02 September 2024

How can the trade finance industry create a digital ecosystem? Pamela Mar, Managing Director, Digital Standards Initiative, International Chamber of Commerce (ICC) explores how bridging trade and financial flows could be the key

MINUTES min read

The integration of the physical and financial information flows that underpin global supply chains is an integral part of a harmonised digital trade ecosystem. For financial institutions, it offers the promise of faster, more secure management of trade finance transactions, allowing more capital to flow to both current and new markets. Recent pilots that, in place of traditional processes, deploy electronic documents of title across secure networks have demonstrated this potential – reducing transaction times from a week or more down to 24 hours or less, in addition to freight cost savings from shipping paper across continents.

A longstanding challenge has been the seeming lack of standardisation of data, electronic documents and forms, and processes used by different trade platforms and networks, which creates barriers to digitalisation when supply chain partners transact across different platforms, networks and jurisdictions. Only recently have some platforms or networks aligned bilaterally on processes, data and documentation through application programming interfaces (APIs) in order to enable data sharing. But as markets expand, and supply chains become more rather than less complex, the bilateral approach faces its limits.

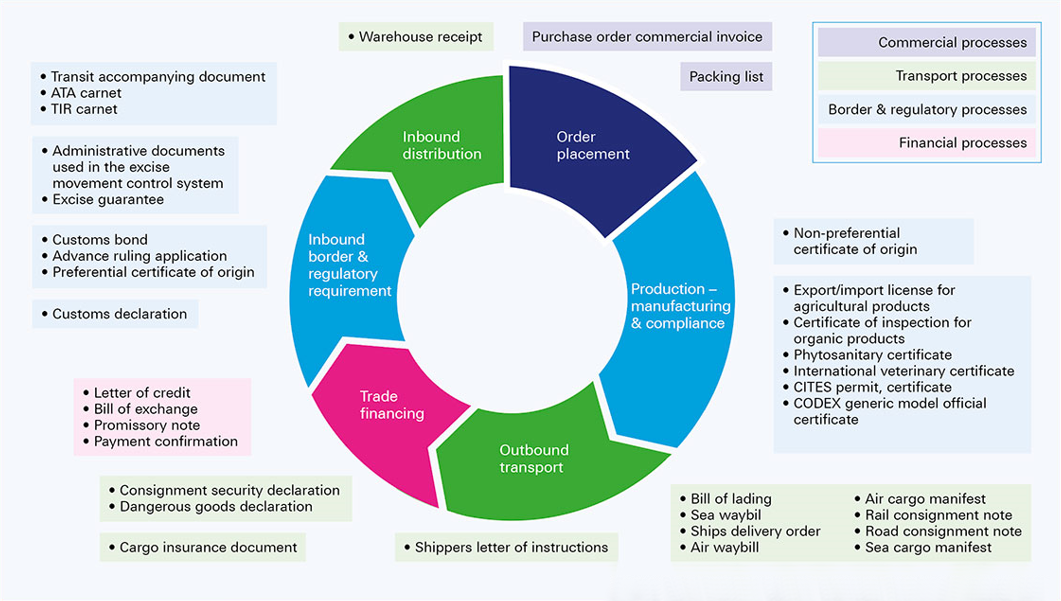

Figure 1: The 36 essential trade documents

Source: Digital Standards Initiative, International Chamber of Commerce (ICC)

Comprehensive frameworks

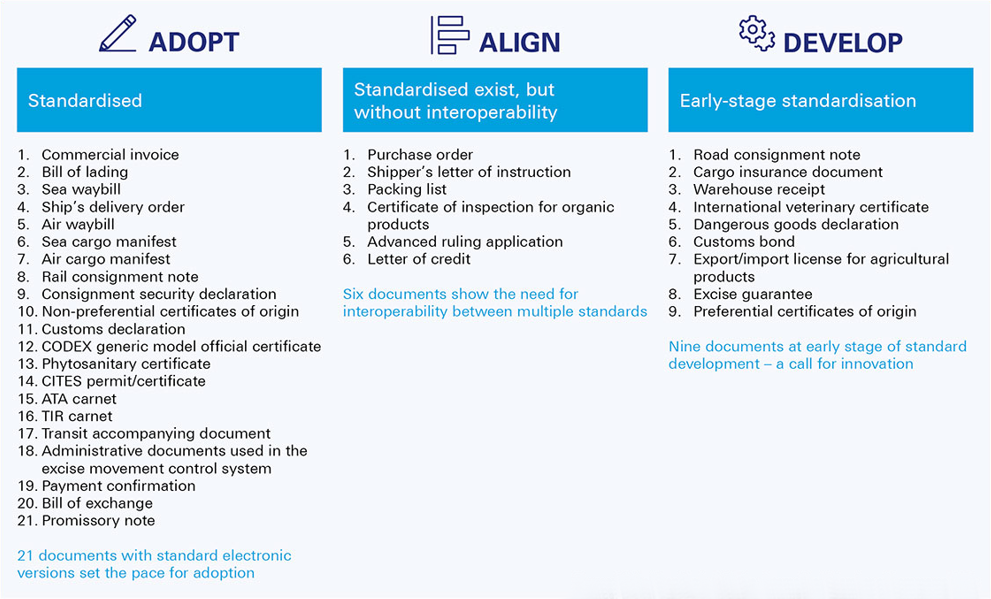

The Digital Standards Initiative (DSI) has begun to address several of these challenges by developing a comprehensive framework to align data and electronic documents along the end-to-end supply chain. Over an 18-month period, its Key Trade Documents and Data Elements (KTDDE) Working Group analysed 36 essential trade documents (see Figure 1 above), with the aim of simplifying the panoply of standards, driving convergence in the use of these standards and creating a pathway towards interoperability of data and documents across networks and platforms. Of these 36 documents, a useful starting point for industry convergence are the 21 that are already fairly harmonised, ready to be scaled and offer the potential for interoperability.

Notably, the standardised set includes three of the four key trade documents facilitating financial processes. The Payment Confirmation benefits from the adoption of ISO 20022 within the framework of the Swift network, while bills of exchange and promissory notes are transforming under industry-led efforts, including the Digital Negotiable Instruments Initiative of the International Trade and Forfaiting Association and the Digital Ledger Payment Commitment by the Bankers Association for Finance and Trade.

Although significant strides have been made in digital transmission, the process for the fourth key trade document – the letter of credit (LC) – is still largely driven by proprietary processes, unstandardised data and traditional document checking needs. Historically these may have existed due to varying legal, compliance and sanction screening requirements, plus the need to identify counterparties across jurisdictions – but today, solutions exist for various parts of the LC-at-scale puzzle.

Given the dominance of documentary credits internationally, the potential gains from digitalising LCs across players and networks could be high. Although private efforts to digitalise the LC process at scale have been implemented to some extent, it remains to be seen whether the development of inclusive standards can address the core issues at play: the need for banks to retain commercially sensitive, proprietary processes while standardising core data, processes (such as KYC, AML and credit) and APIs to allow digitalisation to expedite processing, transfer and payment. The gains would accrue not just to banks, but, importantly, to the millions of SMEs and other traders whose scale or location currently excludes them from the traditional LC process.

Better leverage data

The extent to which data from the physical information chain, when secured, could go towards trade finance processes, as well as how this might occur practically through trade platforms and/or digital networks, could also prove promising for the further integration of physical and financial data.

“Some banks are already applying optical character recognition…and other technologies to extract and structure data”

On the first point, the Commercialisation Working Group of the ICC Global Banking Commission used the KTDDE analysis of seven core trade documents to explore the relevance of the data elements in these documents for trade finance. The group’s initial results show that, depending on the type of financing, between 50% and 70% of the data elements in these documents could be reapplied to fulfil the data needs of the related trade finance process. Of course, such data will need to be authenticated and securely transferred from the trade document such that banks might be able to simplify their own documentary and checking processes.

Some banks are already applying optical character recognition, natural language processing and other technologies to extract and structure data found on physical documents. It is possible that these technologies plus a secure data feed could, over time, fill most if not all the core data needs within the trade finance process. The additional use of digital identities to onboard and verify supply chain partners could foster digitalised, expedited and cheaper transactions.

That data found in trade documentation is essential for trade finance may be intuitive, given that it references the same supply chain. But determining exactly where this data is generated, and which data elements need to be authenticated, secured and ported over, are the first steps in realising the integration of these separate processes. The next challenge will be to determine how this transfer might take place. For example, could open, standardised APIs be the key to moving from documents to data?

Legal reform, standards and trust

As more countries align to the United Nations Commission on International Trade Law’s Model Law on Electronic Transferable Records (MLETR), and the use of electronic transferable records (ETRs) becomes more common, scalable models for data and document transfer will likely emerge. A key to the MLETR is that it primarily defines how ETRs should be securely transferred between parties to ensure functional equivalence to the specific document of title, without distinguishing between ETRs that are primarily finance related or trade related. This is a marked difference from digital platforms that streamline specific trade or finance processes to enable alignment and data sharing among their members.

To prepare for this eventuality, the DSI is developing a way to assess the ability for digital trade platforms and systems to fulfil the performance of transferring ETRs under MLETR. The technical assessment is a key part of the analysis that will help to create a roadmap for the industry to move from documents to data at scale, which was first mooted in Trust in Trade, published in March 2023.1

Applying zero-trust architecture to trade formed the basis for determining the feasibility of secure sharing of key trade data elements that appear in multiple trade documents. In its recent aggregate analysis, the KTDDE working group identified 189 core data elements, of which around 50 are shared across more than five documents. Unbundling these elements from their individual processes, as well as prescribing a secure way for them to be shared across multiple parties, could do much to reduce administrative checking and clearance times, which will help all supply chain players, including banks. The DSI believes that the way forward is to understand what needs to happen at the granular level, to map a pathway to scale built on three pillars: legal reform, standards and digital trust.

The movement towards MLETR alignment is gathering pace: half of the G7 is already there, and many more major trading nations are now considering how to achieve alignment. But that is not enough. Interoperability relies on standards and trust. We hope that the KTDDE analysis, together with our work on reliable systems, will go some way towards anchoring and pointing the pathway to achieving these in the near future.

The author would like to thank Merlin Dowse, Vice Chair of the ICC Banking Commission, Joshua Kroeker of Mitigram and Hannah Nguyen of the Digital Standards Initiative for their feedback and views which contributed to this article