2 February 2022

Sending money internationally is a challenging process for both individuals and businesses. As volumes and values increase, new market entrants are competing but also cooperating with banks to remove friction and improve transparency. How is this benefiting the end customer? flow reports from the recent BAFT 2022 Bank to Bank Forum

MINUTES min read

Why has it been so difficult for businesses to make cross-border payments? Before recent initiatives such as SWIFT gpi,1 these payments were unpredictable, lacked traceability and clients were not informed where the payment was at any specific time, nor the fee that had been deducted for the service.

Traditionally, cross-border payments have been executed via correspondent banks, with SWIFT acting as the message carrier. There are numerous friction points associated with this model. These include speed inconsistencies; cross-border operating differences; FX-uncertainty and having to deal with conflicting regulatory frameworks across jurisdictions, with ambiguity around financial risk and fraud.

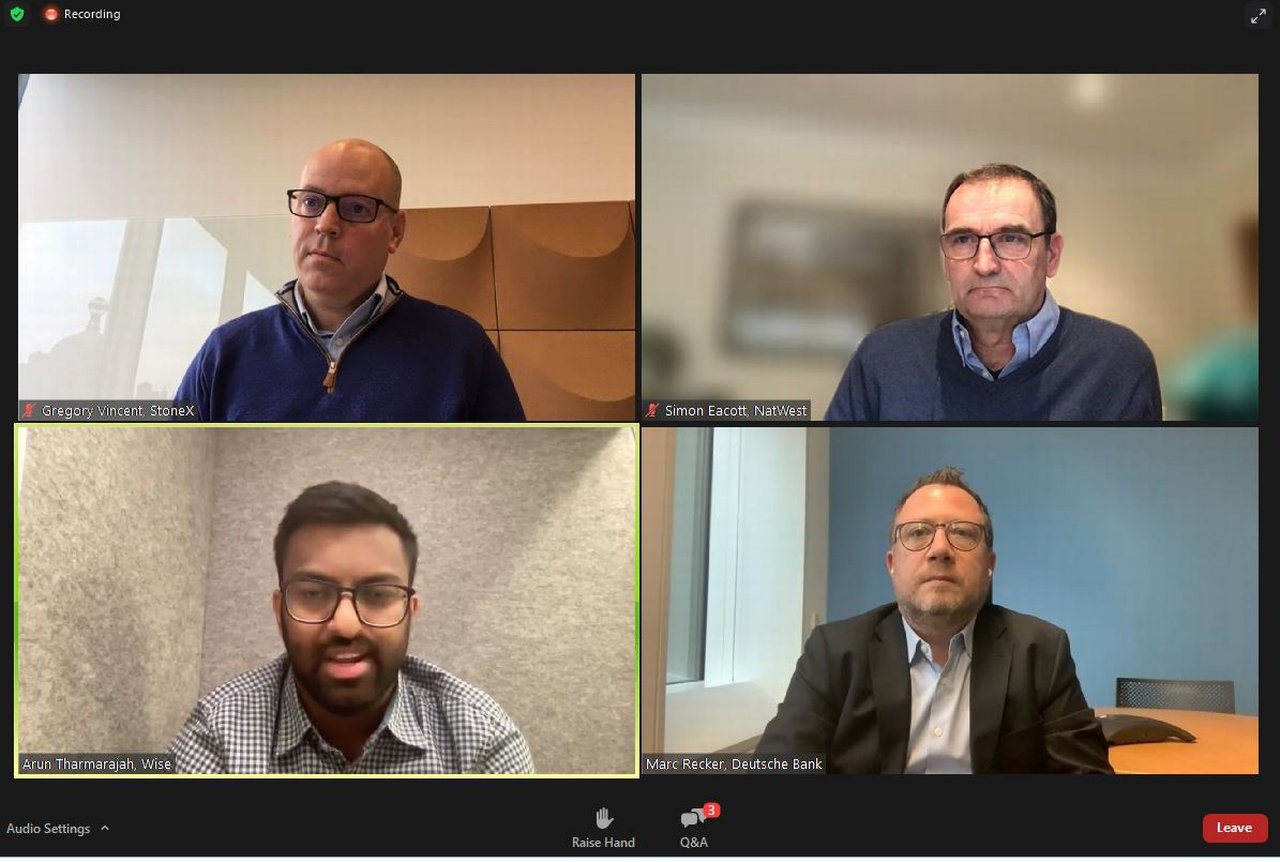

“There is no omnipresent system that connects various banks across the world through which international payments can be transacted,” explained Marc Recker, Managing Director & Global Head of Product, Institutional Cash Management at Deutsche Bank (bottom right below).

Recker was addressing delegates at the Bankers Association for Finance and Trade (BAFT) 2022 Virtual Bank to Bank Forum, as the moderator for a panel discussion entitled, ‘Incumbents vs. Disruptors: The Good, the Bad, and the Ugly?’ He was joined by:

- Simon Eacott (top right), Head of Product Development and Innovation, Payments, NatWest;

- Arun Tharmarajah (lower left), Head of European Banking, Wise (formerly TransferWise, a global technology company specialising in moving money internationally); and

- Gregory Vincent (top left), Global Head, Financial Institutions, Stone X (FX payments providers in emerging markets to financial institutions).

Friction and opacity

As Recker noted in his introduction, traditionally cross-border payments have been executed via correspondent banks, with SWIFT acting as the message carrier, but as already noted there are numerous friction points associated with this model.

Against this background, fintechs have attempted to enter the cross-border payments space, depicting the correspondent banking model as slow and opaque in its fee structure.

They have made certain inroads, and most accept that they have brought an enhanced client experience to the market. Yet in terms of actual numbers, fintechs still play only a minor role in the cross-border payments space. The banks themselves have, for their part, responded with initiatives such as SWIFT gpi and, more recently, SWIFT go for lower value payments2. SWIFT itself is currently undergoing a major strategic transformation, repositioning from a point-to-point message carrier to transaction orchestrator. All this has counteracted – and will continue to – criticism of the ‘outdated’ traditional correspondent banking model.

Disruption of incumbents

But is this enough as fintechs continue to build out their technology? By deploying AI and data analytics they can also provide vital insights related to transaction frequency, devices, locations etc. In addition, pointed out Recker, “Banks also face a real threat now in terms of disruption, which will likely emerge from larger players such as Visa or Mastercard who are currently building the infrastructure to process retail push payments.”

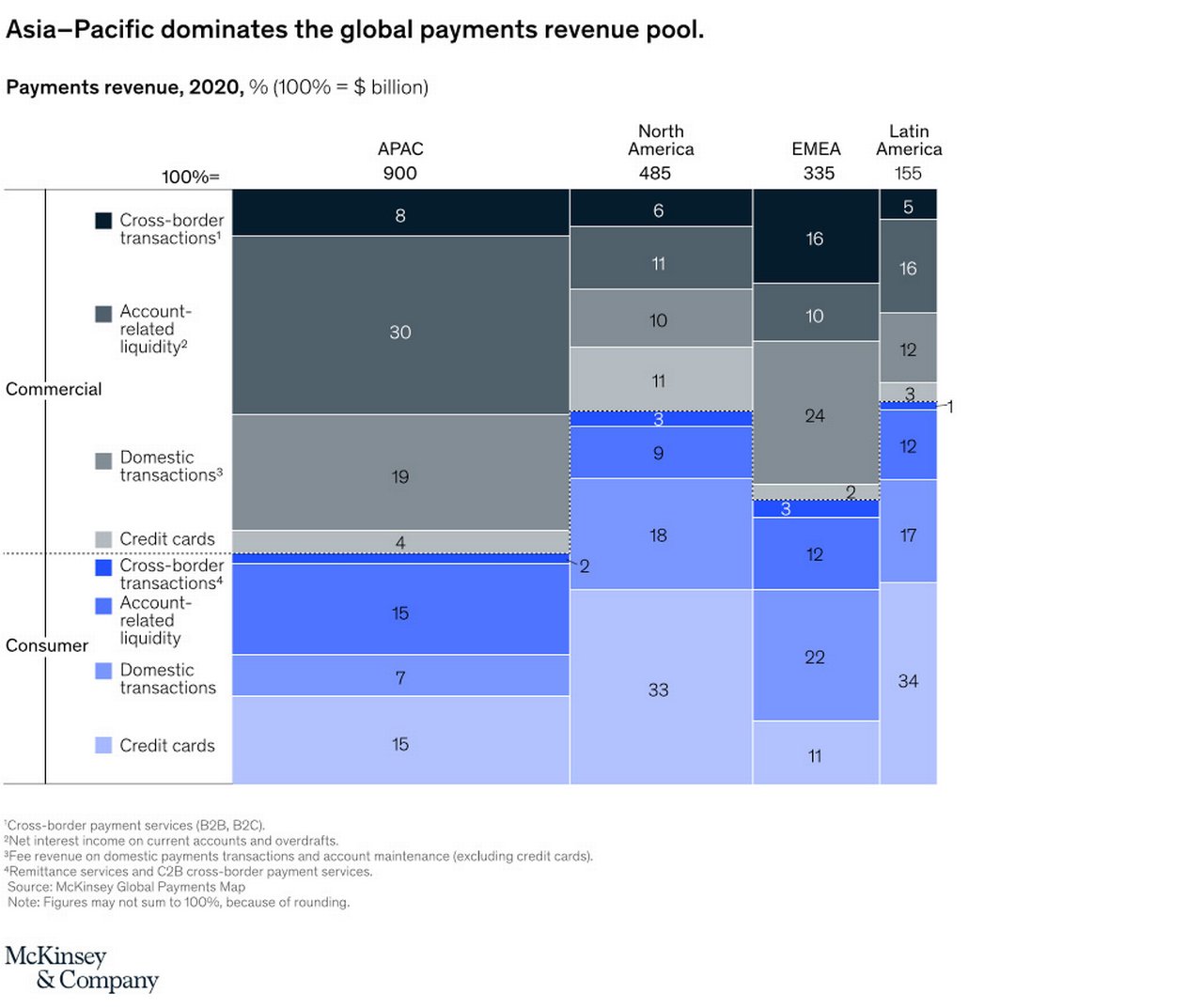

Furthermore, competition in cross-border payments is set to increase, and so further disruption is on the horizon. Statistics show that for 2020, the cross-border payment market was valued at nearly US$21trn, and it is expected to grow exponentially in the years ahead. “We expect pressure on both fee and processing margins to continue in many regions, while recovery in interest margins is expected to be slow and moderate at best,” forecasted McKinsey in October 2021. “These combined forces disproportionally affect incumbent players reliant on traditional revenue streams, such as card issuers and banks holding significant commercial and consumer deposit balances, and thus spur a need to rethink payments revenue models and identify alternative paths to value,”3 See Figure 1 for a summary of the 2020 payments landscape.

Figure 1: The global payments revenue pool

Source: McKinsey: The future of payments: Transformation amid turbulent undercurrents (October 2021)

According to McKinsey, with travel and trade volumes in decline due to Covid-19 restrictions in 2020, cross-border e-commerce transactions grew 17%. Volumes for cross-border network provider SWIFT were 10% higher in December 2020 from the same month a year earlier.4

Why has the cross-border space been ripe for disruption and why does it continue to be targeted by new market entrants?

“Lines are getting increasingly blurred. New technology is coming along all the time, regulation is becoming much more of a factor in cross-border payments and throughout all of this innovation is emerging,” said Eacott, who reminded delegates that disruption from new market entrants had “made great strides” in solving the basic problem: moving money across borders “has been complicated.”

Payment systems have developed domestically, he added, with their own national requirements in mind and little thought for what that could mean cross-border. “Payments is a network business”, he stated, “It has a complicated ecosystem and there are challenges in jurisdictions and data formats.” Customers, however, used to more seamless experiences in other aspects of their digital lives want improved transparency, speed and transaction cost information in their business transactions.

“Cross-border payments have sat traditionally with global banks,” reflected Stone X’s Vincent, who noted that when dealing with fall-out from the 2008/09 global financial crisis in the decade that followed, tackling cross-border payment friction was not top priority when they were “focussed on other areas such as cost-cutting and ringfencing”.

Unsurprisingly this was a time, he added, when “banks were not popular, and the public was open to the idea of an alternative to banks.” Banks focusing elsewhere, combined with the post GFC bank-fintech regulatory mismatch enabled fintechs to “play around in the sandbox with far less risk that it was likely to backfire on them.” Tellingly, he cited the fact that although the huge valuations in payments company stocks have started to moderate in recent weeks, for the second time in modern financial history (the first being the dotcom bubble) “we see companies getting amazing valuations without having to prove a viable business model!”

Regulatory arbitrage

Recker asked panelists if they thought the regulatory gap between banks and fintechs was shrinking.

“These businesses are very different,” suggested Arun Tharmarajah of Wise. “Banks are regulated in a way that they can lend deposits. You put some money in; you lend it out but the days in which interest rates were significant and one could make a bit of margin on that are over.” The ensuing global financial crisis that followed, he said, was “a response to capital reserves and liquidity.”

Tharmarajah reminded delegates that a non-bank generally does not lend so the regulation is “appropriate.” While there are variations, he said, “across many jurisdictions a non-bank does not have access to national payment systems, so there is a reliance on the clearing bank to provide the required payment service.” In addition, banks are varied in size, scope and business models. While a global bank will focus on its payments business, a small savings bank is unlikely to prioritise “building out a great customer experience for someone wanting to send €500 to an exotic market once a year”.

NatWest’s Eacott paid tribute to the fintechs for providing a “wonderful catalyst” for banks to up their game by focusing on the customer experience and their end-to-end journey. “Get it right for the customer, you get it right for the bank,” he stressed.

Competing and cooperating

Panellists were agreed that while fintechs had clearly grabbed market share in the retail P2P space, this was less true in the corporate segment, as corporate treasurers have, so far, gravitated towards their incumbent banking provider. Of course, this could all change, given the fintech interest in the cross-border payments space. However, few providers try to serve the whole world in every corridor, and the industry can expect to see collaborations and partnerships that serve particular segments. As Recker put it, “even the bigger banks cannot invest in everything.”

As banks work with technology partners to deliver initiatives to serve specific industry sectors, or trade corridors and geographies, the landscape looks set to further evolve.

“Cooperation is coming to the fore, and you don’t have to do it all yourself, and when you adopt that mindset both customers and banks win,” concluded Eacott.

Sources

1 See SWIFT gpi: a progress report at flow.db.com for the background to gpi

2 See SWIFT Go: Low value payments rethought at flow.db.com for more information

3 See https://mck.co/3L6Jt96 at mckinsey.com

4 See https://mck.co/3L6Jt96 at mckinsey.com

Marc Recker

Managing Director & Global Head of Product, Institutional Cash Management at Deutsche Bank

Cash management solutions Explore more

Find out more about our Cash management solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

CASH MANAGEMENT, TECHNOLOGY

How to prevent payments fraud How to prevent payments fraud

With payments fraud on the rise, how can treasury departments prepare the best line of defence against would-be fraudsters? flow reports on a recent EuroFinance webinar that explored new fraud patterns and how these risks are being addressed

CASH MANAGEMENT, TECHNOLOGY

SWIFT Go: Low value payments rethought SWIFT Go: Low value payments rethought

The launch of SWIFT Go is a milestone for the cross-border payments space. As the story continues to develop, flow explores how the industry is driving the initiative forward – and how companies could benefit

CASH MANAGEMENT

CBDCs and the impact on cross-border payments CBDCs and the impact on cross-border payments

A growing buzz around central bank digital currencies (CBDCs) is seeing proofs of concept and pilots worked on by many central banks across the world. As these schemes gain traction, Deutsche Bank’s Bradley Lonnen, Alexander Bechtel and Marc Recker outlined in a webinar how CBDCs could transform cross-border payments