23 April 2021

Production shortfalls, political wrangling, safety concerns and vaccine hesitancy have created barriers on the road to normalcy, but the overall roll-out of injections is nonetheless advancing steadily, report flow’s Graham Buck and Clarissa Dann

MINUTES min read

“Ever tried. Ever failed. No matter. Try again. Fail again. Fail better." Playwright Samuel Beckett’s lines may have evoked a wry smile of recognition from all those involved in developing and producing millions of anti-Covid vaccines to repel the advance of a global pandemic.

Their task has been to fast-track the research and development of an effective, cost-efficient jab; one producing as few side effects as possible that can be mass produced, easily stored and transported for rolling out across many countries. Given this stringent list of demands, the surprise should be that the leading vaccine manufacturers have ticked so many of the boxes and not that they have sometimes missed one or two.

Teething troubles

With lockdowns and other containment measures providing a temporary and economically painful means of keeping the spread of coronavirus at bay, vaccines do offer the world the best route towards a return to some sort of normality. It is an unfortunate setback that safety concerns are hampering the rollout of AstraZeneca and Johnson & Johnson’s product, to which many hopes attached for an effective mass vaccination campaign.

“Between them the AstraZeneca and J&J vaccines were the best chance for many developing countries,” reported The Guardian on 13 April. “The Oxford/AstraZeneca vaccine is being produced at no profit and is easy to transport and store at room temperature. That was deliberate – the university and the company have pledged to make it highly accessible. The J&J vaccine is the other great hope, because it is given as one dose, not two, cutting the cost and making it easier for countries with shaky health systems to mass-vaccinate.”

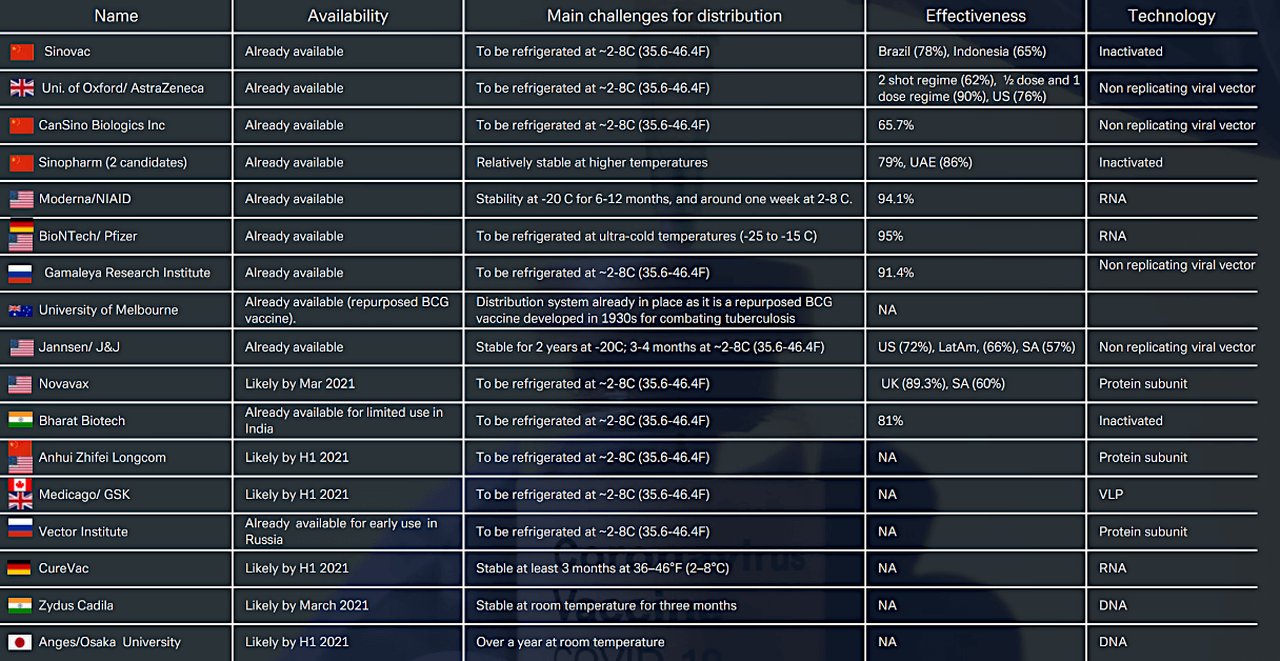

Figure 1: Main anti- Covid-19 vaccines approved and in development (Click to enlarge)

Source: Deutsche Bank Research, WHO, Telegraph, various websites. Note: Phase 3 end dates are indicative.

Production shortfalls and disputes over which customers get priority for vaccine deliveries have regularly made headlines since the start of 2021; most recently on 16 April when Moderna1 announced that supply chain issues in Europe meant it could not fulfil Q2 orders from the UK and Canada, although the EU and Switzerland would receive their shipments in full. A report on AstraZeneca, from the UK’s BBC, sets what has been achieved so far and how hard it was for a producer normally dedicated to developing cancer cures to fast-track the vaccine. It points out, “The problem is that manufacturing vaccines is really difficult… some batches work better than others, and when you add in the complexity of regional supply chains, things get complicated and sometimes don't work”.2

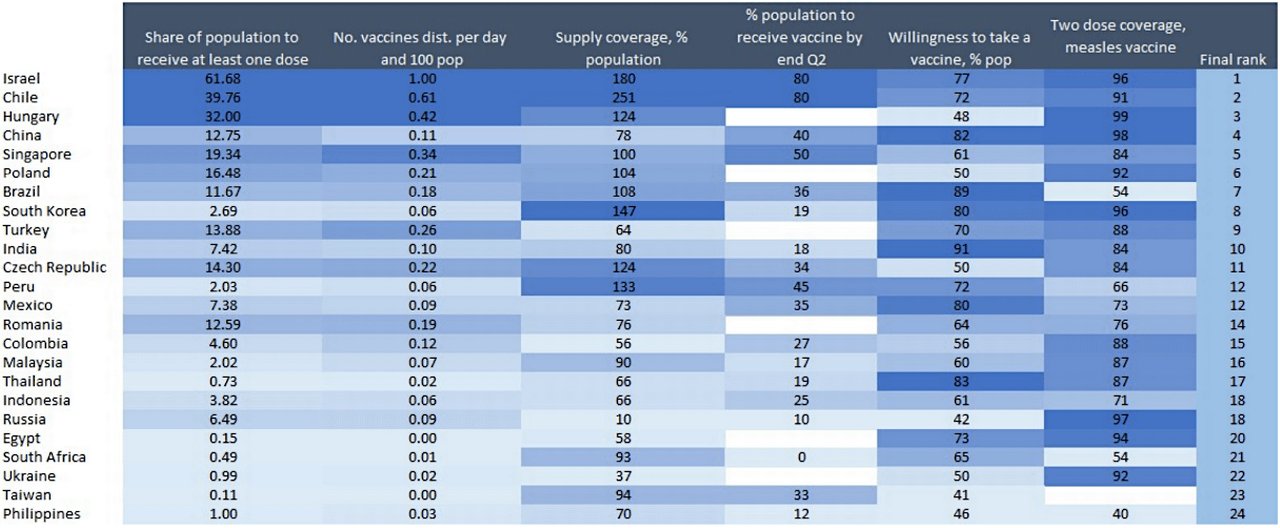

Yet despite shortfalls, safety concerns and substantial numbers of people averse to receiving an anti-Covid jab, the trajectory is forwards. In the 7 April edition of their monthly Exit Strategy Policy Tracker, Deutsche Bank Research analysts Marion Laboure, Jim Reid and Apurv Chaudhari report “the global vaccine rollout continues to accelerate” and that more than 150 countries have granted approval to at least one vaccine and begun inoculations. Figure 1 lists the main anti-Covid-19 vaccines already available and those due to launch shortly.

By 19 April, according to Bloomberg3, more than 910 million doses had been administered across 156 countries – enough to vaccinate 6.0% of the global population – with the most recent rate 16.3m doses administered per day. Of this total, the US accounts for 212 million doses (about 23.4%) and is adding nearly 3.13 million to the figure daily. “Up to 15 billion doses are needed globally,” they add. “This should be covered in 2022 even though most vaccines require two doses.”

One year on

In the meantime, with the pandemic now well into its second year the extent of the virus’ impact divides the world’s regions into three basic categories:

- Countries that have so far managed to bring down the infection rate sustainably and contain the first wave (e.g. China);

- Countries that are experiencing a fresh wave with a rise of new infections after they had brought down daily infection rates for a longer time (e.g. Italy, France, Sweden, Germany, India, Brazil and Chile);

- Countries that have successfully brought the winter wave under control (e.g. the UK, the US, Mexico and South Korea)

Despite this variable progress, the global Purchasing Managers’ Index is already back at its strongest levels since 2011, when economies were similarly in recovery mode following the global financial crisis. However “country divergences are widening” observe Laboure, Reid and Chaudhari and “it is anticipated that the global manufacturing recovery will tend to “re-synchronise” as the strongest economies tug up the weaker emerging market economies”.

The euro-area manufacturing sector is regarded as particularly strong, despite recent well-publicised concerns over the slowness of the region’s vaccination roll-out and Italy is the only major Eurozone activity where activity has been flagging as Germany, France and Spain gently pick up despite extended or tightening social distancing measures. In Eastern Europe, the high growth rates in new coronavirus cases has had a more damaging impact on economic activity in Poland, Hungary and the Czech Republic, with Russia diverging from the trio and showing greater resilience.

“Vaccines are very expensive. They save lives, they allow economies to reopen, but we sell them at the price of a meal”

A growing portfolio

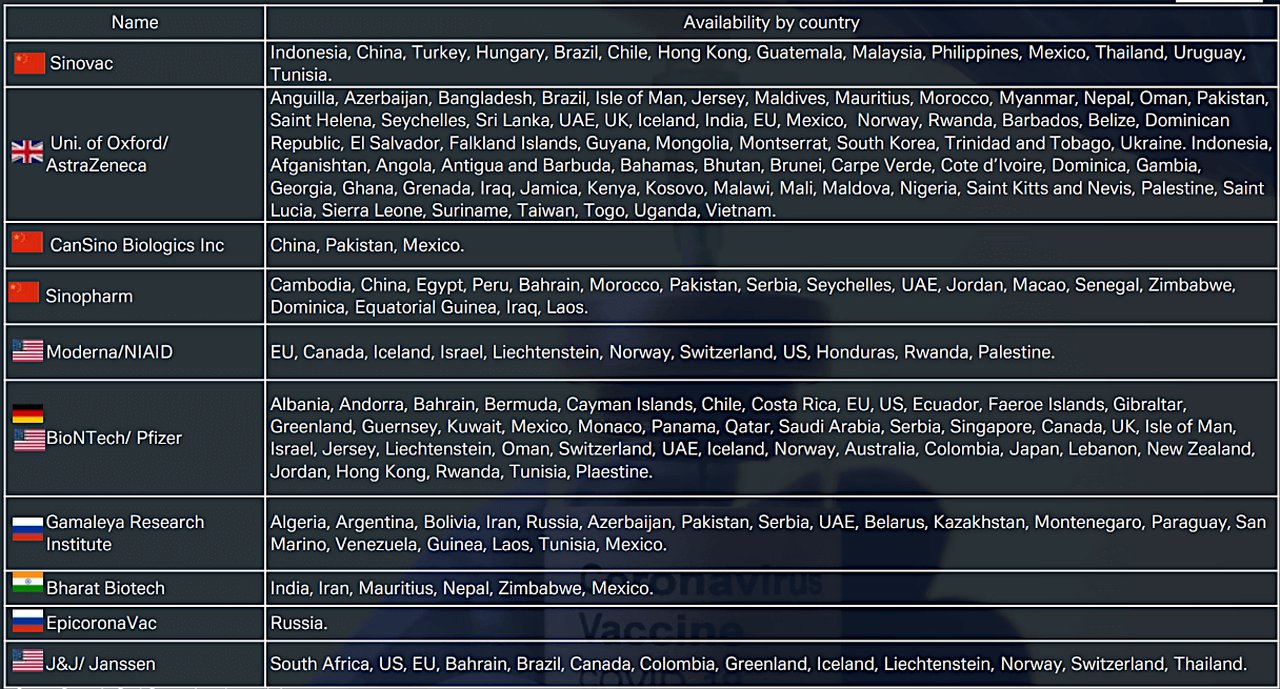

The 7 April Deutsche Bank Research report also lists the countries that have approved and made available the main anti-Covid vaccines launched so far, as set out in Figure 2. The situation can – and does – change daily; for example, the US subsequently halted injections of J&J’s vaccine on 13 April after reports of a rare blood-clotting disorder in a handful of recipients and South Africa promptly followed its lead.

Figure 2: Vaccine approval by country (Click to enlarge)

Source: Deutsche Bank Research, various websites

“The J&J vaccine makes up more than 20% of the known vaccine orders in South Africa (39%), Romania (37%), Poland (27%) and Hungary (22%),” reported Deutsche Bank Research analysts in the 16 April issue of CEEMEA Macro & Strategy Weekly. ”South Africa faces the biggest difficulties in substituting the vaccine and a further delay in vaccination would be concerning as South Africa has still not vaccinated even 1% of its population”.

CEEMEA M&SW also noted that the efficacy of the Sinovac vaccine had been downgraded following a Chilean trial suggesting it might be little more than 50%, the threshold above which the World Health Organisation deems a vaccine suitable for general use. By contrast, tests suggest that the Pfizer-BioNTech and Moderna vaccines cut the risk of catching Covid-19 by more than 90%.“The risk associated with the low overall efficacy is that it might not be high enough to achieve herd immunity,” add analysts. “The only two countries in CEEMEA with Sinovac orders are Turkey and Ukraine. Turkey could be especially affected by this as Sinovac makes up 96% of its vaccine portfolio”.

As The Economist commented in its 20 March issue, “it does not take much for people to lose confidence in vaccines” and similar reports of blood clotting among some European recipients of the AstraZeneca shot persuaded many countries in the EU to stop using it. “They say this shows they take safety seriously,” the paper added. “Unfortunately, their caution is more likely to cost lives”.

Scientist in Covid-19 vaccine production laboratory at AstraZeneca

Source: AstraZeneca

Fortunately for Europe, its vaccination programme now looks like recouping lost ground over the summer. A further positive sign is the likelihood that future updates of Figure 2 will be expanded to include promising new versions. They include the messenger ribonucleic acid (mRNA)-based vaccine CVnCoV being developed by German biopharma company CureVac, which is in late stage trials and could gain European Union (EU) approval as early as June, according to its CEO Franz-Werner Haas4. CureVac has indicated that by expanding its production network it could manufacture up to 300 million doses by the end of this year and ramped up its guidance for 2022 from 600m doses to one billion. Also encouraging is that the company is working on finessing CVnCoV to address mutations of the virus against which currently available vaccines may be less effective, such as the B.1.351 variant first identified in South Africa.

Vaccine hesitancy

In its 17 April edition, The Economist highlighted the situation in Hong Kong, which has received less publicity in Western media. Since mid-March, all Hong Kong residents aged 30 and over have been entitled to book a vaccination and can opt either for Germany’s Pfizer-BioNTech vaccine or the one produced by China’s Sinovac. “Yet despite plentiful supply only about 8% of the population have chosen to get a shot,” it reported, citing “rock-bottom trust in the government” after two years of political turmoil as a major contributory factor. Last September, when the government offered free Covid-19 tests, fewer than 1.8 million Hong Kong residents accepted the screening out of 7.5 million as “refusing the test was a way of expressing dissatisfaction with the government”. In addition, questions over the efficacy of the Sinovac shot has been an issue here too.

Even the US’ impressive vaccination progress, with President Biden’s original goal of administering 100 million vaccine shots within his first 100 days of office quickly doubled to 200 million, is about to run up against major challenges, continues the newspaper. The country is close to delivering jabs to almost all who want them, “unfortunately, only seven in 10 Americans are interested” and to suppress coronavirus effectively, 70% or more of the entire population must be vaccinated. White evangelicals, or “born-again” Christians, who mostly voted in 2020 to re-elect Donald Trump constitute one of the main vaccine-wary groups. Unlike some others, including African-Americans, who are becoming less hesitant over time, they are “obstinate in their doubts” and the US’s herd immunity “may rest on their shoulders”.

And in their 1 April paper US Economic Perspectives: Covid impact tracker: Monitoring the vaccine roll-out, Deutsche Bank Research analysts Justin Weidner, Matthew Luzzetti, Brett Ryan and Suvir Ranjan write that while the number of new coronavirus cases in the US is well off the peak of early-January 2021 “there are some nascent signs of a potential fourth wave building” even as states begin to completely reopen or roll back restrictions.

Covax progress

As flow reported last September in Covid-19: race for a vaccine, the World Health Organisation’s Director-General, Dr Tedros Adhanom Ghebreyesus warned against “vaccine nationalism” from the early days of the pandemic. He has urged countries to join the COVAX global vaccine allocation plan which, led by WHO and the GAVI vaccine alliance (a global health partnership founded by the Bill and Melinda Gates Foundation) aims to help buy and distribute vaccination shots fairly around the world.

Given the well-publicised squabbles in Europe over vaccine allocation, it might be assumed that the initiative never got off the ground, but on 8 April the two bodies announced that in its first six weeks of operations the COVAX facility delivered nearly 38.4 million doses of vaccine to 102 countries in six continents5. This was achieved despite reduced availability caused by delivery delays and a decision by the Indian government to keep most of the 2.4 million daily doses of the AstraZeneca vaccine produced by the Serum Institute of India for use at home in the face of the country’s resurgent infection rates.

GAVI still hopes to deliver 237 million doses of the AstraZeneca vaccine by the end of May and to offer shots from other manufacturers in addition to the AstraZeneca/Oxford and Pfizer/BioNTech products that it currently supplies, increasing the total to at least two billion by the end of 2021.

Promising technology

And Pfizer’s CEO Albert Bourla also offered an upbeat forecast in an interview6 with Germany’s Handelsblatt and other major European papers that life around the world could have returned to near normal by late autumn, based on Israel’s success with the major rollout of the Pfizer/BioNTech vaccine and the opening up of its economy. “Covid will be like a kind of flu,” he told the paper. “We will get vaccinated and live normally as far as possible.

Bourla revealed that Pfizer provided funding of around US$2bn to ensure that its scientists had all the resources at their disposal to meet his request that the “make the impossible possible”. He added “I couldn't ask them to do in nine months something that usually takes 10 years if they had to worry about resources and money. That wasn't realistic”.

He agreed that mRNA technology, originally developed for cancer treatments, had accelerated mRNA-based drug developments for other diseases as a result of Covid-related progress. “This is a technology that is already 30 years in the works, with the last 20 years of intensive work and constant failures. I think we will be able to master how we can make the most of this technology,” he noted, adding that Pfizer had worked for at least three years with BioNTech to use the technology for developing a flu vaccine.

However, he reflects, “Vaccines are very expensive. They save lives, they allow economies to reopen, but we sell them at the price of a meal.”

According to Bulgaria’s Prime Minister, Boyko Borissov, a new vaccine supply contract that the EU has been negotiating with Pfizer-BioNTech for up to 1.8 billion vaccines to be delivered in the next two years is based on a price of €19.5 per dose. “The prices are going up quickly,” said Borissov in reports published on 11 April7. “Pfizer’s was €12, then increased to €15.5. Now for 2022 and 2023, the EU contracts are being signed for 900m vaccines, but already at a price of €19.5”.

AstraZeneca CEO Pascal Soriot points out the enormity of what has been achieved so far: “Developing, manufacturing and distributing a vaccine is a highly complex endeavour, especially when done at this speed and scale. Making a vaccine is a biological process that allows for little margin for error, which is why it is inevitable that there will be challenges along the way,” he told The Guardian on 10 March 2021.8

He added, “Vaccinating people across the world is without doubt the biggest public health programme in history”

“Vaccinating people across the world is without doubt the biggest public health programme in history”

Deutsche Bank Research reports referenced

The House View: Exit Strategy Policy Tracker by Marion Laboure, Jim Reid and Apurv Chaudhari (7 April)

CEEMEA Macro & Strategy Weekly by Christian Wietoska, Danelee Masia, Peter Sidorov, Oliver Harvey, Hongtao Jiang, Alireza Kharazi, Fatih Akcelik, Anna Friedemann, Ninghao Sha, Ankit Jain, Twisha Roy, Naman Mishra (16 April)

US Economic Perspectives: Covid impact tracker: Monitoring the vaccine roll-out by Justin Weidner, Matthew Luzzetti, Brett Ryan and Suvir Ranjan (1 April)

Sources

1 See https://reut.rs/3apFx2v at reuters.com

2 See https://bbc.in/3ap60NO at bbc.co.uk

3 See https://bloom.bg/3sDlaW2 at bloomberg.com

4 See https://bit.ly/3gtsBMU at pmlive.com

5 See https://reut.rs/3tGhzrv at reuters.com

6 See https://bit.ly/32CsZAN at lesechos.fr

7 See https://reut.rs/2RJJrNi at reuters.com

8 See https://bit.ly/2QonYsS at theguardian.com

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

flow case studies, Trust and agency services {icon-book}

AstraZeneca and tomorrow’s therapeutics AstraZeneca and tomorrow’s therapeutics

Growing shareholder value and delivering medicines where they are needed most is a tightrope that AstraZeneca has walked for a while. flow’s Clarissa Dann catches up with Andy Barnett, the Anglo-Swedish group’s Head of Investor Relations, about what it takes to maintain investor loyalty over the long term

flow case studies, Cash management, Technology

How BioNTech masters real-time treasury How BioNTech masters real-time treasury

Innovation and speed have been part of BioNTech’s DNA ever since its formation 16 years ago. Back in 2020, it took the German biotech company less than a year to develop a vaccine against Covid-19. flow’s Desirée Buchholz talked to Dirk Schreiber, BioNTech’s Head of Treasury, on why real-time treasury is key for him – and how APIs help to achieve this goal

flow case studies, Cash Management

E.ON Drive: streamlining payments for EV charging E.ON Drive: streamlining payments for EV charging

Boosting demand for electric vehicles (EV) is key to decarbonising road transport. With corporates accounting for 60% of car purchases in Europe, incentivising companies to electrify their motor fleets is essential. flow’s Desirée Buchholz reports on how E.ON Drive is contributing to this goal – and why efficient payment processes and APIs are part of its success