24 August 2023

How can you promote trust that a transaction can go ahead, and that the parties are in receipt of funds? One solution is escrow accounts. flow explains how escrows work and how digitalisation has made an escrow arrangement seamless for clients

The etymology of the term ‘escrow agreement’ can be traced back to the old French word ‘escroue’, which meant a scrap or roll of parchment.1 These documents were used as a written instrument that could be given to a third party until a certain condition was fulfilled. While the underlying processes involved have seen many changes, the overarching concept is the same.

Today, an escrow is an account designed to hold funds, securities or other assets pending the completion (or fulfilment) of certain conditions to release or distribute the escrow property.

These are laid out under the escrow agreement – from real estate, insurance trusts, capital raisings and M&A to project financing, litigation and bankruptcy proceedings. They are typically managed through a tripartite agreement between a depositor, a beneficiary and an independent third-party provider – or escrow agent.

When used correctly, escrow accounts are a powerful asset for businesses looking to ensure the security and compliance of their transactions. By taking time at the outset to understand clear milestones, businesses can trust that their assets are held securely and that their transactions are conducted with speed and efficiency.

How it works

By using an escrow agreement for a corporate acquisition, for example, both parties can be assured that the transaction terms will be honoured and that their assets will be protected. The escrow agent will hold onto the funds until the ownership is transferred, and all other conditions of the purchase are fulfilled.

“An escrow agent is a neutral independent third-party provider. It has no discretion as to what is done with the assets being held and takes instruction from the escrow parties”

Absolute clarity regarding any milestones (the ‘conditions precedent’) that may trigger a transfer or settlement is a must and no divergent interpretation should be possible. Such actions must be amenable to being carried out instantly, or at least within a pre-determined time frame. Moreover, the counterparties to the underlying contract and the escrow agent should agree on the consequences of a missed milestone.

“An escrow agent is a neutral independent third-party provider. It has no discretion as to what is done with the assets being held and takes instruction from the escrow parties” explains David Contino, Head of Escrow – EMEA, Trust & Agency Services, Deutsche Bank.

Once the conditions are satisfied, the escrow agent will release the funds to the seller and confirm the successful completion of the transaction.

Setting up an escrow

There are several ways to establish the successful execution of a business transaction, with insurance instruments and good old-fashioned faith being two potential methods. The most common by far, however, is the use of an escrow agreement. These are widely known, accepted, and regarded by many as the most efficient and economical way of closing a transaction. An escrow agent should be:

- Streamlined and flexible. The provider needs to perform the required checks quickly and establish the account by making sure all documentation is in order and correct, and that all conditions to release are agreed.

- Experience and commitment. The agent needs the capability to open accounts across the world and accommodate multiple currencies.

- In it for the long haul. Escrow arrangements may be set up today and run for a year or two –even longer, and in some cases. The escrow agent needs to guarantee optimal client service throughout the transaction lifecycle.

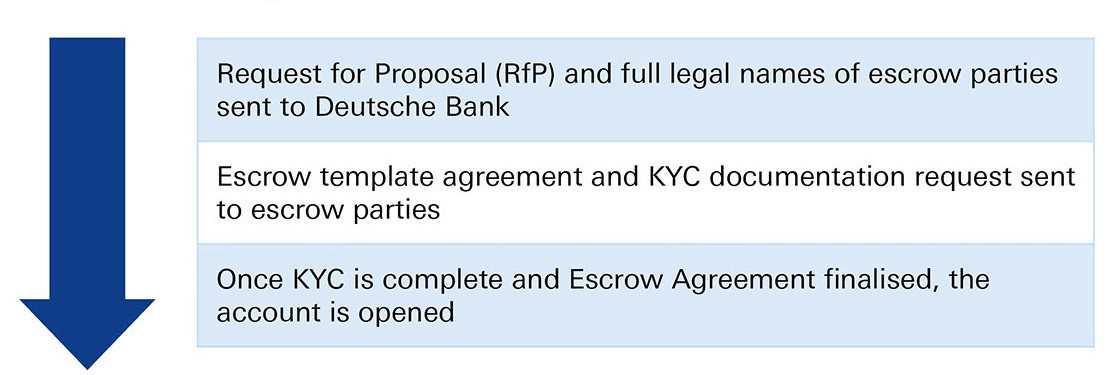

As a first step, the escrow agent is mandated and will send the escrow template agreement to the escrow parties. Then, the Know Your Customer (KYC) documentation is sent to the escrow agent for onboarding. When the KYC is complete, the escrow account is opened, and the escrow agreement is finalised and signed by all parties (see Figure 1). The entire process takes one to five business days.

Figure 1: Escrow execution/closing process

Source: Deutsche Bank

Digitalising escrow

Significant investments are being made to digitalise the set-up and management of escrow accounts. “We hear from many of our clients how they seek an efficient bank partner that has invested in technology,” says Annie Koutsavgousti, Director of Escrow Sales, Deutsche Bank, Americas. “We understand these requirements and have created a digital portal to assist clients’ needs in all aspects of the escrow process.”

For instance, Deutsche Bank’s Escrow Direct portal provides buyers, selling shareholders and attorneys with a digitised, centralised and simplified process that allows for the management of shareholder information, creation of Letters of Transmittal (LOT) and fast-tracked payments to shareholders. This digital channel replaces the paper-based process for LOT collection; this, in turn, mitigates execution risk and enables faster, frictionless payments to shareholders (also known as beneficiaries). The process is as follows:

- Upload beneficiary details. Users upload a centralised register of beneficiary information to view and confirm data. Deutsche Bank then validates the content of completed LOT against this register for accurate payment transmission.

- Electronic documentation execution. Using the law firms LOT template, clients can easily create LOTs and incorporate customised terms and conditions. Escrow Direct then embeds beneficiary information and tax documents for frictionless email transmission to beneficiaries, who can securely populate, review and submit tax information, and execute the documentation electronically.

- Track LOTs online. Clients can track the status of LOTs sent and signed to beneficiaries in real time on a dashboard with individual details and aggregated status charts and graphs.

- View payment transmission status. The Escrow Direct payment dashboard tracks the status of payments with payment initiation, distribution amount, payment reference details and confirmation details.

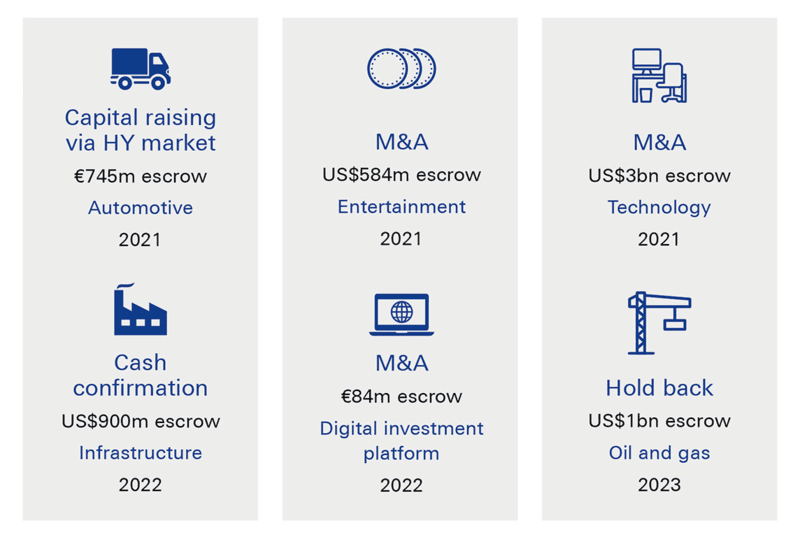

“Our expertise and experience in multiple asset classes allow us to support a variety of escrow scenarios,” says Deutsche Bank's Kisha Holder, Director, Head of Escrow and Specialized Agency, Americas.

The following figure provides a few examples of escrows facilitated by Deutsche Bank’s TAS team.

Figure 2: Examples of escrows facilitated by Deutsche Bank's TAS team

Source: Deutsche Bank