14 June 2021

Gold is one of the few commodities that has seen its value soar during Covid-19. But what happens when its top-producing countries go into lockdown? Peter Steenkamp, CEO of South African gold-mining firm Harmony Gold, tells flow’s Janet Du Chenne how the company is engaging investors amid the pandemic

If 2020 was a record year for gold,1 then economic recovery and low interest rates look likely to further boost demand in 2021, given the commodity’s popularity as a long-run inflation hedge, especially in emerging markets.2 While this is good news for gold producers in these regions, it also places the burden of proof on them to show they are meeting today’s higher standards in a sector that has been firmly on the radar when it comes to environmental, social and governance (ESG) concerns. South African-based gold-mining firm Harmony Gold knows this well and has a plan.

During these uncertain times, the company is bolstering its efforts to reach out to investors. “Investor engagement has never been more important than in the months since Covid-19,” asserts Peter Steenkamp, the organisation’s CEO. “Fortunately, we mine a commodity that is considered a ‘safe haven’ during unprecedented times and got to witness record-high prices.”

Harmony operates nine underground mines in the Witwatersrand Basin in South Africa, which stretches from Johannesburg to Welkom in a 250-mile arc. It also owns the Kalgold open-pit mine on the Kraaipan Greenstone Belt, as well as several surface treatment operations. In addition, in Papua New Guinea the company operates Hidden Valley, an open-pit gold and silver mine in the Morobe Province, where it also owns half of the Wafi-Golpu copper-gold project.

With output from these operations, Harmony was able to increase production profit by 65% to ZAR6.8bn (US$417m) for the six months to 31 December 2020, a 65% increase from ZAR4.1bn (US$280m) for the same period in 2019. However, it has not all been plain sailing, and during the Covid-related disruptions, the company had to work hard to ensure it maintained production targets.

As ESG themes have ascended investors’ agendas during the pandemic,3 Harmony is also enhancing its value creation story by operating safely and sustainably while delivering profitable ounces (or a high grade of gold) and increasing margins. This article explores the work of Peter Steenkamp and the (investor relations) IR team in telling that story.

Engaging investors

To begin with, their efforts leverage the company’s 70-year experience in stakeholder engagement. Harmony Gold has a primary listing on the Johannesburg Stock Exchange and has maintained a dual listing of Deutsche Bank-managed American Depository Receipts (ADRs)4 on both the New York and Nasdaq stock exchanges since 2005.[ii] In these times of disruption, investor relations have pivoted towards virtual communications, and Steenkamp comments that “platforms such as the Deutsche Bank Virtual Investor Conference[WM1] have been ideal for reaching out to international investors and telling our story”.

Steenkamp shared his story with flow during a phone call in March 2021, one year on from when Covid-19 restrictions were first enforced across the globe. “When lockdown first hit South Africa on 27 March [2020] we went into complete shutdown,” he recalls. “But during that time, we were involved in a couple of virtual investor conferences and meetings including Bank of America’s annual Sun City conference and we spoke to many investors.”

US$2,067

The price of an ounce of gold reached a record high in August 2020

Harmony’s IR team and management also jointly hosted a large number of investor meetings in the space of two months. These meetings demanded they demonstrate their passion, enthusiasm and engagement skills to allay investor concerns about South Africa being in a hard lockdown (‘alert level five’) with all mining activity suspended. “Investors were asking what it meant for the company and what we were going to do about it,” says Steenkamp. The team successfully managed their expectations, assuring them that Harmony was still generating income from its open-pit mines and surface operations, while selling its gold to the Rand Refinery, which was considered an ‘essential service’.

In May 2020, the South African government relaxed restrictions to level four, which allowed mining operations to resume, albeit at only 50% capacity (full mining capacity was to be permitted at alert level 3).

In addition to these ‘crisis’ meetings with investors, Harmony implemented a proactive IR campaign in March 2020 at the onset of the lockdown to assure investors of employees’ safety and to mitigate any ESG concerns. This included radio campaigns and the development of a Standard Operating Procedure to help prevent transmission of Covid-19 at Harmony’s South Africa and Papua New Guinea sites. “We also converted many of our hostels into isolation areas while our medical hubs at our operations, which are run by professional nurses and doctors, were in full operation,” says Steenkamp.

A medical facility at one of Harmony’s mining operations

Source: Harmony

In line with ‘responsible stewardship’, which is one of Harmony’s four strategic pillars, and the driving force of its ESG strategy, Steenkamp explains that the company also “looks after the community where our mines are based and explains what they need to do to protect themselves from Covid-19”. The company distributes food parcels, sanitising equipment and protective face masks. “The entire mining sector pulled together and worked in unison during the hard lockdown,” he recalls. “The mining industry has always been at the forefront of managing communicable diseases such as HIV and tuberculosis, to name a few.”

Harmony’s mining operations are in close proximity to areas where these conditions are rife. These diseases can potentially impact the health of the company’s neighbouring communities, and vice versa. Steenkamp explains that “the mining industry has historically always been at the forefront of dealing with these social issues, and Covid-19 was another one that required we pay extra attention.” As part of Harmony’s Covid-19 protocol, and to promote social distancing, various safety measures, including reduced cage (elevator) capacity for transporting workers underground, and installing underground hand sanitising stations at various points, were introduced. “As a result of these initiatives, we didn’t get the soaring numbers that people anticipated, given that workers are normally in close proximity to each other during mining operations,” says Steenkamp.

Investor relations on the ground

Sharing these initiatives with investors is a basic fabric of Harmony’s IR team. Steenkamp believes it’s the role of the IR team to be the “custodians of sharing all news – both good and bad – and always looking for opportunities to share”.

The IR team participates in several investor conferences and calls throughout the year. [WM1] Company announcements and press releases are distributed to a database, and the team also targets new investors and jurisdictions that could potentially have an appetite for an emerging market gold-mining firm.

Unsurprisingly, the IR team brings together a range of different skillsets. According to Steenkamp, a “numbers person, a marketer, a writer and a lawyer” collaborate to craft a message that is externally shared through various activities. The team maintains a media schedule and a calendar dedicated to monthly communications on ESG topics and company activities in this area.

In addition, Harmony developed an ESG report for the FY19 reporting period and an inaugural Task Force on Climate-related Financial Disclosures (TCFD) report in the FY20. Both of these reports accompanied the publication of the company’s integrated annual report. “Our move to the TCFD was designed to improve our risk management process and to more clearly articulate the likely financial impact of climate change on the company’s balance sheet and income statements,” says Steenkamp. To this end, the IR team liaises with ratings agencies and completes disclosure questionnaires from these agencies.

"Sustainability has always been a part of our DNA"

Distilling ESG messages

This proactive approach to sustainability was part of Harmony’s DNA long before ESG became mainstream. The arrival of Steenkamp, a long-time mining safety advocate, in 2016 saw Harmony double down on its focus on the ‘S’ of ESG, which is an important objective given that the mining sector’s reputation has been tarnished by past fatalities, injuries and illnesses.

A focus on issues such as health and safety, trade union relations, governance, and empowering South Africans previously disadvantaged under the Apartheid regime is something that mining companies have long considered in their messaging. Here, Steenkamp believes experience is the measure of success: “Our main objective is to convince people that there is more to our business than just mining.”

Harmony’s dedication to employee welfare and its wider social commitments is also evident in other measures. For example, over the years it has acquired numerous mining operations from its peers that no longer complemented their strategies. Harmony integrated and optimised these assets, extending the life of mines and turning them into profitable businesses. A good example is the story of Unisel mine. Harmony acquired it in 1996 and extended its operating life by a further 24 years, thereby ensuring job security while uplifting and sustaining local communities and businesses.

The company also has a risk management framework to ensure the safety of employees is prioritised and that work-related injuries and fatalities are reduced (see Figure 1). “Our total injury and accident frequency rate has improved over the past decade and is now at 7.69 per million hours worked as we strive towards our goal of zero loss of life,” notes Steenkamp.

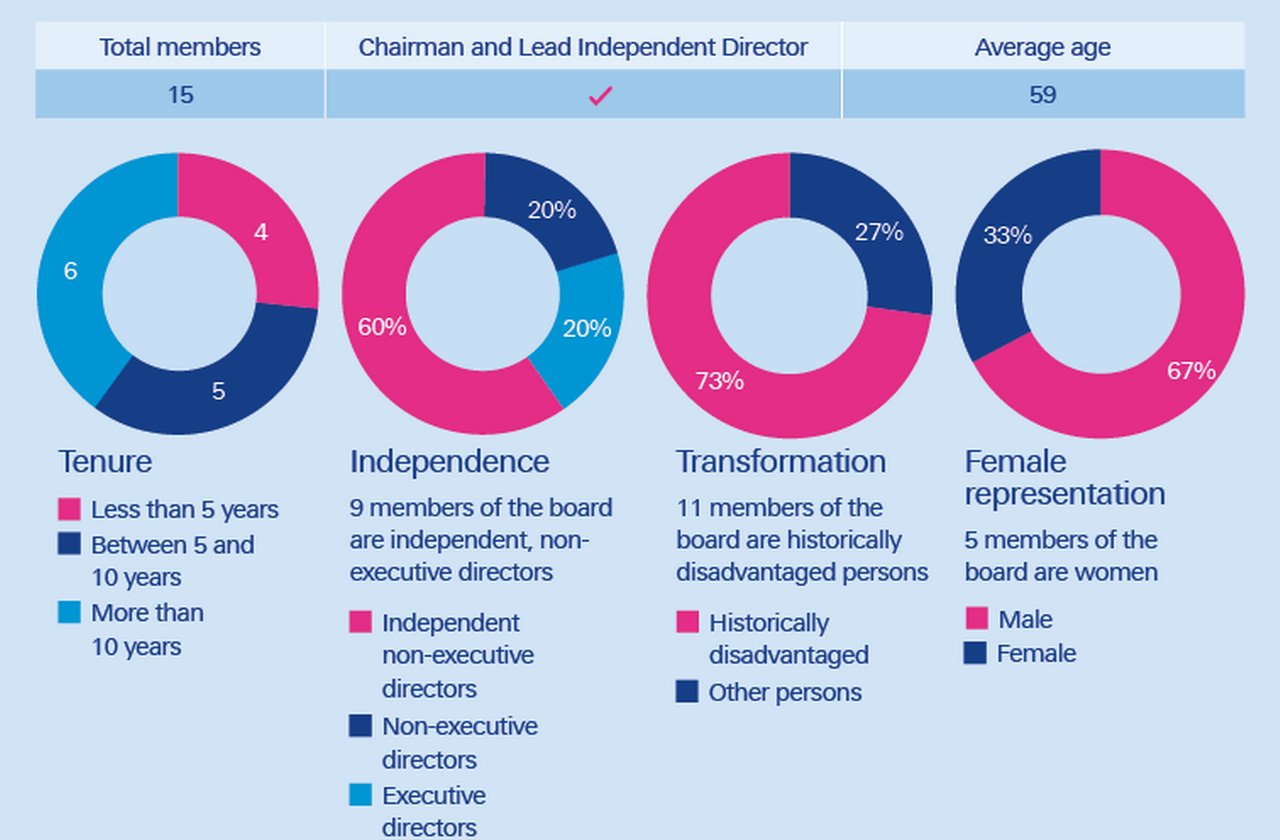

Figure 1: Harmony’s board composition as at 23 October 2020

Source: Harmony Gold

On the ‘E’ in ESG, Harmony’s ESG Report 20206 seeks to address each of its sustainability impacts and what it is doing to manage them. This includes land rehabilitation and water management strategies, which are aimed at conserving natural resources by improving water efficiencies through re-use and recycling. The company has rehabilitated 48 hectares of land, grown sorghum as part of a biodiversity project, and uses water generation pumps at some sites to turn wastewater into potable water for surrounding communities.

“We have focused our activity on implementing key tenets of our new sustainable development framework – from growing our portfolio of assets towards profitable ounces, to managing and mitigating our water and climate risks. We continue to embed our proactive safety and healthcare strategies while building trust in the communities in which we operate,” explains Steenkamp. “Over the next five years we aim to strengthen our delivery on key sustainable development indicators and adhere to the UN’s 17 Sustainable Development Goals as they apply to our business.”

Harmony is also planning to reduce its carbon footprint by consuming renewable energy and is building a 10-megawatt solar plant in the Free State with the ambition of ultimately increasing its output year on year.

On the ‘G’ of ESG, the company has adopted a corporate governance and compliance policy and framework underpinned by the principles of the King IV Code (the governing body [WM1] for listed entities) on Corporate Governance in South Africa. Based on these principles, the roles of the CEO and the Chairman are separate and the board composition is diverse and varied (see Figure 2). The Chairman also has a Lead Independent Director to ensure independence and avoid conflict of interest issues.

Managing the trade-off

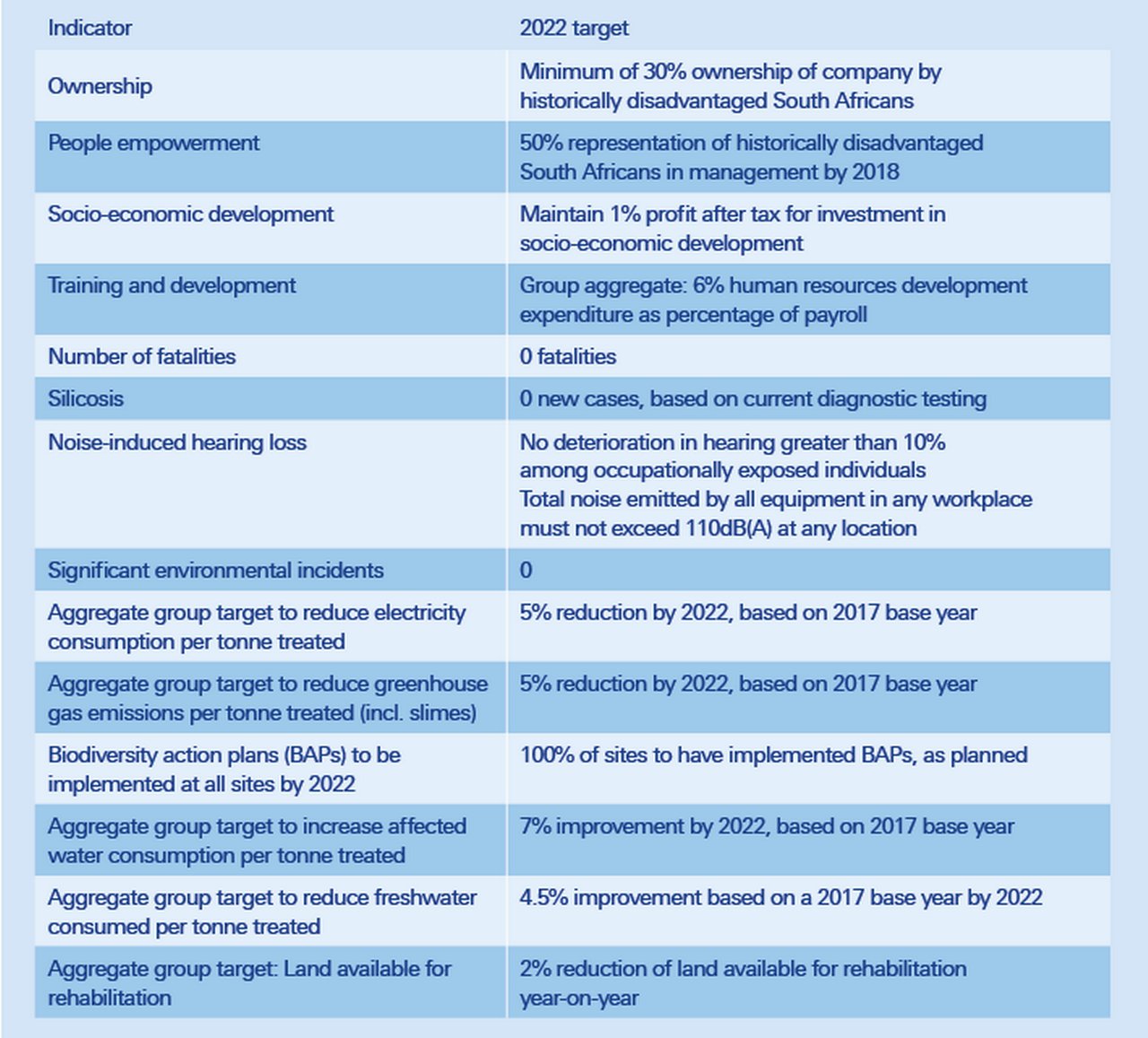

Given its sustainability experience, Harmony has been able to proactively address ESG concerns. “Despite the environmental impact of mining, ESG issues have always been core to a mining company,” says Steenkamp. “Our social labour plan is government and union-approved and we know that in order to protect our licence to operate, we have to have these local economic development and corporate sustainability plans in place.” A top rating from risk management company Risk Insights in terms of ESG disclosure and [WM1] recognition in the Bloomberg Gender-Equality Index [WM2] go some way towards validating the corporate’s sustainability measures, and Harmony continues to work on set targets regarding its sustainability key performance indicators (see Figure 2).

Figure 2: Sustainable development performance is measured by group aggregate targets

Source: Harmony Gold

Going for gold?

Going forward, in addition to stakeholder management of ESG issues, a commodities supercycle could present further ESG challenges for Harmony.7 Steenkamp is unfazed, however: “We’re not price-chasers but price-takers,” he says. “We can’t control the gold price, but we focus on what we can control and that is our production, costs and commitment to ESG regardless of where we are in the cycle. We are a resilient company that can add value through our existing operations and asset mix, integrated ESG practices, astute acquisitions, and green investments into South Africa.”

With a focus on sustainable gold, the company’s share price has increased by 305% since 2016 (as at 31 December 2020), when it introduced its strategy of producing safe profitable ounces and increasing margins. And, with increased production from surface operations of late, [WM1] it has been able to de-risk while benefitting from the wider margins that those operations have delivered. “Ultimately, we’ve been able to demonstrate that we can provide value throughout all cycles, so while we can’t control commodity pricing, we can focus on being a sustainable business that will still be here for many decades to come,” concludes Steenkamp.

Sources

1 See https://bit.ly/2QQNTcN at forbes.com

2 See https://bit.ly/3sAhtkR at gold.org

3 See ESG investing: roots to return at flow.db.com

4 ADRs allow US investors to hold shares in non-US companies

5 See https://bit.ly/2Oa4QxU at harmony.co.za

6 See https://bit.ly/3sASBsV at harmony.co.za

7 See Greening the supercycle at flow.db.com

You might be interested in

TRADE FINANCE, MACRO AND MARKETS

Greening the supercycle Greening the supercycle

Are we heading for another commodities supercycle? One could be forgiven for thinking this was just around the corner given some of the bounce-backs in prices, but ESG priorities and liquidity shortfalls bring different nuances, flow’s Clarissa Dann reports

Trade finance and lending

Ghana’s next-generation infrastructure Ghana’s next-generation infrastructure

Over the last decade, Deutsche Bank has arranged over €2bn of financing in Ghana across 20 transactions. The latest such deal – a €150m financing for two critical infrastructure projects in the Southern and Western regions of the country – was announced in February 2021. Clarissa Dann reports on a history of collaboration

Trade finance and lending, flow case studies

Sustainable latex from Cameroon Sustainable latex from Cameroon

Allegations related to environmental and social issues in Halcyon Agri’s Cameroon rubber plantations attracted headlines until they were addressed through its Corrie MacColl subsidiary. flow´s Clarissa Dann reports on how sustainable finance helps the firm set