06 November 2020

With the US Election result too close to call after a record turn-out by the American people, all eyes are on how its electoral system arrives at choosing a leader and the components of its Congress. flow's Clarissa Dann summarises the potential impact of four potential options, drawing on Deutsche Bank Research

All elections have implications for the wider economic outlook, but given that the US economy (around US$22trn in GDP) is the world’s largest and touches most parts of the global system, the 2020 election result has particular nuances – especially in this time of Covid-19. Others include consequences for climate change, now the US has withdrawn from the Paris Agreement and the future of multilateral trade.

With the highest turnout by the electorate in more than a century on 3 November, and more than 100 million early votes (36 million in-person and over 65 million ballots by mail) cast as a result of the Covid-19 pandemic; there was a sense of determination about the 2020 US election not seen before. However, by the morning of 4 November there was still no clear result – postal votes take longer to count as they have a more time-consuming verification process.

In other words, the winner of the race to 270 electoral votes – the number needed to win occupancy of the White House – has yet to be determined from the final counts of key swing states; something that may not be completed for several days.

Also under scrutiny is the entire democratic process with fears of a contested election, heightened by a declaration from President Trump he would mount a challenge to the US Supreme Court regarding the ongoing counting of mail-in votes in states still yet to declare their winner.1

Commenting at midday GMT, Deutsche Bank’s Jim Reid said, “A fairly remarkable election so far. However, even if you’d known the current state of play would you have guessed the market reaction so far? Pre-election a “Blue Wave” was seen to be the most risk-friendly outcome with a Biden Presidency/Republican Senate potentially being the worst short-term outcome. However, the latter is probably marginally the most likely outcome now and, importantly, with a high chance of the Presidency being contested in this scenario.”

According to Deutsche Bank Research’s 2020 election primer (28 October), from US Chief Economist Matthew Luzzetti and Deutsche Bank economist colleagues Brett Ryan and Justin Weidner, key concerns among voters have been the handling of the economy and management of the coronavirus.

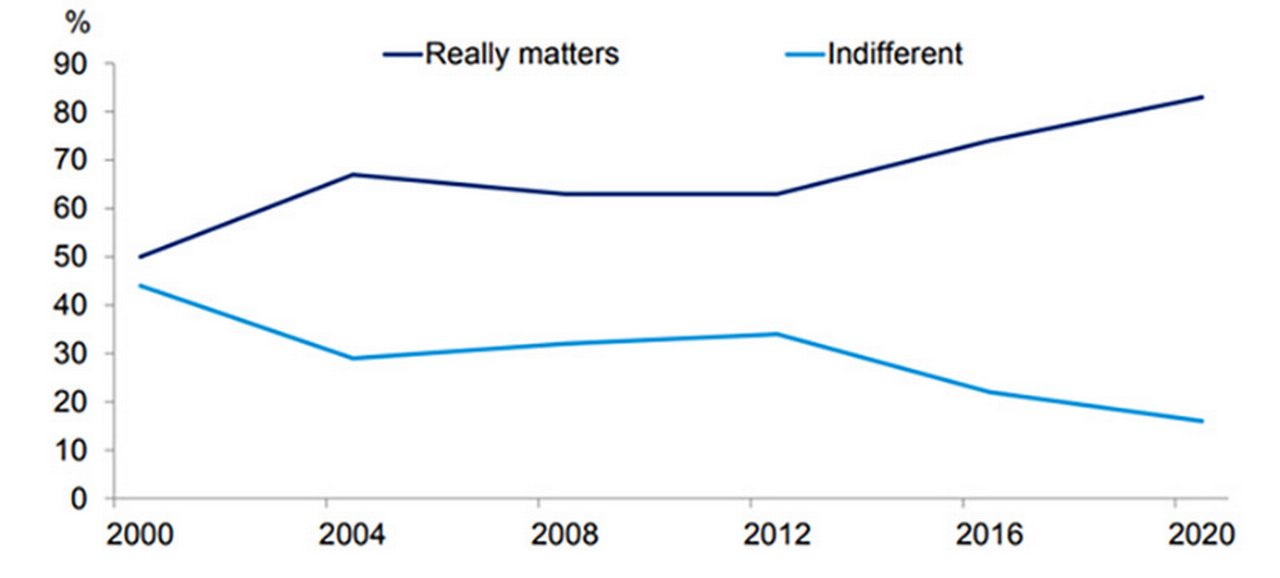

Unlike previous years, around 80% of registered voters believe “it really matters who wins the presidential election” and that this 2020 election is “very consequential to the future trajectory of the country.” See Figure 1.

Figure 1: % of registered voters who say it really matters who wins the presidential election

Note: Survey conducted July 23-Aug 4, 2020. Source: PEW Research Center, Deutsche Bank

This article reviews the economic outlook arising from the four possible combinations of Congress composition – while one will look more likely than others after this article goes to press; we took the view it was nevertheless helpful to note the policy perspectives of each scenario; especially with what now looks like a very close margin. So one would expect to see a certain amount of “reaching across the aisle” to secure agreement on issues such as infrastructure and healthcare – with elements of each one finding their way into whatever administration eventually takes up the reins because of the fine balance of the results. The main points are summarised from the Deutsche Bank Research report, US Economic perspectives: Election could bring sweeping changes (22 October) by Luzzetti et al.

US Congress structure

Of the three branches of government, Congress is the only one elected directly by the people

The winner of the election is determined through the “Electoral College” system, an arrangement originally devised in 1787 and amended in 1804 that comprises a total of 538 votes with more densely populated states having a larger allocation than smaller ones. A candidate needs to secure 270 Electoral College votes (50% plus one) to win the election.

At this point it might be helpful to summarise the structure of the US Congress, which comprises the House of Representatives and the Senate. This is what is known as a bicameral political system with legislators in two separate houses.

The US Capitol Visitor Center explains, “Congress is the legislative branch of the federal government that represents the American people and makes the nation's laws. It shares power with the executive branch, led by the President, and the judicial branch, whose highest body is the Supreme Court of the United States. Of the three branches of government, Congress is the only one elected directly by the people.”

House members may serve for two years and there are 435 seats available (representing the population of the 50 states) – all of which come up for contesting every two years. Senators can serve for six years, and there are 100 seats available. Around a third of these seats come up for election every two years and at present there is no limit on how many times a member of the House or Senate may serve.

These two institutions represent the legislative branch of government, and they’re responsible for drafting, debating and ultimately voting to approve or reject laws. The president on the other hand, represents the executive branch of government – which is responsible for enforcing the laws of the Federal Government.

Usually, a single party – Democrat or Republican – will control a majority of the seats in either the House or the Senate. Some years, one party may control both. The other branch of US Government is the judiciary, headed by the Supreme Court, whose role it is to interpret the law.

While it is more usual for a single party to control the majority of seats in the House or Senate – and in some administrations one party has controlled both – the President’s ability to get legislation through and deliver on election promises depends on how aligned they are with majority in each house.

Currently, the Democrats hold a majority in the House of Representatives with 232 seats versus the Republicans' 197 (218 are needed for a majority).

However, the Republicans have a majority in the Senate by 53-47 and, as observed by The Guardian on 2 November, “Even if Biden defeats Trump, he will be unable to pass legislation on key issues such as healthcare, immigration and climate change unless the Democrats simultaneously seize the Senate.2” Deutsche Bank’s Luzzetti adds in the research report, “Regarding the Senate outcome, which is just as important for the economic outlook in terms of fiscal stimulus expectations, the Democrats need to net three seats and win the Presidency, or four seats if Biden does not win.”

"We anticipate that Republican senators will remain resistant to a big fiscal package"

Biden win and Republican Senate

Fiscal stimulus

This outcome, notes the team, is negative for 2021 growth, but as the count continues is looking highly likely. “Fiscal stimulus is likely to be far more marginal and other key elements of the Biden agenda that could be implemented through executive orders or guidance on regulation are likely to be negative for near-term growth prospects.” Luzzetti adds in his Podzept podcast with Matthew Barnard on 28 October when he estimated around US$500m would be the upper end of the stimulus; “Less fiscal stimulus upfront for an economy that we think needs it given the Covid trends we are seeing.”

In the 22 October US economic perspectives report, Luzzetti et al note the limitations of a big fiscal package in the event of Republican control of the Senate. “We anticipate that Republican senators will remain resistant to a big fiscal package, likely even more so than in recent months when President Trump supported a larger package. Areas of agreement could be support for small businesses and middle class tax cuts, but key issues related to unemployment insurance, state and local government support, among others are unlikely to be areas of agreement in this scenario.”

Tax and infrastructure

Areas of agreement could, they add, be support for small businesses and middle class tax cuts. However, while there might also be support for large-scale infrastructure packages, there could also be, they note, “disagreements on how such a deal is funded (i.e., publicly funded versus public-private partnerships) and the insertion of a politically contentious issue like the environment into the calculus will once again dash hopes for a large infrastructure deal”.

Importantly, an obstructed Biden administration could, they add, be forced to instead focus on areas where members can use executive orders or guidance on supervision and regulation to achieve campaign promises in a number of areas. Key issues to consider, where Trump has pushed for reduced regulatory constraints in recent years, include health care, energy, finance, and the environment.

Trade

Although the “Blue Sweep” scenario (see below) noted “the first pillar of the Biden plan on international economic relationships is to work within coalitions, which would mark a sharp turn from the unilateral approach taken by the Trump administration over the past four years”, some progress in this direction is not out of the question with a Republican Senate. A more conciliatory approach to trade does look more likely with a Biden administration ratcheting down confrontations with other advanced economies that were targeted with tariffs on steel. But the degree to which he can get this done and “shelve threats of global auto tariffs” is reduced from what it would have been in an all-blue Senate. However, on 3 October, The Economist pointed out in its leader ‘Bidenomics” that while Biden “has a record as a free trader”, he is unlikely to remove tariffs quickly and “his plan indulges in petty protectionism by, say, insisting that goods are shipped on American vessels.”3

And while Deutsche Bank’s Luzzetti et al see a possible return to multilateral trade negotiations under Biden, they note that a US population sceptical about its benefits “may require a clearer focus on how trade deals benefit US households, particularly those that have suffered costs from globalisation and automatisation in recent decades”.

Climate change

After a three-year delay, the US has become the first nation in the world to formally withdraw from the Paris climate agreement.4 Although President Trump announced his intention in June 2017, UN regulations for withdrawal meant that the decision only took effect on 4 November – the day after the US election. A new president could re-join it in the future.

Commenting on the Biden manifesto, The Economist observed (3 October), “Mr Biden’s climate policy represents real progress. Building green-power grids and charging networks makes sense because the private sector might hold it back.”5 However, with a Republican Senate, the Biden plan for a clean energy revolution will see the light of date remains to be seen.

“Blue Sweep” scenario

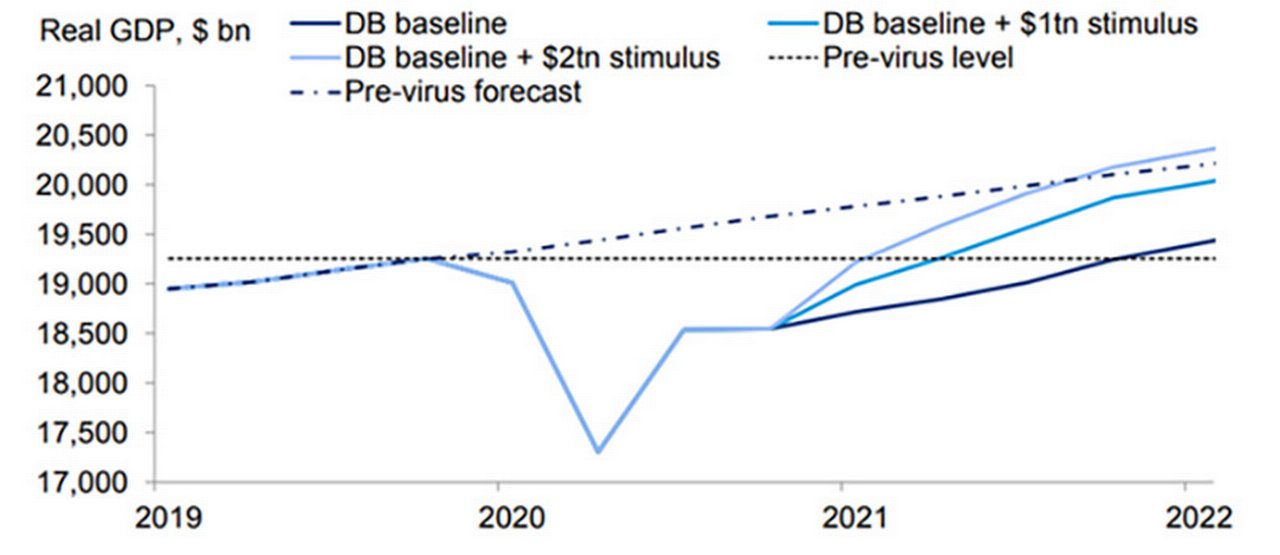

If Biden wins the presidency and the Democrats take control of the Senate (now looking less likely), this result would, says Luzzetti et al, “provide most fiscal stimulus to the economy in 2021” and “the most growth positive outcome, at least for 2021. We have included this to show the scope of what would have been the potential (see Figure 2).

Figure 2: Economic impact of stimulus

Source: BEA, Haver Analytics, Deutsche Bank

Fiscal stimulus

Campaign promises of an upfront US$2trn to US$2.5trn included “support for extended employment insurance, state and local governments funds, stimulus checks [cheques], funding for combatting Covid (e.g., PPE, testing and tracing, etc.) and aid to certain sectors (e.g., airlines) and small businesses via a renewal of the Paycheck Protection Program (PPP) to allow for second loans, among other measures”.

Other fiscal measures as part of the “Building Back Better” plan, include funds for a “buy America” initiative as well as infrastructure spending, investment in education and childcare, among other initiatives.

Tax increase delays

Although Biden has committed to reversing much of the Trump tax cuts and, in particular, raising the corporate tax rate “on day one”; the Deutsche Bank Research team explain that “ it will take time to craft and implement a tax bill and we anticipate that preference will first be given to stimulus”.

While the Biden plan does detail around US$2.5trn of tax increases over the next decade, Luzzetti says, “we assume these will not be implemented until the economy is on firmer footing, likely late 2021 or early 2022”.

Biden has committed to not raising taxes on any household earning under U$400,000 while restoring the top individual tax rate to 39.6%. The plan also increases the corporate tax rate from 21% to 28%, increases the cap on social security earnings, and taxes capital gains as ordinary income for taxpayers with US$1m more in income, among other measures.

Economic impact

To assess the potential near-term implications of the Biden measures for the economic outlook in 2021 and 2022, Luzzetti’s team used the Federal Reserve model for the US economy (FRB/US model) to run some simulations.

These showed that, factoring in the tax changes and stimulus already agreed by Congress, “an additional US$2tn stimulus package could significantly boost the economy next year, lifting real GDP growth by about five percentage points, adding three million jobs, and lowering the unemployment rate by nearly two percentage points.

“These are big effects that could happen in 2021, and it could accelerate achieving pre-virus levels of activity to the middle of next year from our baseline, which would be around the turn of 2021/22, said Luzzetti in his 28 October Podzept broadcast.

Trade and climate change

The degree to which Biden would be able to move away from the retrenchment of the Trump Administration into nationalism in a more multilateral direction (see above) would be increased if the Democrats had control of the Senate.

Trump win and Republican Senate

This scenario assumes the Democrats retain their current control of the House of Representatives and that the status quo scenario which has played out across the past four years continues for another four.

Luzzetti et al forecast that a Trump White House and Republican Senate “are likely to push for several of the initiatives recently floated by the Trump administration, including making permanent key features of the Trump tax cuts, modest further cuts to the corporate tax rate, and payroll tax cuts to boost near-term growth prospects.” However, they add, “achieving agreement with a Democratic House on many of these issues will prove difficult, unless they include some measures that are skewed towards Democratic priorities.”

In the Podzept podcast of 28 October, Luzetti reflects, “I think you will see a big push to implement the phase 1 trade deal with China. That is something that has a lot of promise but has been pushed off the rails a bit with the Covid crisis.”6

It is possible that there may be softening of some of the more nationalistic ”America First” positioning as a Trump going into his second term might do more to make history as a “most liked” president.

Trump win and Democratic Senate

Although the least likely of scenarios, this result is, reflect Luzzetti et al, “also one of the more interesting outcomes with potentially binary implications for economic policy and fiscal stimulus in the coming years”.

This is because a Trump administration alongside a Democrat control of the Senate and House “could break from the Republican Senate’s fiscal conservatism that has mandated fiscal contractions in the years following the Global Financial Crisis and, more recently, held back progress on recent fiscal stimulus talks”.

They point out that “significant infrastructure spending is one potential area of agreement for a Trump White House and Democratic Congress, though only if the President is willing to rely heavily on public funding”. Another area of agreement – at least in terms of goals if not tactics – is a hard line on foreign trade and the economic relationship with China in particular.

Changing view on the USD

While observers have been predicting a broadly weaker dollar across both G10 and emerging market foreign exchanges, the current state of play on the Election has, according to Deutsche Bank’s FX Strategist George Saravelos, changed the perspective. This is because:

- If unified government becomes impossible, “this would make agreement on sizeable fiscal expansion more difficult;

- In the event of a protracted contested election, “The market is likely to be most concerned by genuine uncertainty on the vote margin rather than political uncertainty relating to a refusal to concede;

- There is a risk that protracted election uncertainty leads to a politicisation of COVID containment measures accompanied by an inability to provide fiscal support.

Deutsche Bank Research reports referenced

2020 election primer (28 October 2020) by Matthew Luzzetti, Brett Ryan, Justin Weidner, Suvir Ranjan, and Sourav Dasgupta

US Economic perspectives: Election could bring sweeping changes (22 October) by Matthew Luzzetti, Brett Ryan, and Justin Weidner

FX Special Report: Changing view on the dollar (4 November) by George Saravelos

Sources

1 See https://on.ft.com/364tWmE at ft.com

2 See https://bit.ly/351ZkDc at theguardian.com

3 See https://econ.st/2TVuJ3H at economist.com

4 See https://bbc.in/38csH7x at bbc.com

5 See https://econ.st/3mVTuJG at economist.com

6 See https://bit.ly/2TV2vpV at dbresearch.com

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

MACRO AND MARKETS {icon-book}

Matters of the mind Matters of the mind

Covid-19 has inflicted the greatest change upon the global population since World War II and highlighted the importance of wellbeing. Michael Morley tells flow how an informed approach to employee wellness could play a meaningful role in a sustainable recovery

MACRO AND MARKETS

Jobs and Covid-19 Jobs and Covid-19

As lockdown continues into Q2, unemployment escalates in all regions. What does this mean for economic recovery? Clarissa Dann reports on the balance between profit and GDP tomorrow versus survival today

MACRO AND MARKETS {icon-book}

On the bright side On the bright side

Caught in the slipstream, or powering ahead? Dr Rebecca Harding examines ASEAN’s trade momentum in the context of wider geopolitical disruption