May 2020

As the deadline for the cessation of Libor as the most widely used benchmark for financial products looms ever closer, Graham Buck reports on how SONIA, the Bank of England’s preferred successor, is gaining traction

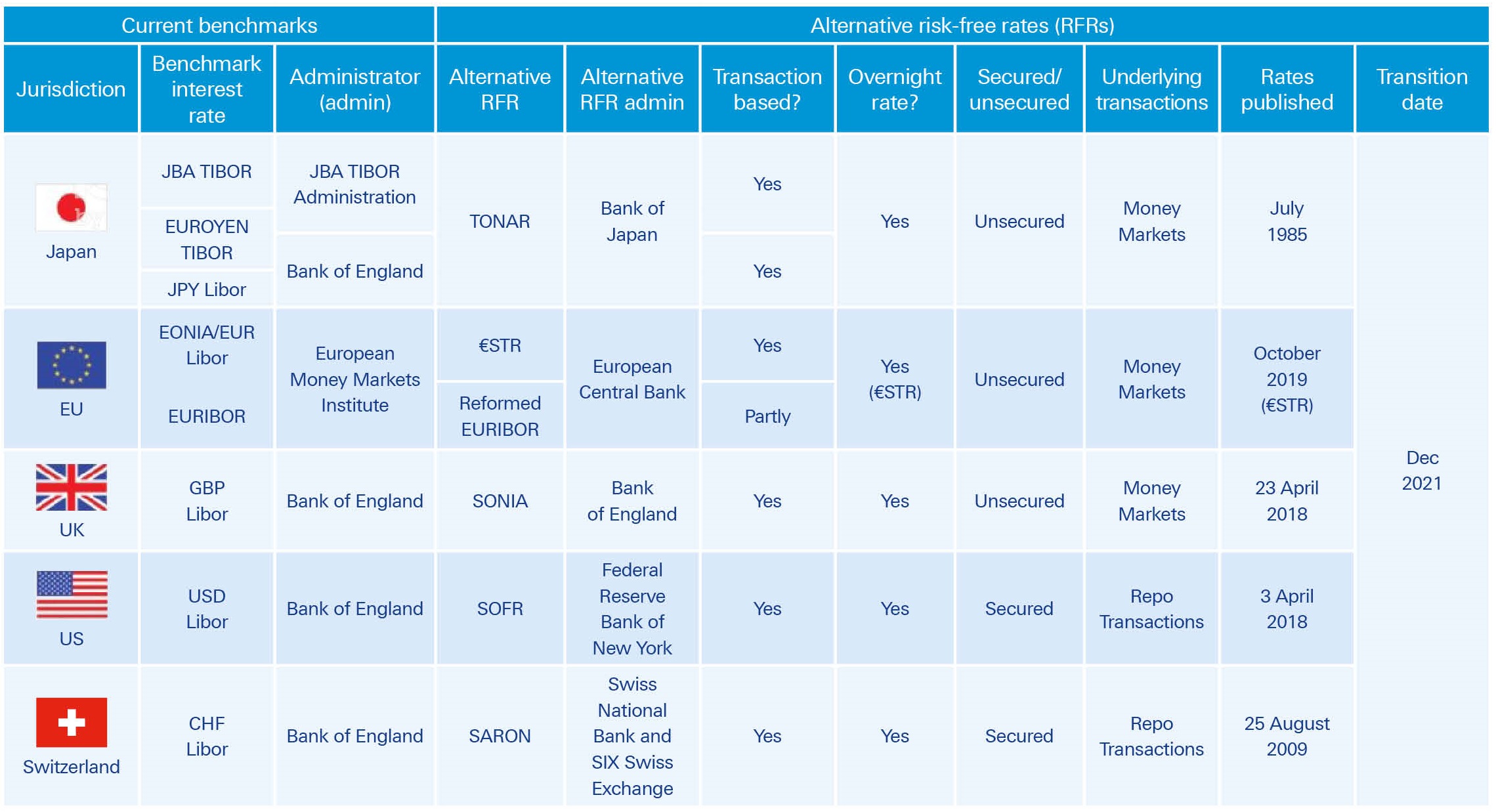

In flow’s ‘Leaving Libor’, Helen Sanders documents how managing the transition from the London Interbank Offered Rate as the touchstone for financial instruments by the end of 2021 is a global challenge.1 Working groups are focused on finding the most appropriate solution for the move from a reference rate regime based on interbank offered rates (IBORs) to one based on a new set of overnight risk-free rates (RFRs).

Solutions available include the Bank of England (BoE) Sterling Overnight Index Average, better known as SONIA, as well as the US Secured Overnight Financing Rate (SOFR), Europe’s Euro Short-term Rate (€STR), Switzerland’s Swiss Average Rate Overnight (SARON) and Japan’s Tokyo Overnight Average Rate (TONAR); each of them with its own nuances, unique characteristics and underlying methodology.

Figure 1: Options for transition from Libor

*These are the main five transition rates, but the transition from IBOR to RFRs could bring additional benchmark rates in scope that are indirectly linked to IBOR or use IBOR in the methodology.

Source: Global Financial Markets Association

SONIA is a backward-looking overnight reference rate, lacking a credit element that measures the average of rates paid on overnight unsecured wholesale funds denominated in sterling. Established in 1997, SONIA’s strengths include compliance with international best practice for financial benchmarks and having the BoE as administrator, making it a preferred benchmark for the transition from Libor to a sterling RFR.

In April 2017, the BoE’s Working Group on Sterling Risk-Free Reference Rates confirmed SONIA as the chosen successor, in preference to FTSE Russell’s newly launched Sterling Secured Overnight Executed Transactions (£SONET) and the Sterling Repo Index Rate (£RIR).2 In July 2019, BoE Governor Andrew Bailey (then CEO of the Financial Conduct Authority) reported that SONIA had become the cash market’s norm for new issues of sterling floating rate notes.

SONIA as the solution

As part of the move from unsecured financing to the new observable regime, in January 2020 the Working Group published its priorities for the Libor to SONIA transition.3 They included:

- No issuance after Q3 2020 of cash products linked to GBP Libor;

- A material reduction in GBP Libor inventory by Q1 2021;

- A further shift of volumes from Libor to SONIA in derivative markets;

- Setting a framework for transition of legacy Libor products; and

- Addressing Libor legacy contracts.

Complicating the task is the fact that not all products can simply transition from Libor to SONIA. Several major structural differences mean the latter is not a like-for-like replacement.

This has not prevented SONIA’s rapid progress in the derivatives market; by H1 2019 it represented just over 45% of notional swaps trading in sterling and it will soon become the most common benchmark.4 However, it had not made any impact in the cash market until June 2019, when Associated British Ports became the first bond issuer to move to a SONIA-based coupon from a Libor-based coupon on an existing bond; a £65m floating rate note due 2022 that switched to compounded daily SONIA.5

It was quickly followed by UK transport group National Express, which in July completed a SONIA-benchmarked corporate loan “using daily compounding, with a five-day reset lag to give a more transparent, data-led benchmark”.6

Biting the bullet

In November, Deutsche Bank’s European Commercial Real Estate (CRE) Group completed its first compound SONIA-based loan for real estate group Kennedy Wilson, to refinance its €46.5m acquisition last summer of Ditton Park, a 200-acre office park located near Heathrow Airport and the M25 motorway.

“We knew for some time that Libor would go at the end of 2021, which meant opening up an economic discussion with borrowers,” says CRE Director Clive Bull. “That creates a burden in terms of resources – time that could be spent negotiating a new loan must be directed to renegotiating an existing one instead. It’s also expensive, as it requires paying for counsel.”

Bull explains that rolling into 2021 with a number of Libor loans was “unappetising, to say the least”. In late 2018, his team began reviewing the possibility of SONIA transitions – although they expected the clearing banks, “which have by far the biggest problem”, to be the first to make the move.

“But it soon became clear that no one was keen to be the pioneer,” says Bull. By mid-2019, with little sign of action, the CRE team bit the bullet from Q3 and started making the switch to SONIA where possible for UK lending.

Tougher challenges

What could prove more problematic are highly syndicated and leveraged loans, as well as Libor-based corporate loans where the borrower has the ability to change the period – for example, from one month to three months and back again – fairly easily. “Changing the period is a much bigger issue for systems under a SONIA loan,” Bull explains.

The more challenging area of the market is leveraged finance loans that are both syndicated and actively traded; under compound SONIA, this presents the challenge of keeping track of accrued interest and ensuring that the loan’s bidder receives the correct amount. It’s not something that can be done manually and needs to be embedded into the system.

The call for action from UK regulatory bodies, to ensure that Libor-based issuance of new cash products ends in Q3 2020, provides the impetus for borrowers and lenders to make the move and accelerate the pace of transition over the months ahead.

"Systems and controls implementation is a critical part of being ready"

However, issues still remain. “Systems and controls implementation is a critical part of being ready and represents the biggest stumbling block, particularly for syndicated lending,” says David McNally, IBOR Transition Director for Corporate Banking at Deutsche Bank. “The onus is both on technology vendors to upgrade software and on lenders to consume, test and implement those changes in time.”

To address the challenge resulting from the market infrastructure to support SONIA not yet being ready, the BoE has published a discussion paper to assist in the acceleration for its adoption. It is also seeking views on the publication of two indexes, a SONIA Compounded Index and a SONIA Period Average.7

“The publication of an index is a catalyst to accelerate the operational transformation that is needed,” says McNally. “However, only once questions relating to the outstanding market and pricing conventions are settled will the door be opened to full-scale product development and deployment.

“Once we reach that inflexion point, I expect to see a paradigm shift in engagement with clients where we move away from broadening market awareness into transition and the widespread adoption of contracts referencing the new benchmark.”

Sources

1 See Leaving Libor at flow.db.com

2 See https://bit.ly/2TNXgco at bankofengland.co.uk

3 See https://bit.ly/2TN0xZh at bankofengland.co.uk

4 See https://bit.ly/3cXDqms at fca.org.uk

5 See https://bit.ly/33gVbbU at cms-lawnow.com

6 See https://reut.rs/2Qa7ZeY at reuters.com

7 See https://bit.ly/38JCWwZ at bankofengland.co.uk

You might be interested in

CASH MANAGEMENT, MACRO AND MARKETS {icon-book}

Leaving Libor Leaving Libor

By the end of 2021, Libor will have all but disappeared. Helen Sanders looks at what treasurers should consider amid the phasing out of this widely used benchmark interest rate

TRUST AND AGENCY SERVICES

Are you ready to leave Libor? Are you ready to leave Libor?

With the phasing out of the most widely-used benchmark interest rate, flow looks at how one bond transaction successfully switched to a new reference rate

CASH MANAGEMENT, REGULATION, MACRO AND MARKETS

Asian banks keep up to speed on ISO 20022 migration Asian banks keep up to speed on ISO 20022 migration

The new global language for financial communications is very much a work in progress. In this article written for The Asian Banker, Nancy So assesses how banks across the region measure up