20 November 2024

Sibos descended on Beijing for the first time this year, arriving with some of the biggest payment topics in tow – from the G20 Roadmap and ISO 20022 to AI and digital wallets. flow explores the latest developments shaping the future of payments

MINUTES min read

For visitors arriving in Beijing for the first time, cashless payments is an unavoidable topic. As you weave your way from the plane to arrivals, you are greeted by large billboards encouraging foreign travellers to download a Guide to Payment Services in China. This is because while card payments have long been an accepted norm across Europe, China has somewhat by-passed these traditional card-based systems – with digital wallets and QR codes dominating person-to-person and retail transactions.

This scenario served as a fitting backdrop to many of the conversations that shaped the week’s conference. The differences between East and West highlighted the very real fragmentation in the world of payments, while the ease at which international cards could be added to the local digital wallets showed that, through greater harmonisation, we are able to bridge these divides.

This year’s conference theme, 'Connecting the future of finance', focused on bringing together the pieces that make up the global payment ecosystem. And if payments can be seen as a puzzle, the G20 Roadmap for Enhancing Cross-border Payments is perhaps its box – a vision of what’s to come. Greater standardisation driven by the new global standard for payment messaging ISO 20022 and the legal entity identifier (LEI) are surely the puzzle’s border pieces – to be tackled first, before a clearer picture can form. The remaining pieces represent the various technologies and initiatives, such as artificial intelligence in anti-fraud and digital wallets, that make up the broader picture – and contribute to a seamless, efficient, and resilient global payments framework.

Building on the discussions at Sibos, this article looks at how the different pieces of this puzzle are coming together. It’s the fourth and final one of a series of Sibos write ups published on flow during the weeks following Sibos. The preceding three are:

A more inclusive G20 Roadmap?

On Day One of Sibos, the Basel-based Financial Stability Board (FSB) released its latest progress report on the G20 Roadmap, with the big takeaway being that the “work done so far is not yet sufficient and that further efforts are needed to meet the quantitative targets”.1

The Roadmap endorsed by G20 leaders in November 2020, aims to make cross-border payments cheaper, faster, more transparent, and accessible. In terms of the speed for example, 75% of transactions are targeted to be credited to the beneficiary within an hour by 2027.2 While this is an area of continued progress for the community, the complexity of the challenge becomes clear upon studying the data.

“Looking at the Swift network today, around 90% of wholesale payments reach the end beneficiaries banks within one hour,” explained Marianne Demarchi, Chief Executive EMEA, Swift, during the session Achieving the G20’s roadmap for cross-border payments: A central ‘bank perspective’. “When you look at the last mile – so the mile that comes from the beneficiary bank to the beneficiary – it's a bit less than 50%.” Frictions in this last leg include currency controls, batch processing, and market opening hours, which often require country-specific solutions.3

“Around 90% of wholesale payments reach the end beneficiaries banks within one hour”

Additionally, better alignment is needed between various cross-border stakeholders, noted one panelist. While the priority of cross-border payment improvements is clear at the policy level, it may not carry the same weight for commercial entities, where meeting the G20’s four objectives could incur costs and raise practical concerns. He added that market infrastructures, often positioned between policymakers and commercial banks, have a role to play in driving alignment.

Although the Roadmap is endorsed at the G20 level, its impact reaches beyond G20 countries. In Kenya, for example, it is playing a central role in pushing the government to work on its infrastructure, to close not only the rural-urban divide, but also the associated digital divide, explained another panelist. For her, the call to action is to re-frame the Roadmap – changing from G20 targets to a more appealing, inclusive initiative, that ensures no one is left behind and everyone gets involved. When it comes to solving these country-specific challenges, this might be the key.

The intersection of ISO 20022 and AI

At its heart, the transition to ISO 20022 is all about the structured, data-rich information it provides to the entire payment ecosystem – and the opportunities for standardisation and innovation. There is, however, still much to complete on this front. As described in the article Embracing ISO 20022 for a connected future the current adoption rate for cross-border payments stands at only 27% and one recurring discussion point at this year’s Sibos was community readiness.

While migration needs to speed up, data quality is also not at the level the industry needs it to be, explained Paula Roels, Head of Swift and Market Infrastructures at Deutsche Bank. “In part this is because the migration is primarily happening like-for-like in the back end of the system,” she said, adding that the Payments Market Practice Group (PMPG) within Swift which she co-chairs needs to “intensify our work in guiding the industry towards the correct usage of ISO 20022 data elements”.

For the payments community to overcome these challenges, leveraging artificial intelligence (AI) technology could be a key enabler. Like ISO 20022, AI models are grounded in data – and higher quality data should lead to better decision making. But what exactly are the use cases in payments, and how close to reality are these?

Pictured: Deutsche Bank’s Chris Bezuidenhout during the ‘AI and ISO 20022: A match made in data heaven’ panel

One area where AI is already having an impact though – both positive and negative – is the payment fraud space. On the one hand, banks are using machine learning and AI to do preventative fraud checks in the payment flow, explained Chris Bezuidenhout, CIO Corporate & Investment Bank Deutsche Bank on a panel titled ‘AI and ISO 20022: A match made in data heaven’. On the other hand, bad actors are responding to AI developments quicker than institutions are, he continued. “It is going to be a continuous battle game for the industry to direct sufficient capacity towards AI-driven use cases because of the multitude of ideas out there and skills required for example in algo development. It’s going to take time and money for the industry to catch up.”

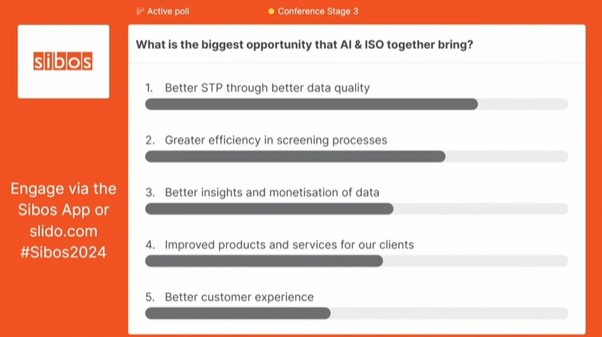

While fraud defences with the help of AI are high on the agenda, the benefits extend beyond this. An audience poll during the panel session asked, “What is the biggest opportunity that AI and ISO together brings?” Top choice was better straight-through processing rates through better data quality (see Figure 1).

Figure 1: Poll result during ‘AI and ISO 20022: A match made in data heaven’

Commenting on the poll, one panelist explained that given the high costs involved with implementing AI, it is no surprise that the popular picks were efficiency gains and reducing costs. He added that while customer experience is a priority, we aren’t far enough into the process for creative teams behind the products to use the new super rich data that is becoming available. This is, however, exactly what corporate customers want in the longer term.

Bezuidenhout added that in the customer experience domain, there's untapped potential in terms of real-time notifications and timing around transactions and behaviours. “What better customer experience also means is that we will have fewer failures, fewer error rates, fewer investigations – and, therefore, higher [straight-through processing] STP rates. As the adoption continues, we will likely see data errors, missing data, truncation – and AI tools can be deployed to flush out these problems and over time start intelligently prepopulating the correct information.”

LEIs for cross-border payments

In the wake of the 2008 financial crisis, the absence of a universal system to identify legal entities hindered the ability of regulators to understand systemic risk and exposures across jurisdictions. To avoid history repeating itself, G20 leaders and the Financial Stability Board (FSB) created legal entity identifiers (LEIs) as a universal way to identify legal entities in financial transactions and other official interactions.4 A fully digital counterpart to a conventional LEI has also been introduced – known as the verifiable LEI (vLEI) – that can be automatically verified without the need for human intervention.5

These unique 20-character alphanumeric codes essentially serve as a passport for legal entities. “We all have national identity cards, but if I had tried to get into China with my Belgium ID card, I would not be here speaking to you,” said Alexandre Kech, CEO at GLEIF during the Sibos session ‘Identity and digital identity – Reshaping cross-border ecosystems.’ “That's why we have passports, because these are recognised not only domestically, but internationally as well – and this is what the LEI achieves for the financial world,” he continued.

“Consuming the LEI on the flight of a transaction is still something that needs to be addressed”

For payments, several domestic applications for the LEI have emerged. For example, China’s Cross-border Interbank Payment System (CIPS), The Reserve Bank of India and the Bank of England’s CHAPs are each mandating – or plan to mandate – the use of LEIs for certain transactions. While the use of LEIs within domestic payment rails is driving wider adoption, there is still some way to go in extending this to the cross-border space. If this can be achieved, the FSB believes it could play an important role in supporting the G20 Roadmap objectives – with its latest progress report recognising the “potential benefits of the LEI in strengthening data standardisation as well as assisting and supporting STP, KYC processes, and sanctions screening”.

With plenty of upside on the table, what are the hurdles on the road ahead for payments adoption? According to Paula Roels, one challenge is that the checks performed in payments go beyond the financial risk component. “If the LEI could provide the additional data attributes needed to perform these non-financial risk assessments, such as location of the operating or servicing entity, then it could be a big value add,” she suggested.

When evaluating how mature the payments community is in adopting the consumption of the LEI, work is still at an early stage. “While banks do appreciate and understand the value of the LEI in a KYC process when they onboard their clients, actually consuming that data on the flight of a transaction is still something that needs to be addressed,” Roels said.

Overcoming these barriers could have implications that extend beyond payments and into the supply chain, where LEIs and vLEIs have the potential to drive significant efficiencies and bolster security. “The goods supply chain still faces significant challenges related to digital trust, or trust in data, at scale,” said Pamela Mar, Managing Director, ICC Digital Standards Initiative. “If we could get the LEI as the cornerstone of trust and identity within the payments world, that would demonstrate how the use of LEI could transform how we deal with the same issues in the goods supply chain.”

Before any of this can become a reality, adoption is key. “Remember we have 230 million legal entities and only 2.7 million LEIs to date, so we are at the very beginning of this journey,ʺ concluded Roels. “Alongside ensuring the right data attributes are included, we need to work as a community to understand how we can reach 100% adoption.”

The importance of data sharing in fighting fraud

As real-time payments become increasingly integrated into the global financial system, they bring both unprecedented convenience and heightened risks – with faster payments potentially meaning faster loss of money in case fraud happens. In response, there is an urgent need for stronger fraud prevention and detection measures – ensuring that the benefits of real-time payments are not overshadowed by vulnerabilities that can compromise trust and financial security.

“Competition is not the answer to better prevent and detect fraud; collaboration is”

Setting the scene for ‘The power of collaborative data sharing in fighting fraud’ panel, one panelist explained that his bank is witnessing a surge in sophisticated fraud attempts, with realistic bank spoofing attacks, the use of payment QR codes that lead directly to malware, business email compromise used to impersonate the CEO and deep fake technologies examples of the many fronts on which fraud is being fought.

With attacks coming from all directions, how can PSPs better prevent and detect fraud? “We are all actually peers, so competition is not the answer to this problem; collaboration is,” asserted Ute Kohl, Head of Institutional Cash Management Financial Crime Risk Operations and Affiliate Oversight, Deutsche Bank. “On top of this we need to work closely with clients, both in terms of educating them and introducing vendors that can help support them.”

Pictured: Deutsche Bank’s Ute Kohl speaking on ‘The power of collaborative data sharing in fighting fraud’ panel

One tool leveraging the community approach is EBA CLEARING’s pan-European Fraud Pattern and Anomaly Detection (FPAD). Using data from the 86 million payments that move through the system daily, the FPAD can provide PSPs with a more comprehensive view of transaction and beneficiary risks based on the network view. During the session one panelist revealed that in the 10 months since his bank started using the tool they have identified a 37% downtick in losses due to cyberfraud or scams.

Swift also has a significant role to play, having launched its Federated Learning AI initiative at last year’s Sibos – bringing together banks and technology providers to explore how AI-powered data collaboration can significantly reduce fraud while addressing issues related to data governance and privacy.

While these network-level solutions provide an additional and effective level of protection, the sharing of intelligence for fraud combatting purposes remains an obstacle that needs addressing, thanks to diverging regulations and regulatory interpretation related to data privacy. “We need to get to a point where we can talk as a team to the regulators, not only in our own countries, but also across regions – because data protection is certainly something we need to tackle,” said Kohl.

Digital wallets for cross-border payments

Digital wallets have enjoyed a meteoric rise since the Covid 19 pandemic, and now account for 50% of e-commerce and 30% point-of-sale consumer spend globally, according to a 2024 report by Worldpay.6 An initiative initially to improve financial inclusion has grown into something much more profound, with digital wallets having evolved to become the primary payment mechanism in certain jurisdictions. This includes the Sibos 2024 host nation, China, where in 2023 82% of e-commerce spending and 66% of physical purchases were made with digital wallets – totalling around US$7.6trn worth of transactions.7

In the session ‘Unleashing the potential of digital wallets’, one panelist explained that while digital wallets have done much to support financial inclusion in both banked and underbanked populations, the benefits now extend beyond this traditional mandate to include support for global remittances, government social and relief payments and, increasingly, cross-border payments.

According to another panelist, as digital wallet providers try and break into the cross-border payment space, they face significant challenges:

- Technical standards. Differences in technical approaches between countries create competitive issues, impacting user experiences.

- Currency exchange. As cross-border payments involve different currencies, there is a need for very effective exchange rate management and robust currency conversion mechanisms.

- User experience. Cultural differences lead to varied user interface expectations and, in turn, a lack of consistency across wallets.

Differing regulations also introduce obstacles for digital wallet providers. Anti-money laundering and data protection laws often restrict sensitive data from crossing national boundaries, which makes compliance with local legal requirements, as well as privacy protection, essential, he explained.

Laying the right foundations

Sibos 2024 delegates visiting the Innotribe stage might have been taken there by a friendly robotic dog leading the way. While a popular gimmick, the idea that the world may one day embrace robots for pets is very much aligned with Innotribe’s futuristic agenda. During the week panels covered how consumers may one day pay for goods and services using smart glasses, explore and purchase goods from virtual shops and get our digital twins to book our travel or even conduct meetings on our behalf. In this, lies the two sides of Sibos: the intersection between the present and the future.

Pictured: Robotic dog leading the way to the Innotribe stage

During ‘The future of financial services depends on global connectivity’ panel, Johnny Grimes, Global Head of Product, Corporate Cash Management and Head of Corporate Bank Ireland, summarised the two sides of Sibos 2024. “When we look back, we felt that technology was going to be a big disrupter. But what we've seen is that without solid foundations, it's very difficult to disrupt anything. The focus remains on getting these core hygiene factors in place to enable these types of innovations to come into the industry,” he explained.

For now, it seems like we are on the edge of having these foundations in place, whether that’s through ISO 20022, effective fraud sharing frameworks or the introduction of the LEI. The payments industry continues to join the pieces of a complex puzzle, but the question is: when will it all come together? We’re eager to see if a fuller picture will emerge at Sibos 2025 in Frankfurt.

Sources

1 See fsb.org

2 See ”G20 Roadmap: Forging a path to enhanced cross-border payments” at corporates.db.com

3 See swift.com

4 See gleif.org

5 See gleif.org

6 See corporate.worldpay.com

7 See corporate.worldpay.com