September 2020

Balance sheets and bottom lines are vital tools, but do they show a company’s biggest risks? Elizabeth Pfeuti reports on how Covid-19 has forced the C-suite to pay more attention to environmental, social and governance themes, so their businesses can survive

What is the purpose of corporate governance? One of the most succinct summaries comes from the Institute of Chartered Accountants in England and Wales (ICAEW): “to facilitate effective, entrepreneurial and prudent management that can deliver the long-term success of the company.”

The ICAEW adds that it’s “about what the board of a company does and how it sets the values of the company, and it is to be distinguished from the day-to-day operational management of the company by full-time executives.”

Unseen risk

A core aspect of a board’s role is for members to understand the full range of risks their company faces. Identifying and mitigating them could be the difference between survival and collapse for even the most well-run of businesses.

Nimble organisations expect the unexpected and have the resilience and business continuity management (BCM) systems in place to tackle sudden arrivals of force majeure (a contractual term freeing both parties from obligation because of events outside their control) or any other external environmental shock that damages demand for their products and services overnight.

While nobody could have predicted the impact a global pandemic such as Covid-19 would have on industries such as airlines, tourism and hospitality, it has served as a wake-up call to review BCM strategies, update scenario planning routines and, for some, revisit business models.

In other words, the biggest threat to corporate survival may not be sitting in financial reports but lurking somewhere in the future. Risks often classed as ‘non-financial’ – such as ‘black swan’ events or force majeure – are set to grow in importance for company bosses, their investors and customers alike. Climate change, societal inequalities and unacceptable corporate behaviour all have the potential to confer pariah status on the most successful of companies.

Non-financial risks

At the start of the third decade of the 21st century, it is no longer acceptable for companies operating in either developed or emerging markets to ignore the risks posed by environmental, societal or governance (ESG) issues.

For example, the Deutsche Bank Research paper, Climate Change and Corporates: Past the Tipping Point with Customers and Stockmarkets (September 2019),1 reported that customers can quickly lose their loyalty to a brand they feel has disappointed on an issue that is important to them. Just as companies must move with the times on the products and services they provide, they also need to be aware of how their customers’ sentiment towards a broader range of issues is shifting too.

For decades, while consumers might have intended to purchase more climate-friendly products, they generally failed to do so. This inertia is now disappearing. In the 12 months preceding the report’s publication, the number of UK consumers choosing to purchase from companies they regarded as active on the issue of climate change outstripped those who did not by two to one. The US showed a similar pattern.

Importantly, this is not a class or income issue; whether a company’s products are premium or bargain basement seems to be largely irrelevant. “It doesn’t matter if a firm’s products are high-quality, low-cost, or B2B,” found the research. It also noted that this trend is evident in consumer boycotts. Historically, these events have rarely dented corporate revenues, but this is changing. About one in three consumers have stopped buying a product from a company they “really liked” after it attracted bad press on its environmental record.

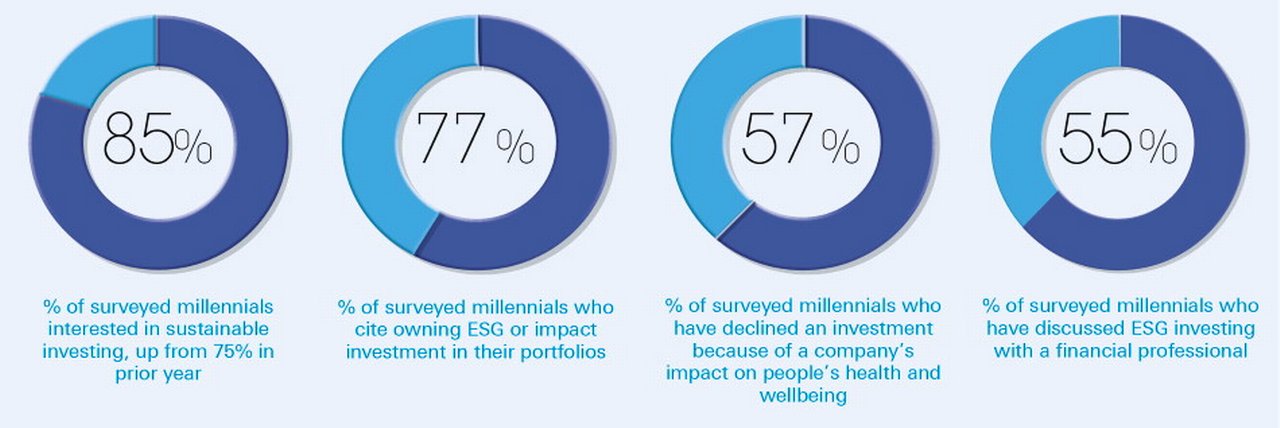

Figure 1: Millennials as consumers

Recent survey-based research from Deutsche Bank’s Capital Markets strategists estimates that nearly US$40trn of wealth will transfer from baby boomers to millennials over the next two decades, representing the largest generational shift of economic resources in human history. The implications for corporate-customer relationships, and the global asset management industry, will be profound (see Figure 1).

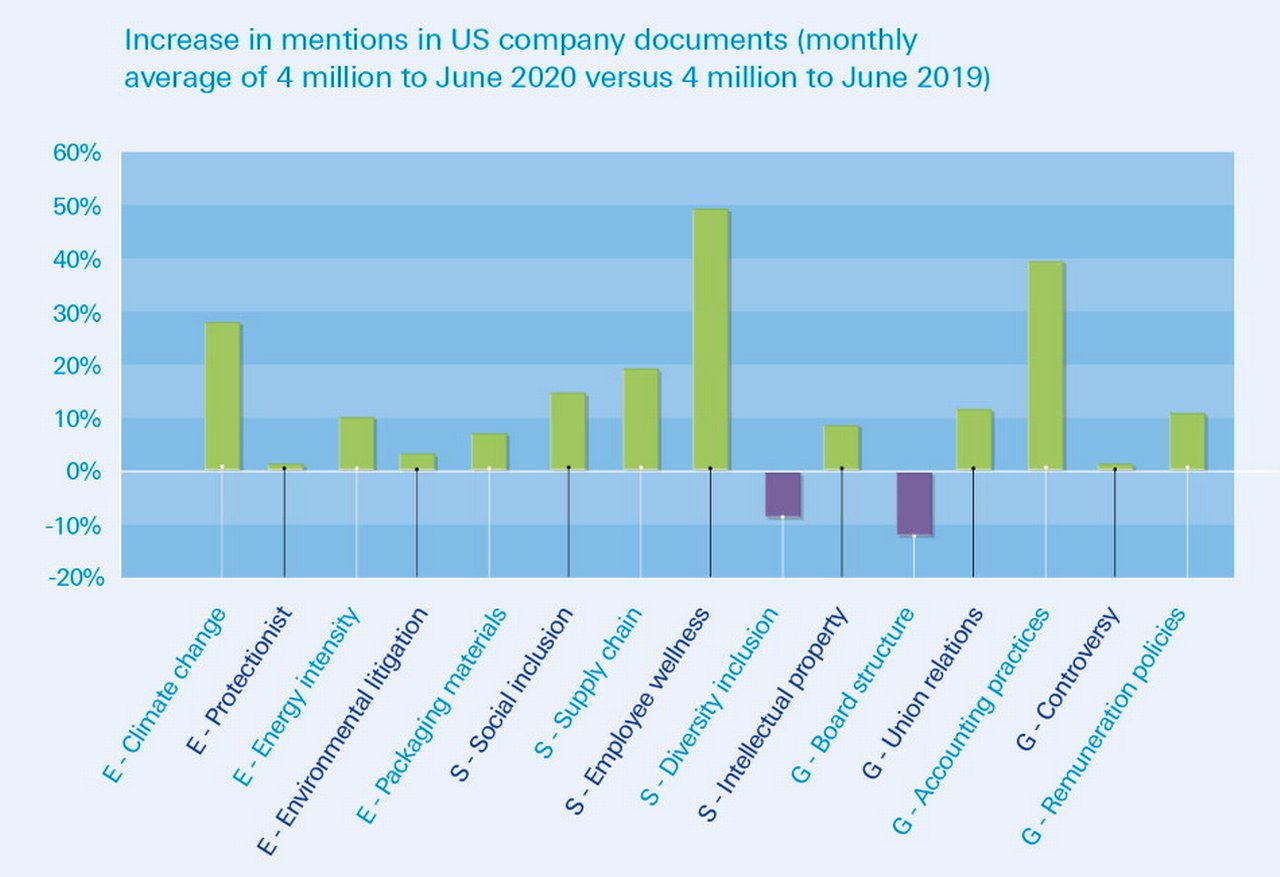

Another Deutsche Bank Research report, ESG Through the Pandemic, shows Covid-19 uncertainty stoking grassroots concerns, such as performance of an asset class and a social agenda extending beyond corporates’ altruistic intentions to include sustainability reporting in their governance. While climate change was one of the most popular ESG topics in the US at the start of 2020 (see Figure 2, page 72), the research report also highlighted themes of ‘employee wellness’ (up 48%) and ‘accounting practices’ (up 38%). Other ESG topics that have increased in prominence are ‘supply chains’ (up 18%) and ‘social inclusion’ (up 16%).

Shareholder support

Broad public concern is swinging behind movements to limit fossil fuel consumption, reduce inequality and tackle questionable workplace practices, and investors are now exerting pressure to force through better performance on ESG issues.

The Global Investor Coalition on Climate Change, the Coalition for Inclusive Capitalism and the International Corporate Governance Network are three international bodies that campaign to improve company practices across the three ESG elements.

Rather than just aiming to improve corporate practices to ease a collective consciousness, these groups – representing trillions of dollars in institutional capital – recognise that the higher a company sets its targets on these measures, the more likely it is to have a successful, profitable future.

Correlation between a company’s climate change performance and its stock falling by 0.3 percentage points relative to the MSCI World Index, leading to underperformance of 5% in 2019, was also reported in Climate Change and Corporates by Deutsche Bank Research (see endnote 1). This is irrespective of whether the stock was previously seen as being strong or weak on climate change issues.

Conversely, companies that were the subject of positive climate change news and made positive announcements on the issue saw their stock outperform the MSCI World Index by 0.8 percentage points per year, or an outperformance of 15%.

This trend is being picked up by consulting firms. According to McKinsey’s November 2019 white paper, Five Ways That ESG Creates Value, 2 “A strong ESG proposition correlates with higher equity returns, from both a tilt and momentum perspective. Better performance in ESG also corresponds with a reduction in downside risk, as evidenced, among other ways, by lower loan and credit default swap spreads and higher credit ratings.”

"ESG factors are risks that, as a company, you have to manage. You cannot ignore them as they can present hard edges for your business"

Regulatory momentum

Regulators have joined the groups agitating for change, with new rules being drafted that could dramatically impact operating models, or even the very ethos of business. Regulation covering ESG has become more prolific over the past decade, and in 2020 the EU has consulted on new measures to demand that companies disclose their exposure to these supposedly non-financial risks.3 The EU argued that without detailed reporting on these matters – including a range of factors falling under the ESG banner – investors would lack a clear view of a company’s long-term performance, even if all financial detail was shown.

The European Commission continues to pursue a green growth strategy, providing a roadmap with new actions to increase private investment in sustainable projects. This is alongside activities to support the different actions set out in the European Green Deal and to manage and integrate climate and environmental risks into the financial system. The initiative will also provide additional enabling frameworks for the European Green Deal Investment Plan.

In addition, ESG is rapidly becoming a compliance issue. “The role of the chief compliance officer in ensuring that ESG disclosures are accurate and truthful is significant, starting with compliance with environmental and health and safety laws, where applicable,” commented Kristen Sullivan, a Partner and Sustainability and KPI Services Leader with Deloitte & Touche LLP, in an interview with Compliance Week (December 2019).4

Strategic imperative

Encouragingly however, many firms are adapting the way they operate. According to Gerald Podobnik, CFO and Chief Sustainability Officer of Deutsche Bank Corporate Bank, the number of companies failing to genuinely engage on these issues is in rapid decline.

“Maybe five to 10 years ago, it depended heavily on the CEO and whether they saw ESG as a strategic imperative,” says Podobnik. “Over the past two years we have seen many starting to adapt to these issues, seeing them as a basic licence to operate going forward. We have even seen some movement towards linking remuneration to certain ESG factors or improvements in some companies.

“ESG factors are risks that, as a company, you have to manage. You cannot ignore them as they can present hard edges for your business,” he stresses. “They also present a massive opportunity to reshape your business going forward, because when the economy changes, corporates have to follow.”

No bigger opportunity to reshape presents itself than a global economic shutdown and subsequent revitalisation of international trade, which may also allow businesses to fundamentally address how they operate.

"We are putting ESG at the centre of everything we do"

“The pandemic has given the social dimension of ESG a far greater importance, because we saw how vulnerable our economies and societies are,” says Podobnik. “The resilience of the economy and its transformation are intertwined, and companies are going to be an essential part of both.”

It might be easy to convince a fossil fuel producer of the danger to its business model posed by the energy transition, but it is less straightforward in other, less clearly linked sectors to foresee potential obsolescence if ESG risks are not taken on board.

Walking the walk

Do sustainable banks outperform? This was the subject of a 2020 report from Deloitte that concluded that:

- A strategic focus on ESG can lead to financial outperformance across industries (prior research), and specifically for banks.

- Banks with good performance on material ESG issues outperform those with bad performance on the same issues by more than 2%.5

In May 2020, Deutsche Bank set out its own sustainability targets.6

They include powering operations entirely from renewable energy by 2025, building on almost 80% of electricity used across the world already coming from these sources.

But as a bank, there is, according to Podobnik, a responsibility to do more – and an opportunity to help clients take a step towards a more resilient future. Seeing a natural fit between ESG and his CFO role, Podobnik assumed the additional post of Chief Sustainability Officer last year, with the remit of crafting a distinct set of ESG products for clients of Deutsche Bank Corporate Bank.

The bank also aims to increase its volume of ESG financing and portfolio of sustainable investments under management to €200bn by the end of 2025. This means working with businesses to provide solutions such as classic loans that can be issued for sustainable use, or even linking interest rates on lending to the borrower achieving certain sustainability scores.

Figure 2: Employee wellness is now the hottest topic in the US

Within the capital markets, Deutsche Bank is committed to boosting the number of green bonds issued to finance sustainable projects or upgrades.7 In June 2020, it issued its own €500m green bond, with the proceeds of the issue to be used exclusively to refinance the bank’s own sustainable projects, such as the expansion of renewable energies.8

Clearly, there is growing demand for these products. Global green bond and loan issuance climbed by nearly 50% in 2019 to a record high of US$254.9bn, according to the Climate Bonds Initiative.9 A further €50bn was issued in the year to the end of April, despite the near closure of global capital markets. Such is the demand from investors that Denmark and Germany are set to issue government-backed green bonds in the near future.

Day-to-day sustainability

Outside long-term borrowing, companies need day-to-day liquidity to meet cashflow needs and finance supply chains, and DWS – Deutsche Bank’s majority owned asset management business which manages the liquidity of many of the Corporate Bank’s clients – has been pushing ahead in innovation.

“We are putting ESG at the centre of everything we do,” says Reyer Kooy, Head of Liquidity Management EMEA and Asia at DWS. “We view this as an absolutely critical area of our strategy, and we want to talk about how this connects to the corporate community. We are already seeing it driving the core behaviour of many companies we interact with.” This strategy aligns with millennials caring more about ESG as investors (see Figure 3).

Many of the clients Kooy works with have already set corporate strategies, initiatives and science-based targets that focus on the ‘S’ and ‘G’ elements, along with the ‘E’, which is the most mainstream. “This trickles down to treasurers, who are looking or are being mandated to find ways to contribute to the sustainability and the ESG goals of the company,” Kooy adds.

Future forward

To meet this ever-growing mandate, in 2018, DWS launched the first money market fund (MMF) in the US to use ESG criteria to select its holdings.10 DWS has extended the ESG process to some of its MMFs in Europe, and hopes in time to have all of its MMFs in an ESG format.11

By the end of 2019, other fund managers had followed suit, with assets across the whole universe of ESG-focused MMFs having grown by 30% to €70bn. This rate compared favourably with the 15% estimated growth in traditional vehicles, according to ratings agency Fitch.12

Figure 3: Millennials as investors

Sources: (1–2) MSCI, Swipe to Invest: the Story Behind Millennials and ESG Investing, March 2020. (3) Allianz, ESG Ethics and Investing: How Environmental, Social and Governance Issues Impact Investor Behaviour, May 2019. (4) Weber Shandwick, KRC Research: CEO Activism in 2017: High Noon in the C-Suite

To help corporate clients stay in line with their internal ESG strategies, DWS has strict policies around MMF investment criteria. “Along with only selecting the highest rated securities from a credit perspective, we have a basic level of ESG built into all of our strategies, and we can show and report how each fund scores on these criteria for our clients,” says Kooy. “But for the ESG-labelled funds, we have a scoring system for each counterparty that is in the fund, and we will not select a security if the issuer does not reach the required score.”

While regulatory, compliance and financial reporting frameworks, along with investor appetite, are clearly accelerating sustainable behaviour, it is encouraging to see that ESG is becoming baked into corporate consciences and executives’ individual passions for their businesses.

Sources

1 Climate Change and Corporates: Past the Tipping Point with Customers and Stockmarkets, Deutsche Bank, 2019. See https://bit.ly/2FWfmnO at dbresearch.com

2 See https://mck.co/2EABrHY at mckinsey.com

3 See https://bit.ly/34EEKc6 at ec.europa.eu

4 See https://bit.ly/34EESIC at complianceweek.com

5 See https://bit.ly/2EpbFa2 at deloitte.com

6 See https://bit.ly/3gAqHXt at db.com

7 See https://bit.ly/31wbfqP at db.com

8 See https://bit.ly/34EtA71 at db.com

9 See https://reut.rs/3hCkPyi at reuters.com

10 See https://bit.ly/3lmnD4P at liquidity.dws.com

11 See https://bit.ly/3jiFJ5N at dws.com

12 See https://bit.ly/32uXwjl at fitchratings.com

You might be interested in

Macro and markets, Trade finance and lending

Post-Brexit TCA: fit for purpose? Post-Brexit TCA: fit for purpose?

flow reports on responses to the long-awaited EU-UK trade deal, concluded just days before the transition period expired on 31 December 2020

TRADE FINANCE, MACRO AND MARKETS {icon-book}

Germany’s lockdown lending Germany’s lockdown lending

flow talks to KfW’s Ingrid Hengster, who provides insights into the development bank’s partnership with the Germany government and commercial banking sector to support German businesses

MACRO AND MARKETS {icon-book}

Matters of the mind Matters of the mind

Covid-19 has inflicted the greatest change upon the global population since World War II and highlighted the importance of wellbeing. Michael Morley tells flow how an informed approach to employee wellness could play a meaningful role in a sustainable recovery