14 August 2024

A heatwave across Southern Europe that forced closure of the Acropolis in Athens, occurred mid-June 2024 as delegates gathered at TXF’s Global 2024 Export, Project and Development Finance in the Greek capital to address key export finance developments. Topics included navigating ongoing geopolitical and economic risks, the future of the OECD ‘level playing field’ and supporting the transition to clean energy

MINUTES min read

One could be forgiven for thinking that the Greeks invented trade, with their establishment of Piraeus in the early 5th century BC as the new port of classical Athens through which import, and export transit trade made its way. The city’s reputation for maritime trade has endured, with Piraeus Port among the world’s top ten shipping centres.

Home to several temples, the most famous of which is the Parthenon, the Acropolis of Athens (a cultural UNESCO World Heritage Site) formed the backdrop to a forum for export finance experts, descending on the city more than a couple of millennia later. Around 1500 delegates comprising financiers, insurance providers, project/construction companies, and government agency reps converged on Athens in mid-June for the Global 2024 Export, Project and Development Finance summit, hosted by Exile Group (comprising TXF).

The event, which is one of the main high points of the export finance calendar, was returning to Athens having been held in Lisbon for the past two years.

Pictured: Delegates at the Global 2024 Export, Project and Development Finance in Athens

Healthy market, though risks remain

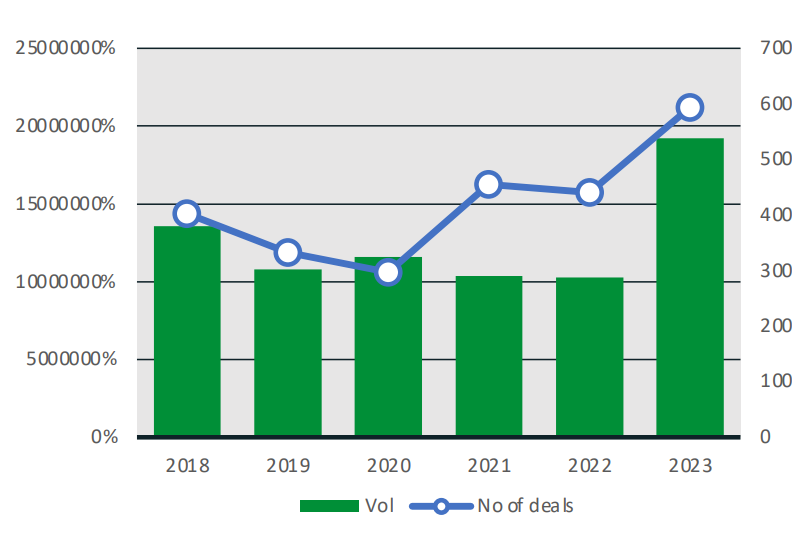

TXF’s co-founder Daniel Sheriff (and CEO of its parent The Exile Group) opened the proceedings with his report of how export finance volumes nearly doubled between 2022 and 2023 in what he described as “a genuinely historic year” (see Figure 1).

Despite the growing importance of export finance in facilitating international transactions, the landscape remains challenging. Amid ongoing political and macroeconomic headwinds, striking a balance between effective risk management and ensuring that financing reaches the areas where it is needed continues to keep export credit agency (ECA) chiefs awake at night.

Figure 1: Export finance deal volumes

Source: Export finance research report 2024 published July 2024 by The Exile Group

Sub-Saharan Africa – home to sizeable reserves of the world's critical energy transition minerals1 – is one region where this need for a delicate balance is felt particularly acutely by market participants. Sheriff explained that there were several positive trends, with the number of African nations that received ECA financing increasing from 17 in 2015 to 27 in 2023. However, many countries were only receiving support on single transactions, or in other cases a handful – and several such as South Africa, Mozambique and Ghana are receiving less export finance.

To put the challenge into perspective, the IFC-WTO joint study of West Africa2 found that the Côte d’Ivoire, Ghana, Nigeria, and Senegal – known collectively as the ECOWAS4 – has a combined annual trade finance gap as high as US$14bn.

With an eye on the future, Sheriff also reflected on conversations he has had with ECAs over the past year, which are increasingly flagging technology risk, particularly as it relates to AI, as a growing concern. “ECAs are increasingly being asked to take venture capital levels of risk, without receiving the associated level of reward,” he added.

Commenting on the perfect storm of risks and responses in the ‘Global Heads’ debate session, Werner Schmidt, Deutsche Bank’s Global Head of Structured Trade and Export Finance, reflected on what the community should doing about them. These include transformational, technological, by country, regulatory to name the most obvious.

“The instant response to this is often more regulation, but this not what is needed,” he said. He continued, “Instead, we need more alignment across different stakeholder groups, i.e. government, ECAs, banks, corporates and any other stakeholders that play a role in export finance.”

We can do this as a community – there are super smart people in this room and elsewhere but given the risk scenarios at play we need to just get on with it” he added.

“Given the risk scenarios at play we need a lot more alignment going forward”

OECD Arrangement: the future or the past?

At the 2023 TXF Global Conference, changes to the OECD ‘Arrangement’ (the Arrangement) – including more export credit support for climate-friendly and green initiatives – was a key topic of discussion, as reported last year in Export finance gets a full house in Lisbon.

Having first launched in 1978, the Arrangement provides clear guidance for ECAs to promote fair competition – and avoid a ‘race to the bottom’ on financing terms. The Arrangement covers tied financing, where the amount of financing is linked to the country of origin of the exported goods and services. Untied financing, whereby the support is not tied to the procurement of goods or services from exporters, is not covered.

As the ECA market has evolved so too has the Agreement – and in March 2023, a modernisation package was agreed, which would help to ensure it was better aligned with sustainability-related policy goals. The changes, which took effect the following July, included increasing the maximum repayment term up to 22 years for Climate Change Sector Understanding (CCSU)-eligible projects, and 15 years for most other projects.

Since the OECD consensus change, TXF Intelligence’s data reveals that the average length of tenor for a renewable ECA-backed deal has increased from 14 years to 15.5 years. A drill down into the details shows the number of these transactions with over 19 tranches increased by approximately 493% between 2022 and 2023.

Though the progress to date is positive, Silvia Gavornikova, Head of Export Credits and Competition Division, OECD (pictured above, left) – speaking on The World of Tomorrow: Export Credit Industry Review – explained that, given how long it takes to structure these longer tenor transactions, it will likely take several years before the full impact is seen. The OECD paper, Quantifying the role of state enterprises in industrial subsidies (13 June 2024)3 provides more detail on the OECD perspective of the whole ‘level playing field’ issue.

The same panel also debated the continued relevance of the decades-old Agreement. While some panellists went as far to call for its abolition, others simply pointed out that as an increasing number of transactions are already completed outside of the Arrangement anyway – its relevance could continue to wane as untied financing takes centre stage. Panellists also noted how inter-ECA competition, which the OECD had tried to stave off all those years ago is on the rise.

ECAs and the road to net zero

There was no escaping the scorching Athens heat and one panellist asked, by a show of hands, who would still attend the conference if air conditioning was not provided. Unsurprisingly, few would still be keen. The wider point being made was that there is often an under reliance on those asking for change and an over reliance on those being asked to implement it.

Pictured: Edna Schöne, Euler Hermes ECA CEO during the ECA CEO ‘Hot Seat’ interviews

Action rather than words is increasingly forthcoming from ECAs. During the ECA CEO ‘Hot Seat’ interviews – a feature of the event – it was clear that sustainability-linked finance and projects with environmental, social and governance (ESG) outcomes ranked among the top priorities.

Euler Hermes ECA CEO Edna Schöne told TXF News afterwards, “The German government’s new climate strategy came into place from last November, and we are really kick starting it this year. For 2024, the strategy is straightforward, it's called ‘greener and leaner’, which is fairly self-explanatory. Greener is clear. We want to really increase the portion of green projects in our portfolio, and not only these, but also impact projects. That means doing business with a positive climate, social and environmental impact. We already started with that last year, and successfully, as more than 50% of our new business consisted of impact projects.”

She explained how Euler Hermes is also working closely with the German government to de-bureaucratise through 14 measures. Three were highlighted during the session: giving Euler Hermes more decision-making authority; creating digital products for small and medium sized businesses (SMEs); and developing an AI-driven large language model to unlock efficiencies.

Collaboration among ECAs is also ramping up. Last December, at the COP28 climate summit in Dubai, a group of European and North American ECAs launched a UN-backed initiative – known as the Net-Zero Export Credit Agencies Alliance (NZECA) – to help meet net-zero goals by 2050 by supporting the decarbonisation of trade and facilitating joint action from public and private finance. For example, all members have vowed to end new direct support for unabated fossil fuels by the end of 2024.4 During a panel session on the topic, a representative from the Swedish Export Credit Corporation (SEK) – a founder member of NZECA – described the alliance as an effort to standardise the way ECAs work and create common ways of reporting such that they can accelerate the transition together.

In tandem, ESG methodologies are helping to provide clearer guidance and drive best practices among stakeholders. For example, the Loan Market Association (LMA) has published several frameworks and model provisions for the sustainability-linked loan market that are deliberately high-level and jurisdiction agnostic – useful tools for stakeholders looking to enter the market.5

While these and other similar frameworks are beginning to drive good practice, challenges remain. During the panel session ‘Navigating ESG Methodology for ECA Finance’, an LMA representative described the inherent tension between preserving the level of flexibility required to support the market’s development and the need to promote integrity and robustness in the sustainability products.

With the risk of “greenwashing” a perennial trip hazard for the industry, these frameworks are often used more rigidly than was originally envisaged – serving to stifle innovation in the market. The panellists agreed that upskilling around the topic of ESG issues is needed among law professionals to ensure these frameworks can be deployed more adeptly.

How CPRI is remaining relevant

By helping to manage and transfer credit and political risks associated with lending and investment activities, Credit and Political Risk Insurance (CPRI) remains an important risk distribution tool for banks. This is reflected in the increasing total insured exposure among participating banks, which grew from US$130bn in 2019 to US$167bn in 2022 – facilitating a total of US$360bn in credit transactions across a wide variety of asset classes.6

So, what are the trends shaping this space? Speaking on a panel titled, Inside the Adyton: a Banker’s toolkit, Boris Jaquet, Global Head of Trade Finance & Lending Distribution, Deutsche Bank, explained that portfolio de-risking solutions are becoming a more prominent feature of the market.

Portfolio solutions can offer a competitive advantage for banks looking to reduce capital allocation requirements and access new sources of capital. To achieve this, banks bundle pools of exposure into a portfolio transaction, comprising several different tranches – segments of the portfolio that vary by risk and return – that can then be distributed to investors based on their risk appetite.

Under European and UK regulatory frameworks – and provided the credit risk transfer is deemed significant enough – portions of the portfolio transaction might be categorised as a portfolio solution or significant risk transfer (SRT).

“From a bank perspective it is important that these [CPRI] tools remain relevant”

As we get to more complex transactions there is an attrition within the market as to who can offer support. “From a bank perspective it is important that these tools remain relevant – going forward it will be a question of talking together, getting together, having the right broker, and I am confident we can achieve this,” concluded Jaquet.

Copenhagen 2025

Reflecting on the energy transition financings, concerted efforts are being made to press forward on the road to net zero – be it through the revised OECD Arrangement, the Net-Zero Export Credit Agencies Alliance (NZECA) or more robust ESG methodologies.

With the 2023 United Nations (UN) report finding that the world is headed for a temperature rise of up to 2.6C – well beyond the ambitious 1.5C target – the net-zero related ECA deals transactions were a step in the right direction, but the general feeling among panellists during the two-day event was that more work is likely needed.7 It will be interesting to see what progress has been made by the time this huge community with enormous capacity to make projects happen reassembles in Copenhagen next year.

Global 2024, Export, Project and Development Finance, hosted by Exile Group, was held at the Divani Caravel, Athens, Greece on 11–12 June 2024. It reconvenes 10–12 June 2025 in Copenhagen, Denmark

Sources

1 See unctad.org

2 See wto.org

3 See one.oecd.org

4 See unepfi.org

5 See lma.eu.com

6 See iacpm.org

7 See unfccc.int