16 March 2022

While renewables financing is at an all-time high, the demands of the energy transition mean that more is needed. Deutsche Bank’s Sandra Primiero took part in a webinar hosted by infrastructure media and research specialists Proximo, discussing renewables finance and the role that non-payment insurance could play in driving the green revolution

MINUTES min read

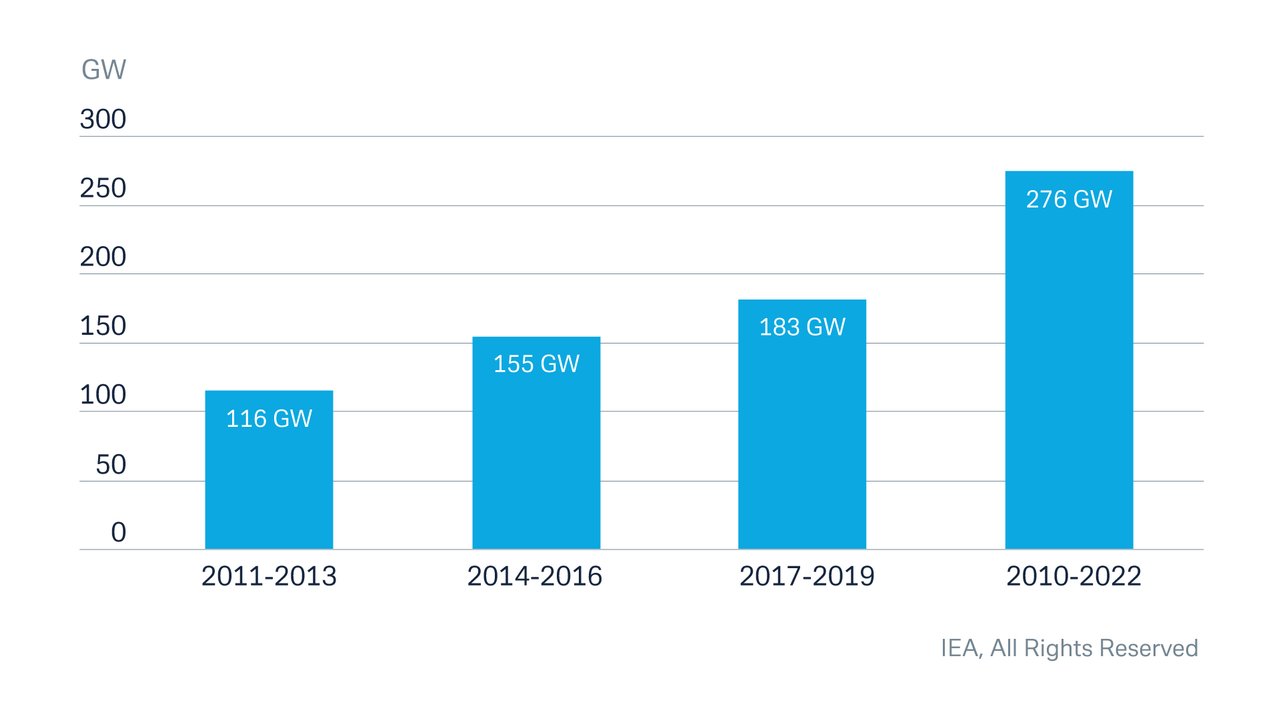

Renewable energy lies at the heart of global decarbonisation efforts – and the market is growing. The total capacity of renewable energy rose by 45% in 2020, the largest year-on-year increase since 1999.1 According to the International Energy Agency (IEA)’s Renewable Energy Market Update 2021, this uptick in renewable capacity accounts for 90% of the entire global power sector’s expansion (see Figure 1).2

Figure 1: Average annual net renewable capacity additions, 2011-2022

Source: The International Energy Agency: Renewable Energy Market Update 2021

Maintaining this growth, however, requires significant and sustained investment over the next few decades. While much of this will come via capital being directed away from fossil fuels, the level of funding needed will nevertheless tax the balance sheets of existing, experienced lenders and force more recent entrants to step up.

To ensure that the funding required to meet net zero targets can be met, banks are assessing new ways of mobilising capital in the renewables space. This is driving the use of existing, but underutilised products, such as non-payment insurance; a topic that formed the discussion at a webinar held by infrastructure media company Proximo, with the support of credit insurer Tierra Underwriting on 6 January 2022. Entitled “Non-payment insurance for renewables finance”, the event’s speakers were:

- Tom Nelthorpe, Proximo (Moderator)

- Andrew Beechey, Managing Director, Tierra Underwriting

- Sandra Primiero, Global Head Natural Resource Finance, Deutsche Bank

- Matthew Beckett, Head of Insurance Distribution, SMBC

The changing landscape

As the world’s energy mix transitions away from fossil fuels and towards renewable energy, innovative new market segments are emerging, including concentrated solar energy, carbon capture and storage, nuclear fusion and smart electricity grids, to name just a few.3 But some of these technologies are more developed than others.

“For instance,” explained Deutsche Bank’s Sandra Primiero “solar and wind have been around for a while and the technologies are well developed and already widespread in the market.” Other products – such as green hydrogen – are still in the early adoption stage, and they are not even available for commercial lending yet. “These emerging products have pricing structures that work in a different way than traditional industries, which adds to the complexity of the environment,” she added.

While financing sectors that are market-ready remains the priority, emerging areas that could provide an alternative to emission-intensive sectors – for instance, battery, hydrogen and green steel – will need significant levels of finance over the next 10 years.

Non-payment insurance

To ensure the industry can finance the rapidly growing renewables market, “the financing and insurance markets need to come together to absorb this risk and finance or insure these new technologies,” explained Andrew Beechey, Managing Director at Tierra Underwriting.

One solution within the insurance universe is non-payment insurance policies, which are offered by insurers and provide diversified, investment-grade risk capacity and protection to project finance lenders. When the project finance team offers a short-, medium- or long-term loan to developed or emerging market borrowers, the insurers are established as protection for the banks, covering any payment defaults.

He said that acting as a relatively straightforward risk distribution tool, banks that use non-payment insurance products can benefit from Basel-III-compliant insurance policies, backed by the financial strength of insurers that are rated A or above, as well as sharing their risk with insurers as non-competing, silent partners. This alternative form of risk management increases the lender’s risk-bearing capacity, supporting increased ticket sizes and allowing more lending into green project finance.

Matthew Beckett, Head of Insurance Placement EMEA, for SMBC commented, “Non-payment insurance is certainly becoming a meaningful avenue for us as a bank – and the market is becoming more liquid and more engaged in this kind of project finance.”

Primiero added that Deutsche Bank “has have been working with innovative insurance tools in the natural resource sector for about 20 years, so it made sense to take on the ‘future-proof’ renewable energy solutions as well. And by balancing our portfolio with the emerging green technologies and the more-mature renewable businesses – with their different margins – we can de-risk our balance sheet and support the energy transition over the long term.”

“I have not seen anything that comes close to a cap in capacity yet”

No cap in green financing capacity - yet

Non-payment insurance products are helping to offset risk distribution challenges for banks, which is driving investment into innovative new energy solutions. As the industry chases down ambitious decarbonisation objectives, will a cap in financing capacity eventually be reached?

“While there are many green projects to fund – and a lot of financing needs from a bank perspective – I have not seen anything that comes close to a cap in capacity yet,” Primiero responded. “But if we do come close, there is room to ask insurers for support. I can see the insurance appetite shifting from projects that would have been plentiful in the past but are no longer attractive – such as coal – to projects with green objectives.”

Proximo, with the support of Tierra Underwriting, hosted the webinar “Non-payment insurance for renewables finance” on 6 January 2022. It can be viewed here. To view the event in replay mode, please first register, click on a confirmation link and then scroll back through all the provider’s events to this date

Sources

1 See https://bit.ly/3tLdFPp at iea.org

2 See https://bit.ly/3tLdFPp at iea.org

3 See https://bit.ly/3J2o6oe at forbes.com

Trade finance solutions Explore more

Find out more about our Trade finance solutions

solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

Sustainable finance, Trade finance and lending, flow case studies

Powering Australia’s energy transition Powering Australia’s energy transition

Australia is on track to power most of its National Energy Market with renewable resources by 2050. One important contributor is its onshore wind power. flow’s Clarissa Dann reports on how three new Global Power Generation wind farms, equipped with Vestas machinery, were supported with an innovative accounts receivables purchase facility from Deutsche Bank

MACRO AND MARKETS

Higher energy prices – here to stay? Higher energy prices – here to stay?

The recent surge in energy prices raises big questions: will Europe be able to secure its energy supply on the back of reduced investments in fossil fuels and ongoing geopolitical conflicts? And how can corporates best prepare for a prolonged period of elevated energy prices? flow’s Desirée Buchholz reports

Macro and markets, Trade finance and lending

Commodities 2022 – a transition-tinted landscape Commodities 2022 – a transition-tinted landscape

As economies implement their decarbonisation targets, this changes supply and demand for not only metals and minerals, but also the energy needed to smelt the ores. Drawing on Deutsche Bank Research analysis, flow’s Clarissa Dann takes a closer look at China’s aluminium output, and the prospect of another oil glut