17 July 2020

The Covid-19 crisis is refocusing the way investors view environmental, social and governance measures, reshaping their purely altruistic intentions towards performance based metrics. Corporates’ priorities have also changed since the pandemic began. flow’s Janet Du Chenne looks at the drivers of these shifts in attitudes and what shape ESG will take in the new normal

When former US energy company Enron filed for bankruptcy in December 2001, it unearthed one of the largest accounting scandals in corporate history. A sophisticated web of loopholes, special purpose entities and poor financial reporting hid billions of dollars in debt from failed deals and projects. The scandal was cited as the biggest audit failure1, brought to light by the dotcom bubble burst2, which also uncovered improper accounting at WorldCom in 20023.

As a consequence, the Sarbanes-Oxley Act of 20024 enforced improvements in the accuracy of financial reporting for public companies and mandated increased penalties for destroying, altering, or fabricating records in federal investigations or for attempting to defraud shareholders.

Almost two decades later amid a very different crisis, accounting practices have ascended to the top of the priority list as one of the environmental, social and governance (ESG) factors measuring the sustainability and societal impact of an investment in a company or business.

In dbSustainability, Deutsche Bank Research’s new offering for ESG investors, a report titled ESG through the pandemic5 shows that since the Covid-19 outbreak, corporates are typically 38% more focussed on accounting practices than they were at the start of the pandemic. Its author, Luke Templeman, an analyst in Deutsche Bank’s Thematic Research team notes that “crisis events have a habit of weeding out accounting problems that could be kept under wraps during good times.”

Just as the dotcom bubbled sparked a deep dive into the goings on at Enron and WorldCom, the 2008 financial crisis shone a light on accounting and audit mismanagement of some banks and Japan’s 2011 earthquake and tsunami helped unveil accounting problems at Toshiba6. The coronavirus has brought to light similar scandals, with China’s Luckin Coffee receiving a delisting notice from Nasdaq7 after failing to file its annual report and reportedly inflating sales figures.

Growing through crisis

Each crisis has nurtured the journey of governance statements into company reports and accounts forcing companies to adapt good corporate governance through transparency. The notion of corporates ‘doing good’ became a topical board room discussion post-Enron and, following British Petroleum’s Deepwater Horizon oil spill in the Gulf of Mexico8 in 2010, environmental and social joined governance to form a collective trio of measures embraced by companies. In the past decade they have begun integrating ESG into their reporting to demonstrate to investors and stakeholders their more ethical behaviour.

A deeper understanding of ESG between issuers and investors followed, with the wider capital markets community throwing its weight behind supporting ESG reporting and communication with global frameworks and reporting formats. In 2018 the London Stock Exchange analysed how investors’ use of ESG information was changing and published guidance9 to help issuers understand what ESG information they should provide and how they should go about providing it.

Auditing groups played their part. PwC sought to bridge the divide between investors and corporates on ESG reporting. They explained investors’ need to understand a company’s long-term value creation plan and receive credible, standardised information to support long-term risk assessments while ensuring corporates – even those with good ESG stories to tell – were giving investors the right information in the right format10.

KPMG went a step further11, with survey-based research showing how regulation is having clear impacts on investor decision making. Under EU requirements, such as the new Disclosure Regulation EU/2019/2088, by the end of 2020 investment managers will have to disclose how they have integrated sustainability risks into their investment decision-making processes. They showed how investors are using ESG disclosures, the likely impact on credit ratings and how possible changes in investment strategy could occur as a result of the focus on ESG.

"Crisis events have a habit of weeding out accounting problems that could be kept under wraps during good times"

ESG enters a new phase

Given the global nature of the pandemic and the disruption it has caused in economies and society at large, ESG is entering a new phase and people approach it with a different lens, according to Deutsche Bank Research. Their analysis of how ESG has changed and performed since the onset of Covid-19 is based on data from AlphaSense, Bloomberg, FactSet, and the Global Impact Investor Network (GIIN).

Using the AlphaSense system to track the extent to which corporates are discussing various ESG issues and the number of public documents (including filings and ESG reports) and their matrix containing the five most relevant issues from each category of environmental, social and governance, the research team deduces that corporates’ ESG priorities have changed in response to the pandemic.

The top five ESG topics are:

- Employee wellness;

- Accounting practices;

- Climate change;

- Corporate supply chains; and

- Social inclusion.

The people agenda has ascended the list, with US data showing the focus on employee wellness was up 48% (see Figure 1). Other ESG topics that have increased in prominence are 'supply chains' (up 18%) and 'social inclusion' (up 16%). Surprisingly, comments Templeman, “given how the pandemic has shown just how fragile the world’s supply chains can be, it is somewhat unexpected that managers have only increased their discussion of corporate supply chains by 18%.”

Figure 1: Employee wellness is now the hottest topic in the US

Source: AlphaSense, Deutsche Bank

While these topics have supplanted climate change as the hottest ESG themes, people have not forgotten about decarbonisation. The Deutsche Bank Research report notes this topic has increased in visibility over the course of the pandemic (see Figure 2) as companies discuss how to ensure their investment in the economic recovery is as ‘green’ as possible. “It seems highly likely that the focus on climate change and inequality, particularly at the World Economic Forum, has led to the increased visibility discussion at a corporate level,” says Templeman.

Figure 2: European corporates have not forgotten about climate change

Source: AlphaSense, Deutsche Bank

Similar issues are emerging in Europe, with ‘employee wellness’, ‘climate change’ and ‘supply chains’ representing the biggest increase in discussion since the outbreak of the virus.

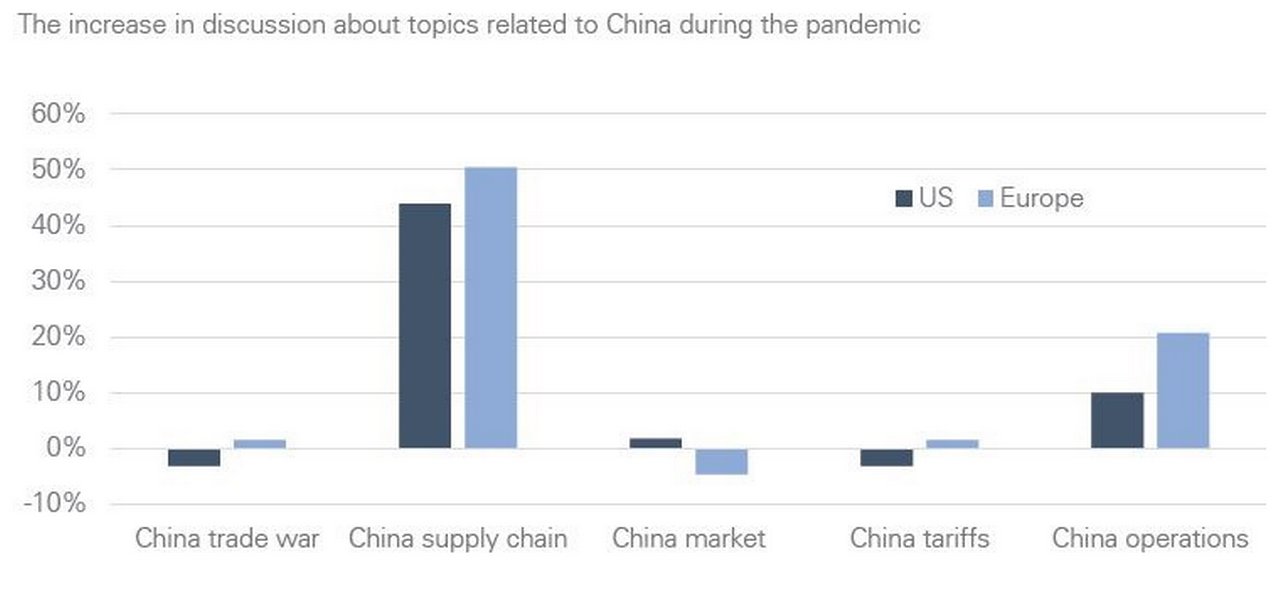

Throughout the pandemic, there has been regular discussion about how US and European corporates might adjust their China strategy following the pandemic (see Figure 3) with debates around China supply changes having increased by 40-50%. By far the biggest increase in talks on China-related topics has been what to do about supply chains. That is only accelerating the trend towards local manufacturing, notes the report.

Figure 3: Business discussion about China jumps

Source: AlphaSense, Deutsche BankComplicating the issue of China supply chains is that many US and European companies have operational investment in China that produces for the local markets and generates a material portion of their earnings. “For example, the auto production that takes place in China is almost entirely for domestic consumption,” notes the report.

Change in investor sentiment

Investors have also changed the way they look at ESG, according to the report, with analysis showing that investors have severely curtailed their investment into ESG funds over the past three months.

A further analysis of the Global Impact Investing Network’s 2020 investor survey during the pandemic shows that overall, investors will increase their investment in ESG by two per cent this year. That is down sharply from last year when investors expected to increase investment by 13%. While just over half of investors intend to maintain their planned activity for 2020, 15% expect to increase their allocation and 20% will decrease it (see Figure 4).

Figure 4: Investors will change their ESG activity

Source: Global Impact Investing Network

The group of ESG investors plans to invest less in emerging markets than in developed markets. Currently, 45% of assets under management are allocated to the developed markets of North America and Europe. Meanwhile, 12% resides in Latin America and the Caribbean, while 11% sits in Sub-Saharan Africa.

ESG funds rebound during Covid-19

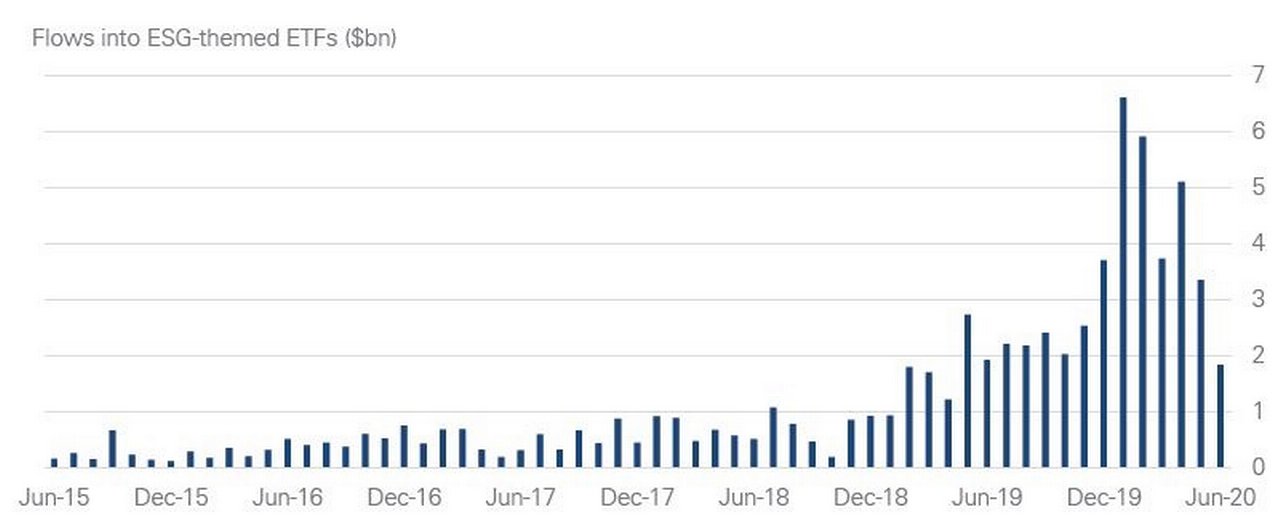

With the Covid-19 pandemic focussing investors’ minds on asset classes they know will give them a good return, it is encouraging to see ESG-themed Exchange Traded Funds (ETFs) have rebounded from the crash in equity prices at the beginning of March. Bloomberg’s global universe of ESG and sustainability themed ETFs, comprising 377 funds12 shows regained momentum (see Figure 5).

Figure 5: Following outflows in March, ESG ETFs regain momentum in June

Source: Bloomber Finance L. P., Deutsche Bank

But investors have become far more cautious and inflows into ESG-themed ETFs has dropped (see Figure 6).

Figure 6: Investor’s more cautious about ESG-themed ETFs

Source: Bloomber Finance L. P., Deutsche Bank

European investors have curtailed their flows into ESG-themed funds by two-thirds over the course of the virus outbreak. Global funds (those that benchmark to a global index) have seen investor flows drop four-fifths, while in Japan funds have started to see net outflows. The outlier is the US. At the beginning of the virus outbreak, the flow of money into ESG-themed funds dropped by half; however, it has since recovered to the level it sat just before the outbreak.

With new concerns such as the dependence of many corporate supply chains on single countries and sources growing since the crisis, there are worries as to how those themes will now be incorporated into ESG analysis. “This factor will no doubt rise in importance in ESG analysis and may unexpectedly result in certain companies being upgraded or downgraded,” notes the report.

Performance remains encouraging

While investors have been reluctant to increase their allocations to ESG funds, their performance throughout the pandemic has been encouraging. The Deutsche Bank Research team’s analysis of four key regions in Bloomberg’s global universe of ESG and sustainability themed ETFs in the US, Europe, Japan, and global, paired with its own index of the 10 largest ESG funds in each region shows a notable difference in the performance of US-focused funds relative to funds in Europe and Japan.

ESG-themed funds in the US have returned very similar performance to those of the broader market during the pandemic. The simple explanation for this is that the top holdings of these funds – Microsoft, Apple, Amazon and Facebook - are broadly similar to those of the market, notes Templeman. These top-10 holdings in ESG ETFs comprise between 25% and 32% of each fund – the top-10 holdings of the S&P 500 comprise 29% of the index. The performance of ‘global’ ESG funds has been relatively similar to the MSCI World Index but these funds have a different composition.

The findings indicate that increasingly ESG is being judged on the same merit as traditional asset classes. Compared to last year’s analysis, stocks that exhibit a deterioration in their climate change news flow exhibit outperformance when overall share markets are falling. “The theory was that investors care less about “doing good” during a crisis,” says Templeman, adding that in all four regions ESG funds either outperformed or showed equal performance as their respective benchmarks during the stock market crash of March 2020 (see Figure 7). “This gives additional weight to the argument that investors are judging ESG stocks and funds based on their financial merits, rather than an altruistic merit that accepts underperformance,” adds Templeman.

Figure 7: US ESG funds track the market, while more diverse European funds outperformed

Source: Bloomberg Finance L.P., Deutsche Bank

Templeman adds that “positive results for ESG stocks during the Covid-19 crisis is an encouraging sign that investors see a focus on ESG as being a signal of a stock’s financial returns”.

Green bonds’ upward trajectory continues

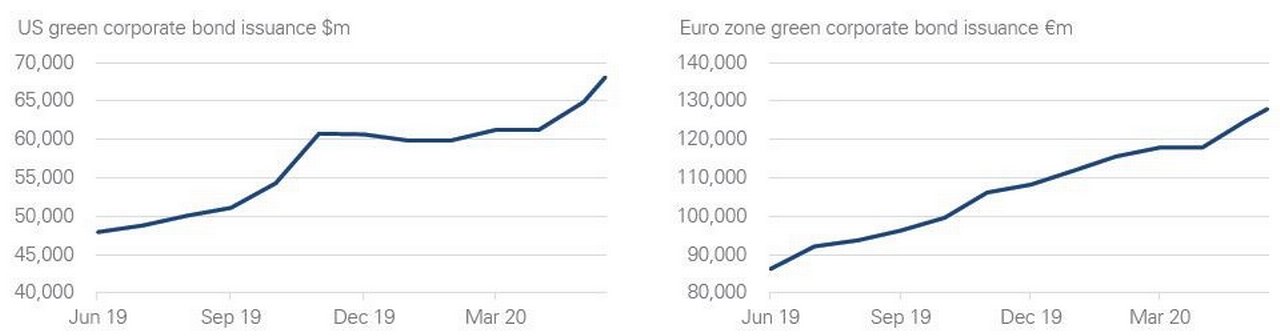

The research report notes that while Covid-19 has curtailed the issuance of green bonds, with 2020 issuance so far running at a third of last year’s level, the market has begun to recover and the outbreak represents only a temporary roadblock on the otherwise upwards trajectory (see Figure 8). Demand for green bond issuances continues, with Deutsche Bank leading on three new issuances in one week in July 202013.

Figure 8: Corporate green bond issuances recovers in the US and in Europe

Source: Bloomberg Finance L.P., Deutsche Bank

Corporate green bonds are still a small proportion of the overall investment grade market. The penetration of green bonds remains in single digits although it is rising. In addition, the index of green bonds has broadly tracked the performance of regular investment grade bonds in both the US and Europe (see Figure 9). “The fact that investors were just as comfortable with the financial metrics of green bonds during the virus outbreak as they were with non-green bonds is a positive sign for the continuation of growth in the green bond market,” says Templeman.

Figure 9: Investors as comfortable with green bonds as they are with investment grade debt

Source: Bloomberg Finance L.P., Deutsche Bank

Taking stock of the green bond trajectory is Gerald Podobnik, a Member of the German government’s Sustainable Finance Advisory Council and CFO of Deutsche Bank Corporate Bank, who notes that issuance reflects a maturing market. Regulatory intervention has also helped. “The first issuers wanted to send a message: look at us, we’re committed to operating sustainably,” says Podobnik. “But the Paris Climate Agreement, the supplementary One Planet Summit in 2017 and ultimately the European Commission’s Sustainable Finance Strategy gave the idea a tremendous boost”.

Podobnik adds that such regulatory requirements and incentives can help the financial sector make a huge shift towards sustainable finance swiftly. “More and more institutional investors use sustainability criteria to manage their portfolios and are enquiring after sustainability ratings,” he says. The EU Taxonomy defining fixed criteria should offer investors transparency in how firms measure on their sustainability agendas.

The EU is also revising its directive on non-financial reporting for companies. “We are convinced that the current crisis provides an opportunity to take interventionary action to link growth and sustainability,” notes Podobnik. “When the coronavirus crisis began we all saw that parts of our economy lack resilience. This shows how important a sustainably-oriented economy can be. As a bank we can provide a decisive boost by supporting sustainability from every angle – for example by issuing our own green bonds”.

"We are convinced that the current crisis provides an opportunity to take interventionary action to link growth and sustainability"

Guidance released during the pandemic by the International Capital Market Association is also likely to boost green bond issuance by setting out performance related targets, note the Deutsche Bank Research team. While the first set of guidance relates to sustainability-linked bonds, which pay coupons based on whether the issuer has achieved certain performance goals, it is likely to lead more companies to set targets for the proceeds of the bonds rather than merely state how the proceeds will be used. These targets include a selection key performance indicators, and calibration of sustainability performance, while improvements promised should be material and beyond a "business as usual" trajectory.

Commodities adapt to decarbonisation realities

Given climate change’s prominence on the agenda – with decarbonisation gaining momentum since people have not travelled during Covid-19 – commodities industries are seeing their risks building and face increasing pressure from regulators and investors to adapt. A new report by Deutsche Bank Research’s Liam Fitzpatrick, titled, Decarbonisation: Can mining & steel sustain in a low carbon world?’14, notes European steel is facing significant policy uncertainty and higher carbon costs, while mining is threatened by longer-term substitution trends. It’s not all bad news, notes Fitzpatrick, as the global energy transition will require materials intensive technologies that will boost demand for some metals.

Despite these transition risks, such as CO2 abatement coasts, a European green deal and other regulatory considerations, some steel companies are well positioned. “With the integration of ESG across investment mandates and growth in green financing, companies with strong climate strategies and portfolios can increasingly gain a competitive advantage,” says Fitzpatrick. He singles out four producers, Anglo, Boliden, Acerinox and Aperam as trailblazers in adapting to the decarbonisation thematic.

Copper demand will benefit materially from the low carbon transition through growth in renewables and electrification and, “coupled with our bullish short-term view, is our preferred major metal for the decarbonisation thematic,” adds Fitzpatrick.

The next phase of ESG

With employee wellness and social inclusion featuring more prominently on corporates’ agendas, Covid-19 has intensified the focus on the ‘S’ of ESG by shining a light on social inequality. Some popular thinking15 urges that a “citizens’ dividend” in recovery projects could address some of those societal imbalances and create structures that turn short term fixes into more permanent successes for all of society. This could position ESG for a new phase in its role assisting recovery, leveraging what it has already learned about performance and metrics during the pandemic.

Some governments – including those of North America and Scandinavia – support a type of citizens’ dividend, by driving ESG projects that create jobs and provide equal shares in funds tied to national wealth. Favourable tariffs for renewable energy projects in the US also incentivise public involvement in these schemes. The US also used public equity to fund research projects that have helped bring innovations such as global positioning system (GPS) technology to life.

As countries extend their fiscal and monetary policies to helping corporates impacted by the crisis, some have made their support conditional on providing citizens’ equity in their companies. For example, France has mandated that AirFrance/KLM grants its shares to members of the public. Just how far other policy makers and corporates will push this idea in their recovery plans remains to be seen, but given the extent to which Covid-19 has exposed inequality, they will be reminded that a rising tide lifts all boats.

Summary of Deutsche Bank Research reports referenced

dbSustainability - ESG through the pandemic (1 July 2020) by Luke Templeman, Jim Reid, Karthik Nagalingam

Decarbonisation: Can mining & steel sustain in a low carbon world? (2 July 2020) by Liam Fitzpatrick

Sources

1 See https://bit.ly/3jce7Aj at wikipedia.org

2 See https://bit.ly/32kU9go at investopedia.com

3 See https://bit.ly/2CyQ6Cs at wikipedia.org.com

4 See https://bit.ly/2B3OS1K at wikipedia.org.com

5 See https://bit.ly/2WlrUux at db.com

6 See https://bit.ly/2DBQtwu at ktmc.com

7 See https://bit.ly/3exCzZb at globenewswire.com

8 See https://bit.ly/38WmVW2 at epa.gov

9 See https://bit.ly/3fwcpaB at lseg.com

10 See https://pwc.to/32ljbfG at pwc.com

11 See https://bit.ly/3fveG5H at KPMG

12 An ESG ETF holds a basket of securities based on a company’s ESG practices

13 See https://bit.ly/2Cyejcf at db.com

14 See https://bit.ly/2OsRida at db.com

15 See https://nyti.ms/3jffH4m at nytimes.com

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

TRADE FINANCE, MACRO AND MARKETS {icon-book}

Germany’s lockdown lending Germany’s lockdown lending

flow talks to KfW’s Ingrid Hengster, who provides insights into the development bank’s partnership with the Germany government and commercial banking sector to support German businesses

Macro and markets, Trade finance, Cash management, Opinion {icon-book}

View from the top: A different level of athlete View from the top: A different level of athlete

Deutsche Bank’s David Lynne shares his perspective on how corporates are evolving their businesses and how this is reshaping bank/corporate relationships as they navigate new trade corridors, reroute supply chains and empower direct access consumers

Cash management, Trade finance and lending, Macro and markets

GCC: four trends corporate treasurers should be aware of GCC: four trends corporate treasurers should be aware of

Digital transformation and infrastructure investment are top priorities in the Middle East as the region diversifies away from oil and gas. How does this impact the corporate treasury teams of companies operating in the region? flow’s Desirée Buchholz reports and shares two client examples from the Asia-Middle East corridor