23 January 2024

B2B marketplace sales are growing quickly, and so is the number of companies implementing platform-based business models. How can treasury support marketplace success and ensure efficient cash management? A new white paper by TMI and Deutsche Bank provides answers

MINUTES min read

As more people purchase goods and services online, the business-to-business (B2B) sector is increasingly adopting digital sales channels in response. It’s no longer only consumers but also B2B buyers who want to buy anywhere, at once and 24/7 – and the Covid19 pandemic has accelerated this trend globally. According to McKinsey, the “consumerisation of B2B buying appears nearly complete”.1

So it’s no surprise that digital marketplaces, which have altered purchasing behaviour in the B2C space – see Amazon, Alibaba or Tencent – are also advancing in the B2B arena: in the US, more than one in four B2B buyers do at least half of their purchasing on these marketplaces, according to a survey of Digital Commerce 360 and Forrester Research.2 The survey estimates that 2023 B2B marketplace sales in the US have more than doubled to US$260bn from US$112bn in 2022.3

While the US and China lead the pack, the growth of digital B2B marketplaces is a global trend: In India, for example, B2B marketplaces are expected to become a US$200bn market by 2030.4 In Europe, the data provider Dealroom counts more than 250 B2B marketplaces – with the figure still growing.5

Benefits of a B2B marketplace

Central to digital marketplaces is the utilisation of advanced technologies and data-driven algorithms to match supply with demand efficiently. These marketplaces often offer a wide range of products or services, harnessing network resources to attract a large user base. They prioritise user experience, personalisation, and convenience, making them a go-to destination for both buyers and sellers.

“While buyers enjoy greater choice, faster delivery, and cost reductions, sellers gain access to a larger client base with reduced risk”

“While buyers enjoy greater choice, faster delivery, and cost reductions, sellers gain access to a larger client base with reduced risk,” says Matthaeus Sielecki, Head of Embedded Finance Solutions, Cash Management at Deutsche Bank. He adds that a marketplace helps participating operators increase their share of wallet through third-party reseller commissions. “Additionally, it provides them with deeper market insights, allowing them to monitor platform usage, encompassing search and transaction data. This valuable data can be monetised or leveraged to enhance the platform, creating a more compelling value proposition for both buyers and sellers.”

Sielecki differentiates between four different market types, which overlap and evolve.

- Digital marketplaces: sophisticated online ecosystems that serve as intermediaries connecting multiple stakeholders in a digital economy. These platforms facilitate the exchange of goods, services, or information among a diverse array of participants, including businesses and consumers.

- Platform business models: While digital marketplaces primarily focus on facilitating transactions, platform business models encompass a broader spectrum of activities. Airbnb exemplifies this by connecting individual hosts (B2C) with travellers, but it also extends its offerings to Airbnb for Work, facilitating bookings for business travellers (B2B).

- Subscription-based business models: These models involve customers paying periodic fees to access a service or product continuously.

- Direct-to-customer models: These models involve brands selling their products or services directly to consumers, bypassing traditional intermediaries.

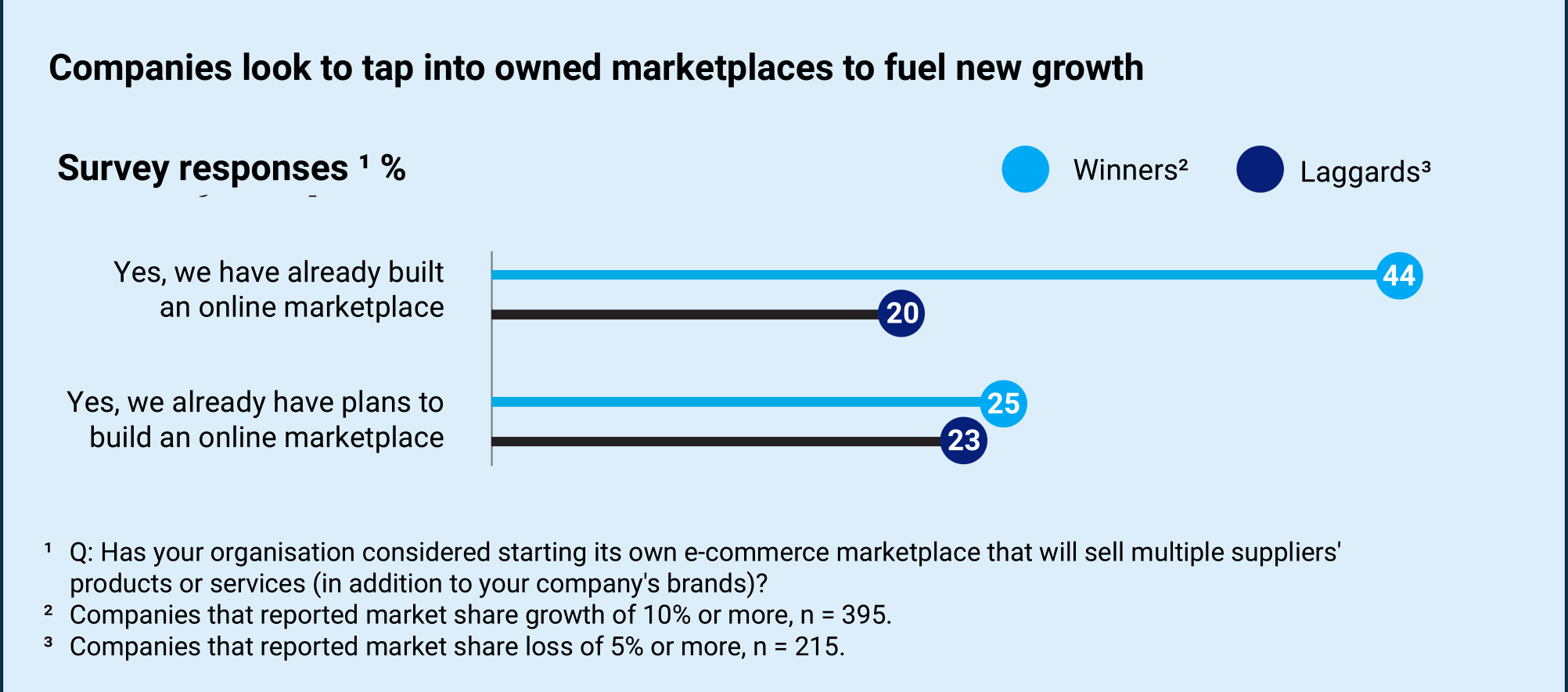

This success of these new business models has not gone unnoticed: In April 2023, McKinsey published a survey among 3,800 B2B decision makers across 13 countries. The results show that the adoption of company-owned marketplaces increased by 8% in 2022. Among the B2B companies winning the most market share, 44% have either already built or have plans to build their own marketplace (see Figure 1).6

Figure 1: Successful companies are engaged in marketplaces

Source: McKinsey Survey April 2023

Prominent examples of companies that have built their own marketplace include Germany’s engineering and technology giant Bosch, which, via its start-up company Azena launched a marketplace allowing software developers to sell their video analytics applications to the users of these surveillance and monitoring cameras, as flow reported in the February 2022 case study Smart payments for smart cameras. Customers include sport teams, which are using AI to monitor crowding at their stadium entrances and local transport operators wishing to gain insights into passenger flows.

Treasury’s role in creating a digital marketplace

Treasury’s role is pivotal in establishing the financial and operational framework for this innovative business model, particularly given the high demand for effective cash management in these fast-paced ecosystems. In response, a new white paper, jointly authored by TMI and Deutsche Bank, outlines the essential steps that corporate treasurers should follow to initiate and sustain digital marketplaces.

The report opens by examining treasury’s early role in planning once the company has decided to establish a marketplace. Structured according to the different stages – discovery, preparation, implementation, and expansion – the paper describes how treasury can contribute to marketplace success.

According to the authors, a crucial aspect lies in understanding the technical and regulatory requirements in the target countries as there are regional variations that shape payment processing, Know Your Customer (KYC), Anti-Money Laundering (AML), and data protection regulations. This impacts the initial onboarding of merchants to the platform as well as payment processes once the platform is live.

An example where regulatory clarification is required is in defining the rules and responsibilities surrounding payment processing on behalf of others (POBO), a common practice on platforms with third-party merchants.

Despite the significance of these considerations, Sielecki observes, “treasury is often overlooked in the early stages of marketplace development, as the business prioritises speed to market over initial efficiency.” This initial exclusion can result in escalated payment processing costs, high FX fees, and redundant internal efforts when a marketplace starts to scale up.

This challenge becomes particularly evident when a multitude of smaller local Payment Service Providers (PSPs) are employed to establish a presence across various countries instead of implementing an overarching, optimised cash management system. To prevent frequent restructuring and to strike a balance between the need for rapid market entry and the mitigation of financial risks, treasury involvement should begin from the very inception of the marketplace project.

Pitfalls to avoid for corporate treasurers

The white paper also outlines key considerations and pitfalls to avoid from treasury’s perspective – in particular, when it comes to managing counterparty, credit, liquidity and FX risks. “Establishing a marketplace will necessitate treasury to reassess the business assumptions for monetisation and the financial risk model,” Sielecki explains. If, for example the business model commits to same-day merchant pay-outs, but internal systems cannot match and post related receivables at that pace, credit risk arises.

The paper also stresses the importance of strong connectivity between the different systems – the front end of a marketplace, which is typically designed by the business to match its preferred aesthetics, the enterprise resource planning (ERP) system as well as the treasury management system (TMS).

“Treasury can contribute to the connectivity discussion in two ways,” the authors write. “First, it may suggest that a bank or PSP directly connects to the e-commerce platform through an open API. (…) Second, treasury may recommend implementing a central payments gateway,” which serves as a technical middleware hub and can aggregate data from various payment methods, as the paper describes. This approach usually makes most sense when dealing with multiple jurisdictions.

How banks can help

Finally, the paper examines how banks can assist treasury teams in their marketplace journeys. This includes providing bread-and-butter financial services like payments, reconciliation, clearing, and FX for the marketplace business. At the same time, banks can also help corporates to boost marketplace sales by offering a range of financing options, simplifying partner onboarding procedures, and providing support for broader geographic expansion.

In addition, when a bank possesses insights into the flow of funds, the payment channels employed in these flows, and how FX impact these flows, it can collaborate with treasury to bundle services that mutually benefit both parties. “Banks with extensive global reach can offer valuable guidance to treasurers navigating complex regulatory demands in diverse countries,” says Sielecki. “They can proficiently handle payment integrations and settlement orchestration, all the while providing robust financial structures.”

To discover more about the rise of digital marketplaces and the role of corporate treasuries in setting them up – and sustaining them – download your complimentary copy of this in-depth whitepaper, authored by TMI and Deutsche Bank:

Sources

1 See mckinsey.com

2 See digitalcommerce360.com

3 See digitalcommerce360.com

4 See bvp.com

5 See app.dealroom.co

6 See mckinsey.com