21 January 2021

Now that President Biden and Vice President Harris are installed in the White House, what are their immediate priorities? flow´s Clarissa Dann takes a look at Deutsche Bank Research’s insights, along with other observations on stimulus, infrastructure and tax reform – and responses from the central ban

At noon on Wednesday 20 January on the West Front of the US Capitol in Washington DC, Joseph Robinette Biden Jr. was inaugurated as the 46th President of the United States, with Kamala Harris as Vice President.

Contrary to previous flow articles on the US Election assuming a divided government with a Biden presidency, a Republican Senate and a Democrat-controlled House of Representatives, the 5 January 2021 run-off elections in Georgia changed everything.

“A blue sweep has now become the base case,” notes Deutsche Bank Research US Economics team in their 7 January report US Economic Perspectives: Fiscal infusion to sweep economy back to pre-virus path.

They point out that although the Democrats hold historically narrow margins in Congress, a 50-50 tie in the Senate (but Harris has the casting vote) would “restrain some of the more sweeping elements of the Biden agenda.” This article takes a closer look at some of its nearer-term likely outcomes.

Phase 1: Stimulus

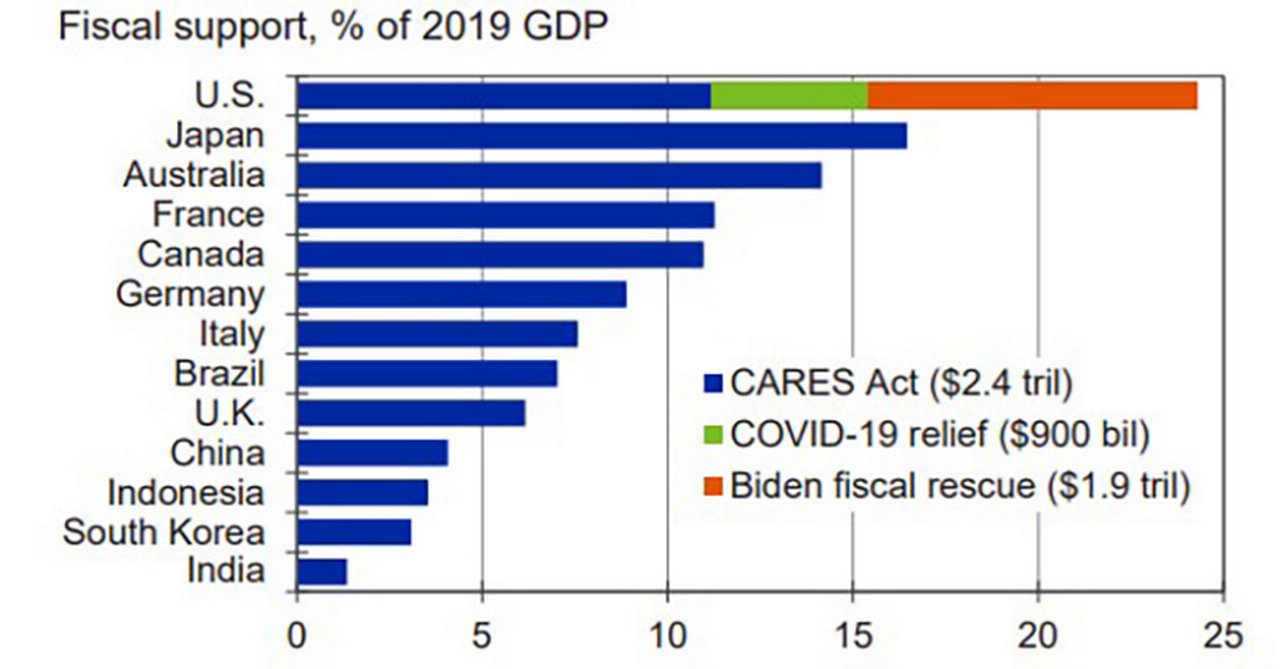

On Thursday 13 January the then President-elect Biden announced a US$1.9trn stimulus package called the American Rescue Plan. If passed into law in its entirety (which few observers think will happen), it would, observes Moody’s Analytics, “bring total fiscal support—deficit-financed discretionary fiscal policy—to US$5.2trn since the pandemic hit”. The agency continues, “This is equal to an astounding nearly 25% of 2019 GDP—approximately three times that provided during the financial crisis, and substantially more than provided by any other country in the world (see Figure1)”. In their view, “This is a key reason the pandemic has done substantially less harm to the US economy than most others despite the more severe health crisis here due to botched efforts to contain the virus”.

Figure 1: Biden pumps up fiscal policy

Source: Moody´s Analytics

In their 15 January US Economic Notes, the US Deutsche Bank Research economics team point out that they had revised up their 2021 real GDP growth forecast by two percentage points to 6.3% (Q4/Q4) in their 7 January commentary. In addition, they revised down unemployment rates to 4.3% from an earlier 5%, “driven by an expected rise in the labour force participation rate, which should move back towards the pre-pandemic level about two percentage points above current readings”.

The contents of the American Rescue plan include:

- Funding to provide individuals with economic security for the duration of the pandemic – in the form of a further Economic Impact Payment of US$1,400 per person for eligible recipients. The payments would be on top of the US$600 approved by Congress in December and sent out in early January 2021 – making a total of US$2,000. “The new payments would go to adult dependents that were left out of the earlier rounds, like some children over the age of 17. It would also include households with mixed immigration status, after the first round of US$1,200 cheques left out the spouses of undocumented immigrants who do not have Social Security Numbers,” added CNN on 15 January.1

- Funding for state and local governments.

- A US$15bn new grant program for small business owners, separate from the existing Paycheck Protection Program.

- A US$35bn investment in some state, local, and non-profit financing programmes that make low-interest loans and provide venture capital to entrepreneurs.

- Enhanced unemployment benefits and expanded refundable tax credits.

- Funding for critical workforce supports – such as re-opening schools and improving childcare facilities.

- Funding to help manage the virus, such as the vaccine distribution plan and scaling up of testing. It also includes the hiring 100,000 public health workers, nearly tripling the community health workforce.

"[The stimulus] is a key reason the pandemic has done substantially less harm to the US economy than most others"

“The number one priority for the new administration is getting an additional round of Covid relief passed,” said Deutsche Bank’s US Chief Economist Matthew Luzzetti in a Podzept podcast, Biden’s First 100 Days.2 “This is a meaningful path to growth this year,” he added.

Luzzetti’s team notes that this first phase of the Biden plan is aimed at combatting the Covid pandemic and addressing the near-term economic fallout from the virus. “The second phase, which is expected to focus on longer-term priorities such as infrastructure and tax reform, will likely be rolled out next month at Biden's first address to a joint session of Congress,” they explain in their 15 January US Economic Notes.

Phase 2: Infrastructure and tax reform

Biden’s second bill is set to tackle longer-term goals such as job creating, infrastructure reform, tackling climate change and improving racial equality. They go back to what he had outlined in his manifesto “to build a modern, sustainable infrastructure and an equitable clean energy future”.3 This included investment in clean energy innovation (including the auto industry), energy efficient buildings and affordable new homes, sustainable agriculture and conservation.

Deutsche Bank’s Head of Government & Public Affairs for North and Latin Americas Frank Kelly sees this as an opportunity for Biden to bring about consensus in both Houses. “Biden wants to do this in a bipartisan way and sees this as a moment to bring the country and politicians on Capitol Hill together,” he said in the Biden’s first 100 days Podzept podcast. Kelly estimates that the eventual figure will come in at around US$3trn and reflects, “This is all to be dealt with after we get through the stimulus package”.

To pay for the investment and to drive his climate change agenda a programme of tax reform was outlined in Biden’s manifesto, but how much of this will actually get enacted remains to be seen. In his 14 January Bloomberg Tax article, Potential tax reforms of a Biden administration, Sanjay Agawal of US accounting firm MGO notes, “During the 2020 presidential campaign, the Biden team made a few things clear: that he would work to roll back certain elements of the 2017 Tax Cuts and Jobs Act (TCJA), which he and other prominent Democratic Party figures see as tax breaks and loopholes for corporations and high-net-worth-individuals; and that he would work to spur economic growth with incentives focused on promoting U.S.-based manufacturing and supporting the clean energy sector.”4

Central bank responses

Figure 2: Market increased rate hike prospects as taper talk begins

Source: Bloomberg Finance LP, Deutsche Bank Research

The anticipated upgrade in economic growth and the labour market is, note Deutsche Bank Research economists in Fed Watcher: Fiscal fill up could bring forward tapering, but inflation is the ultimate arbiter (11 January), pulling forward Federal Research QE tapering to year end. “Officials are not particularly likely to feel the need to add more stimulus by extending weighted average maturity (WAM) or increasing the pace of their purchases as long as financial conditions remain supportive. Indeed, they sound more willing to bring forward the timing of tapering their bond purchases, obviously depending on how the economy evolves over the New Year,” they explain.

“We expect the Fed to begin signalling its tapering intentions at the June Federal Open Market Committee (FOMC) meeting once they have received convincing evidence that the vaccine roll-out is proceeding in line with expectations and commence a gradual taper in December,” they add. The team has also brought forward their expectation for lift-off to Q4 2023 from the first half of 2024 but note, “The key risk is that both of these actions are delayed due to insufficient inflation pressures”. Key points to note from the 15-16 December 2020 FOMC meeting minutes 5 include:

- U.S. real gross domestic product (GDP) was continuing to recover in Q4 2020, but at a more moderate pace than its rapid Q3 rate, and that the level of real GDP remained well below its level at the start of 2020.

- Consumer price inflation through October—as measured by the 12 month percentage change in the PCE price index—remained notably below the rates seen in early 2020.

- The nominal U.S. international trade deficit widened in October. Both imports and exports continued to rebound from their collapse in the first half of the year. Goods imports in October rose above their January level after several months of strong growth. Goods exports, however, had only recovered 75% of their decline since January despite brisk growth in agricultural exports. Services trade remained depressed, driven by the continued suspension of most international travel.

- Prices of global risky assets increased notably, implied volatility dropped sharply, and the dollar depreciated against most currencies. Most advanced foreign economy sovereign yields were little changed, as policymakers in several countries announced additional actions aimed at maintaining accommodative financial conditions.

- Financing conditions in capital markets continued to be broadly accommodative, supported by low interest rates and high equity valuations.

Packed Senate agenda

The incoming administration has clearly got its work cut out. As Luzzetti and colleagues put it, “The Senate has a packed legislative agenda over the next couple of months. First, the Senate will have to take up the one article of impeachment of President Trump that was voted in the House last week. Second, the Senate will also have to move on a number of Biden cabinet nominations – most notably, former Fed Chair Yellen's nomination to be Secretary of the Treasury. At present, it remains unclear how the Senate will proceed with these competing legislative priorities, though one path would be for the Senate to split its time over the coming weeks, conducting an impeachment trial in the morning and addressing fiscal stimulus/Biden cabinet nominations in the afternoon.”

The next few weeks will be interesting.

Deutsche Bank Research publications referenced

- US Economic Notes (15 January) by Brett Ryan, Justin Weidner and Matthew Luzzetti

- US Economic Perspectives, Fiscal infusion to sweep economy back to pre-virus path (7 January) by Matthew Luzzetti, Brett Ryan, Justin Weidner, Peter Hooper and Amy Yang

- Podzept Podcast: Biden’s first 100 days with Matthew Barnard, Matthew Luzzetti and Francis Kelly

- Fed Watcher: Fiscal fill up could bring forward tapering, but inflation is the ultimate arbiter (11 January 2020) by Justin Weidner, Matthew Luzzetti, Brett Ryan, Amy Yang, and Avik Chattopadhyay

Sources

1 See https://cnn.it/3p4Tp7S at edition.cnn.com

2 See https://bit.ly/3qFo4Jj at dbresearch.com

3 See https://bit.ly/2XZsvCr at joebiden.com

4 See https://bit.ly/360ypHR at news.bloombergtax.com

5 See https://bit.ly/3p98OE8 at federalreserve.gov

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

Trade finance and lending {icon-book}

Across the Great Divide Across the Great Divide

Trade economist Dr Rebecca Harding reflects on the US Exim Bank’s annual spring conference compared with the ICC Banking Commission event in Beijing and notes how polarised attitudes to trade have become and that is businesses that trade and not governments

Trade finance and lending {icon-book}

Sunset to sunrise Sunset to sunrise

Just because the oil majors are withdrawing from the North Sea, that doesn’t mean there is no extraction. Clarissa Dann looks at how reserve-based lending is supporting the smaller independent oil producers that are thriving in the region

Trade finance and lending

Farewell to trade barriers? Farewell to trade barriers?

At the close of an extraordinary year, eyes are on growth forecasts for 2021 as economies climb out of Covid-19. But for these to materialise, trade needs to move back towards multilateralism, explains Dr Rebecca Harding