09 September 2021

Federal Reserve chair Jerome Powell plans to start tapering off its asset purchase policy as the US economy recovers. But to what extent is the Delta variant of Covid-19 undermining this strategy? flow’s Graham Buck reports

MINUTES min read

In August 2020, Federal Reserve Chairman Jerome Powell’s speech at the annual Jackson Hole symposium signalled a definite shift in policy. Several months into the Covid-19 pandemic, the US economy had suffered a battering and Powell confirmed that the Fed would relax its stance on inflation – by tolerating a temporary rise above 2% – as one of the measures in helping it to revive. 1

Twelve months on, the message now is that the US economic recovery is strong enough for the Fed to begin to taper its policy of asset purchases later this year, said Deutsche Bank analyst Henry Allen (covering for for vacationing colleague Jim Reid) in the Early Morning Reid bulletin on 31 August.2

He reported that Powell also felt “there’d been “clear progress” towards the Fed’s maximum employment objective, and that the economy had already passed the test of “substantial further progress” on their inflation objective.

Steady hand

At the same time, the Fed chief “also struck a dovish tone that was picked up by investors, as he stressed that tapering was not a signal for eventual rate hikes, and warned that monetary policy should not respond to transitory inflation pressures, as any moves to tighten prematurely could needlessly slow hiring and keep inflation too low.”

Investors worldwide were reassured, having previously fretted over a possible repeat of “the 2013 taper tantrum”, wrote Simon Nixon in The Times of London on 2 September. At that time the Fed – then with Ben Bernanke as its chairman – had signalled “what investors considered a premature tightening of monetary policy in the aftermath of a long crisis”. The ensuing sharp rise in US bond yields and fall in stock markets had threatened to trigger a fresh crisis by pushing up borrowing costs and derailing fragile emerging market recoveries and it needed Bernanke’s “intensive damage limitation” to soothe market nerves. Eight years on Powell had proved more successful than his predecessor by convincing markets that “even if tapering starts later this year, interest rate rises may still be some way off”.

Powell also played down fears that either the US or wider world is on the brink of any inflationary spiral to warrant a sudden tightening of monetary policy; an outlook shared by other central banks including the Bank of England and European Central Bank (ECB), said Nixon. The speech was consistent his previous performances, commented The Economist in its 3 September issue. “Mr Powell has refined the way the Fed communicates, targeting his messages at ordinary Americans rather than economists. He has led a landmark shift in the way it thinks about interest rates. And in the process, he has presided over a bold gamble, keeping policy ultra-loose even as inflation soars.”

Inflation persists

As flow reported in our July article ‘Inflation: where next?’ the message from the Fed and others that the re-emergence of inflation will be short-lived has failed to convince many analysts. However as noted in their 31 August white paper, ‘US Economic Perspectives: Trend inflation dashboard supports Powell’s Jackson Hole message’, Deutsche Bank’s US Chief Economist Matt Luzzetti and colleagues noted that Powell had offered five reasons to support their view that “the recent inflation spike was likely to prove temporary” and among them “was the “absence so far of broad-based inflation pressures.” Others were listed in the team’s separate note ‘DB Fed Watcher: Jackson Hole affirms that September is too soon for tapering’, also published 31 August (and in May Bloomberg actually listed six reasons3 why the Fed was unperturbed):

- Little sign of inflationary wage gains;

- Inflation expectations remain anchored;

- Moderating rice gains in high-inflation terms; and

- Persistent global disinflationary forces.

Nonetheless, US core personal consumptions expenditure (PCE) inflation in July maintained the strong momentum of the previous three months in July, inching four basis points higher to 3.6% year-on-year, its highest reading since the early 1990s, although “once again a handful Covid-related categories” accounted for most of the increase. Some encouraging trends were evident within the August data, the team noted. “Several sectors that were at the epicentre of prevailing supply-demand bottlenecks have shown some progress towards normalising. For example, though vehicle prices remained elevated at +0.9% in month-over-month terms, which was well below the more than 3% monthly gains over the last quarter.”

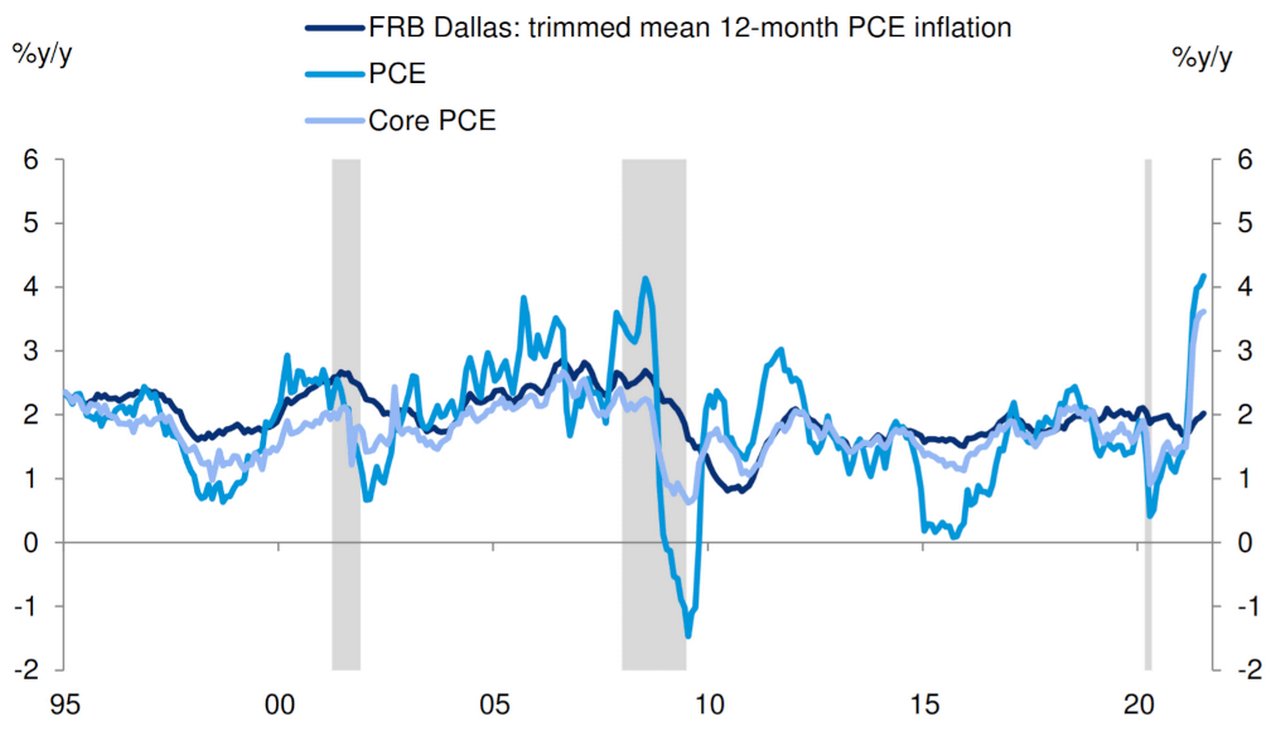

Figure 1: US Headline inflation and some common measures of underlying inflation: Core and trimmed mean

Source : FRB Dallas, BEA, Haver Analytics, Deutsche Bank

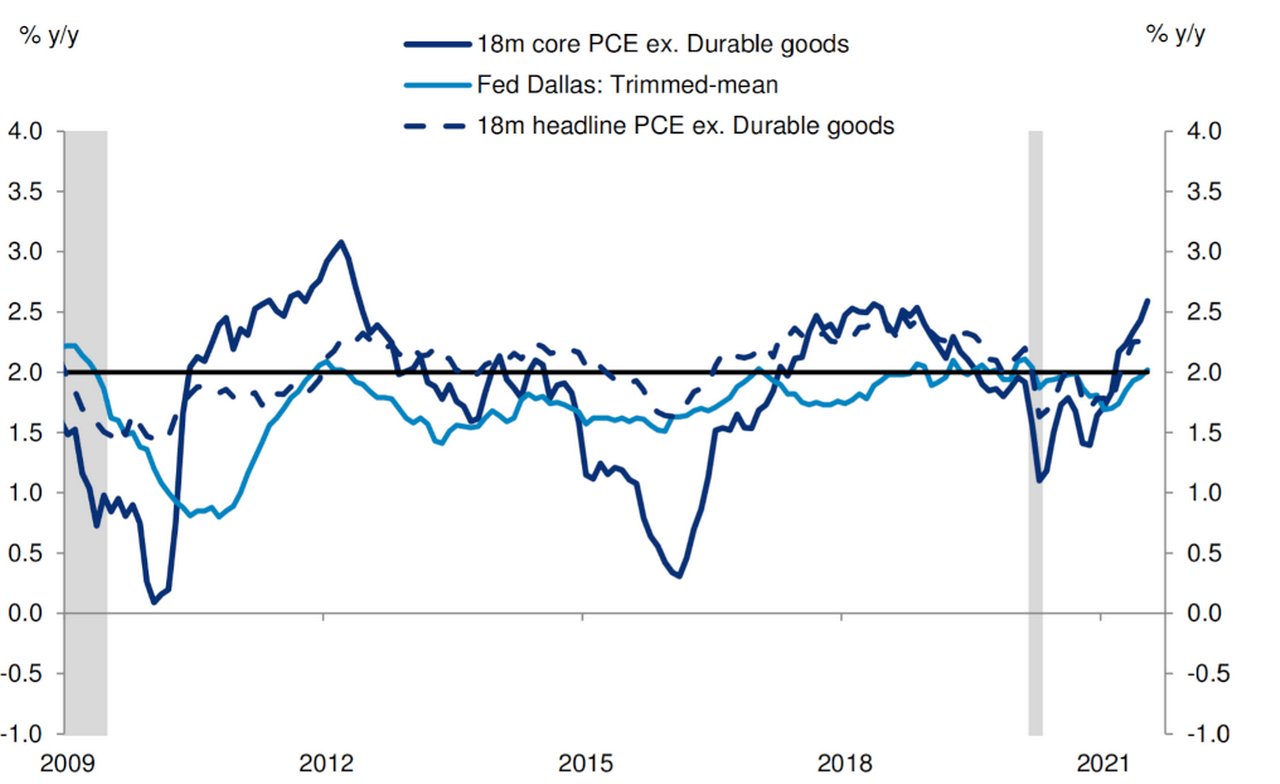

Figure 2: Measures of broad-based US inflation generally remain moderate

Source : FRB Dallas, BEA, Haver Analytics, Deutsche Bank

Luzzetti and colleagues are only modestly adjusting their trend measures of US inflation in response. “Our monthly mean estimate of underlying inflation edged 3bps higher to 2.05% in July, while the median estimate increased 6bps to 2.02%. The latter is consistent with the trimmed mean PCE measure which is now at the Fed’s target. In contrast with headline and core measures of inflation, underlying inflation is thus close to the Fed’s 2% inflation objective,” they report.

“While Powell now seems to be more comfortable with the transitory inflation narrative, he also emphasised the importance to remain vigilant for evidence that inflation pressures are becoming more broad-based and thus persistent. As such, it will be important to keep monitoring the incoming data for signs of improving supply/demand imbalances and inflation moderation.”

“It will be important to keep monitoring the incoming data for signs of improving supply/demand imbalances and inflation moderation”

In search of full employment

Three days after the Deutsche Bank report by Luzzetti et al was published, the US jobs report for August showed that non-farm payroll growth added only 235,000 jobs against expectations that the figure would be around 720,000. There was a similar disappointment in April – when Deutsche Bank Strategist Jim Reid reflected that the 266,000 added instead of the expected million was “highly indicative of how difficult it is to hire at the moment as the economy fires back”.4 As Powell pointed out in his 27 August Jackson Hole speech, “The levels of job openings and quits are at record highs, and employers report that they cannot fill jobs fast enough to meet returning demand.”

This latest low level of jobs was explained in The Sunday Times’ 5 September issue by its US economic and business columnist Irwin Stelzer. In his view, the Covid-19 Delta variant is estimated to have reduced job creation by about 600,000 as US workers with childcare responsibility stayed at home while those exposed to contact with the public also opted to remain housebound over the risk of taking available jobs in leisure and hospitality – industries that added no jobs in August but had grown at an average of 350,000 jobs in the previous six months.

“The weak new job number is due more to a lack of available workers than a lack of available jobs,” Stelzer concluded, noting that 10.1 million US jobs remain unfulfilled; the US labour force participation rate is, at 61.7%, still well below the pre-pandemic level of 63.3%; and bidding for workers has taken America’s average hourly earnings to 4.3% above their level in August 2020.

As bargaining power shifts from employer to employee, it is benefiting American workers at the lower end of the wage scale and also giving them an incentive to move from low-value to higher-value jobs. “The [US] labour market is changing. Its ultimate shape, the balance of bargaining power, won’t be clear until the Delta distortion is removed.”

“The prospects are good for continued progress toward maximum employment”

The Fed, however, looks forward to “full employment” as a result of the current favourable conditions for jobseekers. “With vaccinations rising, schools reopening, and enhanced unemployment benefits ending, some factors that may be holding back job seekers are likely fading.” Chair Powell’s speech was upbeat. “While the Delta variant presents a near-term risk, the prospects are good for continued progress toward maximum employment,” he said in his 27 August speech.5

Winter, however, is coming in the Northern hemisphere and it remains to be seen how this will shape infection levels and containment responses.

Deutsche Bank Research reports referenced:

Early Morning Reid (31 August)

US Economic Perspectives: Trend inflation dashboard supports Powell’s Jackson Hole message by Amy Yang, Matthew Luzzetti, Brett Ryan and Justin Weidner (31 August)

DB Fed Watcher: Jackson Hole affirms that September is too soon for tapering by Amy Yang, Matthew Luzzetti, Brett Ryan, Justin Weidner and Avik Chattopadhyay (31 August)

Sources

1 See https://bit.ly/3jP612K at federalreserve.gov

2 See https://bit.ly/3jP612K at federalreserve.gov

3 See https://bloom.bg/3tngXYq at bloomberg.com

4 See Back to work? at flow.db.com

5 See https://bit.ly/3jP612K at federalreserve.gov

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

MACRO & MARKETS, CASH MANAGEMENT

Inflation: where next? Inflation: where next?

As inflation moves upwards, central banks continue to assert that the increase is transitory. Yet a return to “uncomfortable levels” is a very real prospect as the US economy undergoes its biggest shift of direction in four decades and others follow its lead, reports flow’s Graham Buck

Macro and markets, Dossier Covid-19

Back to work? Back to work?

While anti-Covid vaccine rollouts have helped some regions lift coronavirus restrictions, limited access to labour could also limit economic recovery. flow’s Graham Buck and Clarissa Dann review sectors at risk and what this means for employers and governments

Macro and Markets

America’s US1.9trn kick start America’s US$1.9trn kick start

Despite some late nips and tucks to ensure its safe passage, President Biden’s US$1.9trn American Rescue Bill is an ambitious package whose remit goes beyond reviving the US economy post-Covid-19. flow’s Graham Buck and Clarissa Dann examine what this means for US GDP growth