07 May 2020

As lockdown continues into Q2, unemployment escalates in all regions with the International Labour Organization predicting losses of more than 300 million full time job equivalents. What does this mean for economic recovery? Clarissa Dann reports on the balance between profit and GDP tomorrow versus survival today

In a letter to staff on 28 April 2020 entitled “Preparing for a different future”, British Airways Chairman and CEO Alex Cruz explained the reasons for the headcount reductions being discussed with the British government and trade unions. These were “not just to address the immediate Covid-19 pandemic but also to withstand any longer-term reductions in customer demand, economic shocks or other events that could affect us”.1

The airline, along with many other businesses, is grappling with the fact that − as Cruz puts it − the taxpayer cannot be expected to offset salaries indefinitely. “Any money we borrow now will only be short-term and will not address the longer-term challenges we will face,” he said.

BA Chairman and CEO Alex Cruz with the UK monarch HM The Queen in happier times (May 2019)

If an industry is forced into operating at well below capacity to observe social distancing rules, revenues and profitability will drop. Some business models – airlines being an example – just cannot take this. As flow reported in Consumer caution and Covid-19 (30 April) “as each economy plans its lockdown exit, households are saving more, and prioritising home essentials over luxuries”.

However, its unemployment rate directly impacts an economy’s recovery prospects. It was for this reason that governments put in place “soft loans to support companies while public health needs mean economic activity is suppressed” (The Economist, 2 May). However, “that approach relies on the idea that things will eventually return to normal”. Some employers, such as BA with its announcement of 12,000 redundancies, and Virgin Atlantic’s declaration of its 3,000 cuts have taken the view the revenue hole is too big and not necessary temporary as appetites for air travel change – and most likely diminish.

"For millions of workers, no income means no food, no security and no future"

Scale of the job loss impact

In the International Labour Organization’s updated estimates and analysis of its report, Covid-19 and the world of work (3rd edition, 29 April), it notes the scale of unemployment is worse in Q2 for all major regional groups. “Estimates indicate that the Americas (12.4 %) and Europe and Central Asia (11.8 %) will experience the greatest loss in working hours.”

This United Nations’ main labour body updated its prediction of Q2 job losses to 305 million full-time jobs based on a 48-hour working week. Pointing out that the 1.6 billion workers in informal economies represent half the global workforce, it calls for governments to “protect the vulnerable”. “As the pandemic and the jobs crisis evolve, the need to protect the most vulnerable becomes even more urgent,” says ILO Director-General Guy Ryder (29 April). He continued, “For millions of workers, no income means no food, no security and no future. Millions of businesses around the world are barely breathing. They have no savings or access to credit. These are the real faces of the world of work. If we don’t help them now, these enterprises will simply perish.”2

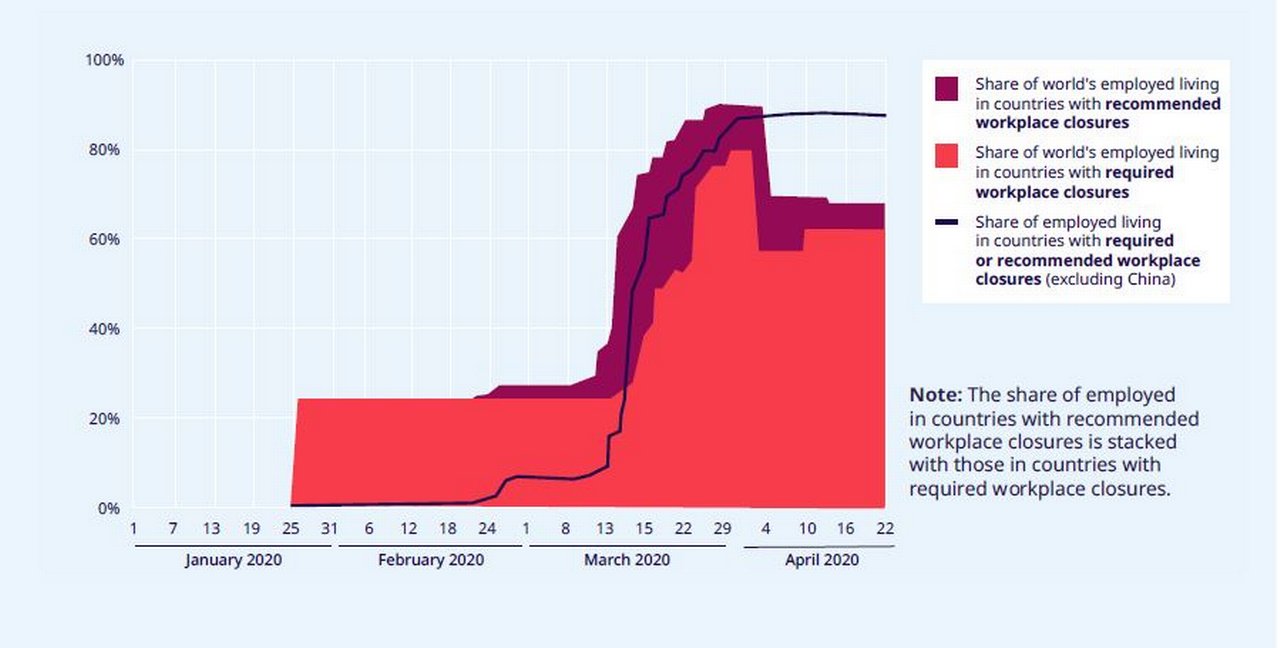

According to the ILO, around 68% of the world’s total workforce, including 81% of employers and 66% of own-account workers, are currently living in countries with recommended or required work place closures. Tellingly, it predicts, “For those that are engaged in global supply chains, disruptions are likely along the forward and backward linkages of the chain as other countries continue to face reductions in economic activity.”

Figure 1: Impacts of recommended and required workplace closures (as of 22 April 2020)

Source: International Labour Organization

Regional differences

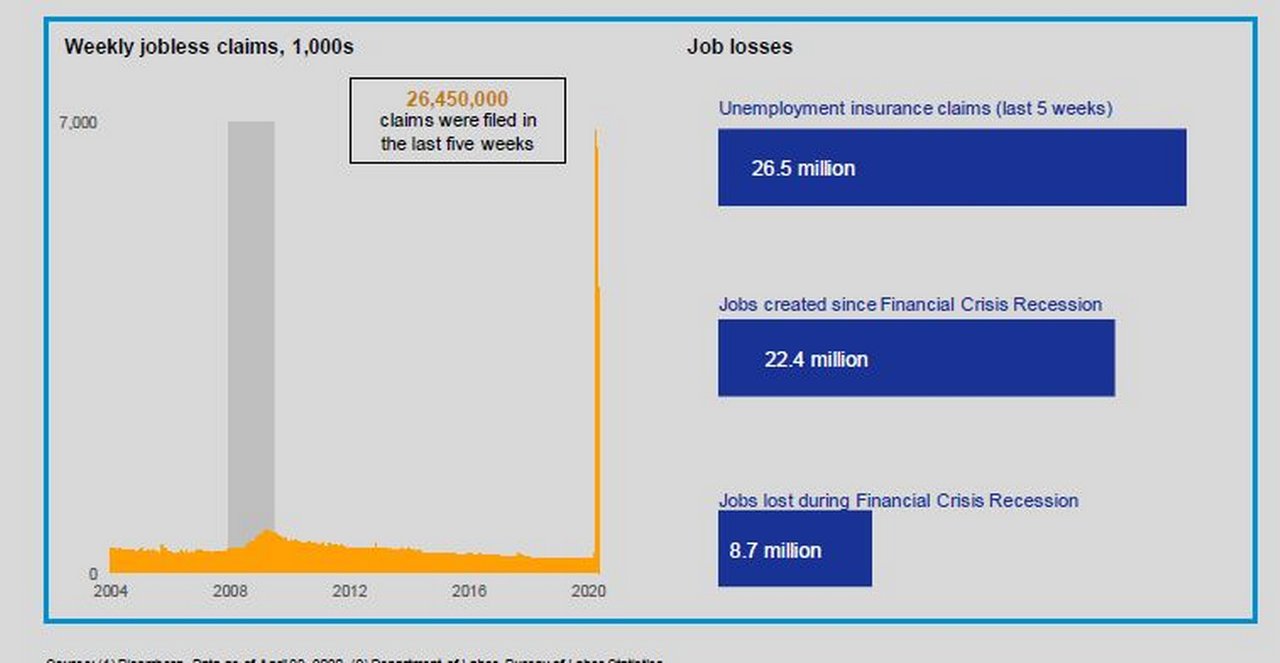

26,450,000

Levels of unemployment impact interest rates, FX, credit and equities, says Torsten Sløk, Chief Economist at Deutsche Bank Securities. “Because of different policy responses, including lockdown decisions and kurzarbeit in Germany, some countries and some states in the US have seen a much bigger increase in the unemployment rate than others,” he explains.

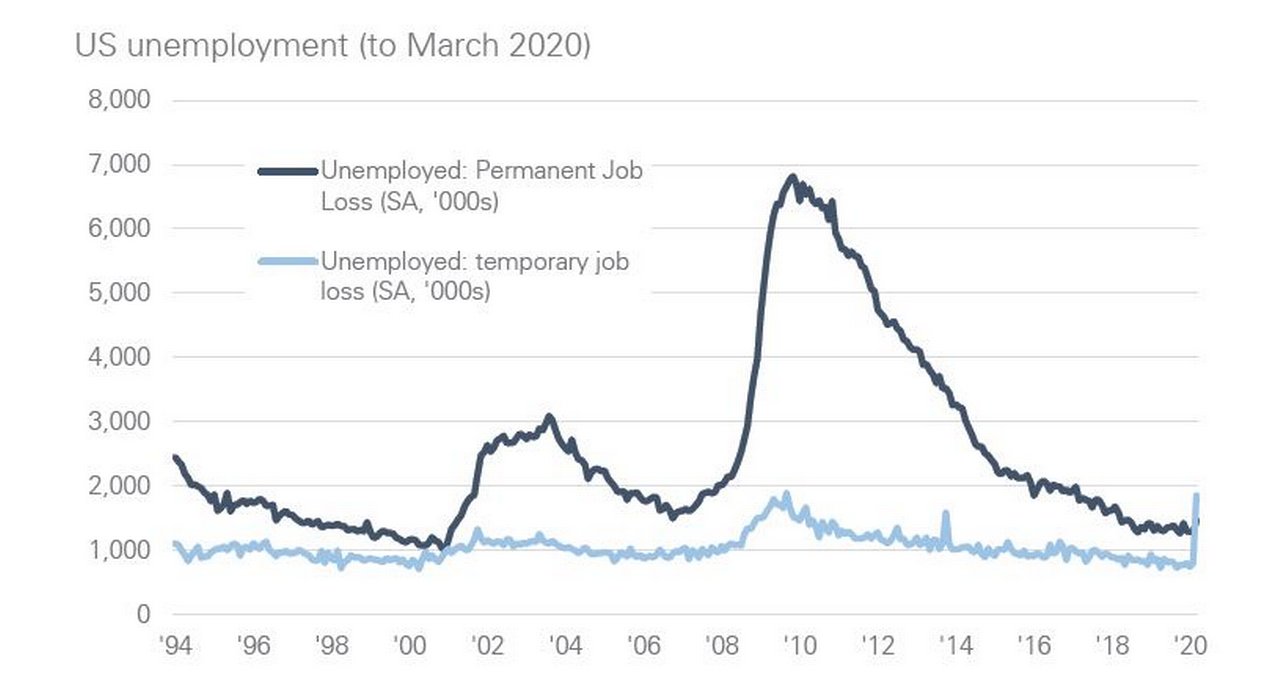

For example, adds Tom Joyce, Capital Markets Strategist at Deutsche Bank in C-Space: Life after Covid (April 2020), “with more than 26 million new jobless claims, the US has undone the job creation of the entire post-crisis decade in five weeks” (see Figure 2). He continues, “In the US, Deutsche Bank and consensus forecasts for peak US unemployment in Q2 are in the 17–20% area, nearly double the highest US unemployment rate of the post WWII era (which was just over 10% in 2009).”

Figure 2: Historic rise in US unemployment

Source: (1) Bloomberg. Data as of April 28, 2020. (2) Department of Labor. Bureau of Labor Statistics

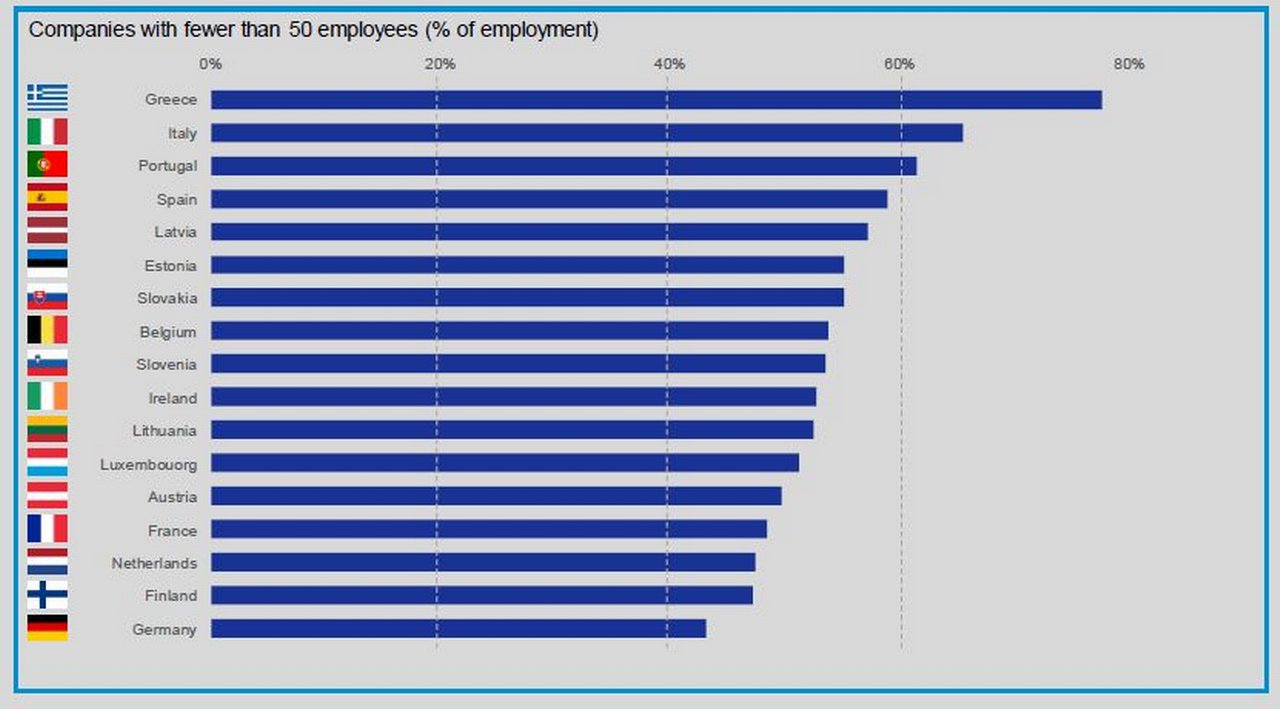

Turning to Europe, Joyce makes the point that numerous countries across Southern Europe have a more vulnerable labour market structure, because of the higher dependence on tourism as well as the smaller average size of companies driving employment (see Figure 3).

Figure 3: Europe’s vulnerable labour market structure

Source: FT. Moodys “Coronavirus’ lasting credit impact will depend on crisis duration and fiscal exit strategies.”

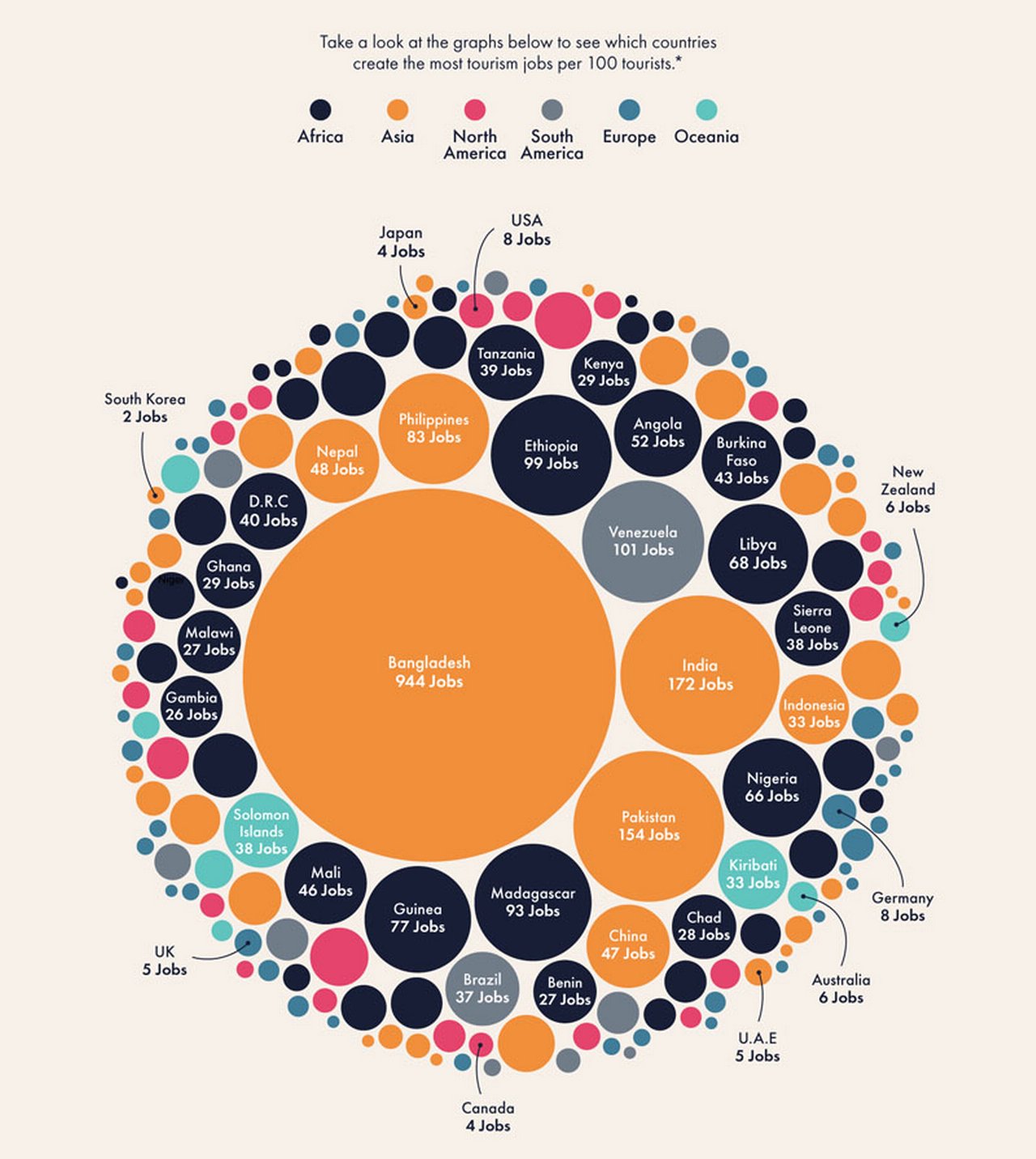

When the direct contribution of travel and tourism to an economy’s employment is analysed in terms of jobs created for every 100 tourists it attracts, Bangladesh leads the pack of 172 countries. The infographic from official-esta.com (see Figure 4) spells this out.

Figure 4: the most tourism jobs per 100 tourists

Source: official-esta.com

"The biggest difference between the financial crisis and today is the huge increase in furloughing rather than permanent layoffs"

Furloughs and lay offs

Starting points of unemployment levels have, notes Deutsche Bank’s Sløk, “significant consequences for expected cash flow for corporates as well as the outlook for consumer spending and capex spending”.

This is demonstrated when you consider countries and American states with high unemployment rates alongside countries and states with low ones. “Companies operating in countries and states with lower unemployment rates are likely to experience a faster rebound in earnings which, ultimately will also results in a faster rebound in GDP,” he predicts.

Figure 5: Temporary layoffs exceed permanent ones for the first time

Source: BLS, Haver Analytics, Deutsche Bank

Readiness for rebound is a point developed further in Deutsche Bank Analyst, Thematic Research Luke Templeman’s paper, Furloughs, layoffs, and recovering from Covid-19, which, despite the high profile lay-offs in the news, reveals a more far-sighted approach to preserving human capital.

“Perhaps the biggest difference between the [2008-09] financial crisis and today is the huge increase in furloughing rather than permanent layoffs,” reflects Templeman (see Figure 5). “There are three reasons for this: most economists and firms expect the Covid-19 crisis to be short, albeit deep; there is a greater risk of reputational damage in laying off staff; and staff have increasingly become more important to companies.”

The report analyses several metrics to determine the importance of staff to long-term profitability:

- Companies now make a lot more profit from each of their employees than previously. Large US companies generate more than US$55,000 per staff member each year, a significant jump from the roughly US$38,000 generated just in the pre-financial crisis boom era. Meanwhile, European companies generate just over €33,000, a little higher than the pre-crisis level, however, a strong climb since its immediate aftermath.

- The report examines the Human Capital Return on Investment (RoI) by taking a deep dive into the financial accounts of individual European stocks. One unexpected result is the relationship between Human Capital RoI and subsequent share price movements, Returns on Equity (RoE), and a firm’s overall staff costs. In short, the higher a company’s staff costs, as a proportion of its total operating costs, the lower its Human Capital RoI. This suggests that in firms where staff costs are not a large proportion of the cost base, managers are less troubled by ensuring that new hires are justified, and they therefore bring lower returns. This might be easy to explain if these companies were young, high-growth companies. But this is not the case: the sample of low-staff cost companies was dominated by energy, utility, and consumer firms.

- It is also quite striking from the research to see which companies exhibit the strongest relationship between RoE and Human Capital RoI. Companies in the top quartile for RoE see very little correlation with Human Capital RoI, while the worst stocks have the strongest positive relationship between RoE and Human Capital RoI.

Templeman concludes: “From our sample of large companies, we find that companies that are struggling may have the most to gain. This implies that, if the worst performing firms can increase the efficiency of their hiring decisions, this can have a substantial effect on their returns.”

At the end of the day, the balance of public sector exchequers to support private sector future revenues – and tax flows – is a difficult one. Some industries are at a crossroads and are navigating the “new normal” post-Covid-19 or could find themselves in an environment where everyone lives with it. This requires innovation and resilience to deliver value and that means having the right people.

Summary of Deutsche Bank Research reports referenced

Global Macro Outlook: Virus curve flattening out and recession curve flattening out (1 May 2020) by Torsten Slok

Furloughs, layoffs, and recovering from Covid-19 (30 April 2020) by Luke Templeman

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

MACRO AND MARKETS

Central banks: on-side or outside? Central banks: on-side or outside?

How much “support” should central banks give Covid-19 stricken economies? With the focus on fiscal responses, what tools remain in the monetary policy armoury? flow´s Clarissa Dann reviews Deutsche Bank Research insights

Cash management, flow case studies, Technology {icon-book}

Tomorrow’s treasury: what’s the role of real-time? Tomorrow’s treasury: what’s the role of real-time?

The vision of a “real-time treasury” has been around for several years now. But how do instant payments and access to real-time information really change the way treasury is managed? flow’s Desirée Buchholz hosts a debate on the role of real-time in the future of treasury

Technology, Macro and markets

AI deep research – is this a gamechanger? AI deep research – is this a gamechanger?

The flurry of AI deep research launched at the beginning of 2025 has significant consequences for knowledge workers – and the global economy. flow shares insights from Deutsche Bank Research’s paper that identifies winners and losers – and AI’s capacity for longer-term self-improvement