20 July 2021

NRG Energy is at the centre of transforming businesses and communities by helping them buy clean energy in a way that is simple and tailored to their needs. flow’s Janet Du Chenne explores how the company’s own transformation is enabling this initiative

When a Texas-based global food distributor with customers in 90 countries sought to reduce the environmental impact of its business operations, it set a 20% commitment to renewable energy by 2025. To meet its sustainability goals, the company looked at buying solar energy in the sunny state, but needed a simple, easy-to-execute contract, rather than the complex financial transactions and lengthy contract sizes (20 years) of power purchase agreements (PPAs). NRG Energy, which is also headquartered in Texas, stepped in to provide it with renewable energy at grid parity.1

To suit the company’s procurement needs, NRG acted as the go-between to source the energy from the renewable generation and break it down into a simplified procurement process. Instead of a lengthy PPA with the energy facility, NRG provided the company with a simple contract for 10 years of 25 megawatts (MW) at a fixed price, allowing it to achieve price certainty in an ever-changing market. This ensured a much shorter time commitment and one single, consolidated bill. The 25MW of solar energy provided by NRG’s plan supports 100% of electricity usage at 18 of the food distributor’s locations, including its Houston headquarters and multiple warehouses that require significant refrigeration. Scott Hart, Vice President Supply, NRG Business, observed at the time: “This marks the beginning of widespread ‘retail’ renewable products – the type of plan that the competitive power market was created to develop. The result is transformative.”

In another instance, the City of Houston was looking to reduce greenhouse gas (GHG) emissions, with the aim of powering municipal operations with 100% renewable energy by 2025. NRG provided the City with a simple, affordable solution that enabled it to achieve its climate commitment five years ahead of schedule. In addition to providing retail electricity, NRG is supporting Houston’s larger Climate Action Plan implementation through sustainability consulting support, energy efficiency funding, and an affinity programme to help City employees purchase discounted renewable energy.2

These partnerships highlight the ways in which NRG has supported the energy transition over the past decade by simplifying the provision of retail renewable energy. At the same time, it is undertaking its own transformation from an independent power producer to a leading integrated energy and home services company. NRG’s focus on serving the customer and its modern approach to power is paving the path towards a more sustainable energy future.

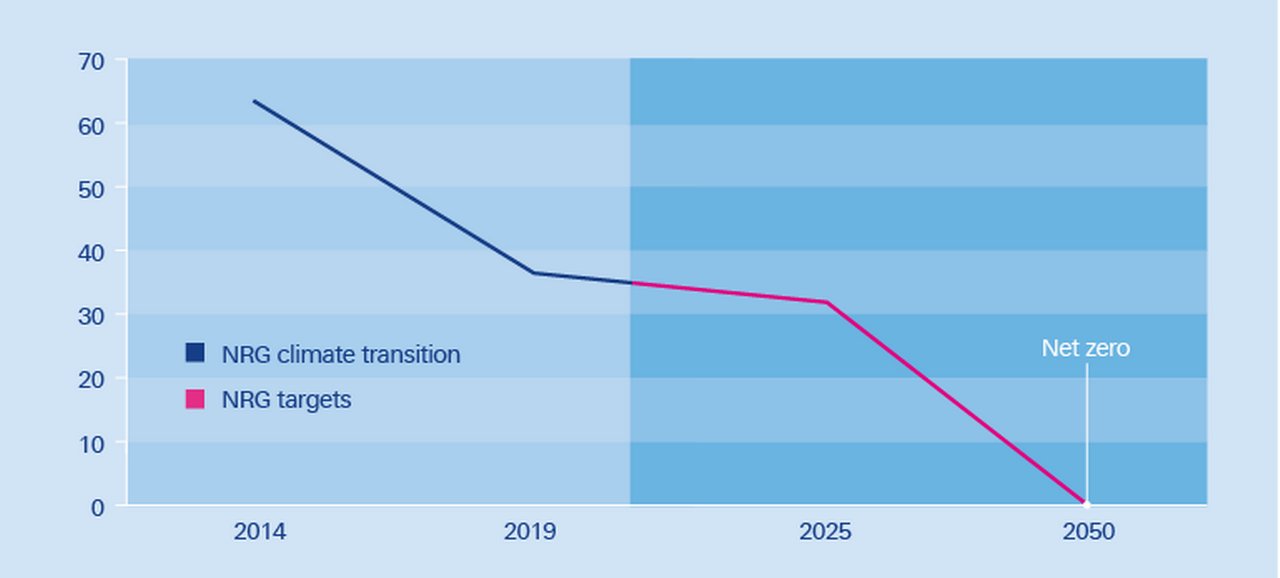

This transformation aligns NRG’s emissions-reduction goals with United Nations (UN) Intergovernmental Panel on Climate Change guidance to limit global warming to 1.5°C in the post-industrial era. It is aiming to reduce its carbon footprint by 50% by 2025, from its 2014 baseline, on the way to achieving net zero by 20503 (see Figure 1).

Figure 1: NRG's climate transition strategy and goals (MMT of C02 equivalent emissions)

Source: NRG

To achieve that goal, the company is decarbonising its existing business lines by replacing fossil fuel generators with more efficient gas-fired generators, and retiring those assets as they approach their economic end of life. Currently, gas-fired plants make up about 43% of the portfolio, with coal-fired facilities accounting for 34%.

NRG has also sold off fossil fuel assets, including 20.2 gigawatts (GW) of generation capacity, through its divestiture of its former subsidiary GenOn Energy, to creditors via a restructuring in 2017 and other announcements.4 And, to support the move away from its power-producing roots towards an asset-light energy retailing business, NRG completed its acquisition of Direct Energy in January 2021 from British utility holding company Centrica in a US$3.625bn all-cash transaction.5

Uniting sustainable goals with financing strategy

In addition to the strides NRG has made in reducing the environmental impact of its operations, the company has also sought to tie its financing to the same goals. Its acquisition of Direct Energy marked the first time that a US issuer used a sustainability-linked bond (SLB) to make that possible. To finance the acquisition, NRG used the proceeds of about US$3.8bn via a five-tranche bond offering,6 which included the SLB linked to the company’s sustainability targets.

A press release on the company’s website says that the bond “presents the next step in aligning NRG’s business and financing with company commitments towards a low emissions future by creating a direct link between its climate and funding strategies”. The preference for an SLB over a green bond is that the former is “more adapted to its activities,” NRG explained, referring to the Direct Energy acquisition as an example. By contrast, green bonds have ring-fenced use of proceeds requirements and must be used to fund certain low-carbon projects or investments.

A press release also revealed that the SLB will support the company’s efforts to pursue growth, achieve its climate transition strategy and a low emissions future, and bring increasing value to its stakeholders.7 By issuing the bond, NRG is linking financing to the realisation of its GHG reduction goal. The company’s SLB framework8 aligns with the UN Sustainable Development Goals (SDGs) relating namely to items 7 (Affordable and Clean Energy) and 13 (Climate Action). Its key performance indicator (KPI) is absolute GHG emissions, with a sustainability performance target (SPT) of reducing emissions to 31.7 million metric tonnes (MMT) of CO2 equivalent emissions by the end of 2025, which is based on the company’s previously issued public GHG reduction goal of 50% by 2025 from the current 2014 baseline.

Any divestments or acquisitions over the life of an SLB would not result in a recalibration of the SPT, in keeping with the overall net-zero ambition. Should NRG fail to achieve any of the targets included as part of the legal documents of any SLB, the implications could include a coupon step-up, or an increased redemption fee.

Structuring the first US SLB

The seven-year bond9 was part of an overall debt package used to finance the Direct Energy acquisition. The US$900m secured notes were measured against the KPI absolute emissions target of 31.7MMT of CO2 equivalent at the end of 2025 (representing a 50% emissions reduction compared to the 2014 baseline). This covers emissions from the production of wholesale electric power at facilities owned or controlled by the company, emissions generated from electricity purchased and consumed by NRG, and emissions encompassed by employee business travel. If NRG fails to meet the target, this will result in a 25-basis point increase to the interest rate payable on the notes from and including the interest period ending on 2 June 2026, upon issuance of the 2.45% secured notes priced at 99.859%.

Working with bank partners

In addition to the SLB, NRG issued US$500m of senior secured notes paying 2% interest and maturing in 2025, US$500m of senior unsecured notes paying 3.375% interest and maturing in 2029, US$1.03bn senior unsecured notes paying 3.625% interest and maturing in 2031, and US$900m of Alexander Funding Trust pre-capitalised trust securities (1.841% senior secured notes), or P-caps, redeemable in November 2023. Proceeds from the P-caps offering, which will be kept locked up in the trust, are designed to support letters of credit, which NRG needed to back collateral obligations associated with Direct Energy’s trades.

Deutsche Bank’s corporate and institutional client coverage teams orchestrated the provision of multiple services to the overall debt package. These include trust and agency services, such as bond trustee, registrar, paying agent, transfer agent, collateral agent, administrative agent, account bank, and Delaware Trust services provided by Deutsche Bank Trust Company Americas to all of the issuances, and a letter of credit provided by the bank’s trade finance franchise in relation to the P-caps.

Gaetan Frotte, Senior Vice President, Interim Chief Financial Officer and Treasurer at NRG Energy, describes these services as integral to NRG’s funding strategy, ensuring its accountability to investors in meeting its climate goals. “The SLB, in particular, reflects our commitment to reducing GHG emissions. By tying our business and financing to our climate goals – supported by Deutsche Bank’s trust and agency services, which is facilitating the overall issuance, and the bank’s trade finance franchise, which is providing guarantees to support this transformational acquisition – we are well on track towards a net-zero future.”

Gerald Podobnik, CFO and Chief Sustainability Officer of Deutsche Bank Corporate Bank, says that the bank is seeking to play an active role in achieving the targets set out in the 2016 Paris Agreement: “In doing so, we will assist our clients in implementing their sustainability strategies and monitor their achievements over the longer term as well.”

Rating sustainable financing

NRG obtained a second-party opinion of its SLB framework by Moody’s affiliate Vigeo Eiris (V.E). The benchmarking firm, which provides environmental, social and governance (ESG) assessments, data, research, benchmarks and analytics, graded the sustainability-linked pricing metric used by the company on its novel bond “advanced”, which is its highest rating.

Benjamin Cliquet, Head of Sustainable Finance Business Development at V.E, notes that NRG was not the first to issue an SLB (it was preceded by Italian energy company Enel, Brazilian pulp and paper company Suzano, Swiss pharmaceutical firm Novartis, and French fashion house Chanel), and it had previously used the sustainability-linked mechanism in the loan market. “For the past three years you had many energy companies working directly with banks, which included this mechanism in loans,” he says. “Then, in 2020, the bond market began to follow, and while NRG was among the first issuers of a linked bond, the company has been working on similar approaches in the loan market.” Cliquet expects the SLB market to grow as other US utilities study it with the intention of issuing in 2021.

NRG also obtained an updated ESG risk rating from Sustainalytics. The company reviewed various ESG factors relevant both generally across industries and specific to NRG’s business and provided an ESG Risk Rating score of 31.8 on a scale of 0–100 (with 100 being the most severe risk rating), representing a significant 7.9-point improvement from its 2019 risk rating of 39.7. The rating places NRG in the 36th percentile (172nd lowest risk out of 483 companies) of its industry group (Utilities) and in the 16th percentile (10th lowest risk out of 59 companies) within its sub-industry group of Independent Power Producers and Traders.

The ratings provider also noted that NRG “exhibits strong corporate governance performance, which reduces its overall risk. The Carbon – Own Operations category is NRG’s second most material ESG issue after Emissions, Effluents and Waste, and this Framework outlines the steps NRG is taking to address this issue. Furthermore, NRG is noted for not having experienced significant controversies”.

Powering ahead

On 5 January 2021, Mauricio Gutierrez, CEO of NRG, highlighted the acquisition of Direct Energy as a “new era” in the company’s transformation into a sustainable energy retailer. “Together we will embrace the modern low-carbon economy by leveraging best-in-class tools and technologies to better serve our customers,” he said in a video interview about the deal.10

“Together we will embrace the modern low-carbon economy by leveraging best-in-class tools and technologies”

The company also provided a glimpse of what businesses, homes and communities in America can expect it to deliver in support of their sustainable goals. Going forward, it will be easier for them to access over 1.8GW of renewable power contracted, on demand. Households can also look forward to charging home vehicles. As the saying goes, real transformation requires effort. And as NRG is showing, it needs the right energy too.

Sources

1 See https://bit.ly/3881BOn at nrg.com

2 See https://bit.ly/2RwdFn4 at houstontx.gov

3 See https://bit.ly/2Nz1CUr at power-eng.com

4 See https://bit.ly/3h8T3Mh at investors.nrg.com

5 See https://bit.ly/3aYTxBk at nrg.com

6 See https://bwnews.pr/3qYOy9c at businesswire.com

7 See endnote 6

8 See https://bit.ly/2O3xwYS at investors.nrg.com

9 See https://bit.ly/3sveUzT at investors.nrg.com

10 See https://bit.ly/3dLIdKx at youtube.com

You might be interested in

TRUST AND AGENCY SERVICES

The green home maker The green home maker

On the road to economic recovery, Spain’s mortgage lender Unión de Créditos Inmobiliarios aims to facilitate access to housing and support the development of energy efficient buildings. flow’s Janet Du Chenne reports on how a securitisation enables the company to offer products that promote these goals

flow case studies, Sustainbale finance, Dossier Covid-19 {icon-book}

Pharma karma Pharma karma

Novartis is taking bold steps to increase access to medicines and tackle complex global health challenges. flow’s Janet Du Chenne explores how a social bond focuses the pharma company on achieving ambitious targets for getting medicines to low- and middle-income countries

TRUST AND AGENCY SERVICES {icon-book}

The personal touch The personal touch

Twenty-one years after it was established, the UK-Swedish biopharma company AstraZeneca is one of the first developers of a candidate vaccine against Covid-19. flow's Janet Du Chenne finds out how a people-centred mindset makes a difference in scientific innovation