November 2020

Although the 2020 US Election results indicate a Biden/Harris victory, the path to the White House is less than straightforward. flow's Clarissa Dann takes a look at the next steps, and how the results have impacted the economy, markets and central bank policy so far

“Biden has won the most extraordinary election of our time,” exclaimed Barrons, the US investment weekly from Dow Jones (part of News Corporation).

While the congratulations have been coming in from some of the world’s leaders after a flurry of media pronouncements, the result is not finalised. There has not been, as at the time of writing, been any form of concession from the incumbent President Trump.

This result, noted Deutsche Bank’s US Chief Economist Matthew Luzzetti observed on 6 November, “may not be finalised for some time, as outcomes in some states could be contested over the coming weeks, and recounts are likely in states with slim margins”.

As for the Senate outcome, that remains, according the Luzzetti and his team, “more uncertain” and “it looks likely that a special election in Georgia on 5 January will determine which party controls the Senate over the next two years”. However, they reconfirm their earlier prediction of “a divided government with a Biden presidency, a Republican Senate and a Democrat-controlled House of Representatives”.

What happens next

8 December

This date marks the so-called "safe harbor" deadline, by which time states have to resolve any disputes over their vote totals and formally certify the winner. According to the US National Constitution Center, “A federal law (3 U.S. Code § 5) known as the “safe harbor provision” requires a state to settle these disputes and determine its electors six days before the electoral college members meet in person. In 2020, that deadline is December 8, since the college votes on December 14, 2020.”1

14 December

The votes for the President in the Election contest, are, explains the US National Constitution Center, “votes for a slate of electors who cast ballots in the Electoral College, a gathering held in the 50 states and the District of Columbia on an appointed day in December after the election”. For 2020, this day is 14 December and any legal issues surrounding vote counting have to be resolved by then.

Incumbent US Senate majority leader Mitch McConnell has commented that anyone who is running for office “can exhaust concerns about counting until the Electoral College casts their ballots on 14 December”. Another potential (although rare) development is that a “faithless” elector could cast his or her vote for a different presidential candidate. Some states, but not all, have the legal power to disregard a vote cast by a faithless elector.

5 January 2021

The state of Georgia holds its run-off vote for two US Senate seats — and this outcome will determine whether Republicans maintain their majority in the Senate. If they do, it will, as we explained in our 6 November article, limit Joe Biden’s ability (assuming he is confirmed as President) to pass legislation quite as envisioned in his manifesto such as legislation to reduce carbon emissions.

6 January

US Congress convenes to count the electoral votes and officially declare a winner.

20 January

This is Inauguration Day, when the President Elect is sworn in by the US Supreme Court Chief Justice and officially assumes office in the afternoon.

Democrat leadership

Subject to the above process confirmations, US Congress leadership from 20 January 2021 looks set to be Joe Biden as President and Kamala Harris as Vice-President. Both come from legal backgrounds. Biden graduated from law school in 1968 and started his own law practice in 1971 before developing his political career. Having held office as Vice President under Barack Obama’s leadership from January 2009 to January 2017, he is, as The Economist put it on 7 November, “steeped in the traditional values of American diplomacy from his time in the Senate”. A week earlier the newspaper had commented, “Mr Biden will not be able to end the bitter animosity that has been mounting for decades in America. But he could begin to lay down a path towards reconciliation.” Biden’s transition team have started work on filling cabinet positions, but choices will be, reported the Financial Times on 8 November “somewhat constrained because Republican control of the Senate will necessitate nomination of more centrist candidates” given the “political reality” of Senate control.2

Former Attorney General of California3, Kamala Harris, noted the FT on 7 November, is set to be both the first woman, and first woman of colour, elected to executive office in the US. “It puts the US senator… a heartbeat away from the top job. She will serve as the official understudy to the oldest president Americans have ever elected and be the odds-on favourite to lead the Democrats in 2024, if, as expected, Mr Biden does not run again,” predicted the FT.4

"The outlook for the economy is extraordinarily uncertain"

Economic and markets outcome

Fiscal stimulus

Given the prospect of a Republican controlled Senate (unless the state of Georgia run-off changes this), Deutsche Bank Research sees its baseline assumption of a US$750bn fiscal package legislated by Q1 as “reasonable” (Canvassing the post-Election Day economic landscape, 6 November)5. This is more than their originally projected US$500bn for this scenario on the grounds that “Senate Majority Leader McConnell has sounded more open to a stimulus deal, indicating that it should be a priority before the end of the year while also hinting at flexibility around support provided to state and local governments – a key sticking point in negotiations thus far”.

This package is likely, the research team adds, to contain an extension of the Payroll Protection Program (PPP), enhanced unemployment benefits, aid for state and local governments, targeted funds for highly impacted industries such as airlines, and aid for schools and health items.

However, in their Konzept article, As labour markets adapt, so too should fiscal policy, Deutsche Bank Research Economists Brett Ryan and Justin Weidner explain that while the PPP and the sizeable expansion of federal unemployment insurance (UI) that supplemented existing state income support mechanisms were “critical” innovations, more of the same is not the best approach going forward. This is because the continued spread of Covid-19 has changed patterns of economic activity, accelerated greater automation of certain functions so that , in their view “the optimal policy mix should shift away from payroll subsidies and towards more income support and job retraining”. In other words, they explain, as the pandemic drags on, “it will be more effective to provide income support to those who may not be rehired than to try to preserve employee-employer relationships that could become obsolete because of structural changes in the economy”.

Federal Reserve QE and economic outlook

In a press conference following The Federal Reserve’s Federal Open Market Committee (FOMC) meeting on 5 November, Chair Jerome Powell said, “As we have emphasised throughout the pandemic, the outlook for the economy is extraordinarily uncertain and will depend in large part on the success of efforts to keep the virus in check. The recent rise in new Covid-19 cases, both here in the United States and abroad, is particularly concerning.”6 He reiterated that the Fed’s “response to this crisis has been guided by our mandate to promote maximum employment and stable prices for the American people, along with our responsibilities to promote the stability of the financial system”. The statement included a reminder that the FOMC aims to keep inflation at an average of 2% over the long run, having shifted its inflation target in late August7.

In the Deutsche Bank Research Fed Notes: November FOMC recap: Awaiting clarity before fine-tuning QE, the team noted that no change looked likely in the QE strategy: “We thought the overriding message from the Chair’s comments on this topic was that asset purchases are working effectively as currently designed, and that the composition and pace of purchases remains ‘appropriate’”. This amounts to the current US$120bn per month (US$1.44trn a year). Powell said the purchases “have materially eased financial conditions and are providing substantial support to the economy”.

Post-election bounce

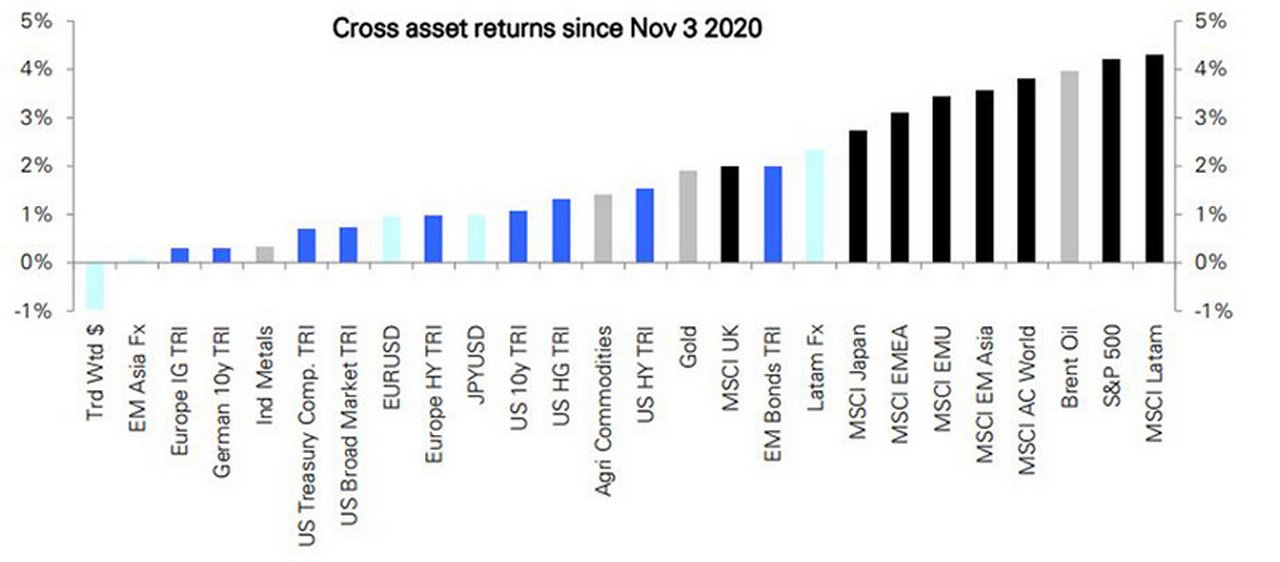

Figure 1: Almost every asset class bounced after Election Day

Source: Bloomberg Finance LP, Haver, Deutsche Bank Asset Allocation

Almost every asset class posted strong bounces post- US Election Day, but largely stayed within the ranges that have prevailed recently, explained Deutsche Bank Research Strategists Binky Chadra, Srineel Jalagani and Parag Thatte in their report, The post-election bounce (6 November). “While various market narratives have ascribed fundamental drivers to the moves, in our reading these have been in line with the historical playbook, largely reflecting the unwinding of protection positions after calendar risk events,” they explained (see Figure 1 above).

Although near-term implied volatility across asset classes had risen sharply going into the election (with volatility curves steeply inverted), as it subsequently unfolded in “an orderly fashion”, volatility collapsed and curves are “now significantly flatter across the board”.

The report goes on to detail how US equities posted the largest post-election bounce (+2 days) since 1900, but the bounce in the S&P 500 took it only to the top of the range it has been in since August. In addition, the Nasdaq bounced to the top of its recent range on an absolute basis as well as relative to the S&P 500.

While we wait…

As the prospective journey to (and from) 1600 Pennsylvania Avenue plays out, another piece of news hit the global headlines prompted excitement from the markets. On 9 November Pfizer and Biontech announced that a “vaccine candidate was found to be more than 90% effective in preventing Covid-19 in participants without evidence of prior SARS-CoV-2 infection in the first interim efficacy analysis”.8 Volatility was back. “Vaccine hopes revived investor appetite for airlines, hotels, energy firms and others hit hardest by the pandemic, sending shares soaring − in some cases by more than 40%,” observed the UK’s BBC.9

A lot can happen in a week…

Deutsche Bank Research Reports referenced

Canvassing the post-Election Day economic landscape, 6 November by Matthew Luzzetti, Brett Ryan, Justin Weidner and Peter Hooper

As labour markets adapt, so too should fiscal policy, pages 64−65 of Konzept: What we must do to rebuild (November 2020), Deutsche Bank Research

Asset allocation: The post-election bounce (6 November) by Parag Thatte, Srineel Jalagani, and Binky Chadha

Sources

1 See https://bit.ly/3plesUb at constitutioncenter.org

2 See https://on.ft.com/3eROK4J at ft.com

3 See https://bit.ly/2Uhl6fS at harris.senate.gov

4 See https://on.ft.com/3eRkerO at ft.com

5 See https://bit.ly/36sZliL at dbresearch.com

6 See https://bit.ly/32F0XoB at federalreserve.gov

7 See https://bbc.in/2IsYaYM at bbc.com

8 See https://bit.ly/2Uicu8D at pfizer.com

9 See https://bbc.in/3niF1HL at bbc.com

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

MACRO AND MARKETS

Covid-19 and inflation Covid-19 and inflation

As economies move along their pandemic exit trajectories, and the cost of economic stimulus raises the spectre of galloping inflation, flow's Clarissa Dann reviews Deutsche Bank Research analysis on whether this scenario is likely given the current central bank grip on markets

Macro and markets, Cash management, Trade finance and lending {icon-book}

US-German trade ramps up US-German trade ramps up

As the US overtakes China to become Germany’s top non-European FDI destination, financial journalist Ivan Castano Freeman provides a deep dive into these burgeoning corridors, drawing on insights from Deutsche Bank experts and the German American Chamber of Commerce, Inc. (GACC New York)

Technology, Macro and markets

AI deep research – is this a gamechanger? AI deep research – is this a gamechanger?

The flurry of AI deep research launched at the beginning of 2025 has significant consequences for knowledge workers – and the global economy. flow shares insights from Deutsche Bank Research’s paper that identifies winners and losers – and AI’s capacity for longer-term self-improvement