11 February 2022

As the automobile industry shifts up a gear on accelerating average selling prices and electrification, what does this mean for transition metals? In the second article drawing on Deutsche Bank Research’s January 2022 Commodities Outlook Clarissa Dann reports on a copper supply tipping point and what this means for inflation

MINUTES min read

With commodity consumption expected to recover to pre-pandemic levels through2022, and decarbonisation a demand driver for several hard commodities, all eyes are on ‘transition metals’ such as aluminium, copper, and lithium and the processes used to produce them.

The flow article, Commodities 2022 – a transition-tinted landscape, took a closer look at aluminium, and China’s strategy to replace coal-fired production with electricity from renewable sources. And in Powering electric vehicles, the commodities impact, we explained how the move away from internal combustion engines (ICEs) to electric vehicles (EVs) is impacting platinum group metals (PGM) demand. This article pulls together further insights into the auto industry and, specifically, the outlook for copper and its relationship with inflation, drawing on Deutsche Bank Research’s January 2022 Commodities Outlook.

Changing up?

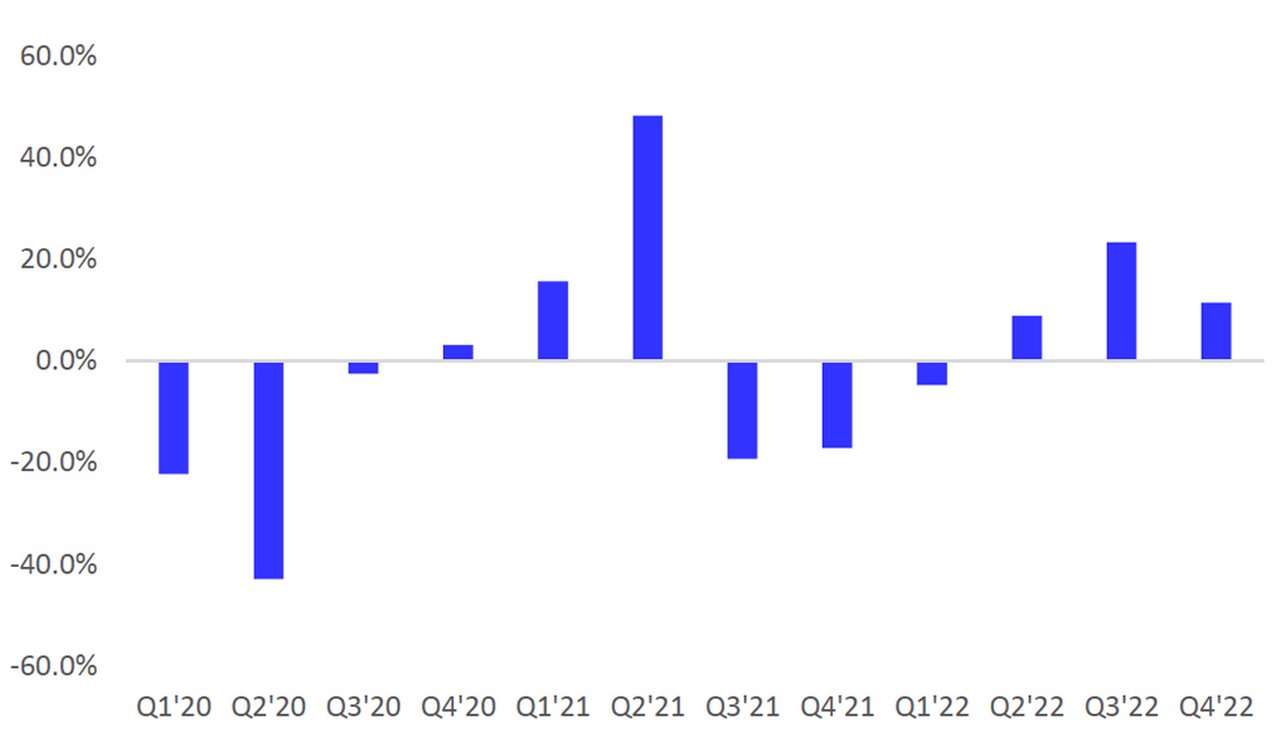

Figure 1: Auto production in H2 2022 forecast

Source: Deutsche Bank estimates

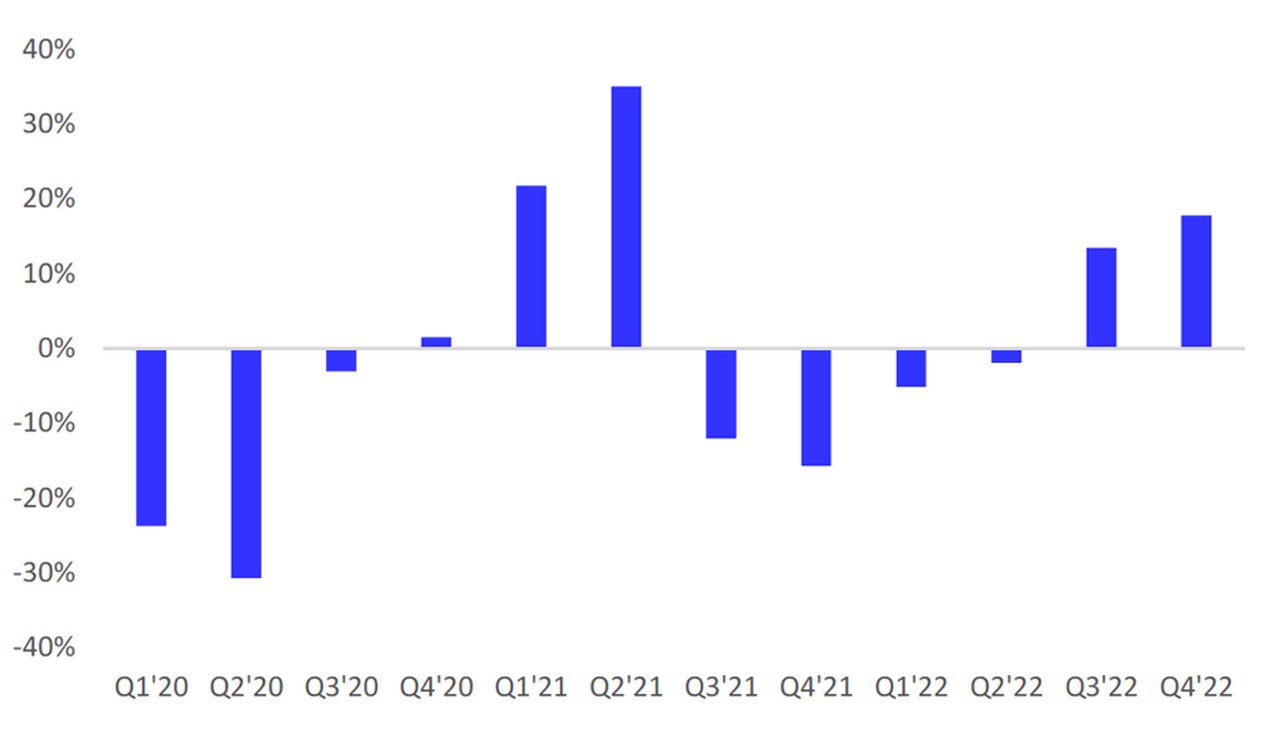

Automakers around the world were forced to cut production during last year, driven by the ongoing shortages of semiconductors, and this in turn has impacted commodity demand, particularly for platinum group metals (PGMs) and aluminium. “After three years of stable volumes, 2020 was the worst year in recent history,” reflect the authors of Commodities Outlook. Hence there was a substantial level of pent-up demand that could have led to strong sales in 2021. However, this was countered by the semi shortage issues that hampered production. As a result, volumes in 2021 were challenged and ended the year flat year on year.” (See Figures 1 and 2.)

Figure 2: Auto sales H2 2022 forecast

Source: Deutsche Bank estimates

More encouragingly, noted the Deutsche Bank Research report DB Global Automotive (8 December 2021), conditions for automakers are positive in the longer term. “Demand is strong, inventories remain tight, EVs are being rolled out and boosting average selling prices, recurring revenue streams develop, distribution models are changing, all of which we see having a smoothing impact on the economic cycle.”

Moreover, adds the report, vehicle electrification is accelerating – particularly in Europe. It points out that new car sales market penetration levels reached 20.5% in Q3 2021 for EVs. This comprises plug-in hybrid electric vehicles (PHEVs) and battery electric vehicles (BEVs) with 11.5% of that for BEVs – doubling overall EV volumes in that 12-month period. “With customers increasingly accepting this drivetrain, infrastructure being improved (22% more charging stations year-on-year in Germany) and over 10 new BEV models being rolled out from EU original equipment manufacturers alone we see this continuing.” The report also points out the effect of large fleets “is still underestimated” and that “more than 50% of premium sales in Germany is fleet business and with CO2 targets getting tighter corporate fleets quickly move to BEV only”.

With around 600 added gigawatt hours (GWh) of cell capacity per annum announced until 2024 in Europe, the team see EV penetration reaching 70% of the auto market by 2030 in Europe, and if all the proposed capacity does get built, “we even see scope for new car sales in Europe to be close to 100% BEV by then”.

In China, “2021 has already seen a large inflection in passenger car BEV sales and we expect the industry to sell about 2.5 million units (12-13% penetration)”. A proliferation of new models in the mid-tier/mass-market segment will, the team estimates, increase BEV penetration to 40% by 2025.

However, while the US lags other regions globally, “consumer adoption could pick up significantly as more vehicle models become available and if the Build Back Better bill passes through the US Senate”. The bill would introduce an award of up to US$12,500 per EV for union-made EVs using domestically sourced components, compared with the current US$7,500, which would make the vehicles more affordable to a wider market.

Transition metal demand

As EVs and associated infrastructure are becoming more popular this will “likely provide a significant boost to demand for many different metals and materials, but particularly for what we call ‘transition metals’, including copper, low-carbon aluminium, nickel, lithium and cobalt,” says the Commodities Outlook. This is because EVs and wind parks require much more metal compared to existing fossil fuel-based technologies.

For copper the team expects an “underwhelming supply performance” and a “solid demand outlook over the next few quarters”. The red-gold metal is a core component in electrics because of its conductivity properties and its malleability for wiring. Electrics make up around 60% of global demand and copper is found in wiring, cables and connectors, including vehicles and consumer electronics. Around 20% of output is used in construction due to its resistance to corrosion.

Most of the world’s 18 million metric tonnes per annum of copper supplies are concentrated in Chile,1 with the world’s largest mine being Escondida, a joint venture between mining giant BHP, Rio Tinto and Japan’s JECO Corp based in Northern Chile (see picture). There are also other suppliers situated in Peru, the US and sub-Saharan Africa (mainly Zambia).

Extracted from oxide and sulphide ores that typically contain between 0.3% and 2% copper, the barriers to entry in copper processing are high. It is a complex, messy and expensive process to convert the ore into copper cathode – the form it must reach before the metal can be used.

The Escondida copper mine in Chile. Source: BHP

“Processing copper from scrap is becoming increasingly important”

With demand for autos expected to pick up for 2022, what does this mean for demand for and supply of copper? The Commodities Outlook forecasts that by 2030, “EVs alone could boost copper demand by around 2.5 million tonnes per annum or 11% of global refined copper demand in 2020 (net effect after factoring in reduced demand from ICEs).

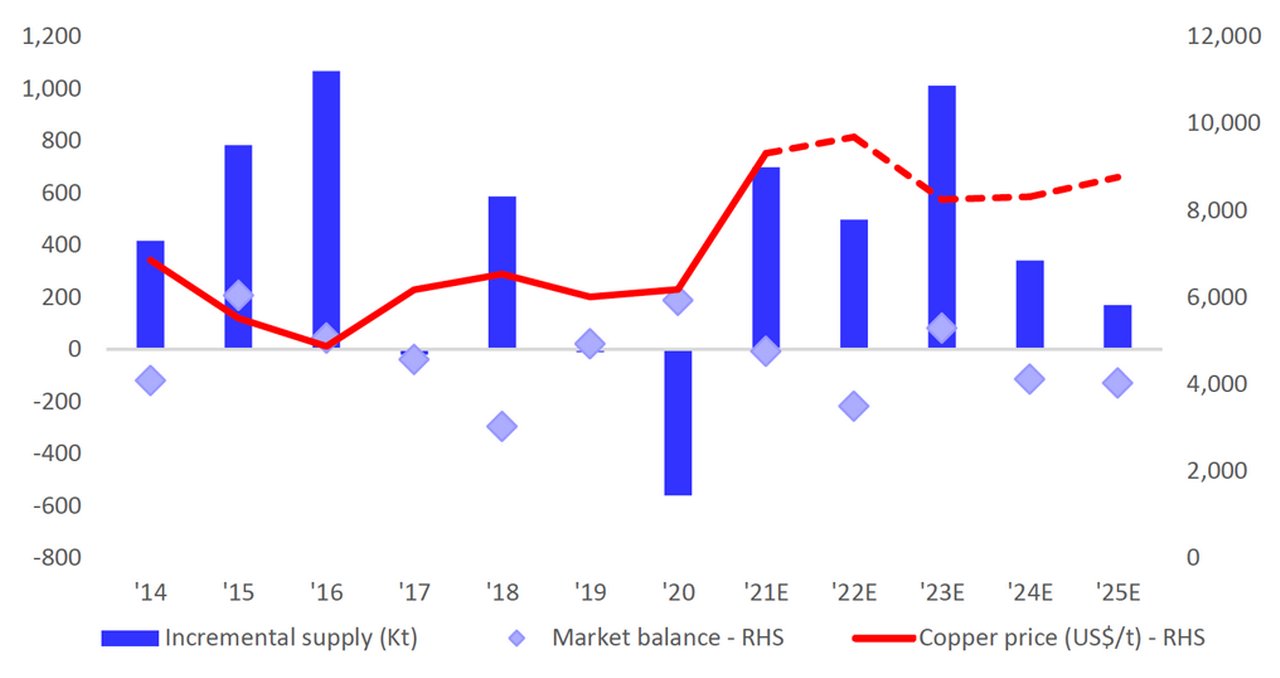

Supply growth has stalled since 2016, but economic recovery from Covid and legacy project approvals will, note the team, increase supply in 2022/23 although supply additions will fall rapidly from 2024 (see Figure 3)

Figure 3: Copper supplies set to fall from 2024

Source: Deutsche Bank estimates, CRU

Several key mining countries have proposed new higher taxation regimes for the mining sector “as nations across the globe look to plug post-Covid budget deficits,” notes the Commodities Outlook, and this factor has impacted copper supplies. Mining taxes are used to fund social programmes as was illustrated in early December when the IMF confirmed in early December there was scope for reform in Peru’s tax system to introduce higher taxes on the key mining sector. Peru is the world’s second largest copper producer after Chile.2

“Higher taxes – and a lack of certainty until new policies are announced – are likely to deter investment”, the report reflects, while noting that in Chile, an onerous increase in royalties and taxes has been proposed but not yet passed. Higher taxes are also being considered by the governments of Brazil, Panama and Zambia. The Deutsche Bank Research team estimates that US$50bn of copper projects slated for an investment decision in the next two to three years could be delayed if uncertainty over taxes continues in the medium term.

In summary, fiscal taxation uncertainty, decarbonisation (uncertainty over future demand and carbon pricing trends), ESG factors (at the corporate and operational levels) and reduced Chinese construction-related demand will, note the team, “keep investment levels contained”.

Processing copper from scrap is becoming increasingly important, reflects Deutsche Bank’s Global Head of Resources Sandra Primiero, as it is less CO2 intensive to reuse, than to extract and produce from scratch. She explains that the energy mix for processing vital and that (green) hydrogen is set to play a substantial role after 2030 at the latest. By then, green hydrogen “will more more price competitive than grey hydrogen because of CO2 charges”, says Primiero. “Our clients will need to make substantial modernisation capex investments – and we aim to finance their path towards the energy transition,” she concludes.

Inflationary concerns

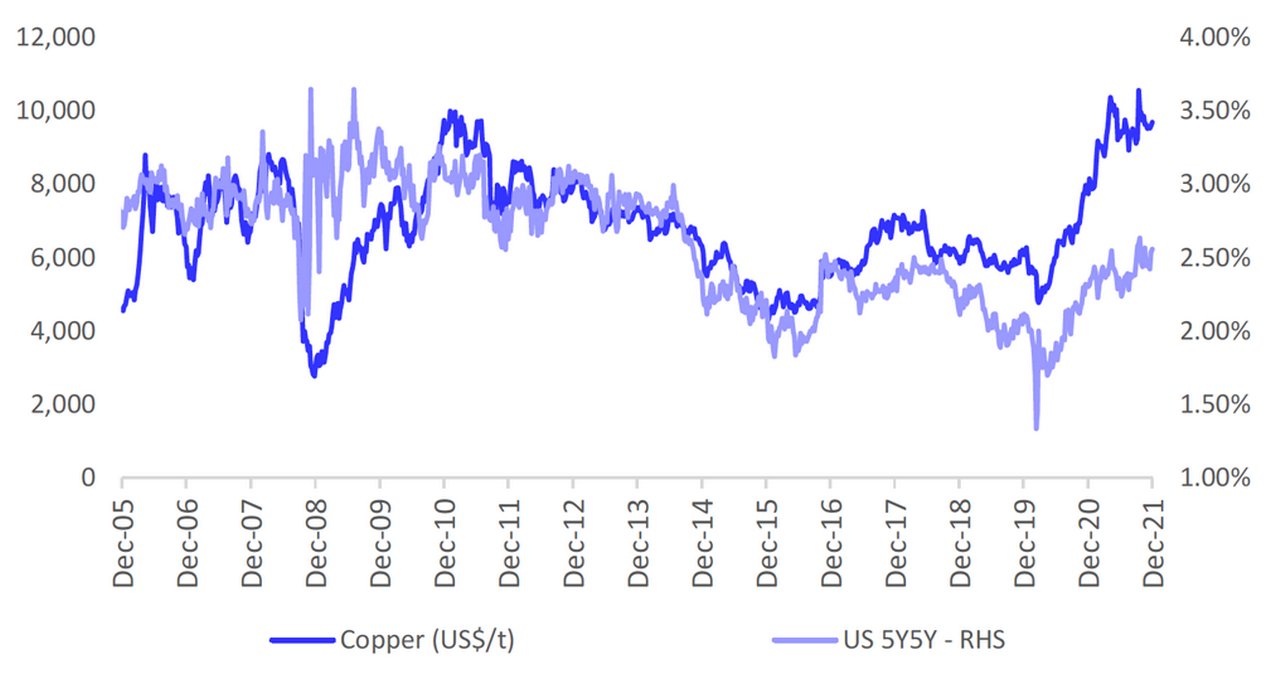

Historically, copper metal pricing has been seen by analysts as a bellwether of economic growth because of its use in building and construction, electronics, transport, consumer goods and machinery (see Figure 4). It is also regarded by some investors as an inflation hedge.3

Figure 4: Inflation and copper prices have moved in tandem

Source: Bloomberg Finance LP, Deutsche Bank Research

Put simply, when the price of copper rises, demand is up, and the economy is regarded as in growth. When it falls, demand sinks and outputs are cut. In the CRU Group’s article ‘Copper’s inflation ride’, (27 August 2021)4 Principal Analyst Craig Lang observed “The copper price has seen a more volatile ride in recent months, following a remarkably steady ascent since its Covid-19 induced low of March 2020.” Lang points out that “global financial liquidity has helped fuel copper’s cyclical recovery against a backdrop of continued supply challenges, a positive secular demand driven by ‘green applications’ and supported by large investments in public infrastructure”. However, he adds, since copper prices reached a record high in May 2021, “inflations concerns have presented headwinds”.

As copper demand exceeds supply this imbalance puts pressure on prices. It goes without saying that rising prices of a fundamental manufacturing input such as copper is an inflationary trend economies could do without as they rebuild after Covid-19 shocks and continue their Net Zero journeys.

Sources

1 See https://bit.ly/3JfvL2b at nsenergybusiness.com

2 See https://bit.ly/3p06uBx at mining.com

3 See https://bit.ly/34xcQ4b at metal.com

4 See https://bit.ly/3oD6zLa at crugroup.com

Trade finance solutions Explore more

Find out more about our Trade finance solutions

solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

Macro and markets, Trade finance and lending

Commodities 2022 – a transition-tinted landscape Commodities 2022 – a transition-tinted landscape

As economies implement their decarbonisation targets, this changes supply and demand for not only metals and minerals, but also the energy needed to smelt the ores. Drawing on Deutsche Bank Research analysis, flow’s Clarissa Dann takes a closer look at China’s aluminium output, and the prospect of another oil glut

TRADE FINANCE, SUSTAINABLE FINANCE

Powering electric vehicles – the commodities impact Powering electric vehicles – the commodities impact

Electric vehicle sales are rising, and progress is underway in finding alternatives to fossil fuel-based vehicle propulsion. What does the transition to EVs mean for the minerals and metals used to reduce emissions, manufacture car batteries and develop fuel cell solutions? Clarissa Dann reports

Cash Management, flow case studies

Connecting cash Connecting cash

Wieland is a fast-growing German copper and copper alloy specialist. After a series of M&A acquisitions in the US, the treasury team found the successive legacy cash management systems were impeding efficiency. flow’s Desirée Buchholz reports on the turnaround