October 2019

As real-time cash management shapes the consumer experience and negative interest rates attack passive deposits, corporate treasurers are employing API-enabled analytics in determining what cash needs to move where and to optimise their FX positions, reports Elizabeth Pfeuti

As the world enters an era that thrives on low latency, it is up to treasurers – and their banking partners – to bring their liquidity management up to speed. Failure to do so would lead to falling behind both competitors and the demands of customers and regulators, while missing out on the biggest opportunity yet to embrace business efficiency.

Among the key changes treasurers need to tackle is the switch from the London Interbank Offered Rate (Libor), the Euro Interbank Offered Rate (Euribor) and the Euro Overnight Index Average (EONIA) to other UK, European and global overnight rates. Contracts drawn up using rates that will soon become obsolete need to be rolled over or renewed, to be in place for when the updated indexes take over.

An additional task for companies operating in euros is to adapt to running two rates: the Euro Short-Term Rate and the new Euribor from 2022. But as market participants feel their way in this new landscape, liquidity might initially be less than they are used to. In this case, contingency plans – which treasurers should be comfortable with – should be crafted and put in place early on.

Changing regulation has added to workloads, but, along with the other challenges, it has also created an opportunity to seek out new and more efficient ways of finding the right balance of company liquidity. That upside is not lost on enterprise resource planning and treasury management systems vendors as they deploy cloud technology to bring dashboard/flight-deck visibility to corporate treasury teams – SAP being one example of this.1

Lightning reactions

“The key for businesses is to have optimum liquidity to enable lightning-quick reactions to the consumer, supplier and regulatory demands,” says Vanessa Manning, Global Head of Liquidity Management at Deutsche Bank. This translates as the ability to have cash instantly available at any point in the working day for whatever purpose – the holy grail for both corporations and those who work with them.

“Initiatives such as the Single Euro Payments Area and revised Payment Services Directive have raised the ante for both businesses and their banking partners, while intercompany loans and transfers, such as those demanded by profit split guidance issued by the Organisation for Economic Co-operation and Development, mean cash has to be moved around the internal company architecture frequently and efficiently,” adds Marc Recker, Head of Cash Market Management at Deutsche Bank.

CFOs need to be aware of all these moves to ensure tax and interest are correctly accounted for and can be agreed by all parties. A complicating factor is the disparate nature of even small companies. Many are split by country, division, historical launch and diverse other business-led factors. This means many operate as stand-alone entities with their own processes, staff and systems, which may have mushroomed due to mergers and acquisitions and/or global expansion.

For those trying to oversee company-wide liquidity, this is the worst of all possible scenarios. It is inefficient and costly and impedes the visibility required by management to drive forward corporate planning. It is no surprise, therefore, that centralising corporate treasury is a firm favourite at EuroFinance and the Association of Corporate Treasurers conferences and training events.

“The answer to the liquidity question, for corporations at least, is not to hold more cash but make more cash available, with visibility the first link in that chain,” says Manning. “The sticking point for many is that account structures have remained the same for 20 years or more. Demands from consumers and regulators have moved more quickly than businesses, and their partners have been able to react.” Tough trading conditions in the aftermath of the financial crisis have also often limited the availability of upgrade investment.

While a significant exercise, rationalising the number of accounts in use by a company can significantly cut costs. More than that, bringing disparate pools of cash into one place also allows much better visibility of what is available – and what is going on in a business.

Banking partners have taken the initiative to offer solutions for managing the number of accounts held by businesses of all sizes and how they work together. Taking accounts online is the first step to consolidation and instant access. Virtual accounts offer new tools that facilitate manual processes, such as invoice matching and automatic account closure following a period of inactivity. By consolidating and streamlining cash pools, CFOs have improved visibility of their accessible liquidity and can take the next step of upgrading the end-of-day processes.

The application programming interface (API) era

Working in real time is something treasurers have seldom had to do, nor have they had the tools available to enable it. End-of-day processes that sweep cash at a set point regardless of what trading happens afterwards have been the standard for decades. This system requires companies to hold extra cash in case of errors or slippage, which is inefficient and costly, especially with some regions’ negative interest rates hitting overnight deposits.

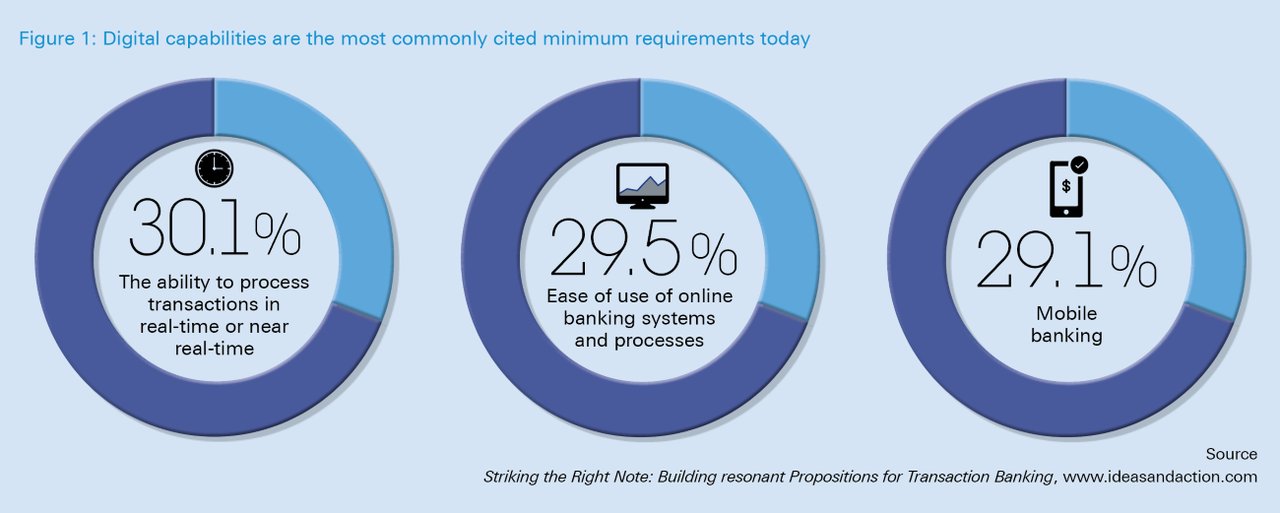

But this current and traditional method could soon be history, as banks and their partners work to implement networks that talk to each other 24/7. A global industry study of more than 300 corporate CFOs and treasurers by financial services consultancy Ideas and Action found that “corporates’ expectations today are very much related to the ability to scale, automate processes and gain efficiencies”, and that “the most important capabilities they look for from their banks today are the ability to process transactions in real or near-real time, the ease of using online banking systems and platforms, and provision of mobile banking” (see Figure 1).2

The momentum is coming from supply chains and the corporate customer network; particularly for those corporates facing consumer markets. A 2018 Economist Intelligence Unit (EIU) report, The future is now: How ready is treasury?, noted that “treasurers now see multi-channel payments and mobile as sources of disruption to their underlying businesses. This means they will now have to adapt their models to be able to deal with changes in supply chain product life cycles and real-time ecommerce”.3

In a real-time environment, businesses can move funds and resolve issues as soon as they present themselves, rather than wait for the allotted time to analyse. This is a huge step forward; no longer needing to maintain cash pools in case funding runs short, they now have what amounts to a ‘just in time’ approach to liquidity management that sees cash allocated as required and sweeps it away to work harder when it is not.4 This approach brings greater precision to the timing of supplier payments, servicing of loans and provision for tax obligations. Under new rules on profit appropriation,5 intraday settlement and real-time liquidity can ensure a company is both compliant and able to demonstrate at a moment’s notice its cash position and records.

The era of APIs has hit banking and is starting to percolate through to corporate treasury clients. The use of APIs, which is gaining pace in retail banking, highlights how digitisation allows partners to communicate seamlessly and automatically in order to bring accounts up to speed in real time. As conduits in the proliferation of open banking, they also have an instrumental role in open architecture being widely adopted in the banking community. Furthermore, their success in achieving this depends on complex security algorithms, which are embedded into banks’ API frameworks, to firmly secure and protect client messaging.

This constant connection could immediately remove the need to reconcile and settle transactions in batches, which create untimely and stubborn roadblocks in a treasurer’s day. “By speeding up transaction agreements, the need to stockpile spare cash in case of errors is drastically reduced, which smooths out the demands on company liquidity and allows treasurers a more accurate view of what is available,” Manning reveals.

APIs also remove the need for round-the-clock staffing, with a digital, automated crew agreeing transactions and moving funds 24/7. Using artificial intelligence (AI), these systems can learn where specific businesses face obstacles and become hyperaware of potential issues.

"The information generated by APIs is amassed in vast data lakes that are analysed to pull out trends or frequent errors, or highlight where a company could be capitalising"

Information bonanza

Through an API, clients and their partners can also access and analyse a huge range of data to use for additional purposes besides accounting. Using the ISO 20022 XML digital language, APIs pass a much broader amount of information between partners about deals, rates and transactions than companies have traditionally accessed, reports Manning.

“This information is amassed in vast data lakes that are analysed to pull out trends or frequent errors, or highlight where a company could be capitalising,” she says. “Banking partners, including Deutsche Bank, have invested in analytics to thoroughly examine where businesses can make efficiencies and run a more streamlined operation. They can highlight where cost is leaking from a business and where more growth can be squeezed from.”

Recker notes how “these analytics can also help a bank understand what its clients need from partners in terms of liquidity management, cash optimisation and investment”. With potentially billions of transactions – with external customers, suppliers and intracompany transfers – banks are increasingly using AI to select key themes from the data and analyse them in the context of a client’s business and operating model. “By identifying valuable, commercial data, AI and machine learning can help banks work with clients to create a bespoke system that works specifically for them,” says Manning.

Security, liquidity and yield are the key drivers for our corporate clients

Each business is different, but treasurers know their specific needs and hurdles. The EIU report respondents said that “the most likely use for AI in treasury will be analysing and predicting supply chain bottlenecks, followed by forecasting working capital needs and predicting payment flows”.6 They also know how vital the efficient management of cash and liquidity is to the growth of their underlying business and its overall success. Once the correct level of available cash can be established, company executives can take stock and plan how to manage their balance sheet, ensuring that unused cash is put to work rather than being stuck in contingency pools.

Low interest rate environment

While interest rates remain low – or negative in some regions – treasurers need new options to enhance their cash positions. Following a decade of these close-to-zero rates, traditional methods of merely posting assets in an account have become too costly for many. Treasurers have seen inflation eroding balances; some even having to pay their bank a negative interest rate for holding cash, which has compelled them to seek options on financial markets.

Money market funds (MMFs), which hold short-term fixed income and liquid debt instruments, have been regulated7 and remade since the financial crisis. They now provide treasurers with somewhere to place cash overnight at relatively low risk.

DWS, the asset management business majority owned by Deutsche Bank, runs a wide range of these MMFs, along with a spectrum of actively managed pooled and segregated investment accounts for clients. Within total assets of around €700bn, almost 9% is held and invested in liquidity and MMF investments, according to Reyer Kooy, Head of Liquidity EMEA & APAC at DWS.

The funds are operated in several major world currencies, meaning a company also has options when planting cash from different regions. “Security, liquidity and yield are the key drivers for our corporate clients,” Kooy says. “And we attend to them in that order. We work to very conservative investment guidelines within the MMFs. Yields are competitive to other short-term investment options despite a highly conservative approach. Our main institutional MMFs employ no leverage, hedging or investment in currency outside of that being committed by the investor.”

This performance comes, in part, from the size of some of DWS’s MMFs – up to US$10bn – which allows the manager to make investment gains by holding assets with longer duration, but still offer daily liquidity to investors. This size also ensures liquidity can be almost immediately withdrawn from MMFs, so companies can access their cash without causing ripples across the fund for other participants.

Importantly, MMFs are also classed as a cash equivalent when noting on a balance sheet, rather than a treasurer having to strike a mark-to-market valuation of assets – as can be the case with other investment vehicles. “With increased automation, banks will soon be able to pass through any unused cash to these funds almost instantly and recall it when needed by the business,” says Manning. “With a more streamlined, accurate and visible consolidated cash position, treasurers can make more of their investment strategy.”

For the moment at least, MMFs need to keep assets overnight for the instruments within them to yield, but 24/7 access that allows cash to be available when a company might unexpectedly need it could be the next flex test for the funds.

For cash that does not need to be accessed as frequently or quickly, Kooy explains that DWS’s corporate clients have a range of solutions that allow them to tier their cash according to their likelihood of needing the money quickly. “These pooled or segregated fund strategies may be tiered by different liquidity profiles and investment styles to suit a client’s needs,” he says. “These funds are carefully targeted and managed to enable companies to meet their specific goals.” The funds hold a range of financial instruments and are actively managed, offering the opportunity of making higher returns through targeting a longer-time horizon than MMFs.

A bespoke approach can also help companies invest in a way that is important to them. Another area where DWS expects further growth is in environmental, social and governance (ESG) investing as the drivers are increasingly incorporated into investors’ guidelines. As such, the asset manager is introducing a sophisticated ESG framework in money market and short-duration mandates and mutual funds.

FX flexibility

Juggling different regulatory standards, economic policies and pressures is becoming a common theme for many companies as they seek common ground to transact with clients and suppliers around the globe. And nowhere is the ground more common than the transaction settlement currency, which can span a handful to an unlimited number.

“For businesses that run with a volatile cash flow, static currency hedging can prove ineffective and often costly,” says Johnny Grimes, Deutsche Bank’s Head of Corporate Bank FX. “By implementing an automated system that allows for and adjusts to the constantly moving in and outflows of the business, hedges can be altered swiftly to ensure a balance sheet is protected from market swings and unforeseen supplier issues.”8

Deutsche Bank has worked with Japan’s Yusen Logistics, an international freight forwarding and logistics company, to implement an FX hedging system for its German subsidiary. Thanks to increased automation, its currency positions that were once calculated at month end are now moving towards real time. This information can be inserted into Yusen Logistics’ treasury management system and fed into an overall cash position to improve a treasurer’s visibility of company liquidity.

Elizabeth Pfeuti is a freelance financial journalist

Sources

1 See https://bit.ly/33cRXWt at sap.com

2 See https://bit.ly/2Mx8jE3 at ideasandaction.com

3 See EIUreport2018 at flow.db.com

4 See Deutsche Bank’s white paper, The road to real-time treasury, at corporates.db.com

5 Under the OECD/G20 Inclusive Framework on BEPS, over 130 countries are collaborating to put an end to tax avoidance strategies that exploit gaps and mismatches in tax rules. See oecd.org/tax/beps

6 See endnote 3

7 See https://bit.ly/2N1vJkw at esma.europa.eu

8 See Hedge with an edge at flow.db.com

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

TRADE FINANCE, CASH MANAGEMENT

Bumpy road or motorway? Bumpy road or motorway?

After LIBOR, digitalisation and future proofing were among the “trends to shape a new decade” discussed by delegates at the 2020 BAFT Global Annual Meeting in Frankfurt

CASH MANAGEMENT

Cybersecurity and fraud protection: exposing bad actors Cybersecurity and fraud protection: exposing bad actors

As spear phishing, business email compromise and other attacks on corporates increase, the chief information security officer is everyone’s new best friend, report Wade Bicknell and Vanessa Riemer

CASH MANAGEMENT

Resilient treasury factors in a lengthy pandemic Resilient treasury factors in a lengthy pandemic

Rapid changes to treasury strategy introduced in response to Covid-19 appear likely to endure as companies adjust to the pandemic having longer-term impact, the latest Economist Intelligence Unit survey suggests