15 May 2020

We are at a critical juncture in the global Covid-19 crisis response as we transition from lockdown into a new period of gradual reopening. Clarissa Dann summarises recent Deutsche Bank research and analysis on execution and virus resurgence risk

With more than 4.3 million confirmed cases of Covid-19 globally and what the European Commission called a “recession of historic proportions” in its Spring Forecast published on 6 May,1 the race to recovery is on. Some economies are further out of the starting blocks than others, but should they be? Are they running the risk of a second wave of contagion and further economic setback in the future?

Following on from our 4 April 2020 perspective in Towards a silver lining, this article, some weeks further along the Covid-19 path, takes a look at the current positioning of economies as they attempt to restore public health, markets and economies, in something of a tightrope act. As Deutsche Bank Group Chief Economist David Folkerts-Landau comments in The House View (12 May), “A highly uncertain and worrying outlook lies ahead, and it is likely that any short-term stability will come at a huge long-term cost.”2

Transmission, tracing and economic damage

Transmission rates are a key indicator, reflects Deutsche Bank Capital Markets Strategist Tom Joyce, who believes that it is very difficult for the economy to sustain high transmission rates (even if mortality runs low for those below aged 60)

In addition, he points out, he “Sweden Model”3 is not scalable for the vast majority of the global population living in dense urban and suburban settings. “While it took three months for the virus to spread to 500 thousand people globally, it only took eight days for cases to double to one million and then a further 13 days to reach two, three and four million, respectively,” he says (see Figure 1). From the narrow lens of economic analysis, “the true impact of Covid-19 comes from its extraordinarily high transmission, the highest in a century, even among young people”.

The economic damage from lockdowns has exceeded every expectation, and, declares Folkerts-Landau in The House View, “We now see much weaker growth in the major developed economies growth for 2020. In 2021, the US will only recover a third of this lost output while Euro Area growth will be more varied given the bigger shock this year and regional differences. This crisis is also going to permanently scar government balance sheets with war-time level deficits likely across the board.”

“In our view, virus suppression and the restoration of public health therefore becomes aligned with favourable economic outcomes,” adds Joyce. “While we need to reopen the economy, and learn to coexist with the virus, it is our view that simply ‘ring-fencing the elderly’ and going ‘back to work’ without virus suppression will lead to unfavourable economic outcomes.”

“The true impact of Covid-19 comes from its extraordinarily high transmission, the highest in a century, even among young people”

Figure 1: Cumulative confirmed Covid-19 case globally

The global economy did not have the best of starting points before the crisis unfolded. It entered the Covid-19 period vulnerable after the US-China trade war, with global growth at only 3% by the end of 2019, and with 23 major economies in a manufacturing recession in the summer of that year. As a result, this “lockdown recession” is expected to be the steepest in almost a century, and only the fifth global recession in the post-WWII period.

Deutsche Bank analysts have revised their full year 2020 global GDP forecasts sharply lower, nearly doubling the ”baseline” contraction expectations for the US, European and global economy. Forecast revisions for the “protracted virus scenario” were also revised down significantly (see Figure 2).

Figure 2: Deutsche Bank Research Global GDP forecast

In a nutshell:

- Covid-19 has the highest transmission rate of any virus in over a century (and widest, impacting 187 countries in just over three months).

- It requires much higher rates of hospitalisation and intensive care admission rates than seasonal flu, including for younger adults.

- Without social distancing, Covid-19 transmission can completely debilitate major healthcare and hospital systems within weeks – hence the lockdown policies.

- Regardless of government-set reopening dates, people will sharply limit discretionary activity and spending until they feel “safe” (consumer spending is 70% of US GDP, and more than 50% of that spending is discretionary).

- Viruses are not stagnant, but mutate, and sometimes strengthen, as they adapt to the human condition (this is what happened during the 1918-19 ‘Spanish flu’ pandemic).

- High transmission in the Northern Hemisphere increases transmission to Southern Hemisphere countries now entering their winter which, in turn, then increases the probability of return back to the North in the autumn.

- “Back to work” policies during periods of high transmission create formidable litigation, insurance and employee management challenges for public and private institutions.

- A high percentage of both US and global populations live in urban-suburban settings.

In order to effectively – and safely – reopen, we need to build an architecture to co-exist with the virus. The damage done by the economics of stoppage arising from lockdowns is just too enormous for more than a short-term response. But what would an effective Covid-19 architecture look like? At the very least it needs to include the following:

- Diagnostic testing to determine who has the virus (hence government targets on test volumes);

- Antibody testing to determine who might be immune from the virus;

- Fever testing to identify those who might be symptomatic; and

- Manual and digital tracing to determine who else may have been infected by the virus – people don’t remember who they have met and if they do, may not always want to name them.

Each of these testing and tracing initiatives have their own sets of weaknesses and shortcomings, so all the measures need to be implemented concurrently to eliminate any gaps.

In some parts of Asia, early, vigilant and broad-based testing has helped those regions move further along their exit paths. However, economies such as the US and, to an extent, the UK that failed to prioritise testing and tracing sooner, are having more difficulties with the phased re-opening of their economies.

“Immunity passports” (see Figure 3) also look set to become part of routine border controls where digital tracing and some form of health QR codes could become commonplace. The UK government’s Covid-19 recovery strategy (11 May) document4 outlines an intended two-week quarantine period for people arriving in the UK, subject to some exemptions.

Figure 3: Digital testing and immunity passports

Source: New York Times 1 March 2020

“Whatever we do, we must take care that the R does not exceed one”

The R Factor

When UK Prime Minister Boris Johnson unveiled a new alert system as part of the country’s “roadmap” for lifting lockdown restrictions on 10 May 2020, the focus was on the “R-number”, with R referring to the average number of people that a person infected with Covid-19 contaminates. The goal is to keep this number below 1.0. “Whatever we do, we must take care that the R does not exceed one,” he said.5 The government went on a day later to issue its Covid-19 recovery strategy, setting out a schematic of how transmission works (see Figure 4).

This UK government strategy document articulates the conundrum facing all economies: “The longer the virus affects the economy, the greater the risks of long-term scarring and permanently lower economic activity, with business failures, persistently higher unemployment and lower earnings,” the authors noted. ”This would damage the sustainability of the public finances and the ability to fund public services including the National Health Service (NHS). It would also likely lead to worse long-run physical and mental health outcomes, with a significant increase in the prevalence of chronic illness.”

Figure 4: Transmission of the virus

Source: HM Government May 2020

Current exit positions

“The Covid-19 crisis risks leading to a further widening of economic divergences in the EU,” notes the EU Spring Economic Forecast (see Note 1). The document points to the differing impacts across the EU – and much the same can be observed all across the world. “The Covid-19 crisis risks leading to a further widening of economic divergences in the EU. While the pandemic is a symmetric shock, the impacts differ across Member States, reflecting the severity of the pandemic and stringency of related containment measures, different exposures due e.g. to the size of the tourism sector, and the available space for discretionary fiscal policy responses.”

It is this divergence that makes any kind of collective approach to restart economies as countries emerge from lockdown very difficult. It is, for example, something the US finds challenging as each of its 50 states are on different trajectories where activity at the state level is highly correlated to political allegiances. From an FX perspective, reflects Deutsche Bank’s Robin Winkler, “Differences between countries matter as much as the global trend, and we thus think of reopening as a competitive race”

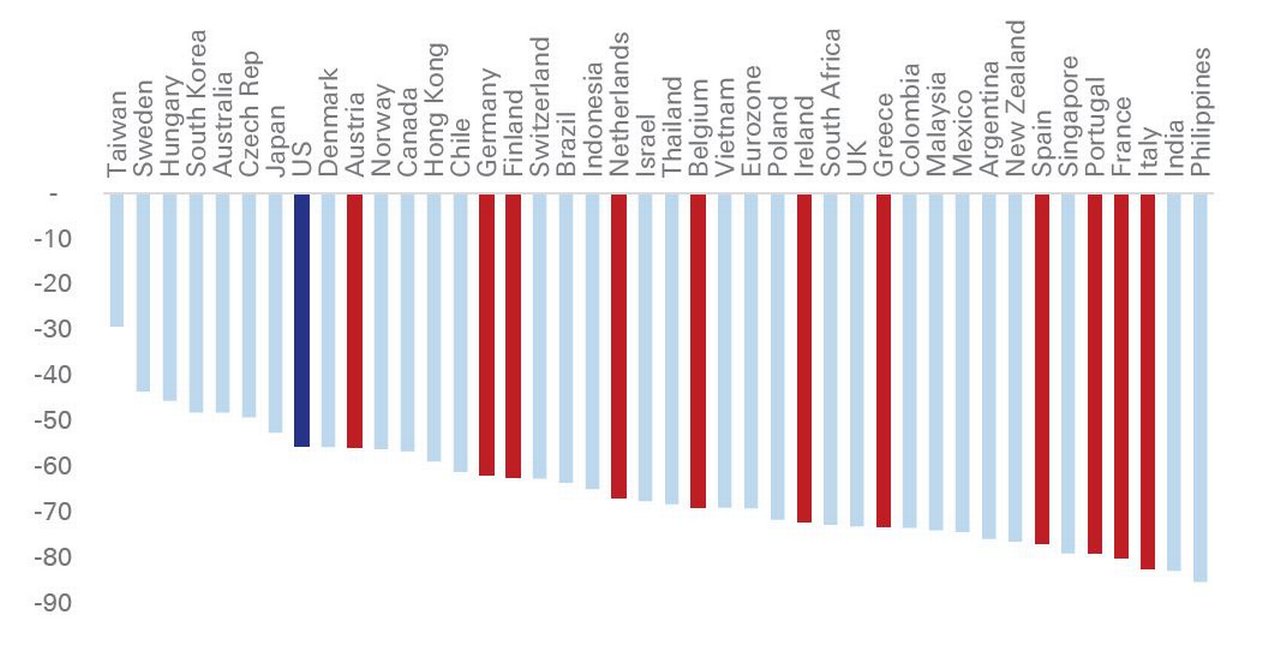

Figure 5: The US is now more open than any Eurozone country

Source: Deutsche Bank, Google Community Mobility Report

While our analysts observe that differences between regions and countries remain broadly stable, they note that North Asia leads the way out of the pandemic, followed by the Nordics and, more lately, Eastern Europe. “Turkey, the Philippines, India, and Italy are the most shut down countries. New Zealand has opened up notably and is about to leave the UK as the laggard in G10,” reflects Winkler (see Figure 5 above).

When it comes to FX, the two major trends particularly relevant for EUR/USD, says Winkler are:

- The US is now more open than any Eurozone member state and is operating under more normal conditions than the Eurozone

- In the Eurozone, the core is diverging from the periphery. Specifically, Germany, Finland, Austria and the Netherlands are significantly more open than Italy, Spain, France, and Portugal. “If this European divergence translates into core economies recovering sooner and faster in the coming weeks, it could complicate progress on a joint fiscal response to the pandemic,” adds Winkler.

New priorities

As the US and other economies move towards a gradual reopening, higher importance and lower risk activities will return at a more rapid pace than higher risk and non-essential services, reflects Deutsche Bank’s Joyce. Figure 6 provides an illustrative overview and the basic principle of those essential industries where there is a low risk of contagion (either through protection or an ability to manage workforce and client interaction locations) are in the top left column, with discretionary offerings such as concerts and gyms with high contagion risks in the bottom right.

Figure 6: Activity importance and risk matrix for reopening

Joyce sees a rise in what he calls “stakeholder capitalism where employees and customers become as important as shareholders, and where “resilience” becomes a more important piece of the environmental, social and governance (ESG) framework. For example, the resilience and security of supply chains will likely become more important than cost and speed – rethinking the “merits” of just-in-time supply chains.

In the meantime, Deutsche Bank analysts offer scant hope for much upside anytime soon and clear winners are hard to predict at the moment. They see economic activity in most regions of the world “advancing gradually over the quarters just ahead but remaining significantly below pre-virus levels through next year and substantially below levels that were projected for the end of 2021 as recently as several months ago”.

But the world is better equipped to deal with this pandemic and life after it than it has been in previous ones in 1918, 1957 and 1968. “Governments around the world have taken extraordinary steps to protect human life and support their economies,” reflects Deutsche Bank’s Henry Allen in his Konzept article: What prior pandemics can teach us today (13 May).6 “This offers the chance for the subsequent recovery to be significantly stronger than it could otherwise have been. Technology is already taking a leap forward. Indeed, the only reason why the covid-19 recession is not even more severe than it is, is because technology has allowed people to work and engage with the economy remotely.”

Summary of Deutsche Bank Research reports referenced

- The House View: Covid-19: Health check (13 May 2020) by Marion Laboure; Henry Allen, and Jim Reid

- FX Daily: Eyes on the eggs (8 May 2020) by Robin Winkler

- Konzept # 18: Life after covid-19 (page 57)

Deutsche Bank clients can access the full research reports here

If you would like access do contact a Deutsche Bank sales representative

Sources

1 See https://bit.ly/2T6TNol at politico.eu

2 See https://bit.ly/2zFMyN7 at research.db.com

3 See https://bloom.bg/2T79BHF at bloomberg.com

4 See https://bit.ly/2WWNOU5 at gov.uk

5 See https://bit.ly/2WxTODX at gov.uk

6 See https://bit.ly/2yVQrh5 at dbresearch.com

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

MACRO AND MARKETS, TRADE FINANCE, CASH MANAGEMENT

End of the tunnel End of the tunnel

With light at the end of the Covid-19 tunnel nearer for some regions than others, flow’s Clarissa Dann examines the pandemic’s economic impact and responses as households and firms plan for the eventual recovery

CASH MANAGEMENT

Corporate tips for navigating Covid-19 Corporate tips for navigating Covid-19

COVID-19 has precipitated a global shock that poses significant risk for business. To assist in this situation, Deutsche Bank’s Capital Markets Strategy team provides a detailed checklist for operational, funding and risk management functions

Macro and markets, Cash management, Trade finance and lending

Towards a silver lining Towards a silver lining

While the Covid-19 pandemic extends its grip, analysts are already assessing the impact and cost of what could be around US$5trn in fiscal support, and economies taking lessons from the global financial crisis