrics and products to show how they make a difference. Podobnik believes more engagement could support the magnitude of the innovation and investments required to lead to wider transformation.

“When a company really puts sustainability into practice, it will, for example, reduce its CO2 emissions. This can be done through better filter systems or by sourcing sustainably generated energy. These investments can be expensive at first glance but that’s what we banks are there for – to offer our clients products so they can afford these investments more readily,” he says.

To support this transformation in business and societies in the next 10 years, banks are recognising a responsibility to do their part as actors in the market, to provide advice to clients on financing and equip them to position their efforts with investors. Again, Podobnik believes this type of transformation can only be effected through engagement that incentivises corporates to behave sustainably. “Our job as a bank is to offer our clients sustainable financing options and solutions that address the obvious problems.”

To incentivise good behaviour through appropriate products the bank has committed to €200bn of sustainable financing and investing activities and has updated its Fossil Fuel policy for financing and capital markets activities as well as its Climate Statement2, and an inaugural Green Bond3. “To give an example, if a customer needs a loan, we can offer them the option of linking the loan to specific ESG targets,” says Podobnik. “If the agreed targets are achieved, the interest rate on the loan is a few basis points lower. It’s really a win-win situation – especially for the client.”

He adds that new sustainable methods and technologies employed by these companies also create jobs. “Sustainability inevitably leads to innovation, and innovation creates new jobs. This is often not factored in, but it is of immense importance.”

As companies pivot towards sustainable investments, a better understanding of their sustainability criteria is to be welcomed. As Podobnik says, “any bank can lend money but real transformation happens when lenders engage with those companies to understand their business models and offer sustainable solutions that contribute to the transformation.”

"Real transformation happens when lenders engage with companies to understand their business models and offer sustainable solutions"

Transformation, not destruction

These sustainability criteria are increasingly geared towards combatting negative publicity facing carbon intensive industries as they demonstrate how they are moving towards net zero and earn the trust needed to move society forward. Podobnik says: “It is time to move towards real engagement and focus on and welcome improvement, towards respect for these companies’ complexities for realities and for investments in the right direction towards transformation, not destruction.”

He cites the example of BP, which is on a transformation journey from an international oil company to become an integrated energy company. Setting out its new strategy in August 2020 BP outlined a transition from fossil fuels to renewable energies, and set a goal of becoming net zero by 20504.

“Shouldn't we truly engage with those industries, really dig deep and understand their situation, and respect that those companies employ people who play a role in communities?” asks Podobnik. “And in today's economy, sustainable finance can contribute to transformation in many ways.”

Sustainable finance in action

In the past year banks have been putting their sustainable financing products to work in transforming the agenda. Deutsche Bank groups them into two categories: use of proceeds products and KPI-linked products. Use of proceeds products such as green bonds and green loans are used by issuers and borrowers, who promise to use the proceeds from a financing transaction exclusively for predefined sustainable purposes. For KPI-linked products, such as ESG linked bonds, loans or sustainability-linked bonds loans the bond issuer or borrower pays less/ more interest on a financing transaction depending on whether or not sustainability linked metrics, or KPIs, are met.

In Enel’s case, the Italian utility was the first corporate to issue sustainability-linked bonds (SLB) in 2019 and recently issued the very first GBP denominated bond, on which Deutsche Bank acted as joint bookrunner, with coupon subject to a step-up in the event the company fails to reach its Installed Renewable Capacity target of 60% by 20225.

This financing aligns with the company’s adoption of a sustainable and integrated business in 2015, linked to global decarbonisation and electrification trends. In its latest 2020-2022 strategy, Enel focuses on the achievement of the UN Sustainable Development Goals (SDGs) throughout the entire value chain, placing the SDG 13 initiative (Action to combat climate change) at the centre. This engagement on financing linked to these goals is helping to make Enel a more sustainable company, with a lower risk profile.

Image credit/source: Enel

The Chañares plant has an installed capacity of 40 MW and can generate up to 94 GWh per year. Construction work on the plant, which is located in Chañaral, began in 2014.

Growing engagement

Corporates are acknowledging that they can access financing more easily by demonstrating similar sustainable KPIs and policies. At a EuroFinance event for corporate treasures and company CFOs in September 2020, publishing and education group Pearson shared how they had seen the benefits of following sustainability targets and KPIs. James Kelly, Group Treasurer shared that an ESG wrapper on a product could produce a win-win situation for both the investor and the planet. He added that sometimes being innovative can also reduce the cost of capital and projects that might formerly have been marginal become more attractive.

The win-win of sustainable finance and applying good ESG standards doesn’t necessarily mean corporates taking a financial hit. Kelly provided an insight into how Pearson embarked on its own sustainability journey. He said this had initially included ESG KPIs in its revolving credit facilities so that the ESG element “wasn’t too intimidating”. Pearson had streamlined itself as a pure-play education company and repaid its debt. Over the summer it returned to the capital markets for the first time in four years with a £350m social bond, whose proceeds will be used for online learning targeted at children from less privileged backgrounds.

The company recently issued a social bond, which was more than nine times oversubscribed. Kelly said that while the company has further to go in its sustainable finance journey, the “buy-in we got internally and from investors” for its recent social bond in a market affected by the pandemic, was very encouraging – and good news at a time when few of the headlines are positive.

Exploring the notion that sustainable finance rewards sustainable business practices, flow also reported how in November 2019 Germany’s Continental found innovative ways to leverage sustainability components for a new €4bn credit line arranged syndicated to 27 relationship banks aligned to agreed sustainability performance. In Supporting clean mobility, Clarissa Dann reflects on Continental’s investment in greener mobility – including innovating through electric drive controls – and the financing it structured to make this possible.

Head of Finance and Treasury Stefan Scholz explained: “By combining sustainability improvements with our new credit line, we have found an innovative way in corporate finance to further advance Continental’s sustainability strategy.” This includes, for example, procuring electricity externally from renewable sources.

In another development, Cologne-based speciality chemicals company Lanxess signed a €1bn revolving credit linked to sustainable conditions. The facility is co-ordinated by Deutsche Bank and Unicredit and depends, among various features, on the successful reduction of its greenhouse gas emissions and an increase in the proportion of women on the top three management levels. The facility was announced one month after the company said it would go climate neutral and eliminate its greenhouse gas emissions of currently around 3.2 million metric tons of CO2 by 2040. “With the 'sustainable' revolving credit facility, we are also underlining our commitment to achieving our ambitious climate targets,” said CFO Michael Pontzen in a press release6.

The triple bottom line

These examples of engagement reveal a growing trend among corporates to move away from viewing sustainable goals in isolation when engaging stakeholders. At Sibos 2020, the barometer event for banking and technology’s role in society, ESG and sustainability were seen as mainstream performance indicators of not only corporates but the financial institutions that bank them. It was clear how different the Sibos 2020 ESG conversation was to that of previous years – there was no room for “greenwashing” – ESG is becoming baked into business as usual.

It was simply put by Florence Fontan, Head of Company Engagement & General Secretary - BNP Paribas Securities Services, in the session The triple bottom line as a driver for sustainable business and a better world (8 October) who said that: “The beauty of sustainability linked loans and bonds is that they enable companies to define ambitious KPIs and any company with a strong sustainability trajectory can access funding. The sheer amount of data now available makes greenwashing a dangerous thing to do as very soon you’ll be caught out.”

During this session, banking experts described the European agenda on taxonomy as a crucial and mandatory disclosure as essential – a common, harmonised set of rules can provide a common, harmonised set of data to look at sustainability through the lens of better business. This is to be welcomed, said Adrian Whelan, Head of Global Regulatory Intelligence, Brown Brothers Harriman. “The sheer amount of data now available makes greenwashing (using ESG as a PR exercise) a dangerous thing to do as very soon you’ll be caught out. Simply ‘talking the talk’ can prove damaging for a company as it’s a strategy that can quickly backfire. Institutional investors are increasingly inquiring about the company’s performance, so when we do sustainable finance it has to be credible.”

"When we do sustainable finance it has to be credible"

In Deutsche Bank’s fourth day of the festival of finance run alongside Sibos, Kamran Khan, Head of ESG Asia Pacific at Deutsche Bank Corporate Bank, explained that 2020 is the year of KPIs, taxonomies and standards in ESG. He shared his top questions for a business to ask itself: What is your risk appetite and what enhances your business environment? How do your products make an impact? And how must you change them with the relevant KPIs to measure their impact?”7

Better banking, better lives through data

At Sibos, delegates heard how data could facilitate the move from a high-carbon economy to one that’s zero-carbon, making it both technically and economically possible. Reliable data is integral towards this goal, so disclosures are important. The use of advanced technology and data-driven analysis can address some of the world’s most pressing problems added Bill Borden, CVP, Worldwide Financial Services, Microsoft in a session entitled Better banking, better lives (8 October). Borden gave three specific areas in which AI and advanced analytics can have an impact:

- Poverty and stability: AI and machine learning can be utilised in reducing poverty; for example in accurately predicting where and when a famine will occur.

- Equity and inclusion: technology can level the playing field, while AI ensures that data is treated confidentially.

- Environmental: the Covid-19 pandemic is an environmental wake-up call. Tech innovations can provide real-time data, helping to differentiate genuine green assets from brown.

Putting responsible AI principles into practice can build confidence and trust among both customers and regulators, he added.

Blockchain as a sustainability enabler

Another unexplored use of technology as an enabler of sustainable transformation is blockchain. Deutsche Bank Macro Research analysts Marion Laboure and Jim Reid identify capacity for the technology to revolutionise corporate structure and earn customer and investor trust. Their research report titled Blockchain and Corporates: Transparency is the New Marketing8 notes that beyond the uses in banking, blockchain can be used in an array of businesses to “build trust with customers, and help organisations improve transparency and become more decentralised.”

Interviews with senior executives of major consumer goods businesses, emerging start-ups, and new blockchain companies found that transparency is key to a company’s relationship with its stakeholders in terms of how its products are made. 37% of those interviewed said they would switch to a company who provided more product information and that consumers were open to using digital channels to find the information they need.

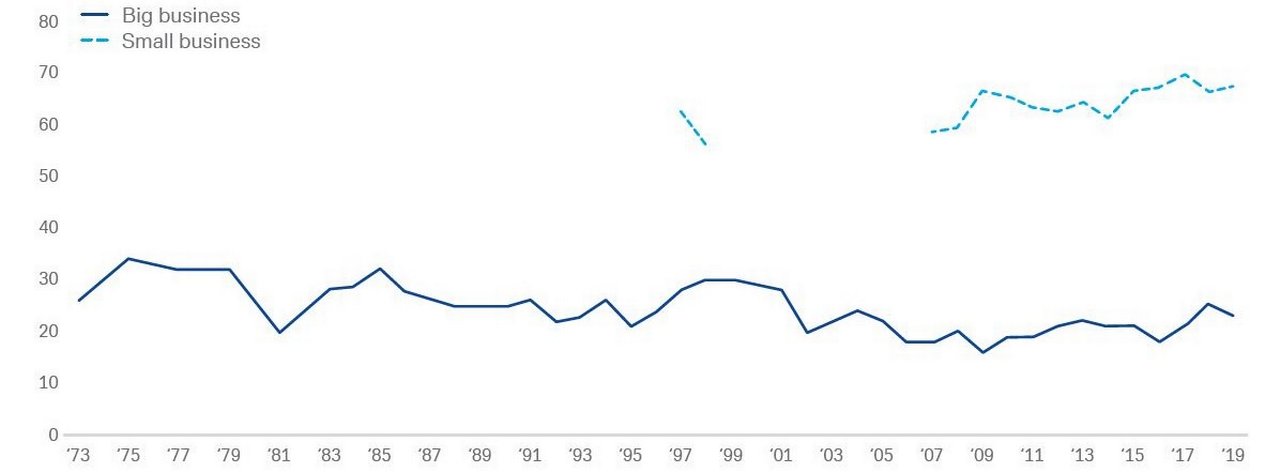

While customer “trust” can be a subjective topic, the data show that less than one in four Americans trust big companies (see Figure 2). By comparison, over two-thirds trust small companies. Consumers, particularly in younger demographics, increasingly value authenticity, local roots, quality, and customised products. These consumer trends frequently exist in tension with the massive and obscure supply chains used by large corporations.

Figure 2: How Americans trust small and big businesses

Source: Gallup

Note: percentage of citizens who have a great deal/quite a lot of confidence in large vs. small businesses.

Here, distributed ledger technology (DLT) can help, suggest the report’s authors. “Corporates can use DLTs, and specifically blockchain, to connect with customers and help large organisations increase transparency and improve the quality control of their products,” they write. “As a result, large corporates can begin to bridge the “trust deficit” they have with customers, and reduce the risk of product failures and scandals.”

In the report Laboure and Reid include a case study about Nestlé to show how the company is using blockchain to share local sourcing information and the final section offers recommendations for how corporations should implement DLTs.

The benefits of using blockchain for decentralised supply chain management are manifold including a transparent ledger system that can trace every product movement; real-time tracking and quality control of any material within the system; and reduced costs as it removes middlemen, offers greater accuracy, and eliminates counterfeit products.

Other uses of blockchain have been cited to improve transparency in capital markets, notably securities trades. Mike Clarke, Deutsche Bank’s head of product management, EMEA, Securities Services explained how a DLT proof of concept in 2019 could enable transparency in identifying underlying beneficial owners of securities driven by the Shareholder Rights Directive II. Traditionally this information has not been shared nor held within sub custodians because of the governance around privacy about information. “DLT allows us to tackle that and store beneficiary information so it's only visible to our client, and then is anonymised for our internal processing. This allows us to cover that area of data privacy,” said Clarke.

From here to there

While the Covid pandemic has accelerated ESG to the top of the society’s agenda, it remains to be seen what shifts are needed to effect complete transformation. At Sibos, delegates questioned whether government intervention, similar to that delivered in 1948 by the US Marshall Plan, could be sustainability’s white knight. But in The triple bottom line as a driver for sustainable business and a better world session, banking experts agreed that it is wider than the regulation and that engagement is the key to transformation.

“By every rationale if you still want to be a profit-making company by then you will need to have incorporated sustainability,” said BBH’s Whelan. “There might still be a few cynics in the market but unless they change their mindset they’ll be out of business in 2030.”

Fontan agreed and added: “Sustainability is becoming mainstream and that starts with consumers and investors. If your company doesn’t join in you’ll become outdated. The pandemic has accelerated the trend and created a bigger appetite for ESG funds. Sustainability finance can help that acceleration and also to channel investment.”

Summary of Deutsche Bank Research reports referenced

Blockchain and Corporates: Transparency is the New Marketing (October 2020) by Marion Laboure and Jim Reid

dbSustainability - ESG through the pandemic (1 July 2020) by Luke Templeman, Jim Reid, Karthik Nagalingam

Sources

1 See https://bit.ly/31rG27Z at europa.eu

2 See https://bit.ly/2TiyDmO at db.com

3 See https://bit.ly/37vGHJq at db.com

4 See https://on.bp.com/2HlhvKx at bp.com

5 See https://bit.ly/31wkOGa at spglobal.com

6 See https://bit.ly/2HgeL1z at lanxess.com

7 See https://bit.ly/3dLY3mp at youtube.com

8 See https://bit.ly/34ka3bB at dbresearch.com

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published published annually and can be read online and delivered to your door in print

YOU MIGHT BE INTERESTED IN

CASH MANAGEMENT

Supporting clean mobility Supporting clean mobility

In December, German automotive component producer Continental agreed a €4bn revolving credit facility with a 27-bank syndicate aligned to sustainability performance. flow’s Clarissa Dann on how the company is navigating Covid-19 and a Tesla-disrupted market place

TRADE FINANCE, FLOW CASE STUDIES

Sustainable latex from Cameroon Sustainable latex from Cameroon

Allegations related to environmental and social issues in Halcyon Agri’s Cameroon rubber plantations attracted headlines until they were addressed through its Corrie MacColl subsidiary. flow´s Clarissa Dann reports on how sustainable finance helps the firm set

MACRO AND MARKETS, DOSSIER COVID-19

How ESG grew up during the pandemic How ESG grew up during the pandemic

The Covid-19 crisis is refocusing the way investors view environmental, social and governance measures, reshaping their purely altruistic intentions towards performance based metrics. Corporates’ priorities have also changed since the pandemic began.