29 August 2023

As interest rates rise to levels not seen since the global financial crisis, returns on cash have also improved. But geopolitical uncertainty and the failure of several major banks put the onus on treasury to plan and manage liquidity. flow reports on a recent Economist Impact webinar where panellists discussed best liquidity management practice

MINUTES min read

The speed of interest rate hikes across developed economies, coupled with resurgent inflation since late 2021 has caused corporate treasury teams to reassess their liquidity management plans and consider how best to maintain access, yield and cash preservation in the new era of cash tightening and economic uncertainty.

The recent Economist Impact webinar Managing liquidity in a changing environment, supported by Deutsche Bank, considered “a topic very close to treasurers’ hearts at the moment”, according to session moderator Simon Jones, an independent treasury expert. He invited two of the panellists, Robert Westreich, SVP treasurer and chief tax officer for Newell Brands and Samuel Vallotton, VP, global treasury, Salesforce to outline their company’s business model and how it impacts on liquidity.

Newell is a US-based multinational that both manufactures and sources consumer discretionary products that include PaperMate, Parker and Sharpie pens, Rubbermaid kitchenware and Yankee Candles. In addition to its head office in Atlanta, Georgia, the company has treasury teams in Europe and Hong Kong. Westreich said that the majority of the company’s invoicing comes in the second half of the year and the liquidity tools employed by treasury include a credit revolver, commercial paper an accounts receivable (AR) securitisation programme and a factoring programme where selected customer receivables are offered a discount so that cash can be brought in quickly.

“For each of these liquidity tools we review the cost, which proved fairly easy when both interest rates and the cost of borrowing were relatively low,” he added. “Now we have to be more mindful of which one we choose.”

The other company on the panel, Salesforce, is a software service provider based in Silicon Valley, perhaps best known for its data visualisation tool Tableau, which it acquired four years ago for US$15.7bn. Vallotton, who is based on the other side of the Atlantic in Switzerland, said that the company and its treasury team have both grown rapidly, with annual revenues now slightly north of US$31bn against US$1-2bn when he started with the company years ago. Salesforce’s products are subscription-based, with customers offered incentives to pay upfront. “That makes it appealing from a cash perspective and contributes to a positive cash flow,” he added. “We have a revolver in place and some long-term debt, but no factoring facility.”

Treasurers are reviewing cash pooling arrangements

Panellist Eric DeVos, global head of liquidity product management for Deutsche Bank, was asked whether he had seen corporate clients adjust their liquidity management strategy over recent months in response to the succession of sharp interest rate hikes.

DeVos noted that the opportunity cost from inefficient strategies and idle cash is increasing, and this had seen many companies review their in-house bank (IHB) and cash pooling arrangements and decentralised treasury structures – each of which help in mobilising cash – together with investment opportunities, financing sources and debt repayments. “There’s also been much interest in multicurrency and other workflow solutions that help increase the number of entities participating in these types of solutions, address inefficiencies and capitalise on opportunities,” he added.

“There was a lot of excess cash and liquidity in the market and there had to be some other place to deploy it, beyond bank deposits”

Companies are deploying their excess cash differently, reported DeVos with bank deposits shifting from overnight to term due to the latter’s greater potential yield. Corporate term deposits across eurozone banks have more than doubled in the past year – an increase of more than €300bn – and overnight deposits decreased by a similar amount over the period. In the US market, in 2022 Federal Deposit Insurance Corporation (FDIC)-backed bank deposits decreased by US$500bn while term deposits increased by US$400bn.

“In Q3 and Q4 last year, corporates were looking to be opportunistic, extend tenors and take advantage of higher yields,” DeVos reported. “But from late Q1 this year, we’ve seen the trend reversing a little, with corporates looking to stay on the shorter side of the cash equivalent spectrum and prioritising access to liquidity and safety over yield.”

A further recent trend “and no surprise” has been a preference for floating interest rate constructs, with different deposit term products popular, such as call notice deposits. As DeVos noted, investment vehicles allowing for participation in the environment of increasing interest rates were a major trend earlier in the tightening cycle. More recently, it has been more muted as most believe that the rate tightening cycle is near, or at its peak.

“Looking back at the expansionary monetary and fiscal policies in place after Covid, it led to an unprecedented surge in savings and bank deposits, as well as a slowdown in credit availability,” he added. “There was a lot of excess cash and liquidity in the market and there had to be some other place to deploy it, beyond bank deposits.”

New instruments to manage short-term liquidity

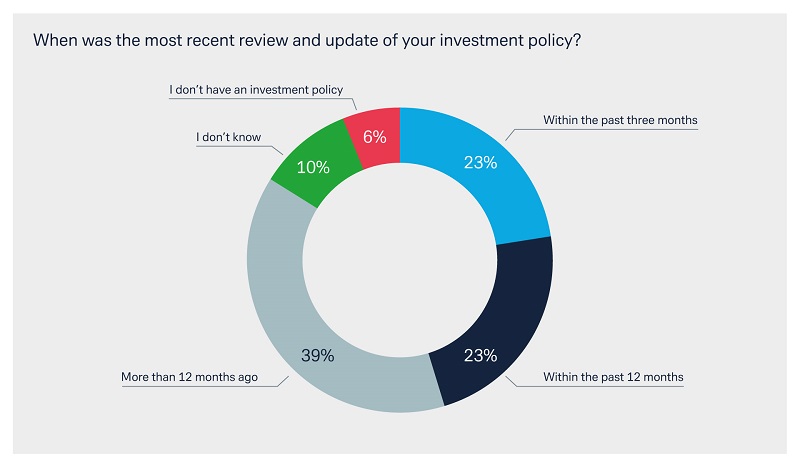

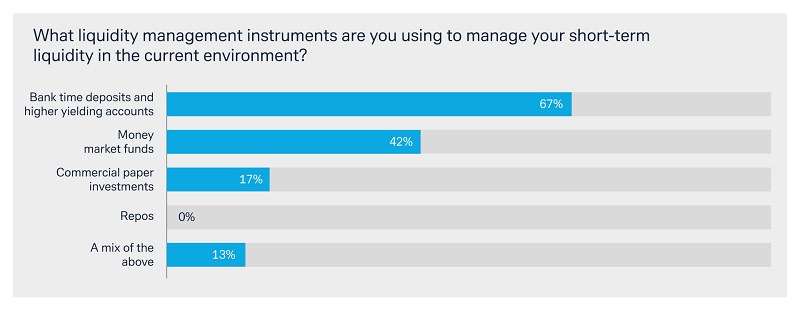

Two audience polls asked treasurers how recently they had reviewed their corporate’s investment policy and the tools they were using to manage short-term liquidity. Responses were as follows:

Commenting on the latter poll, DeVos said: “It’s a little surprising to see repos scoring zero, but it is still an emerging investment vehicle option.”

“In this environment, the emphasis is more on cutting fees than maximising yield”

The two corporate treasury panellists were asked what tech instruments and techniques they now employed and whether they were investing in any new instruments.

Newell in its present form is a company comprising several acquisitions that took time to integrate, said Robert Westreich. For the past 18 months or more, its treasury team has “been on a mission” to implement SAP Treasury across all its operations, which will lend support to the liquidity management tools it employs. Among these are notional cash pools outside of the US, in which multicurrency companies participate by depositing excess cash in their local currency into the pool. This activity is managed by the company’s treasury centre in Ireland, where its in-house bank (IHB) is also located.

With the business including manufacturing companies, distribution companies, holding companies and more, Newell also utilises a netting centre for its inter-company transactions. “In other areas, we’re very proactive from a repatriation perspective,” said Westreich. “The overall objective is to use a variety of techniques to bring the cash back to where we need it. And we repatriate cash back to the US because our external debt is all US-based.”

By contrast, Salesforce has what Vallotton described as “a fairly traditional set-up” with a treasury management system (TMS) connected directly to all its banks via SWIFT, which allows it to track the company’s positions and is the main tool for its IHB. “We’ve looked – and are looking – at application programming interfaces (APIs), which the banks have been talking about in recent years,” he said.

“It’s definitely something that has value, but whether it provides material value for us at the moment is another question. We’re a B2B company, so real-time information isn’t yet top-of-mind for us.”

Vallotton also cited the current difficult business environment for tech companies, many of which have been forced to cut costs and lay off staff. This is resulting in less of a focus on cash flow and a greater focus on profitability, he said. “So, in this environment, the emphasis is more on cutting fees than maximising yield.”

Cash investment service offers alternatives to bank deposits

Recent changes such as the uptake in demand and increased focus on cash flow forecasting, has seen Deutsche Bank develop its cash investment service (CIS), described by DeVos as “our agency investment solution where we provide clients with access to investment vehicles that offer alternatives to bank deposits.”

Through the bank’s agency trading desk and according to investment rules stipulated by the client themselves, there is the ability to go into various money market funds with different underlying holdings and fund characteristics. “Equally interesting is that via the platform, clients have the ability to invest in reverse repos through over 50 different counterparties,” said DeVos.

“We have zero interest in participating in crypto and our investment policy would preclude us from doing so”

The Q&A session that concluded the webinar included a question on whether cryptocurrency is likely to play any real future role in the treasury function “considering that exchange traded funds (ETFs) are now lined up for approval with the US Securities and Exchange Commission (SEC)?”

Vallotton was sceptical: “The path forward seems to be more via central bank digital currencies (CBDCs). But we’re not planning anything around crypto.” Westreich was even more blunt. “We have zero interest in participating in crypto and our investment policy would preclude us from doing so.That shows you that it’s good to have a policy that is flexible. So that when something is fashionable, you can take a look at it objectively and decide whether it makes sense for your organisation.”

- The Economist Impact webinar, supported by Deutsche Bank, Managing liquidity in a changing environment, took place on Wednesday 28 June 2023