10 January 2024

Brazil’s wind energy sector is flourishing. flow’s Desirée Buchholz reports on renewable energy provider Statkraft’s part of the story – and how Deutsche Bank is helping the Norwegian company to finance two greenfield wind park projects in the country

MINUTES min read

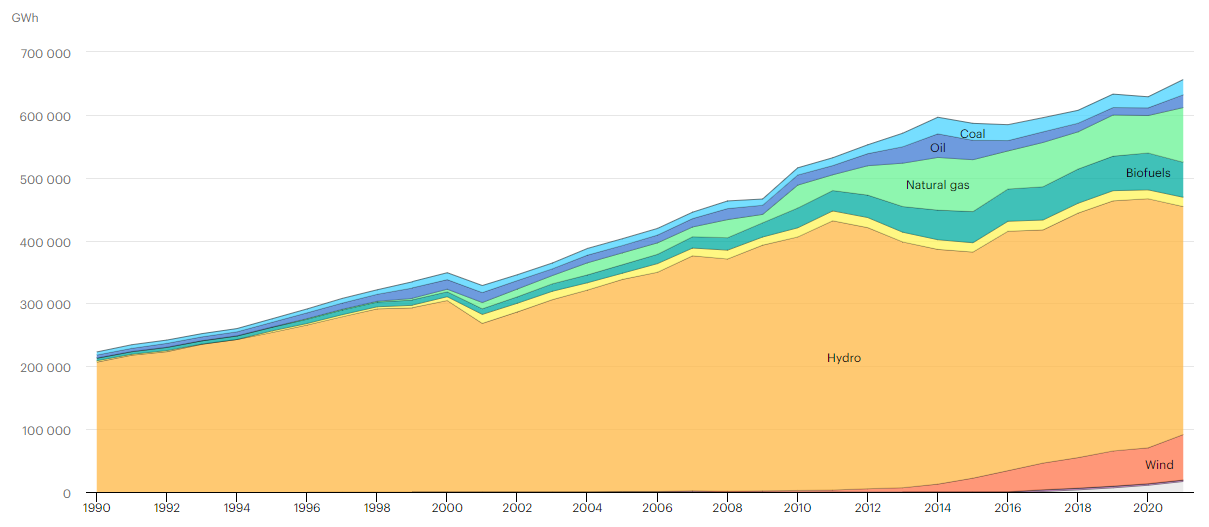

Renewable energy is nothing new in Brazil. In fact, the country has long been a leader in biofuels and hydropower technologies accounting for almost 7% of the planet’s renewable energy production. This outpaces its 3% share of the global population and 2% share of global GDP.1 In 2020, hydropower accounted for roughly two-third of the Brazil’s electricity production (see Figure 1), while the country’s significant oil and gas reserves were mostly exported.

In recent years, wind energy has been gaining importance for local electricity production. With 24GW of onshore wind installed capacity, Brazil has moved up into sixth place in the global ranking of the 2023 Global Wind Energy Report. For comparison: A decade ago, the country had less than 1GW installed.

And Brazil’s speedy catch up is set to continue: the report shows that the country put on stream the third most new wind power plants in 2022, only behind China and the US.2 Next year, the Brazilian Association of Wind Energy (ABEEólica) expects that Brazil will have at least 30 GW of installed wind energy capacity, considering only auctions already held and contracts signed. New auctions would add more installed capacity for years to come.3

Figure 1: Brazil’s electricity generation by source

Source: International Energy Agency (IEA), https://www.iea.org/countries/brazil

While onshore projects are flourishing, Brazil’s offshore wind sector is still in its infancy. Yet, a World Bank study concluded in 2020 that with around 8,000 kilometres of coastline blessed with strong oceanic winds, Brazil has the potential to install more than 1,200 GW of offshore wind.4

Under its new left of centre President Luiz Inacio Lula da Silva, who took office in January 2023, Brazil is now seeking to exploit this potential. By the end of this year, the government aims to pass a regulatory framework for offshore wind and green hydrogen which will help to further promote energy transition.5 Brazil has committed to reducing greenhouse gas emissions by 37% from 2005 levels by 2025, 50% by 2030 and achieve net zero by 2050.6

Statkraft expands Brazilian operations

These growth perspectives – coupled with governmental initiatives to liberalise the local energy market –, have attracted attention by international companies. One of the players that invests in Brazil is Statkraft, a Norwegian 100% state-owned company which develops, builds and operates hydro, wind, solar, gas and biomass assets in 21 countries globally. Founded in 1895, the company not only supplies industrial and commercial consumers with energy but also provides energy and market-based optimisation services for retail companies in the energy business.7

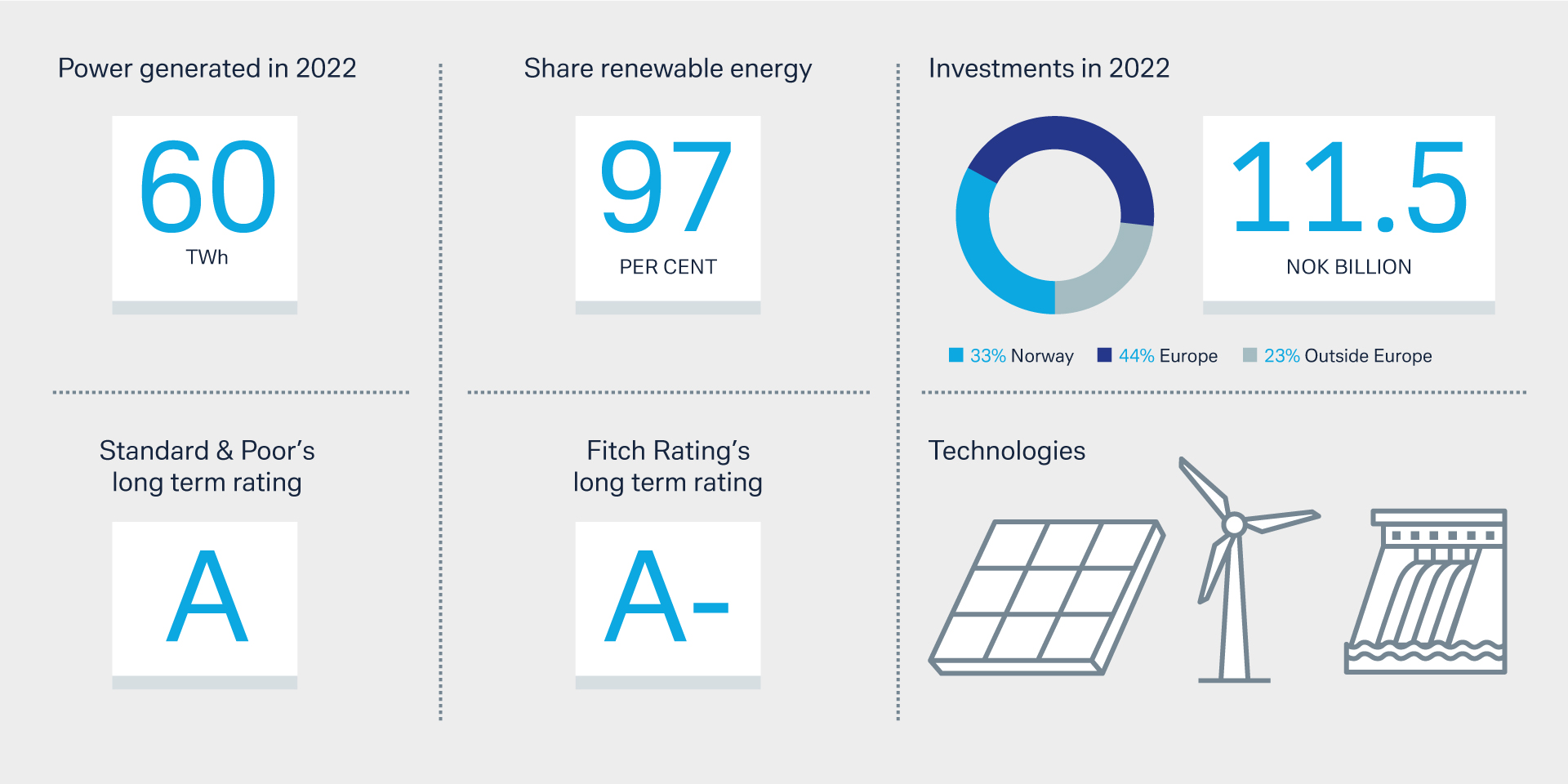

In 2022, Statkraft’s energy generation reached 60.2 TWh leading to a turnover of NOK166bn (EUR14.4bn) and an underlying EBIT of NOK54.4bn (EUR 4.7bn). By 2030, the company aims to expand its renewable energy generation to 100 TWh8 - and the operations in Brazil are supposed to add to this ambitious growth plan.

Figure 2: Numbers of Statkraft FY2022

Source: Statkraft

The Norwegians have been present in the country since 2009 and currently control 18 wind and hydropower plants in Brazil with a total installed capacity of 450 MW. In September, the company acquired 18.69% of the shares in its Brazilian subsidiary Statkraft Energias Renováveis (SKER) from Fundação dos Economiários Federais (Funcef), the third largest pension fund in Brazil. As of today, 100% of SKER is owned by the Statkraft Group.

Statkraft most recently also signed an agreement to acquire two operational wind farms, Jerusalém and Boqueirão, located in the state of Rio Grande do Norte.9 In parallel, the company is developing two wind park projects in northeast Brazil which – together with the latest M&A deal – will more than double the company’s installed capacity in the country to 1.3 GW when completed in 2023 and 2024 respectively, between projects under construction, acquisition and operations.

Supplying Brazilian households with clean energy

These two greenfield wind park projects will be another step towards supplying more Brazilian households with clean energy. The first one – Ventos de Santa Eugenia (VSE) – was launched in 2020. The project entails 14 wind farms with a total of 91 turbines in the state of Bahia and will supply electricity for 1.17 million Brazilian homes (see Figure 3). For the second one – Morro do Cruzeiro – construction started in June 2022. It consists of 14 turbines, which, upon completion, will generate enough electricity for 190.000 Brazilian households (see Figure 4).

Figure 3: Key facts of the Ventos de Santa Eugenia wind project

Source: Statkraft

To secure funding for these two wind park projects, Statkraft arranged credit facilities with Banco do Nordeste (BNB), a regional development bank which finances renewable energy projects at very competitive rates. In case of VSE, BNB provides around BRL 1.06bn over a tenor of 24 years. Morro do Cruzeiro, the company estimates an overall investment of BRL 607m – of which it borrows BRL 257m from BNB for 22 years.

“Our guarantees cover the financial risk of Statkraft for up to two years”

Deutsche Bank Brazil takes a key role in enabling Statkraft to develop the wind parks. Namely, the bank has issued inflation-linked financial guarantees which cover part of the outstanding balance of the financing granted by BNB to Statkraft. “These guarantees are necessary because BNB is not allowed to take non-financial counterparty risks on their books,” explain Eduardo Macchia, Relationship Manager for Statkraft Brazil, and Victor Calabria, Head of Coverage at Deutsche Bank Brazil. “Our guarantees therefore cover the financial risk of Statkraft for up to two years,” Vinicius Oliveira, Head of Trade Finance Brazil, Deutsche Bank adds. The inflation link addresses the growing debt over time – given an annual inflation rate of 4.8% in Brazil in October 202310.

“The guarantees are necessary because BNB is not allowed to take non-financial counterparty risks on their books”

The combination of credit facilities with development banks and financial guarantees by a commercial bank are typical for wind park projects due the complex nature of these projects. The investment horizon stretches over decades, there are several parties involved in constructing and installing the wind parks, and there are risks around pay-offs due to volatile energy prices.

In case of VSE, Statkraft has closed bilateral energy sales contracts for energy consumers through its free market supplier. Coupled with competitive energy contracts of 20 years that the company had won as part of the auction, total project coverage now stands at approximately 51.3% of the total Physical Guarantee of the enterprises.

Figure 4: Key facts of the Morro do Cruzeiro wind project

Source: Statkraft

ESG considerations

While wind parks foster clean energy transition and therefore help to reduce greenhouse gas emissions, construction should not interfere with other environmental goals – that is for example preserving biodiversity. To ensure this, companies generally have put in place monitoring systems to make sure they are adhering to international standards.

The wind projects VSE and Morro do Cruzeiro are being implemented “in accordance with Brazil’s strict environmental and social permitting and monitoring systems”, Statkraft states. “The wind farms have limited land acquisition, no resettlement, low environmental impact and no impact on red-listed species.” In addition, the company would carry out Corporate Social Responsibility activities for nearby communities, focused on education and infrastructure improvements.11

Statkraft, for example, promotes an educational development programme, a project targeted at strengthening formal education in 40 public schools in the cities of Uibaí and Ibipeba (Bahia). The project has reached 806 participants, carried out 167 educational actions, registered 232 local practices and implemented 54 educational facilities, according to Statkraft’s 2022 Annual Sustainability Report.

When it comes to the environmental dimension, Statkraft carried out the rescue of vegetation, assessment of protected species and implementation of the seedling nursery during the licensing process for VSE: More than 20,400 elements were rescued and replanted, more than 300 retrievals and reproductive matrices of species of interest were carried out, almost 17,000 elements of species of interest were quantified in the activities of vegetation suppression and a seedling nursery for the production of 40,000 seedlings each year was implemented.

Source: © Statkraft

Sources

1 See iea.org

2 See gwec.net

3 See gwec.net

4 See worldbank.org

5 See reuters.com

6 See giz.de

7 See statkraft.com

8 See statkraft.com

9 See statkraft.com

10 See tradingeconomics.com

11 See statkraft.com