30 April 2020

Consumer spending drives almost 70% of US GDP and as each economy plans its lockdown exit, households are saving more, and prioritising home essentials over luxuries. flow's Clarissa Dann reviews the changing patterns of consumer behaviour where age groups, regions, and containment strategies determine which industries will get the shrinking wallet allocations

On 23 March 2020 UK fashion and home furnishing company Laura Ashley announced the permanent closure of 70 stores after more than six decades of trading, as it brought in the administrators. In a statement to investors, it said, “The Covid-19 outbreak has had an immediate and significant impact on trading, and ongoing developments indicate that this will be a sustained national situation.”1

UK 71-outlet restaurant chain Carluccios went into administration at the end of March, blaming tough trading conditions made worse by the coronavirus outbreak, which has seen restaurants shut their doors2.

These chains are just two examples of retail businesses that targeted discretionary consumer spending now dealt a further blow by Covid-19. Already the British Retail Consortium (BRC) had reported in September 2019 that the number of shoppers heading to UK high streets, retail parks and shopping centres has fallen by 10% in the past seven years3.

“Recent political uncertainty and a decade of austerity appear to have ingrained a more thrifty approach to shopping among consumers,” commented BRC Chief Executive Helen Dickinson on UK consumer behaviour in February 2020.4 “Furthermore, as sustainability continues to rise up the agenda, many customers are switching to more environmentally friendly products or simply choosing to buy less”.

In the US, the grocery giants such as Walmart, Target, Kroger and Costco are flourishing, reported USA Today on 14 April5, but “others are trying to stave off doom”. In common with many other non-essential goods providers such the UK’s Laura Ashley, these retailers were “already in trouble as Americans shopped increasingly online”.

"Many customers are switching to more environmentally friendly products or simply choosing to buy less"

Lockdown losses

Around the world consumer behaviour has been changing in different ways, depending on the region and the age group, but one thing unites all behaviours during Covid-19 – discretionary expenditure is reduced. This has profound consequences for sectors such as apparel, tourism, hospitality, to name a few.

Graeme Pitkethly, Anglo-Dutch multinational company Unilever’s Chief Financial Officer, told the Financial Times (23 April)6 that around a quarter of personal care products such as hair washing, hairstyling and skincare/personal hygiene were used by people preparing to go to work or school, and added that homeworking was “cutting into demand for products in these areas”. He expected changes in consumer behaviour to persist after the lockdowns ended and said that his business was adapting. Such changes included greater appetite for household hygiene products, and the shift to online digital consumption of media and online shopping which the company sees as “something that will be permanent”.

Airlines face a 50% drop in revenues per passenger kilometres in 2020, according to the International Air Transport Association (IATA). The industry body makes the point, “In addition to the health concerns, the speed with which consumers return to air travel will depend on their financial circumstances. The prospect of a global recession that is more severe than the Global Financial Crisis casts a shadow over the outlook, adding a further challenge for airlines looking to boost consumer confidence to travel.”7

Consumption containment

GDP growth or contraction is determined by volumes of personal consumption, business investment, government spending and net exports. Thus for economies such as the US, where private consumption generates almost 70% of its GDP,8 external shocks that inhibit consumer expenditure such as this current pandemic have a far-reaching effect. All eyes are on what a revival of demand might look like and which sectors will recover first.

“European countries are the least optimistic, while China’s optimism is higher, and Chinese consumers’ intent to spend across select categories is starting to recover,” notes McKinsey in its survey of consumer spending across 40 countries.9

Countries that have had more success with early containment of the Covid-19 outbreak are further ahead with displaying their likely post-pandemic consumer behaviour, which provides some clues as to how other economies are likely to see patterns of spending.

In short, behavioural changes are slowing growth in the forthcoming quarters, notes Torsten Sløk, Deutsche Bank’s Chief Economist, Deutsche Bank Securities. He summarises the household changes as follows:10

- Increase in precautionary savings for households, similar to what occurred after the Great Depression in the 1930s.

- More space between seats at restaurants, cinemas, sport events, concerts, conferences, trains, buses, and aeroplanes

- Fewer people traveling on holiday and going out socially until there is a vaccine, all contributing to lower consumer spending.

- Older generations staying at home until a vaccine is released, along with less willingness by their children to put parents in retirement homes

- Limits on the number of people in supermarkets at the same time, more online shopping, and more online doctor visits.

- Fewer people going to health and fitness clubs and joining group sports

- First-time car purchases, with more people driving their own vehicle to avoid crowded public transport

- Health insurance premiums going up (in countries where there are low levels of state provision)

“Once stores open," says Sløk, “those entities that get dollars coming in the door first will see the biggest impact on upside in terms of balance sheet and cashflow”. He adds that “secondary and tertiary services are more at risk of being more vulnerable”. Sløk explains that it makes a difference which parts of the population will be “allowed out first”. “What does it mean for the older spend on travel and culture if over-75s hear that they will not be allowed out for the rest of the year until there is a vaccine?” he asks.

"Once stores open, those entities that get dollars coming in the door first will see the biggest impact on upside in terms of balance sheet and cashflow"

The reality is that if older people stay at home until a vaccine becomes widely available, we are likely to see downward pressure on consumer spending on entertainment, restaurants, travel, transport, and durable goods, and we have already seen more severe declines in car sales for buyers over 55.

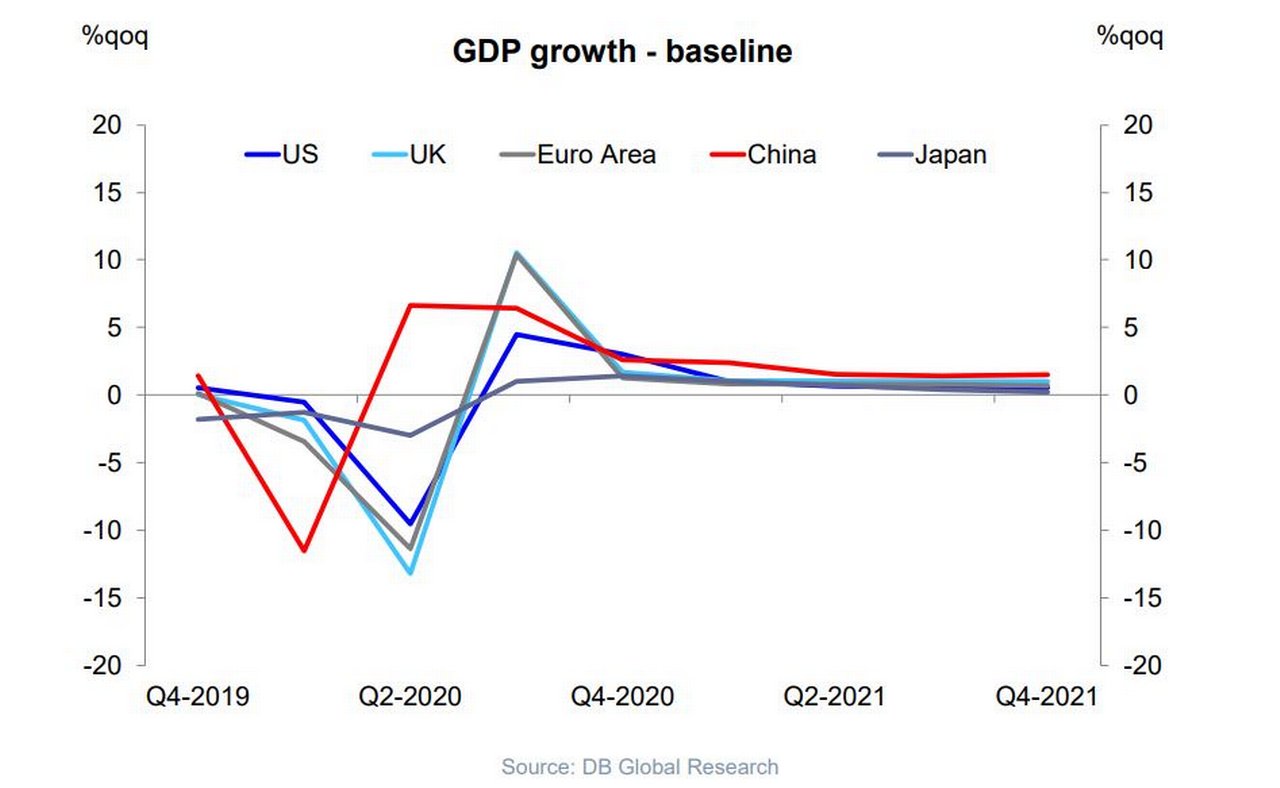

Sløk predicts GDP in the main developed world economies will see a “swoosh” recovery culminating in a long standstill as households save rather than spend (see Figure 1)

Figure 1: A swoosh recovery

Source: DB Global Research

Asia first

On 8 April, flow’s article Covid-19: the economy after Wuhan noted that Asia’s road to recovery has come from an earlier start, with some of the region’s economies in better shape than others. Given the more recent rise of its middle classes, and the impact of Chinese demand on the rest of the world’s trade, household spending behaviour is worth noting

“Just as China, South Korea and Taiwan appear to have successfully contained the outbreak, developments of Covid-19 have been worsening in South Asian and ASEAN economies,” note Michael Spencer and Juliana Lee in their report Asia Macro Insight: Effects of Covid-19 on households (9 April), which draws from Deutsche Bank Data Innovation Group research based on in-depth, high-frequency macro consumer surveys in eight major economies.

They add, “Although China and South Korea seem to have successfully contained the Covid-19 outbreak, household sentiment remains fragile and many people are still reluctant to return to pre-Covid patterns of behaviour.” One could expect a similar pattern of behaviour in economies behind China on the Covid-19 exit trajectory.

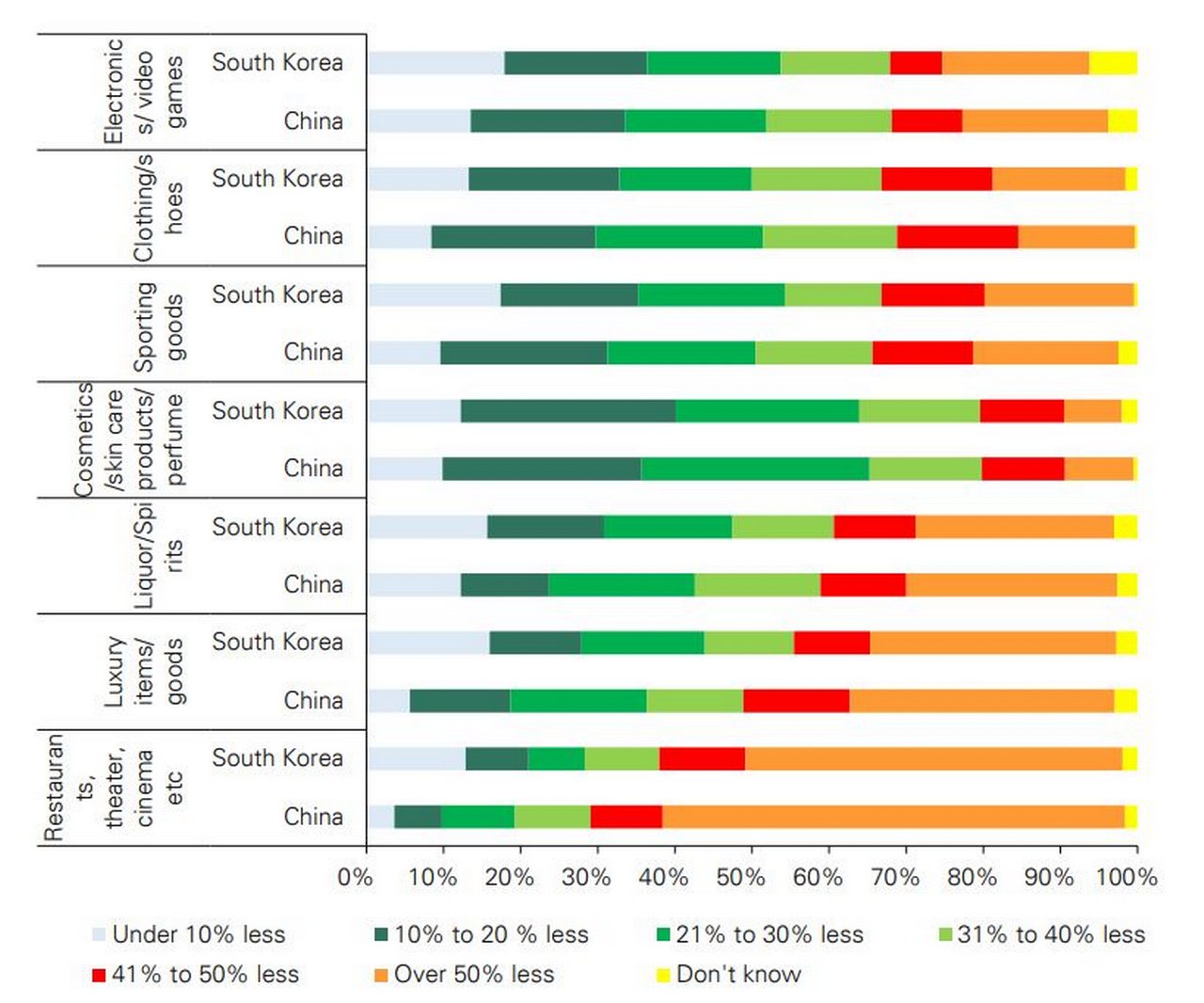

Figure 2: Survey question: How much less are you spending on the following

Source: dbDIG Primary Research, Deutsche Bank Research

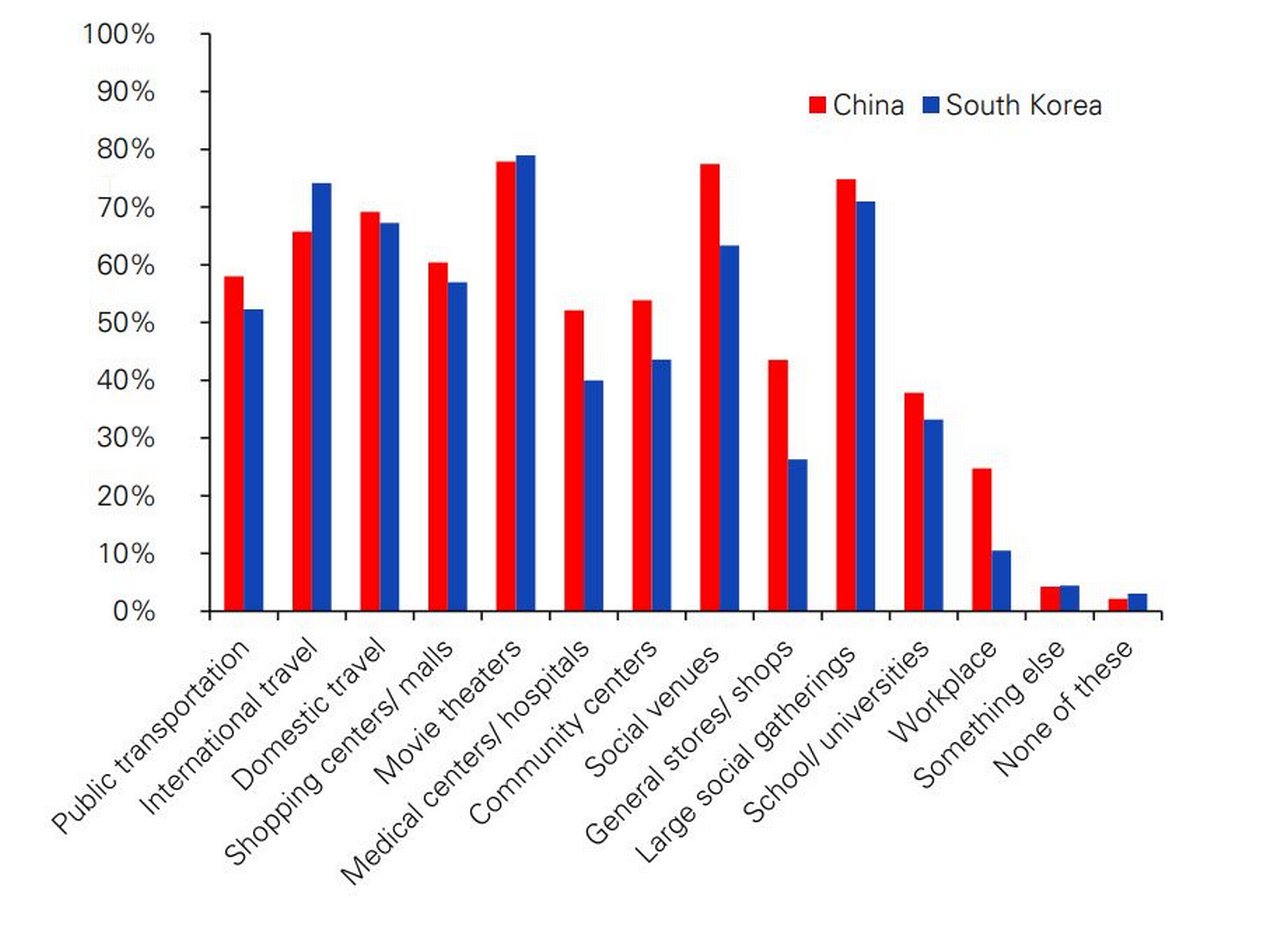

The impact of the pandemic on household behaviour in China and Korea has, note Spencer and Lee, been significant, as the public has voluntarily practised strict social distancing, even in the absence of national lockdowns. “In particular, consistent with the hard data, our dbDIG Household Survey points to a very sharp drop in economic activities that require exposure to crowded, enclosed, public places – including travel, cafes, restaurants, cinema, and recreational venues, among other,” they report.

Another worrying finding was that 40% of Chinese households said “they would feel comfortable getting on a plane only after six months or longer”, which is bad news for economies that rely heavily on tourism, such as Thailand.

Figure 3: Survey question: Which, if any, of the following are you currently avoiding due to the coronavirus?

Moreover, a significant share of China’s households are rethinking their auto purchases, a sector that has already seen a large drop in sales. If not for more robust online volumes, the impact on retail sales would have been even worse.

However, by 23 April signs of recovery in Chinese consumers’ appetite for automobiles was, from the perspective of Deutsche Bank analysts more positive. However, China is not necessarily a bellwether for Rest of the World demand for new models, although data does give some encouragement for car manufacturers. “While passenger retail vehicle sales in China were still down about 40% in March [2020], this represented a rapid improvement from February’s nearly 80% decline. With essentially all dealers now open, we are seeing evidence April should be materially stronger,” note the authors of US autos: Seven debate around autos recovery (23 April).

Impact on credit

Despite the various monetary and fiscal actions from governments around the world to lessen the blow, the Covid-19 shock to consumer – and business – demand is, according to a number of economic observers, likely to strain borrower credit quality. Standard & Poors see this as “resulting in an escalation in missed or deferred payments and, for banks, higher non-performing loans”.11

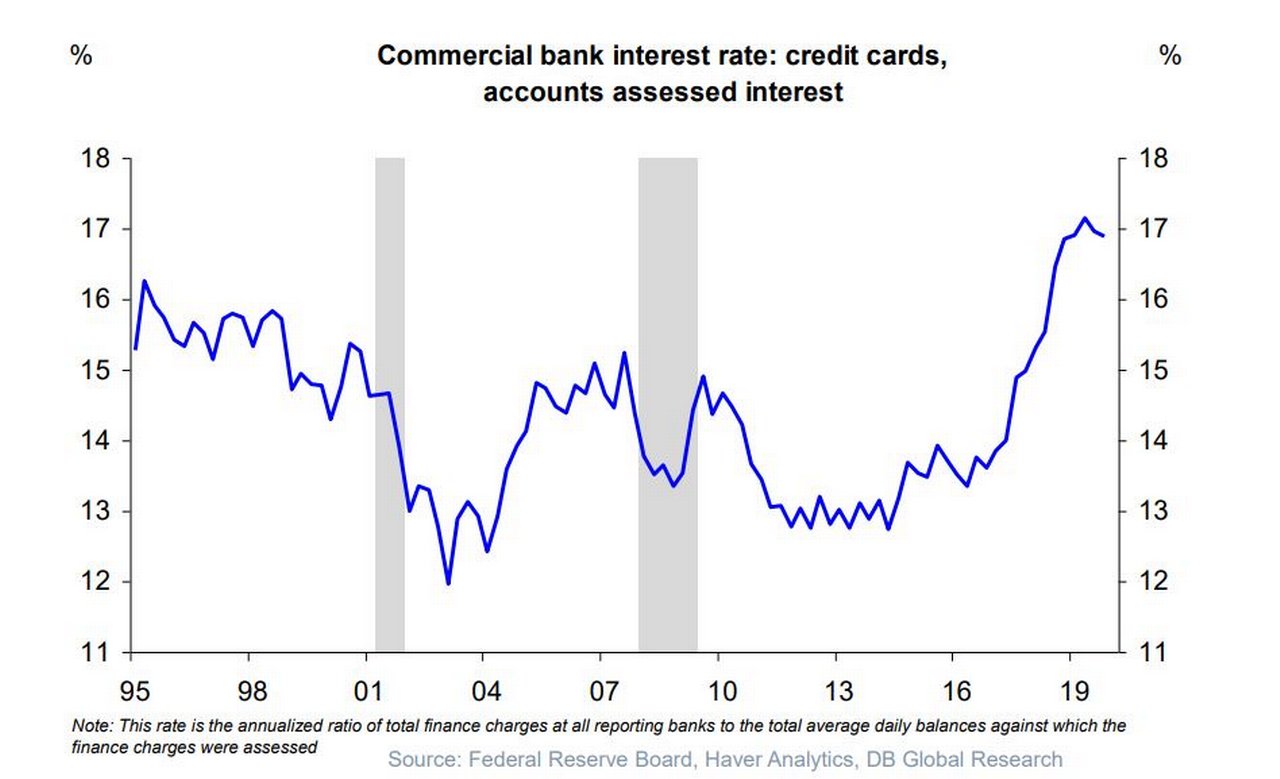

Figure 4: Credit card interest rate at highest in decades

Source: Federal Reserve Board, Haver Analytics, DB Global Research

Sløk reminds us that credit card interest rates are at their highest level in decades (see Figure 4) and that delinquency rates on credit cards and car loans (that finance 80% of new car sales in the US) are rising. Record levels of unemployment in the US are putting pressure on loan repayments – the last time America’s jobless rate reached 25% was in 1933 during the Great Depression.

Despite various schemes globally to help consumers with repayments holidays and freezes on loans, credit cards, store cards and catalogue credit, the perfect storm of reduced consumer demand, high unemployment and increasing consumer debt burden doesn’t look set to pass anytime soon. The International Labour Organization prediction global job losses to the tune of 25 million in 202012 are major inhibitors.

Summary of Deutsche Bank Research reports referenced

Global Macro Outlook: Virus curve flattening out and recession curve flattening out (27 April 2020), by Torsten Sløk

Asia Macro Insight: Effects of Covid-19 on households (9 April), by Juliana Lee and Michael Spencer

US autos: Seven debates around autos recovery (23 April 2020) by Emmanuel Rosner, Edison Yu, and Conor Walters

Deutsche Bank clients can access the full research reports here

If you would like access do contact a Deutsche Bank sales representative

Sources

1 See https://bit.ly/3aMJBHH at theguardian.com

2 See https://bit.ly/2VKOzAl at independent.co.uk

3 See https://bit.ly/2KLADzW at theguardian.com

4 See https://bit.ly/35dEaQX at brc.org.uk

5 See https://bit.ly/3aPzPVn at eu.usatoday.com

6 See https://on.ft.com/35mx7p1 at ft.com

7 See https://bit.ly/2We1D02 at iata.org

8 See https://bit.ly/35idcaA at ceicdata.com

9 See https://mck.co/35mxjEL at mckinsey.com

10 See Global Macro Outlook: Virus curve flattening out and recession curve flattening out (27 April 2020)

11 See https://bit.ly/2Ydj7wp at spglobal.com

12 See https://bloom.bg/2KLBxMQ at bloomberg.co

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published published annually and can be read online and delivered to your door in print

You might be interested in

TRADE FINANCE, MACRO AND MARKETS

Covid-19 and commodities Covid-19 and commodities

Covid-19 has shaken up the world’s commodities sector although price volatility is no stranger to its participants. Reduced demand has seen falling prices, lack of investment, and logistics log jams. Clarissa Dann reviews the fundamentals

Cash management, flow case studies, Technology {icon-book}

Tomorrow’s treasury: what’s the role of real-time? Tomorrow’s treasury: what’s the role of real-time?

The vision of a “real-time treasury” has been around for several years now. But how do instant payments and access to real-time information really change the way treasury is managed? flow’s Desirée Buchholz hosts a debate on the role of real-time in the future of treasury

Macro and markets, Trade finance, Cash management, Opinion {icon-book}

View from the top: A different level of athlete View from the top: A different level of athlete

Deutsche Bank’s David Lynne shares his perspective on how corporates are evolving their businesses and how this is reshaping bank/corporate relationships as they navigate new trade corridors, reroute supply chains and empower direct access consumers