11. August 2021

With Covid-19 having created the most wide-reaching dislocation of trade and supply chains since the global financial crisis, the role of export credit insurance is again under the spotlight. Vinco David and Jonathan Skovbro Steenberg of the Berne Union explain how their members have been increasing support for exporters and their financiers

MINUTES min read

On the face of it, the quick recovery of global merchandise trade from worldwide lockdowns in the wake of the Covid-19 pandemic is an unquestionable success story. Taking a look behind the scenes underlines how innovative businesses resourcefully overcame Covid-related hurdles; how governments swiftly responded to support both individuals and industry; and how a strong and healthy financial and insurance sector stepped up to maintain the capacity of supply vital to world trade.

However, despite the evident resilience of global trade, it is fair to say that the pandemic has put considerable pressure upon the buying and selling relationships which underpin this rally. Amidst the myriad of practical barriers – Would exporters be able to produce agreed goods during lockdowns? Could these be moved? And would there be a market for the buyers to sell into? – has been a full-force reappearance of the natural divergence of interests between buyer and seller such that the payment option which provides the most favourable credit risk for the seller delivers the least attractive liquidity for the buyer.

Cross-border trade and export credit insurance

Export credit insurance indemnifies exporters against the risk that their foreign buyers do not pay for goods or services received. Insured clients include businesses of all sizes, as well as the banks and factoring companies that finance the trade of these businesses. Export credit insurers include both private credit insurance companies, public Export Credit Agencies (ECAs) and multilateral institutions.

Products offer revolving or single transaction cover for one, some or all of an insured’s buyers, ranging from short-term – typically covering trade of commodities, consumer goods and services – to medium/long term – usually for high-value exports of capital equipment and infrastructure projects. They protect against both commercial credit risks (non-payment due to insolvency) and political risks – non-payments due to expropriation, restrictions on currency conversation or capital transfer, war or political violence.

Four main payment instruments

International trade is made up of complex transactions with several parties involved, where different payment options (or instruments) can be appropriate. These are commonly split into four larger categories: cash-in-advance (CIA), open account (OA), letters of credit (LC) and documentary collection (DC).1 These are summarised as follows:

- Cash in advance is a transaction in which the buyer pays for goods before possession has been transferred. It only has two parties and is therefore a cheaper solution. The financial risk of this payment option is borne by the buyer.

- Open account is a transaction in which the buyer pays for goods when possession is transferred, i.e., after the goods are delivered. It only has two parties and is again a cheaper solution. The credit risk of this payment option is borne by the exporter.

- Letters of credit (LC) is a transaction in which the buyer’s bank pays the exporter upon verifying the transaction, while the buyer must pay upon the delivery of goods. The goods are the collateral for the bank. There are more than two parties in this transaction, and the bank is paid a fee for its service. The credit risk of this payment method is borne by the bank.

- Documentary collection (DC) is a transaction in which the exporter’s bank is responsible for collecting the payment from the buyer’s bank in exchange for important documents that make collection of goods possible. There are more than two parties in this transaction, and the banks are paid a fee for their services. The risk of this payment method is shared between exporter and buyer in this structured transaction.

Export credit insurers support all these transactions whether it be inter-firm trade credit insurance products where they insure exporters against their risk when trading on open account terms or they insure the buyers, who have paid in advance, against the exporters not honouring their obligations. Or they can be more complex structures in which export credit insurers insure banks against their credit risk (for example in LC transactions), both when the counterparty is the exporter, buyer or another foreign bank.

The Covid-19 pandemic and its consequences

Increased trade credit support

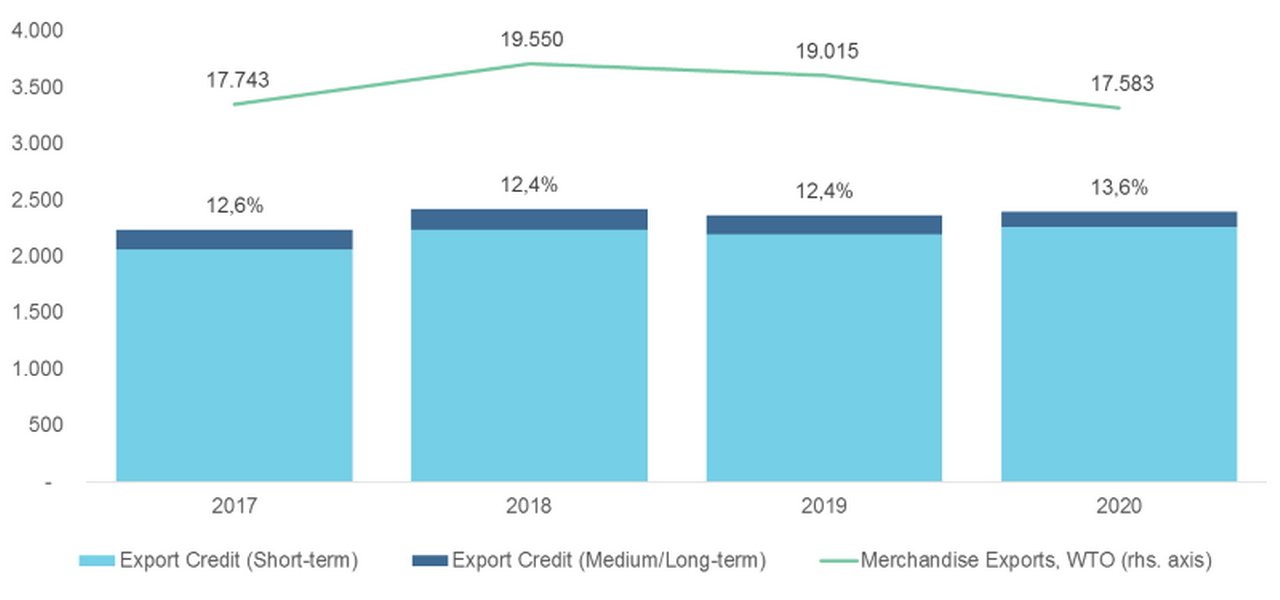

Trade credit is generally considered a low-risk asset class, and fortunately the industry went into the Covid-19 pandemic in a healthy state, well capitalised, firmly regulated and with a strong and cooperative mix of private and public risk takers. These conditions meant that export credit insurers were actually in a position to increase their support for exporters and financiers during this crisis – new cover reported to the Berne Union increased in 2020 by 1.5 %, directly supporting 13.6 % of global merchandise trade in 2020 and indirectly enabling even more, through the extra liquidity and confidence afforded to supply chains.

Figure 1: New export credit insurance and world merchandise exports

Source: Berne Union

Like the rest of the financial and insurance sector, export credit insurers too had to step up and act swiftly to support their existing and new customers. This was primarily done through five different avenues:

- Introducing new products or extending cover;

- Fast-tracking internal processes;

- Helping exporters suffering from a liquidity squeeze;

- Facilitating debt rescheduling; and

- Continuing to indemnify claims.

Both public and private insurers digitalised or otherwise fast-tracked a range processes and provided quick and flexible support for clients.

ECAs in particular have taken a substantial and visible role in responding to this crisis, and many have been called upon to not only support their exporters but also to backstop aspects of the trade finance ecosystem in which they operate.

Working capital support, reinsurance and claims

Short-term liquidity has been a huge problem for many companies, especially SMEs, which have found themselves unable to cut costs at the same rate as they were seeing their turnover fall. In several countries, ECAs saw their mandates stretched to include various forms of domestic support which would help address this, including both direct lending and guarantees for banks’ working capital loans to exporting companies. ECAs with these sorts of programmes already in place quickly expanded their cover or made it more accessible to a wider range of clients. A testament to the success of these initiatives is that new working capital products by export credit insurers increased by 27 %, meaning that new working capital support of exporters reached almost US$50bn in 2020.

Recognising the important role of credit insurance in support of trade, many governments took steps to ensure the industry was able to maintain capacity, including through ECA reinsurance of private risk exposure. Cooperation and risk sharing between public and private sector is one of the great strengths of the credit insurance industry. This ability to maintain existing cover was and is important as this crisis and previous crises have shown that insured trade see smaller declines than uninsured inter-firm trade in times of financial uncertainty.

Credit insurers paid claims of about US$8bn in early 2020, an increase of around 20% from the previous year. While this might seem like a substantial rise in claims paid, it could have been even more severe if not for the effective management of debt distress in cooperation with exporters, their buyers and financiers. Agreements on payment deferrals, moratoria and debt restructuring helped avoid a cascade of defaults and claims as well as maintaining good working relationships between all parties going forward in a post-pandemic recovery.

Rising debt levels

For the export credit insurance industry, the beginning of 2021 has in many ways been a continuation of the latter half of 2020. Underwriters have reported a gradual and continuing increase in demand as well as risk appetite as countries around the world inoculate their populations and more businesses return to normal full capacity. At the same time, many also continue to see a raised background level of requests for debt rescheduling, underlining that some buyers and borrowers continue to be in distress. High levels of debt among both sovereign and corporate buyers mean that insurers are remaining cautious and vigilant, especially of the potential for emerging claims as government support schemes phase out.

A vital tool

The Covid-19 pandemic has been an unprecedented event in modern times which has taken a great toll on the global economy. The export credit insurance industry played a significant role in mitigating the worst effects of the crisis on trade and has proven once again to be a vital tool not only in good times when exports are shipped effortlessly and new markets are being explored, but also in difficult times when risk mitigation, liquidity and business confidence are more important than ever.

Vinco David is Secretary General and Jonathan Skovbro Economic Research Analyst at the Berne Union, also known as The International Union of Credit & Investment Insurers. This is an international non-profit association and community for the global export credit and investment insurance industry

https://www.berneunion.org/

1 See also Deutsche Bank’s Guide to Trade Finance for further explanation

Vinco David

Secretary General of the Berne Union

Jonathan Skovbro

Economic Research Analyst at the Berne Union

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

Trade finance and lending {icon-book}

Trade’s choking hazards Trade’s choking hazards

What happens if cargo ships can’t get through ports? Does trade grind to a halt and impact economic growth in surrounding countries? Independent trade economist Rebecca Harding examines supply chain resilience

TRADE FINANCE, SUSTAINABLE FINANCE, MACRO AND MARKETS {icon-book}

Taiwan’s green energy revolution Taiwan’s green energy revolution

By attracting international corporates and financing with a partnership approach to offshore wind farms, Taiwan is driving renewable energy growth. flow’s Clarissa Dann provides an overview of two large, syndicated export credit agency deals

Trade finance and lending

Ghana’s next-generation infrastructure Ghana’s next-generation infrastructure

Over the last decade, Deutsche Bank has arranged over €2bn of financing in Ghana across 20 transactions. The latest such deal – a €150m financing for two critical infrastructure projects in the Southern and Western regions of the country – was announced in February 2021. Clarissa Dann reports on a history of collaboration