07 November 2024

China’s continuing ‘opening up’ of its economy to overseas investors and corporates was very much in evidence at Sibos Beijing 2024, where 7000 delegates met up at the mainland capital's China National Convention Centre for the first time. flow’s Clarissa Dann reflects on the main conference programme insights into cross-border trade and its digitalisation journey

MINUTES min read

Well, for me it was ‘Hello again Beijing’, after a five-year absence – during which China’s ‘opening up’ journey has moved forward at what seems lightning speed.

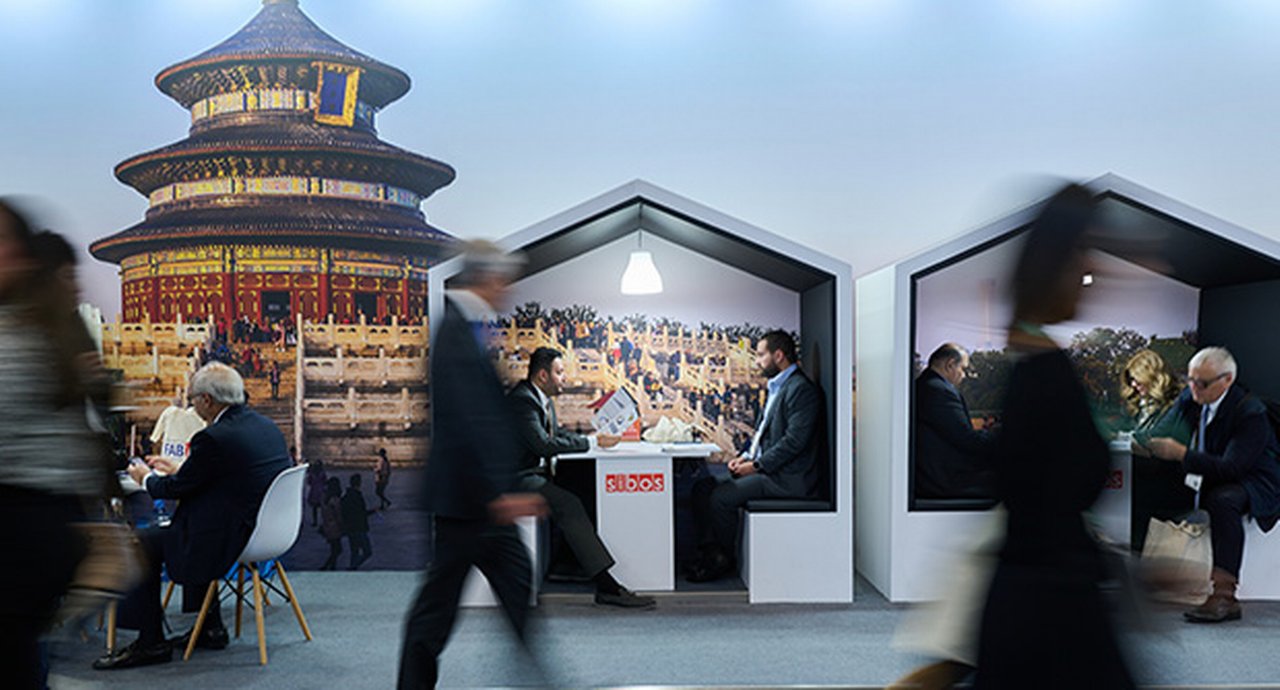

The decision to host Sibos, the annual financial services conference held by the Society for Worldwide Interbank Financial Telecommunication (SWIFT), in Beijing is a massive demonstration of China’s financial openness. While the 1991 and 2009 Sibos conferences were held in what is now Hong Kong SAR, this is the first time it has come to the Chinese capital. AN estimated 7,000 delegates attended in person with a further 3,000 tuning in remotely.

Immigration was a breeze, thanks to the efficient visa service in London. We were greeted with smiles from our patient airport transfer drivers as they navigated gridlocks, driving rain (although we had glorious sunshine for the conference itself with clear smog-free skies) and some rather confused lorries that had not clocked a certain one-way system.

Despite warnings about internet access issues, for Sibos 2024 the hosts had gone out of their way to make their guests feel comfortable and at home. We had no problem connecting with email and communications apps thanks to the Sibos internet service while in the conference centre and adjoining Intercontinental Hotel.

Beijing as a city brings together east and west, past and future, tradition and innovation,” declared Graeme Munro, Swift Chair of the Board at the opening plenary session on 21 October.

“On behalf of the Beijing Municipal Government, I wish to extend warm congratulations on the opening of this event and sincere greetings to all distinguished guests coming from afar” said Mayor of Beijing Yong Yin after Munro’s introduction. “This event highlights both the development opportunities of China and our strong commitment to further opening up and I am confident that the success of Sibos 2024 will foster deeper collaboration among global financial institutions and contribute to Beijing’s efforts in international financial cooperation and development”.

This article sets the scene as the first of a series of post-Sibos reports and takes a closer look at several discussions around trade and technology.

Economic resilience

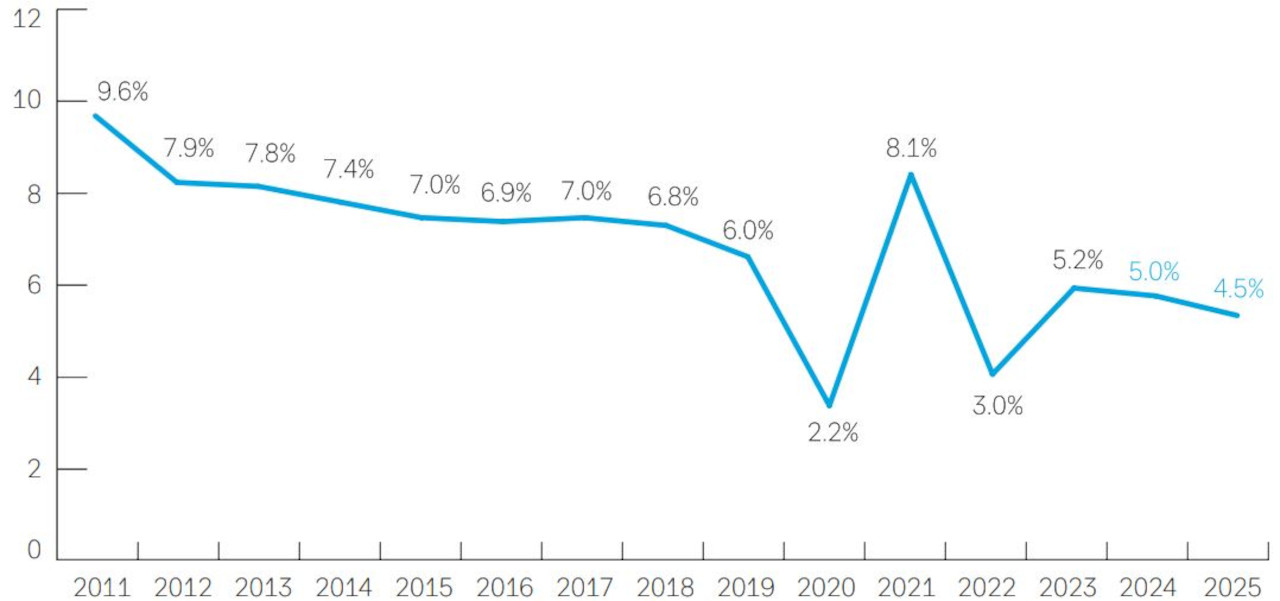

Figure 1: China’s GDP growth since 2011

Data source: DB Research, National Bureau of Statistics of China (July 2024)

The People’s Republic of China (PRC) has been the world’s second-largest economy by GDP since 2010, larger than Japan, Germany, the UK and India combined. As explained in Deutsche Bank’s China Compass, published at Sibos in partnership with law firm HanKun, “As of September 2024, China’s foreign exchange reserves have reached US$ 3,316bn, making China the largest holder of foreign exchange reserves in the world. In the recent decade, China has posted positive GDP growth. Following a moderate post-pandemic growth of 5.2% in 2023, the Chinese government has pegged the country’s GDP growth at ‘around 5%’ in 2024.1

Government stimulus has been a key factor in the country’s recent economic uptick. Yi Xiong, Deutsche Bank Research’s Chief Economist noted, “China's fiscal spending has surged by 12.6% year-on-year YoY in September, according to the latest Ministry of Finance data release. We think this is the main reason why recent economic activity has improved. The surge in spending is fueled by an acceleration in government bond issuances since August.”2

Further background on China’s economy can be found in the flow article ‘Re-enter the dragon’

A resounding welcome for Sibos delegates

The Olympics of Banking

Beijing has been China’s capital since 1153, stretched across four dynasties and is among its largest and most wealthy cities. So, it was entirely fitting that Sibos should venture forth to the Chaoyang district, where the vast China National Convention Centre sits around the corner from the Beijing National Stadium and Beijing Aquatics C, also known as the Water Cube, built for the 2008 Olympics.

“Beijing as a city brings together east and west, past and future, tradition and innovation”

As Mayor Yin put it in his welcome remarks, “This is the Olympics of banking.” His remarks underlined a spirit of cooperation and working together through huge disruptions such as the Covid-19 pandemic. After the 2020 and 2021 online iterations of Sibos, the importance of face-to-face dialogue was appreciated by the 7,000 gathered in Beijing. “It is better to meet,” he reflected. We all agreed. Beijing as a city brings together east and west, past and future, tradition and innovation,” opened Graeme Munro, Swift Chair of the Board at the opening plenary session on 21 October.

The strategic blueprint of China’s future was enshrined in President Xi Jinping’s address to China’s 2022 Party Congress two years earlier on 18 October 2022, explained Yong Yin.3 It was here that he set the tone for China’s trading relationship with the rest of the world: “China has become a major trading partner for more than 140 countries and regions, it leads the world in total volume of trade in goods, and it is a major destination for global investment and a leading country in outbound investment. Through these efforts, we have advanced a broader agenda of opening up across more areas and in greater depth,” said President Xi at the time. “The primary goal is to advance China’s modernisation,” the Mayor told Sibos delegates.

With “Connecting the future of finance” as Sibos Beijing’s key theme, People’s Bank of China (PBOC) Governor Lei Lu explained how this was working in China as it opened its financial sector, interlinking of cross-border payments and international cooperation with the rest of the world. Foreign ownership restrictions on banking securities and insurance have been removed, attracting more than 110 foreign financial institutions to work in the country.

China’s Crossborder Interbank Payment System (CIPS) became operational on 8 October 2015 (a frequent theme at Sibos Singapore 2015) and has been working with Swift to facilitate cross-border payments via its messaging service. Despite media suggestions positioning CIPS as a possible rival to Swift because of US dollar hegemony,4 Deputy Governor Lei Lu underlined the solid partnership between Swift and CIPS. He reminded delegates how Swift had set up a subsidiary in Beijing in 20195 to provide localised services, data and compliance products to Chinese clients. This now has more than 550 users in China – after annual growth of 3% over the past five years. The PBOC will continue to support Chinese financial institutions in cooperating with SWIFT and other financial institutions, he said. Swift CEO Javier Pérez-Tasso pointed out that the “strong integrated financial system we have built over the years has been an essential foundation for decades of economic growth” and confirmed its Beijing and Shanghai teams have accelerated cooperation and innovation with CIPS.

Trade themes at Sibos

“Trade has lifted two billion people out of poverty,” said Standard Chartered CEO Bill Winters “in conversation” with Tasso. And while globalisation was “a good thing for humanity” it “left very important pockets behind in different ways”, he continued. Winters dismissed the idea that it was dead or in reverse, maintaining that trade growth will continue, that “its nature is changing,” and “has forces pulling towards fragmentation again.” Drivers of this trend are supply chain diversification, new points of friction, fragmentation on the back of geopolitical tensions, forces of protectionism, and the ordinary course of supply chain reconfiguration and cost patterns across markets. A further factor is the rise of intra-regional trade at the expense of cross-border trade.

The response for banks, he concluded, is “to recognise these trends and do our best to be in front of them”. This was a point that Deutsche Bank’s Co-Head of Trade Finance and Lending, Atul Jain developed in a flow perspectives interview on Day Two of Sibos.6

“The large-scale changes we’ve had to confront in the past four years alone — pandemic, war, inflation, interest rates, energy and food security, AI, cybersecurity — have made the operating environment for trade largely unrecognisable, and both governments and corporates have had to evolve exponentially to these dynamics.”He went to on to explain how priorities for corporate centred around:

- Ensuring and protecting liquidity;

- Making sure their supply chains are resilient up and down;

- Connecting to new markets and new corridors as part of that resilience strategy; and

- Ensuring they have access to a broad suite of distribution partners to increase their capacity and scale.

Such priorities have resulted in many corporates rethinking China-centric supply chains. As McKinsey reported in August 2023, “For global companies, China’s skilled labour force, extensive supplier ecosystem, and fast-growing domestic markets have long acted as a magnet for manufacturers. As a result, complex, tightly integrated supply networks now link China with the rest of the world. But now, some of those companies are asking themselves whether the attractions that made so much strategic sense over the past 20 years still do—and what might come next. The economic and operational impact of the Covid-19 pandemic, for example, highlighted the risks inherent in manufacturing networks that rely on long-distance supply chains and geographic concentration of key suppliers.”7 Deutsche Bank’s Corporate Bank Head David Lynne told India’s LiveMint that the rethinking of China as a single production source began before Covid and has gained momentum since the pandemic. “First, labour costs in China have risen as its wealth has grown. Second, trade barriers were increasing even before the pandemic. Finally, Covid highlighted the risks of relying on a single global supply chain,” he said. “Many multinationals now produce within China largely for the Chinese market itself, which was less common two decades ago,” added Lynne.8

Alibaba.com: Digital trade in action

Kuo Zhang, President of Alibaba.com explains how the platform supports MSMEs when they trade across borders

While several panels examined trade data, trade and payments, and the ongoing journey towards digitising the entire trade finance ecoysystem, it was refreshing to hear from Kuo Zhang, President of Alibaba.com (pictured, above). This is a platform that supports intra-region Asian trade, and addresses difficulties micro and small medium-sized enterprises (MSMEs) have had accessing finance. In conversation with Sophie Jackson of Treasury Today Zhang explained how he joined the Chinese e-commerce giant retailer in 2011, having held roles at IBM and Microsoft in Beijing following a degree in computer science. His first role at Alibaba was building merchant tools for the Chinese shopping site Taobao, becoming President of Aliababa.com in 2017. He wasted no time in extending the learning from B2C solutions into B2B – and cross-border trade.

Via the Alibaba.com platform, small companies can become cross-border entrepreneurs, he said, citing an Ethiopian coffee grower invited by the World Trade Organization (WTO) to present her case study in Geneva, but unable to join in person because of visa issues. “It was ironic the WTO invited an entrepreneur to present in person but she could not get a visa,” he smiled. The Alibaba platform helped her pay her farmers and navigate the many and complicated moving parts of trading across borders, such as freight forwarding, customs controls, FX etc. But, said Kuo Zhang, SMEs don’t need a visa to do their business with our platform and pointed out that before the launch of Alibaba.com in 1999, MSMEs only accounted for 1% of the exporting GDP percentage. By 2024 this had risen to 60%. “More MSMEs are joining global trade with the help of Swift, Alibaba and financial institutions,” he said. Some 20 million orders each year are supported by Alibaba.com. “Payments need to be made in real time, and not take days,” continued Kuo Zhang before explaining how the platform “balances the protection of buyers and the cashflow of suppliers with credit assistance”. The platform goes beyond transactions and funding but provides logistics information and facilitates returns and refunds. “Part of the role of Alibaba.com is to help buyers lower the barriers, trust each other and do more business with each other,” he said.

New technologies and frameworks for digital trade

In her panel, ‘Digitising global trade – seizing the moment and interconnecting ecoystems’, Avanee Gokhale, Global Head of Trade Strategy at Swift,9 opened with her state of play summary. “As we all know, efforts to digitise trade have gained momentum in the past few years more than they have in decades. Digital documents are gaining acceptance in organisations, banks and platforms are investing in new tech and innovating. There is growing awareness in terms of use of standards and harmonisation. But at the same time, there is a proliferation of digital islands – the IMF puts this at 7% of GDP.”

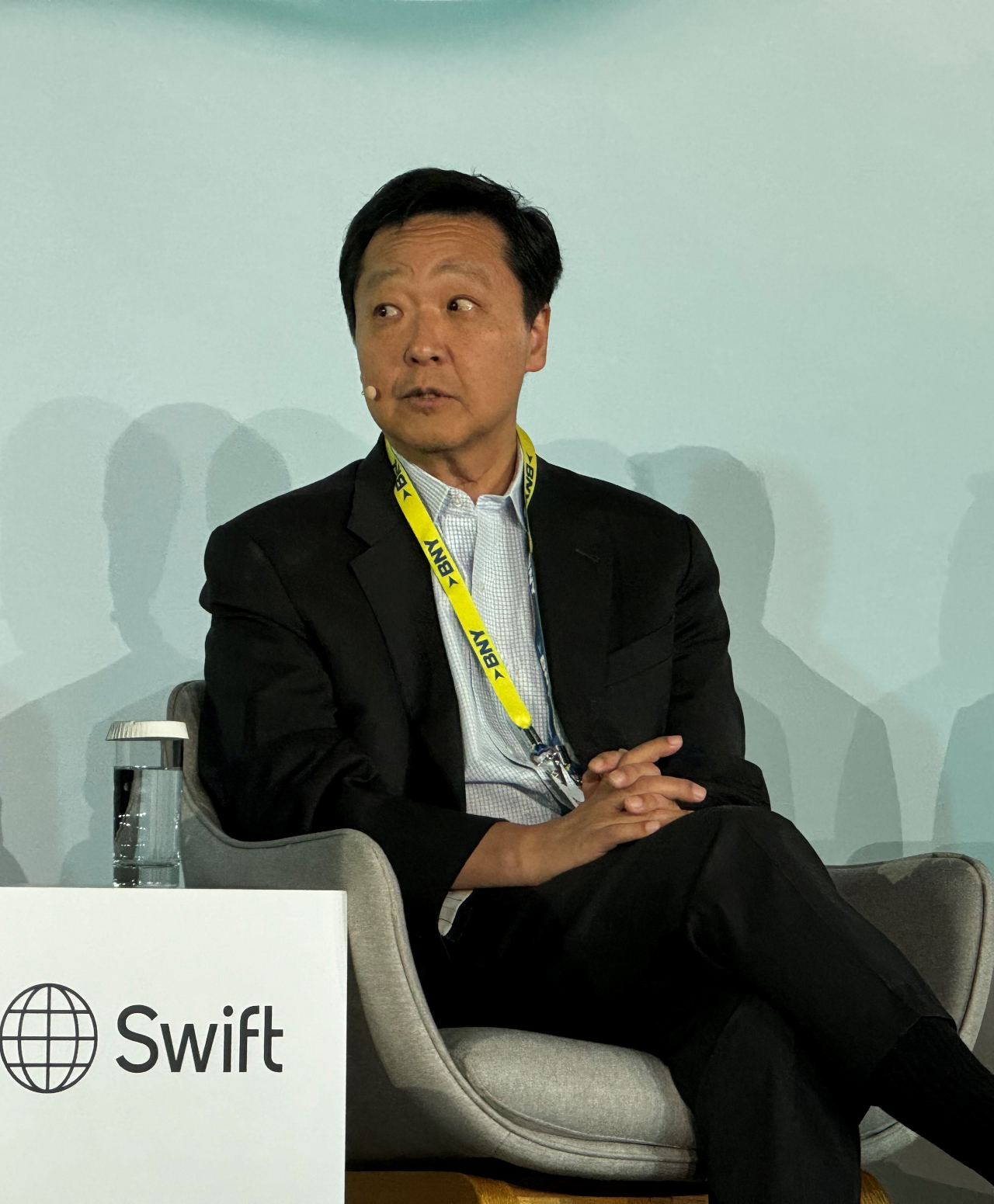

BNY’s Joon Kim explains to Sibos delegates how OCR and GenAI technologies are helping convert unstructured data into structured data

She asked, “how can we as an industry collaborate to move forward and ensure we have a frictionless digital economy?” Joon Kim, Global Head of Trade Finance, Cash Management and Solution Structuring Platform Group at BNY, reminded delegates that with industry standards, “everyone has to be aligned” but given that it “takes a while to move everyone”, much can be done internally to build a digital trade infrastructure that delivers various efficiencies. One piece of low-hanging fruit is the leveraging of optical character recognition (OCR) technology coupled with generative artificial intelligence (GenAI) to convert unstructured data into structured data. The arrival of the Category 7 Swift message from a client triggers an intensely manual process – once input, it is linked to the credit department for credit availability checks, followed by further compliance and red flag checks with all the steps between. Once the data is in the system these processes can be automated with a consistent standardisation and scale which enhances the client experience “ultimately resulting in and doing more international trade business”.

“Global MNCs and buyers can drive [trade finance] adoption”

At the end of the day, while utilities and international organisations can create frameworks, standards and networks, it is down to the participants in trade to make these work for them in a way that does not exacerbate the digital island problem. Pamela Mar Managing Director of the ICC Digital Standards Initiative,10 however, believes that 2024 “has been a real turning point”. In a flow perspectives interview at Sibos, she pointed out that the legal frameworks are coming into place with 37% of global GDP aligned and a further 26% about to align. “We have released our first trade standards framework that draws all the disparate elements of the supply chain (public and private sectors) into one cohesive model, and just launched our first assessment of reliable systems – necessary for any company looking to transact and trade digitally through a trade services platform.11

Banks, added Mar, are a critical part of the supply chain and can support companies going digital and with the transfer of digital records. They can start using digitally generated trade data to find new ways to assess the credit worthiness of SMEs especially across the developing world. “This lies at the heart of the trade finance gap. Banks have power to innovate and provide trade finance” to underserved corners of the market said Mar. As for adoption, it all depends on a corporate’s willingness to take that first step and digitise the processes. “Standards are clear, “ she concluded, and “corporates need to generate globally interoperable trade data form existing ERPs. Global MNCs and buyers can drive adoption – they can align their supply chains and determine the pace”.

The China National Convention Centre across the road from the Olympic towers at Sibos Beijing 2024 which ran from 21 to 24 October

Sources

1 See corporates.db.com

2 See ‘China Macro: fiscal support has arrived’ by Yi Xiong and Deyun Ou, Deutsche Bank Research (28 October 2024)

3 See english.www.gov.cn

4 See ‘HSBC Hong Kong joins China’s Cips rival to Swift’, Financial Times, 25 October 2024

5 See chinadaily.com.cn

6 See "How rerouted supply chains have redefined trade finance relationships" at flow.db.com

7 See mckinsey.com

8 See livemint.com

9 See corporates.db.com

10 See corporates.db.com

11 See "Update on legal reform and standards to promote digital trade global adoption" at flow.db.com