2 November 2023

As sponsors of Global Trade Review’s annual GTR Directory (now in its 20th year), Deutsche Bank’s Trade Finance & Lending leaders Atul Jain and Oliver Resovac share their insights as the trade finance community comes together to make a positive difference during turbulent times

MINUTES min read

Over the course of last year, we have seen how the volatile economic and geopolitical environment – combined with developed world decarbonisation targets and emerging economy power demand – is reshaping the trade finance landscape.

Shape of trade

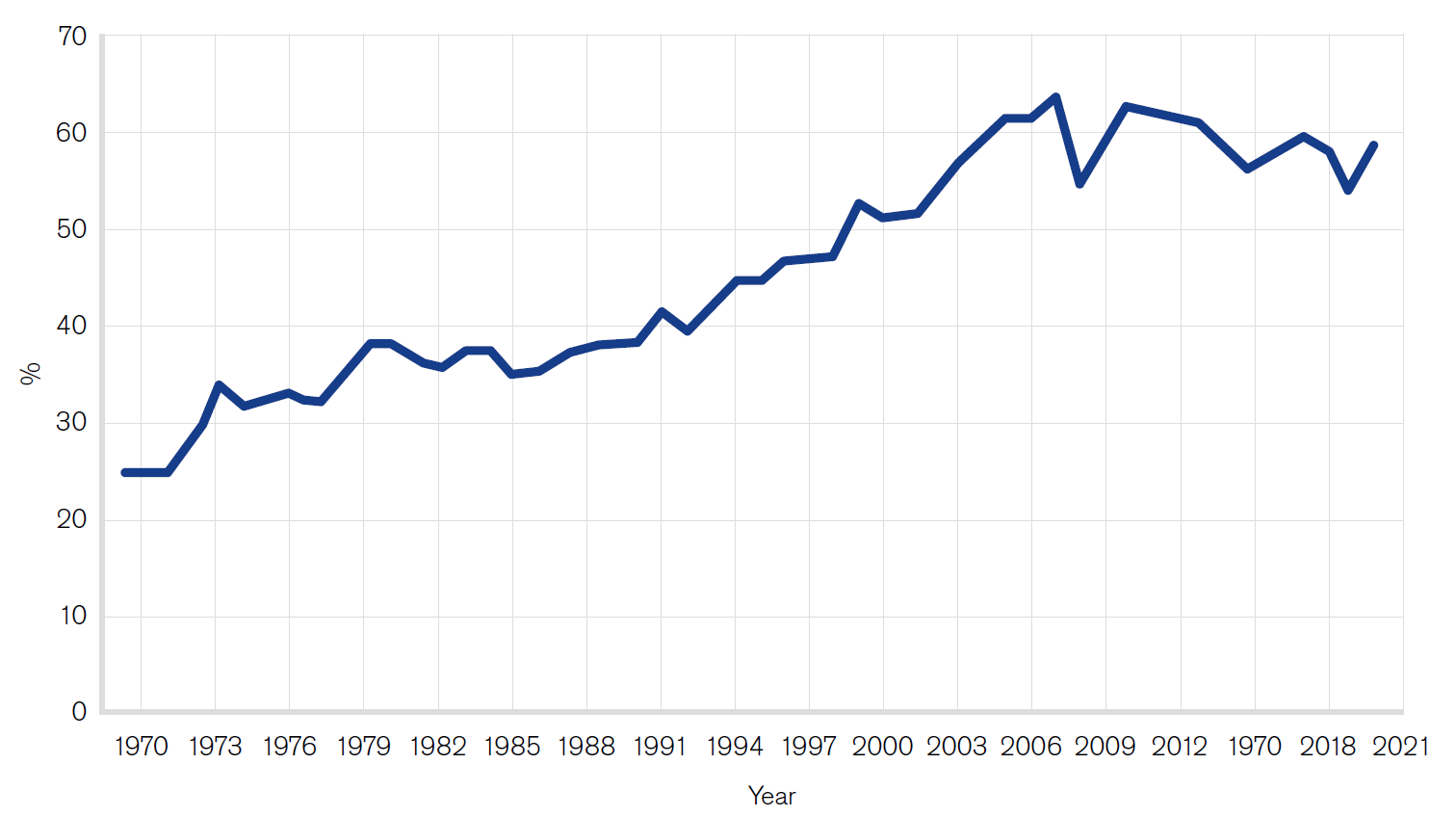

In The great decoupling? Rethinking sustainable globalisation published by the Deutsche Bank Chief Investment Office (July 2023), the authors note that the fall in the ratio of global trade to GDP “has been modest and was likely exacerbated by the impact of the Covid-19 pandemic and is not far off previous peaks.1 Trade remains significantly more important than a few decades ago and could still increase again”. See Figure 1. We agree. And their point that there is a “rethinking, scaling back and simplification of global supply chains” is something we too see in current trade flows – with security of energy, critical metals, and food continuing to drive trade finance demand.

Figure 1: Global trade as a % of GDP

Interest rates

Building on what we termed last year as the “most idiosyncratic risk environment in decades”, the current risk environment is coloured by further uncertainty around how different geographies will navigate the balance between reducing inflation and preventing recession via monetary policy. With the long period of low interest rates behind us, the challenge for trade finance providers is ensuring trade finance lending remains attractive once the risk has been priced in. This intensifies the focus on the services and customer care that go with it – as well as the structuring expertise for the more complex project, natural resources, and infrastructure financings, working with governments on securing export finance guarantees and construction companies to optimise global and local expertise.

Commodities security and decarbonisation

We believe that global banks are well positioned to help companies transform their complex value chains with a focus on environmental and social issues. We have seen how, right across the trade finance ecosystem, banks are in a unique position to connect different players across industries and value chains with global and local expertise – and thus facilitate transformation.

Cleaner ways of keeping the lights on has become a top priority all over the world – particularly in developing economies still awaiting full electrification. The 25-bank syndicate US$3bn export credit agency-backed Trafigura deal signed in October 2022 was an example of the trade finance industry coming together to solve a systemic developed economy problem.

Governments are deploying their export credit agencies, subsidies, and trade relationships to not only secure supplies of energy, but also to better access food production capabilities – such as the soybean and sunflower crushing plant in Lobito, Angola – a SACE ECA deal closed in April 2023. In addition, they are continuing to identify projects with outcomes that reduce the dependency on China for rare earth metals – while not so rare, more than 90% of them, are also processed in China. These require long-term investment and lenders working together – something the trade finance community knows exactly how to achieve.

Supply chains

Improved technology and better, more standardised platforms are transforming logistics and supply chain management, giving buyers more choice in how their supply chains are structured and supporting SME suppliers and with full transparency around ethical sourcing – made possible via sustainability-linked supply chain finance programs. Moreover, supply chain diversification is bringing about new demand for trade finance right across the product types, with markets like Mexico and Vietnam enjoying particularly strong upticks in their export.

Digitalising trade

Despite various initiatives to relieve trade of its paper burden, this was never going to be as straightforward a process as the payments industry. However, the passing of the UK’s Electronic Trade Documents Act 2023 (an alternative to the UNCITRAL Model Law on Electronic Transferable Records) is a major step forward, with implementation set for September 2023.2 Certain documents will then be acceptable in electronic form, including bills of exchange and promissory notes used for financing and payment, bills of lading, and warehouse receipts, to name a few. Done right, alongside more robust fraud detection processes and the broader use of compliant utilities and platforms, this could dramatically lower the cost of trade finance provision, thereby increasing its reach. Could a bold new future for documentary trade be right around the corner?

Outlook

Over the next 12 months, the trade finance community will continue to navigate fluctuating interest rates, the battle with inflation, commodity price volatility, and the tightrope of rising food and energy demand. This GTR Directory 2023-24 is a vital resource for all its members to come together and make a positive difference across these tectonic themes.

This opinion was first published as the Foreword to GTR’s Directory 2023-24 in October 2023.

Now in its 20th edition, the GTR Directory has established itself as the leading source for industry contacts. Featuring more than 2,000 contacts, the directory has a global circulation of over 8,000 copies and is distributed at all GTR conferences, plus many external industry events. The digital version is free to view online or via the GTR app.

Key contact details are arranged in the following categories:

- Financial Institutions & Advisory

- Asset & Fund Management

- Legal

- Credit & Political Risk Insurance

- Fintech & Tradetech

- Government Organisations & Public Bodies

- Collateral Management

- Support Services

Sources

1 A theme subsequently developed in the flow article, Three key risks for the global economy

2 Implementation took place 20 September 2023